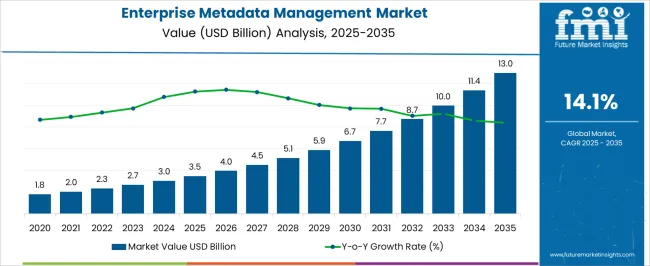

The Enterprise Metadata Management Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 13.0 billion by 2035, registering a compound annual growth rate (CAGR) of 14.1% over the forecast period.

| Metric | Value |

|---|---|

| Enterprise Metadata Management Market Estimated Value in (2025 E) | USD 3.5 billion |

| Enterprise Metadata Management Market Forecast Value in (2035 F) | USD 13.0 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

The enterprise metadata management market is expanding steadily, fueled by the rising importance of data governance, compliance mandates, and the growing scale of enterprise data ecosystems. Industry announcements and technology reports have emphasized the role of metadata management in enabling organizations to improve data quality, ensure regulatory compliance, and optimize analytics-driven decision-making.

Increasing adoption of cloud services, digital transformation initiatives, and advanced analytics has highlighted the necessity of structured metadata frameworks to manage complex data environments. Corporate disclosures have noted significant investment in metadata-driven automation and AI-powered cataloging tools to reduce operational inefficiencies.

Additionally, stringent industry regulations in finance, healthcare, and government sectors have accelerated the integration of metadata management platforms. The future outlook for the market remains positive, with continuous innovations in metadata-driven security, data lineage visualization, and self-service analytics expected to broaden adoption across industries. On-premise deployment models and BFSI vertical applications are projected to dominate due to their compliance-sensitive operations and need for robust data governance.

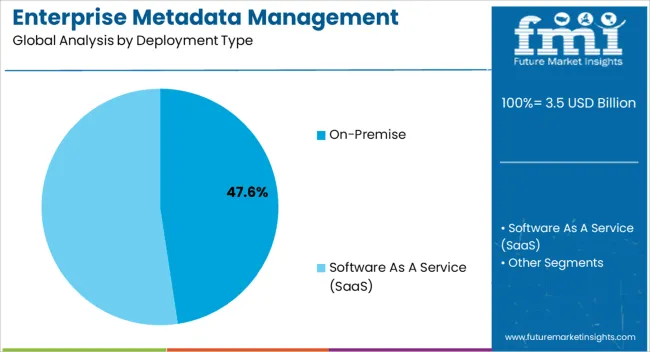

The On-Premise segment is projected to account for 47.60% of the enterprise metadata management market revenue in 2025, sustaining its leadership in deployment type. Growth of this segment has been influenced by the strong demand from enterprises requiring maximum control, data security, and regulatory compliance in their IT environments.

Financial institutions, healthcare providers, and government agencies have preferred on-premise deployment due to strict data privacy mandates and the need to safeguard sensitive information. Industry publications have highlighted that on-premise solutions enable organizations to maintain direct oversight of metadata storage and processing, reducing risks associated with third-party cloud environments.

Additionally, integration with legacy IT infrastructure has favored on-premise adoption, as many enterprises continue to operate hybrid systems that rely on in-house servers. While cloud adoption is increasing, the on-premise model remains dominant among organizations prioritizing security and regulatory alignment, thereby maintaining its stronghold within the deployment landscape.

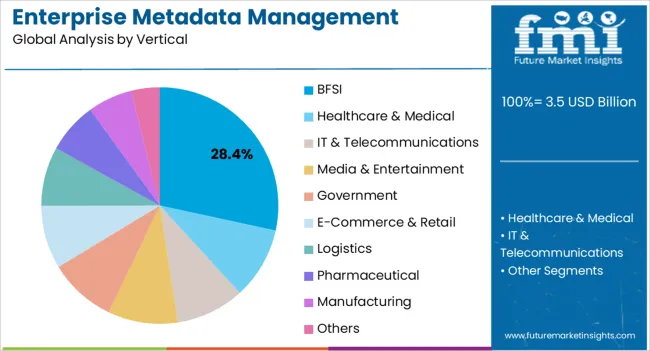

The BFSI segment is expected to hold 28.40% of the enterprise metadata management market revenue in 2025, positioning it as the leading vertical. This segment’s prominence has been driven by the financial sector’s critical need for accurate data governance, regulatory compliance, and risk management.

Metadata management solutions have been widely adopted in banking and financial services to address stringent regulations such as Basel III, GDPR, and local data protection laws, ensuring transparency and traceability in financial reporting. Investor briefings and BFSI industry reports have emphasized the growing reliance on advanced analytics and digital banking platforms, which require well-structured metadata for seamless integration and decision support.

Furthermore, fraud detection, anti-money laundering systems, and customer data management depend heavily on precise metadata frameworks. With increasing digitization in payments, lending, and investment services, BFSI organizations are prioritizing robust metadata solutions to enhance data accuracy, operational efficiency, and regulatory alignment. These factors are expected to sustain BFSI’s leadership position in the enterprise metadata management market.

The global demand for enterprise metadata management is projected to increase at a CAGR of 19.4% during the forecast period between 2025 and 2035, reaching a total of USD 13 million in 2035, according to a report from Future Market Insights (FMI). From 2020 to 2024, sales witnessed significant growth, registering a CAGR of 18.9%.

With the increasing use of technologies such as blockchain and IoT, the deployment of metadata management is predicted to see a new trend by opening up new avenues for applications. The demand for business metadata management is likely to rise since more than 90% of new data collected will be unstructured, data integrators will find it hard to acquire or turn into information. Unstructured data will drive the growth of the corporate metadata management market during the projected period.

To deal with the quintillion bytes of data produced each day, the automation and artificial sectors will play a critical role in the future of metadata management. Furthermore, as the number of data breaches increases internationally, governments worldwide are obliged to implement increasingly strict data security and data management policies. This propels the market for business metadata management tools and services even further. Potential corporate metadata management adopters will encounter difficulty in terms of producing ROI.

Growing Relevance of Data Governance and Data Standards to Boost Market Growth

The growing relevance of data governance and data standards by companies across many industries, along with expanding business data and rising data integration and content management difficulties, is driving the expansion of the worldwide enterprise metadata management market.

The growing demand for organizations across multiple sectors to reduce risk and increase confidence in enterprise data assets, as well as a growing emphasis on collaboration and social networking capabilities, promotes the growth of the worldwide enterprise metadata management market.

Expansion of data warehouses, data mining, and data pooling activities, as well as an increasing emphasis on building centralized data control to boost IT efficiency across organizational environments, are further driving the growth of the worldwide enterprise metadata management market.

Unawareness of the Use of Metadata Management Solution is likely to Hamper Market Growth

A dearth of knowledge of the potential benefits of business metadata management solutions, as well as technological hurdles in metadata storage and data cross-linking, have been recognized as significant limitations to the worldwide enterprise metadata management market's growth.

Widespread Adoption of Cloud-Based and On-Premises Data Management Creating Opportunities

Because of its early use of analytics technologies by consumers and enterprises, North America dominates the worldwide corporate metadata management industry. In most industries, the area has seen widespread adoption of cloud-based and on-premises data management and governance systems.

Investments and revenues in the Big Data and analytics industries are increasing, resulting in a robust market for corporate metadata management in the area. Banking, telecommunications, media and entertainment, healthcare, retail, federal/central government, and professional services are the five prospective and leading industries in North America that are likely to make the most investments in Big Data and analytics solutions. Moreover, factors such as strong penetration in the healthcare and life sciences, retail and e-commerce, and BFSI verticals are likely to boost market growth.

Furthermore, the amount of data created from different sources is rising due to the increased use of smart devices and the region's expanding digitalization tendencies, which are driving the demand for the development of data and metadata management products and services.

The region's exponential surge in data proliferation is prompting businesses to use metadata management systems. Thus, due to the aforementioned reasons, North America is expected to possess 35.4% market share in 2025.

The ESS Metadata Reporting Standards are Favoring Market Growth

During the projected period 2025 to 2035, the Europe region is predicted to develop fast at a CAGR of 19.2%. The European Statistical System (ESS) reference metadata reporting standards provide a set of international standards for transmitting statistical data between organizations.

This is the primary factor predicted to fuel growth in the enterprise metadata management market in Europe during the projected period. Europe is expected to hold 23.7% of the market share for the enterprise metadata management market in 2025.

Ongoing Adaptation of Business Intelligence and Analytics Solutions Fuelling Rapid Adoption

Due to rising enterprise and ongoing adaptation of business intelligence and analytics solutions by companies across various sectors, Asia-Pacific is considered the fastest-growing network forensics market in terms of revenue. Thus, Asia Pacific is expected to procure a 20% market share for the enterprise metadata management market in 2025.

Because of the expanding corporate data and consumer important information in this sector, the Banking, Financial Services, and Insurance (BFSI) industry vertical is predicted to have a dominant market share during the projection period.

Furthermore, rising client interactions outside of the branch across numerous channels such as online, chat, mobile, and social media are likely to drive the usage of enterprise metadata management market solutions. The segment is expected to grow at a CAGR of 19% in the enterprise metadata management market in the sales indicator period 2025 to 2035.

The software as a service (SaaS) deployment segment is predicted to be more popular than on-premises deployment, and this trend is expected to continue during the projection period. Large companies prefer software as a service for a variety of reasons, including lower operational expenses, easier implementation, and more scalability.

During the projection period, software as service enterprise metadata management systems is predicted to expand at the fastest CAGR. Large organizations are leading the way in terms of adoption, and the sector is likely to maintain its dominant market position over the projection period.

With a growing emphasis on enhancing the customer experience, the Small and Medium-sized Enterprises (SMEs) category is expected to develop at the fastest rate throughout the projected period.

Every year, thousands of new firms are launched, with the potential to disrupt the data management industry. FMI has analyzed 3 global data management startups and schleps to give you a head start on emerging technologies and startups that will impact data management in 2025. Meet 3 of the most promising businesses to keep an eye on!

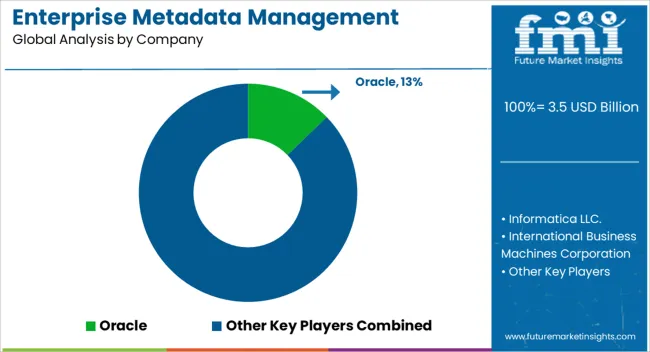

Key companies in the worldwide enterprise metadata management industry include Oracle, Informatica LLC., International Business Machines Corporation, Teradata, Collibra, Adaptive, Inc., Data Advantage Group, Cambridge Semantics, Talend, and MuleSoft, Inc.

Recent Market Developments in the Enterprise Metadata Management Industry:

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 3.5 billion |

| Market Value in 2035 | USD 13.0 billion |

| Growth Rate | CAGR of 14.1% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Deployment Type, Vertical, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, U.K, France, Spain, Italy, China, Japan, South Korea, India, Malaysia, Singapore, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Oracle; Informatica LLC.; International Business Machines Corporation; Teradata; Collibra; Adaptive, Inc.; Data Advantage Group; Cambridge Semantics; Talend; MuleSoft, Inc. |

| Customization | Available Upon Request |

The global enterprise metadata management market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the enterprise metadata management market is projected to reach USD 13.0 billion by 2035.

The enterprise metadata management market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in enterprise metadata management market are on-premise and software as a service (saas).

In terms of vertical, bfsi segment to command 28.4% share in the enterprise metadata management market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise LLM Market Size and Share Forecast Outlook 2025 to 2035

Enterprise VSAT Systems Market Size and Share Forecast Outlook 2025 to 2035

Enterprise AI Governance and Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IoT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise WLAN Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Networks Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Video Market Analysis - Size, Share, and Forecast 2025 to 2035

Enterprise-Grade DLT Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Information Archiving (EIA) Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Manufacturing Intelligence Market Analysis by Deployment Type, Offering, End-use Industry, and Region Through 2035

Enterprise Laboratory Informatics Market Analysis by Type of Solution, Component, Delivery, Industry, and Region Through 2035

Enterprise File Sharing And Synchronization Market

Enterprise Flash Storage Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA