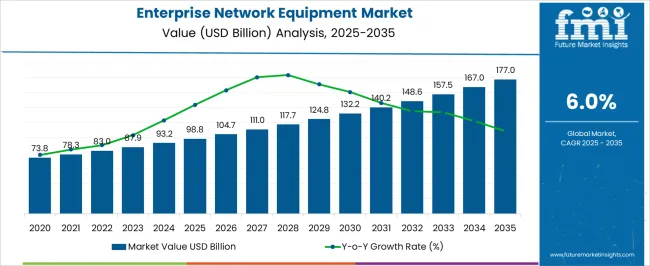

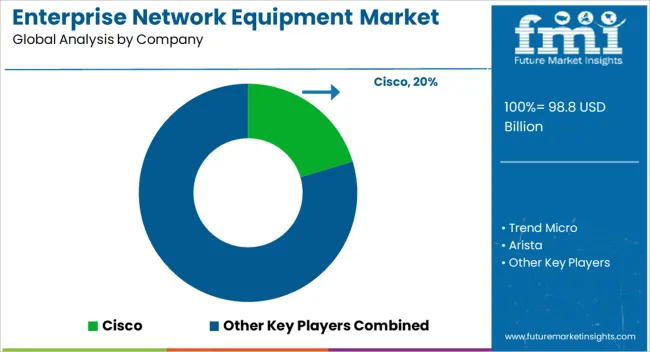

The global enterprise network equipment market is estimated at USD 98.8 billion in 2025 and is projected to reach USD 177.0 billion by 2035, expanding at a CAGR of 6.0% during the forecast period. Growth is fueled by the rapid pace of digital transformation, the proliferation of connected devices, and the rising adoption of advanced networking technologies to support cloud computing, big data analytics, and IoT ecosystems.

Product solutions account for 59.8% of the market share in 2025, reflecting enterprises’ emphasis on deploying secure, high-performance hardware to accommodate growing data traffic and hybrid work models. Meanwhile, the adoption of next-generation software and services, including SD-WAN, network automation, and AI-powered monitoring, is set to accelerate over the coming decade.

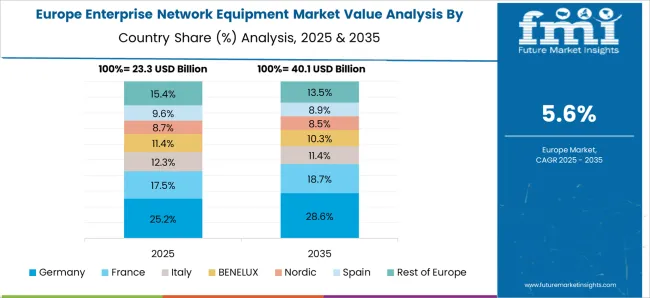

Regional growth is led by North America, Asia-Pacific, and Europe, where robust investments in data centers, the rollout of Wi-Fi 6/6E and Wi-Fi 7 standards, and the expansion of 5G-enabled enterprise applications are reshaping network infrastructure demand. Vendors focusing on energy-efficient solutions, cybersecurity integration, and advanced network management tools will be best positioned to capture market share.

Key players in the enterprise network equipment market include Cisco, Trend Micro, Arista, Broadcom, Dell Technologies, Netscout, Extreme Networks, F5 Networks, FireEye, Fortinet, HPE, Huawei, Riverbed, Juniper, McAfee, Checkpoint, Palo Alto, Symantec, and VMware.

Overall, the enterprise network equipment industry is poised for sustained expansion, underpinned by technology innovation, evolving connectivity needs, and the global shift toward digital-first business models.

| Metric | Value |

|---|---|

| Enterprise Network Equipment Market Estimated Value in (2025 E) | USD 98.8 billion |

| Enterprise Network Equipment Market Forecast Value in (2035 F) | USD 177.0 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The enterprise network equipment market is witnessing steady growth, fueled by increasing digital transformation initiatives, rising data traffic, and the need for secure, high-speed connectivity within enterprise environments. The expansion of cloud computing, edge networks, and hybrid work models is accelerating demand for robust network infrastructure capable of handling advanced data routing, virtualization, and cybersecurity requirements.

Organizations are prioritizing seamless connectivity between on-premise infrastructure and distributed cloud services, which has intensified the focus on performance, scalability, and unified management tools. Additionally, heightened awareness around network resilience, latency minimization, and bandwidth optimization is prompting companies to upgrade legacy systems.

The growing emphasis on compliance, data governance, and zero-trust architecture is expected to further drive innovation in enterprise-grade switches, routers, firewalls, and wireless systems across both mature and emerging markets.

The enterprise network equipment market is segmented by component, deployment modelapplication, and geographic regions. By component of the enterprise network equipment market is divided into Product, Switches, Network security, Firewall, Intrusion prevention, Anti-virus/anti-malware, Secure Web Gateway (SWG), Mobile device security, Others, Wireless, Routers, Network management, Service, Training & consulting, Integration & maintenance, and Managed service. In terms of deployment model of the enterprise network equipment market is classified into On-premise and Cloud. Based on application of the enterprise network equipment market is segmented into IT & telecom, BFSI, Healthcare, Manufacturing, Retail, Government & public sector, Energy & utility, and Others. Regionally, the enterprise network equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Product component segment is expected to generate 59.80% of the total market revenue in 2025, positioning this segment as the largest within enterprise network equipment. This growth is being driven by continuous investments in switches, routers, wireless access points, and other hardware components that form the backbone of enterprise networking.

Hardware advancements in power efficiency, throughput, and port density have improved system performance while reducing energy and maintenance costs. The proliferation of bandwidth-intensive applications, coupled with growing adoption of cloud-native tools and virtual desktop environments, is increasing the reliance on reliable physical infrastructure.

Enterprises are also replacing outdated devices to meet modern encryption, network segmentation, and policy management standards, reinforcing this segment’s market dominance.

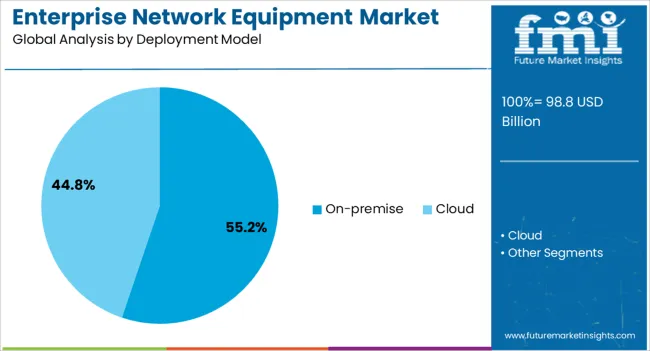

On-premise deployment is projected to account for 55.20% of the overall market revenue in 2025, making it the leading deployment model. This leadership is being driven by enterprises seeking full control over data security, latency, and compliance, particularly in sectors handling sensitive or regulated information.

On-premise models support localized processing and offer direct control over hardware configuration, firmware updates, and access protocols. In scenarios where uptime, data sovereignty, or custom networking requirements are critical, on-premise deployment remains the preferred choice.

Despite the rise of cloud and hybrid models, organizations with large IT footprints and legacy dependencies continue to invest in in-house network infrastructure, particularly in manufacturing, financial services, and healthcare.

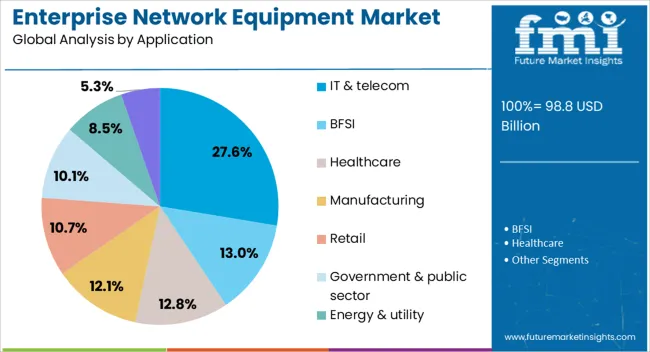

The IT and telecom sector is anticipated to hold 27.60% of the market revenue in 2025, making it the largest application segment in enterprise network equipment. This dominance is attributed to the sector’s continuous demand for high-performance infrastructure to support real-time communications, network monitoring, and distributed computing environments.

Increased network virtualization, 5G rollouts, and cloud-native service models are prompting telecom operators and IT service providers to upgrade network hardware and support multi-tenant environments. Additionally, the proliferation of IoT and edge computing within telecom networks is elevating the need for agile, scalable, and low-latency networking equipment.

As service providers expand their capacity to deliver secure and reliable connectivity, investment in enterprise-grade network systems remains a critical priority.

Enterprise network equipment growth is being driven by hybrid work adoption, cloud-edge integration, security-focused investments, and the expansion of high-density IoT deployments. These factors are reshaping infrastructure priorities for global enterprises.

Enterprise network equipment demand is climbing as organizations adapt to hybrid work, which requires secure, high-capacity connectivity for both in-office and remote users. Investments are being directed toward switches, routers, and wireless access points capable of supporting video conferencing, collaborative tools, and real-time data sharing. Network infrastructure upgrades are essential to handle the increased traffic from cloud-hosted applications and virtual desktops. Enterprises are also deploying advanced VPNs, zero-trust network access, and network segmentation to ensure performance and security across distributed environments. This shift has created opportunities for equipment providers to offer integrated solutions that combine wired and wireless capabilities with centralized management for flexible work arrangements.

The move toward cloud computing and edge deployments is reshaping enterprise network equipment requirements. Organizations are implementing equipment that supports low-latency, high-throughput connections to data centers, cloud platforms, and edge nodes. Multi-gigabit switches, high-performance routers, and intelligent load balancers are increasingly critical to manage workloads closer to end users. Enterprises in sectors such as manufacturing, healthcare, and logistics rely on edge-enabled networks for real-time analytics, automation, and operational continuity. This has led to higher demand for hardware with greater port density, energy efficiency, and support for virtualization. The integration of cloud orchestration tools with network infrastructure is enabling faster provisioning and streamlined operations.

Security has become a defining factor in enterprise network equipment strategies, as organizations face heightened cyber threats and regulatory requirements. Network equipment is now expected to include embedded firewalls, intrusion prevention systems, and encryption capabilities. Compliance with frameworks such as GDPR, HIPAA, and PCI DSS is prompting enterprises to upgrade to devices that offer advanced monitoring, access control, and traffic inspection features. Secure access service edge (SASE) adoption is driving convergence of networking and security functions within enterprise hardware. Additionally, demand for equipment with AI-enabled anomaly detection and automated threat response is growing, ensuring that networks remain resilient against increasingly sophisticated attacks.

Enterprise network equipment is evolving to meet the needs of high-density environments such as campuses, stadiums, and large industrial facilities. These settings require robust, scalable networks capable of supporting thousands of devices simultaneously, including IoT sensors, handheld terminals, and wearables. Switches and access points designed for high throughput and low latency are seeing strong uptake in these markets. Equipment providers are also focusing on delivering PoE-enabled solutions for easy deployment of IoT endpoints without separate power infrastructure. The rise in smart buildings, automated manufacturing lines, and connected healthcare systems has amplified the demand for reliable, high-capacity enterprise networking solutions that can adapt to dynamic workloads.

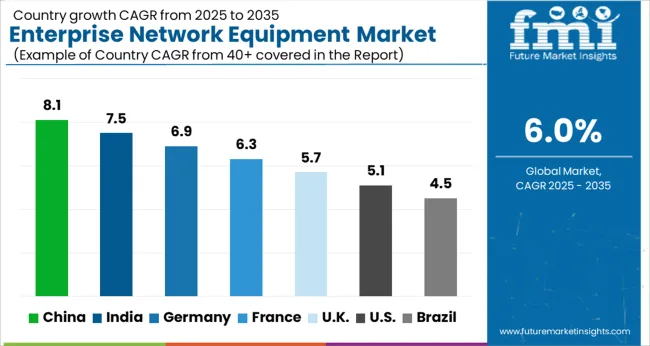

The enterprise network equipment market is projected to expand globally at a CAGR of 6.0% from 2025 to 2035, propelled by hybrid work adoption, cloud-edge integration, and heightened security requirements in enterprise infrastructure. China leads with a CAGR of 8.1%, driven by large-scale corporate digitalization projects, expanding data center infrastructure, and rapid enterprise cloud migration. India follows at 7.5%, fueled by government-backed connectivity programs, accelerated enterprise Wi-Fi deployments, and demand from IT service exporters.

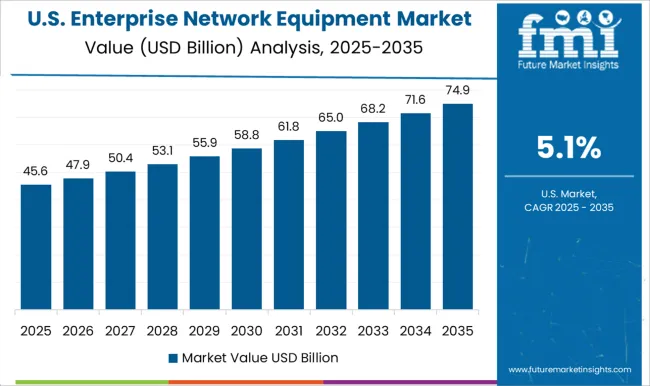

Germany posts a CAGR of 6.9%, supported by Industry 4.0 adoption, manufacturing network automation, and data privacy compliance needs.The United Kingdom records 5.7%, reflecting investments in high-speed fiber integration with enterprise LAN/WAN systems, cloud application optimization, and growing IoT deployments. The United States registers 5.1%, as modernization of enterprise infrastructure is paced by private sector cloud transformation, SASE adoption, and network security enhancements. The analysis spans over 40 global markets, with these six countries serving as key indicators for investment opportunities, vendor expansion strategies, and technology adoption patterns in enterprise networking solutions.

China is forecasted to post a CAGR of 8.1% during 2025–2035, up from nearly 7.2% in 2020–2024, indicating accelerated expansion supported by corporate digitalization and large-scale network modernization projects. The uplift in CAGR reflects significant investment in cloud integration, nationwide 5G rollouts, and enterprise Wi-Fi 6/6E deployments. Data center expansion, along with strong adoption of AI-powered network security solutions, is contributing to the country’s growing share in global enterprise networking. Local manufacturers and global vendors are entering strategic alliances to serve the expanding demand from both large corporations and SMEs, ensuring competitive pricing and advanced feature availability.

India is projected to achieve a CAGR of 7.5% during 2025–2035, improving from around 6.6% in 2020–2024, signaling steady momentum fueled by large-scale digital infrastructure projects. This growth acceleration is linked to increased government funding for BharatNet and enterprise-grade broadband connectivity programs. The IT services sector’s expanding global client base has prompted investments in advanced network solutions, particularly in cloud-enabled WANs and secure edge architectures. The manufacturing and BFSI sectors are deploying high-capacity WLAN systems to handle growing data traffic, while local assembly by multinational vendors is improving equipment accessibility and cost efficiency for domestic enterprises.

Germany is expected to register a CAGR of 6.9% between 2025–2035, up from an estimated 6.0% in 2020–2024, highlighting improved adoption due to Industry 4.0 integration. The increase in growth rate is driven by automation in manufacturing, IoT-enabled facilities, and compliance with strict data protection standards. Enterprises are prioritizing secure, high-bandwidth networking infrastructure to support remote monitoring and advanced analytics in production processes. Partnerships between telecom providers and industrial automation firms are creating tailored network solutions for factories, while increased adoption of cloud-hosted management platforms is streamlining operations for both SMEs and large industrial enterprises.

The United Kingdom is projected to post a CAGR of 5.7% for 2025–2035, increasing from approximately 5.0% in 2020–2024, with the rise driven by hybrid work adoption, enterprise cloud migration, and IoT integration. The increase in CAGR stems from intensified investment in high-speed fiber backbone integration with enterprise LAN/WAN networks and upgrades to support cloud-based applications. Adoption of Wi-Fi 6/6E and SASE (Secure Access Service Edge) solutions is growing across banking, retail, and education. Competitive pricing by global vendors, coupled with UK-specific cybersecurity compliance requirements, is pushing enterprises to adopt next-generation network equipment that meets both performance and regulatory standards.

The United States is expected to grow at a CAGR of 5.1% from 2025–2035, up from roughly 4.4% during 2020–2024, showing a gradual yet consistent expansion. The uptick in CAGR is supported by enterprise adoption of AI-driven network analytics, cloud-managed WLAN solutions, and zero-trust security frameworks. Corporate IT modernization programs are accelerating investment in scalable and secure networking solutions. Vendor competition remains strong, with hyperscale cloud providers partnering with equipment manufacturers to deliver integrated solutions for large enterprises. Public sector investment in digital infrastructure, especially for education and healthcare, is also creating new opportunities for enterprise-grade networking.

The enterprise network equipment market is shaped by a mix of global technology leaders and specialized security vendors such as Cisco, Trend Micro, Arista, Broadcom, Dell Technologies, Netscout, Extreme Networks, F5 Networks, FireEye, Fortinet, HPE, Huawei, Riverbed, Juniper, McAfee, Checkpoint, Palo Alto, Symantec, and VMware. Cisco and Fortinet maintain dominance through comprehensive security suites integrating next-generation firewalls, secure access, and network visibility tools.

Palo Alto and Checkpoint lead in zero-trust frameworks and AI-powered threat prevention, catering to large enterprise and government clients. VMware and Juniper focus on secure cloud networking and SD-WAN solutions, while Trend Micro and Symantec maintain strong positions in endpoint and cloud workload protection.

Dell Technologies and HPE leverage integrated infrastructure security, serving both hyperscale and mid-size enterprises. Netscout and F5 Networks specialize in network performance monitoring and application security, targeting telecom and service provider segments. FireEye and McAfee are recognized for advanced threat intelligence and incident response capabilities.

Huawei and Arista deliver competitive solutions in high-performance networking with built-in security layers, while Riverbed focuses on secure application acceleration. Competitive strategies include expanding AI-driven security analytics, partnerships with cloud hyperscalers, and regional manufacturing to address compliance and latency requirements. Success will depend on balancing advanced threat protection, cost efficiency, and adaptability to evolving enterprise architectures in hybrid and multi-cloud environments.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Component | Hardware (switches, routers, wireless access points, network security appliances); Software (network management, network security); Services (training & consulting, integration & maintenance, managed services) |

| Deployment Model | On-premise and Cloud |

| Application | IT & telecom, BFSI, Healthcare, Manufacturing, Retail, Government & public sector, Energy & utility, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cisco, Trend Micro, Arista, Broadcom, Dell Technologies, Netscout, Extreme Networks, F5 Networks, FireEye, Fortinet, HPE, Huawei, Riverbed, Juniper, McAfee, Checkpoint, Palo Alto, Symantec, and VMWare |

| Additional Attributes | Dollar sales, share, regional demand trends, top threat vectors, competitor product positioning, adoption by industry verticals, pricing shifts, and emerging regulatory impacts. |

The global enterprise network equipment market is estimated to be valued at USD 98.8 billion in 2025.

The market size for the enterprise network equipment market is projected to reach USD 177.0 billion by 2035.

The enterprise network equipment market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in enterprise network equipment market are product, switches, network security, firewall, intrusion prevention, anti-virus/anti-malware, secure web gateway (swg), mobile device security, others, wireless, routers, network management, service, training & consulting, integration & maintenance and managed service.

In terms of deployment model, on-premise segment to command 55.2% share in the enterprise network equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Network Equipment Market Insights – Growth & Industry Forecast through 2035

Enterprise Social Networks Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

Wireless Network Test Equipment Market Report – Growth & Forecast 2025 to 2035

Optical Transport Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Next Generation Network (NGN) Equipment Market Size and Share Forecast Outlook 2025 to 2035

Gigabit Passive Optical Network Equipment Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Data Loss Prevention (DLP) Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Network Simulator Software Market Size and Share Forecast Outlook 2025 to 2035

Enterprise A2P SMS Market Size and Share Forecast Outlook 2025 to 2035

Enterprise-Class Hybrid Storage Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Feedback Management Market Size and Share Forecast Outlook 2025 to 2035

Network Connectivity Tester Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Social Graph Market Size and Share Forecast Outlook 2025 to 2035

Enterprise File Sync And Share Platform Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Mobility Market Size and Share Forecast Outlook 2025 to 2035

Enterprise Metadata Management Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA