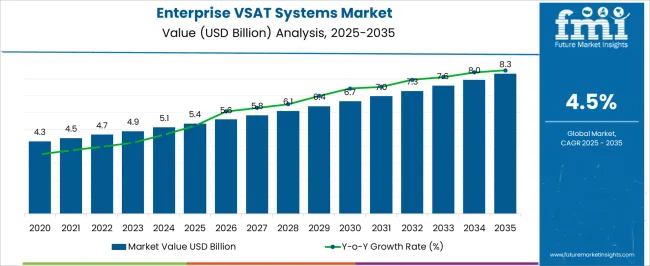

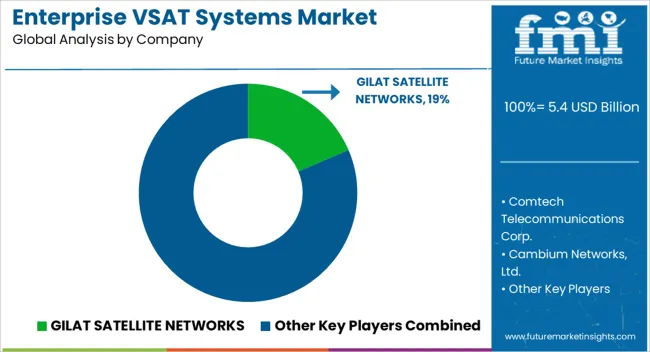

The Enterprise VSAT Systems Market is estimated to be valued at USD 5.4 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Enterprise VSAT Systems Market Estimated Value in (2025 E) | USD 5.4 billion |

| Enterprise VSAT Systems Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The enterprise VSAT systems market is expanding steadily owing to the rising need for reliable satellite communication solutions across geographically dispersed operations. Increased demand from industries such as energy, mining, transportation, and maritime has reinforced the adoption of enterprise-grade VSAT networks to ensure uninterrupted connectivity in remote and offshore locations.

Advancements in satellite technology, including high-throughput satellites and low-earth-orbit constellations, are improving bandwidth efficiency and reducing latency, making VSAT systems more viable for enterprise applications. Growing digital transformation initiatives and the need for cloud-based platforms are driving enterprises to deploy scalable satellite solutions.

Additionally, the emphasis on business continuity and secure communication infrastructure is propelling investments in VSAT deployments. The market outlook remains positive, supported by sustained requirements for high-speed connectivity in areas underserved by terrestrial networks.

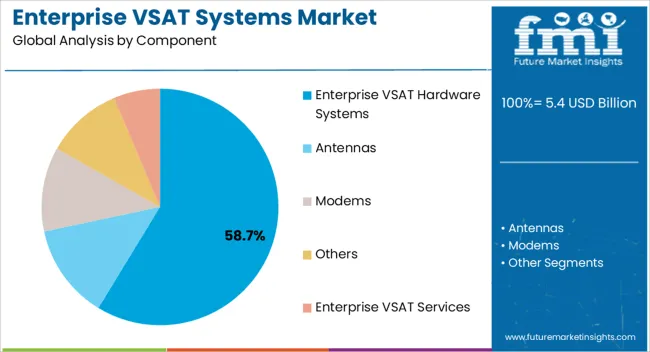

The enterprise VSAT hardware systems segment is projected to account for 58.70% of total revenue by 2025 within the component category, making it the leading segment. This dominance is supported by rising investments in ground equipment upgrades, including modems, antennas, and terminals that form the backbone of satellite communication infrastructure.

Continuous advancements in hardware design to support higher bandwidth, improved signal strength, and seamless integration with modern satellite technologies have increased adoption rates.

The segment has further benefited from enterprises prioritizing reliable connectivity hardware to ensure operational continuity across remote sites, positioning it as the most critical contributor within the component segment.

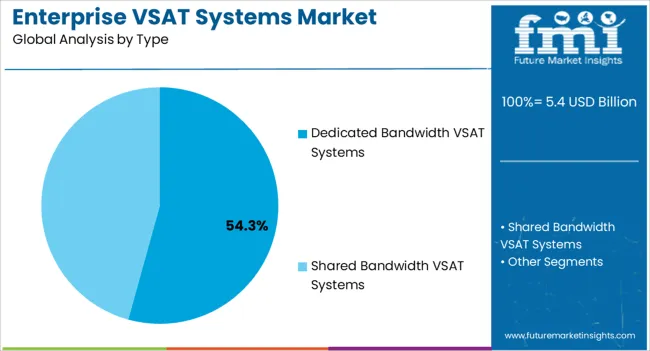

The dedicated bandwidth VSAT systems segment is expected to hold 54.30% of total market revenue by 2025, leading the type category. This growth is being driven by enterprises requiring guaranteed bandwidth, low latency, and high reliability for mission-critical operations.

Dedicated bandwidth ensures uninterrupted performance for applications such as real-time data transfer, video conferencing, and cloud-based workflows. Its adoption is further reinforced by industries operating in isolated regions, where service continuity and reliability are indispensable.

With enterprises increasingly focusing on secure and consistent connectivity solutions, dedicated bandwidth systems continue to maintain leadership in the type segment.

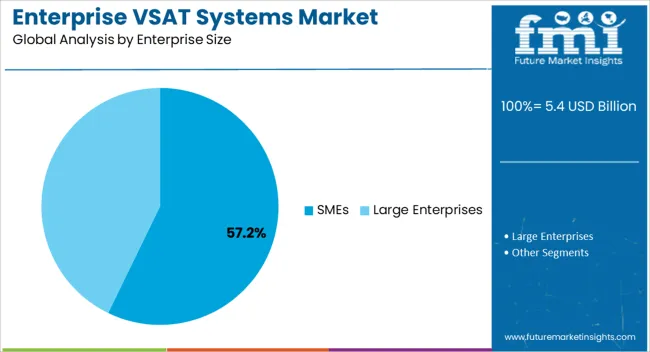

The SMEs segment is anticipated to capture 57.20% of total revenue by 2025 under the enterprise size category, making it the most prominent segment. This dominance is driven by the growing adoption of affordable and flexible VSAT solutions among small and medium enterprises seeking reliable communication in underserved areas.

SMEs are leveraging VSAT connectivity to support remote business operations, digital platforms, and e-commerce expansion. The scalability and cost-effectiveness of VSAT systems have made them attractive for SMEs with constrained budgets but significant connectivity needs.

As digital transformation accelerates globally, SMEs are emerging as key drivers of VSAT adoption, reinforcing their leadership in the enterprise size category.

The following factors are likely to surge the overall growth of the market:

Emerging technologies such as high throughput satellite (HTS) technology are one of the key restraints to the growth of the global enterprise VSAT market.

Sea connectivity issues are further hindering the overall market in tandem with the high cost of installation and maintenance during the forecast period. The liability faced by several payment gateways in terms of security breaches and cyber-attacks has the potential to challenge the enterprise's very small aperture terminal (VSAT) market growth.

Other hindrances include the following:

A few of the key trends exercising significant influence over the sales of enterprise VSAT systems in 2025 include the following:

| Segment | Component |

|---|---|

| Top Sub-segment | Hardware |

| CAGR (2025 to 2035) | 54.3% |

| Segment | Type |

|---|---|

| Top Sub-segment | Shared Bandwidth VSAT Systems |

| CAGR (2025 to 2035) | 59.7% |

According to the FMI, the enterprise VSAT systems market by component for hardware was predicted to hold a value share of 54.3% in 2025, holding sway over the market.

Infrastructure Requirement: Hardware components form the backbone of VSAT systems, including satellite dishes, modems, antennas, and routers. These physical components are essential for establishing and maintaining satellite communication networks. Making them a critical part of enterprise VSAT systems.

Performance and Reliability: Hardware plays a crucial role in delivering reliable and high-performance satellite communication services. Enterprises require robust and efficient hardware to ensure seamless connectivity, data transmission, and network stability, making hardware a priority in their VSAT system investments.

Technological Advancements: Ongoing advancements in hardware technologies have enhanced the capabilities and efficiency of enterprise VSAT systems. The availability of advanced antenna systems, more powerful modems, and improved network management hardware has contributed to the dominance of the hardware sub-segment.

Throughout the research, the shared bandwidth VSAT systems were estimated to hold 59.7% in 2025.

Cost Efficiency: Shared bandwidth VSAT systems allow multiple users to share the same satellite capacity, resulting in cost savings compared to dedicated bandwidth systems. Enterprises can access satellite connectivity at a fraction of the cost, making shared bandwidth VSAT systems an attractive option for cost-conscious organizations.

Scalability and Flexibility: Shared bandwidth VSAT systems offer scalability, allowing enterprises to easily adjust their bandwidth requirements based on their evolving needs. It provides the flexibility to add or reduce capacity as required, enabling businesses to adapt to changing demands without significant infrastructure modifications.

Wide Coverage and Reach: Shared bandwidth VSAT systems provide wide coverage and reach, enabling connectivity in remote and underserved areas where terrestrial infrastructure is limited.

North American region is expected to dominate the market in enterprise VSAT systems during the forecast period. Attributed to the high adoption of satellite services for various applications such as inspection of vegetation identification, historical monuments, volcano monitoring, and disaster supervision in case of storms and hurricanes in this region.

The North America enterprise VSAT systems market held about a value share of 31.4% globally in 2025. The sale of enterprise VSAT systems in the United States of America is likely to soar to a significant extent, where the country held a value share of 19.3% in 2025.

Asia Pacific is expected to expand at a significant growth rate during the forecast period. Owing to the rapid increase in government initiatives to connect schools and colleges within this region. The rise in government initiatives to connect schools and colleges in countries like Australia, India, and China is likely to favor market growth in the region.

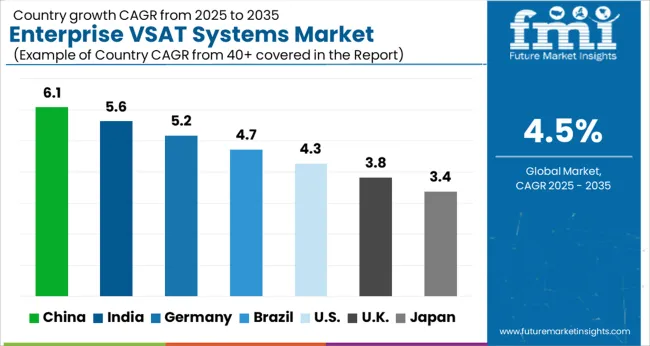

The value share of the enterprise VSAT systems market in Japan was expected to be 5.3% and the market in China is projected to advance at a CAGR of 5.9% during the forecast period. The market in India is expected to move forward at a rate of 6.2% from 2025 to 2035.

With a sizable enterprise VSAT systems market share, these main firms are concentrating on growing their consumer base in new countries. These businesses are making use of strategic collaboration initiatives to grow their market share and profits.

Mid-size and smaller businesses, on the other hand, are expanding their market presence by gaining new contracts and entering new markets, thanks to technical developments and product innovations.

Prominent Strategies Adopted by the Players:

Recent Developments:

The global enterprise VSAT systems market is estimated to be valued at USD 5.4 billion in 2025.

The market size for the enterprise VSAT systems market is projected to reach USD 8.3 billion by 2035.

The enterprise VSAT systems market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in enterprise VSAT systems market are enterprise VSAT hardware systems, antennas, modems, others and enterprise VSAT services.

In terms of type, dedicated bandwidth VSAT systems segment to command 54.3% share in the enterprise VSAT systems market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Rights Management Solution Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Content Management Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA