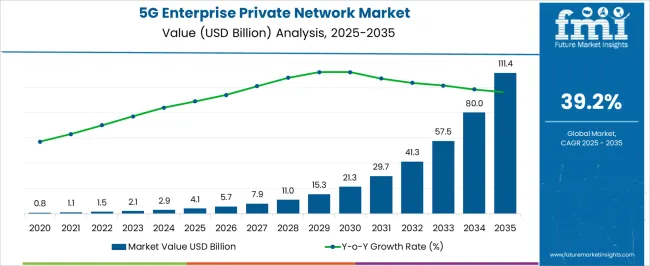

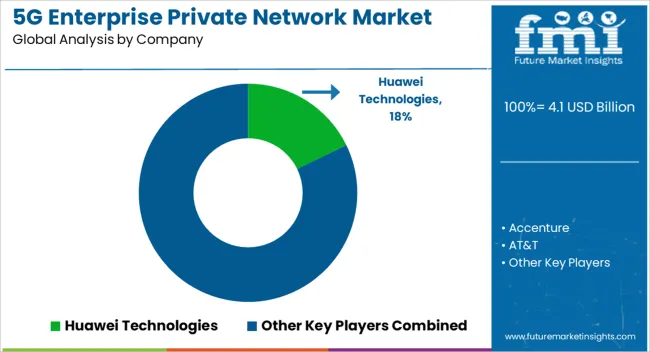

The 5G enterprise private network market is valued at USD 4.1 billion in 2025 and is expected to expand to USD 111.4 billion by 2035, reflecting a staggering CAGR of 39.2%. A rolling CAGR analysis illustrates how growth accelerates in successive intervals as enterprise adoption intensifies across industries such as manufacturing, logistics, healthcare, and smart cities.

Between 2021 and 2025, the market grows from USD 1.1 billion to USD 4.1 billion, with intermediate points at USD 1.5 billion, 2.1 billion, and 2.9 billion. Early adoption is concentrated among large industrial and technology enterprises implementing pilot 5G private networks to enable real-time data connectivity, low-latency automation, and enhanced security. During this phase, the rolling CAGR indicates strong momentum as infrastructure investments and regulatory frameworks begin to support enterprise-scale deployment.

From 2026 to 2030, the market advances from USD 5.7 billion to USD 29.7 billion, passing through USD 7.9 billion, 11.0 billion, 15.3 billion, and 21.3 billion. Growth in this period reflects a rising number of mid-size enterprises integrating 5G networks for IoT operations, AR/VR applications, and predictive maintenance. Rolling CAGR values show consistently high expansion, fueled by network slicing, edge computing, and cloud-based management platforms. Between 2031 and 2035, the market further accelerates, climbing from USD 41.3 billion to USD 111.4 billion, with intermediate points of USD 57.5 billion and 80.0 billion.

| Metric | Value |

|---|---|

| 5G Enterprise Private Network Market Estimated Value in (2025 E) | USD 4.1 billion |

| 5G Enterprise Private Network Market Forecast Value in (2035 F) | USD 111.4 billion |

| Forecast CAGR (2025 to 2035) | 39.2% |

The 5G enterprise private network market is shaped by interconnected parent markets, each contributing significantly to adoption and growth. The telecommunications infrastructure market holds the largest share at 30%, as operators, base stations, and network equipment providers enable the deployment of private 5G solutions with high reliability and low latency. The industrial automation and manufacturing market contributes 25%, with factories and industrial plants leveraging private networks for real-time robotics control, predictive maintenance, and seamless production workflows. The healthcare and hospital market accounts for 20%, where private 5G networks facilitate telemedicine, remote diagnostics, and real-time patient monitoring, enhancing operational efficiency and patient care. The logistics and supply chain market holds a 15% share, driven by demand for asset tracking, autonomous vehicles, and warehouse automation across ports, transport hubs, and distribution centers. Finally, the smart enterprise and commercial buildings market represents 10%, integrating private 5G for secure communication, IoT connectivity, and optimized building management. Collectively, telecommunications, industrial, and healthcare segments account for 75% of total demand, highlighting that network infrastructure, manufacturing automation, and medical applications remain the primary growth drivers, while logistics and smart enterprises offer emerging adoption opportunities globally.

The 5G enterprise private network market is gaining momentum as enterprises prioritize low-latency, high-bandwidth, and secure connectivity for mission-critical operations. Key factors accelerating adoption include the proliferation of IoT devices, demand for real-time data processing, and increasing use of automation across industries.

Enterprises in manufacturing, logistics, and energy sectors are leading investments in private 5G infrastructure to enhance operational efficiency and reduce network dependency on public carriers. Regulatory support for dedicated spectrum allocation and the availability of customizable deployment models are further enabling rapid scale-up of 5G private networks.

As edge computing and AI integration intensify, private 5G is expected to become foundational in enterprise digital transformation strategies.

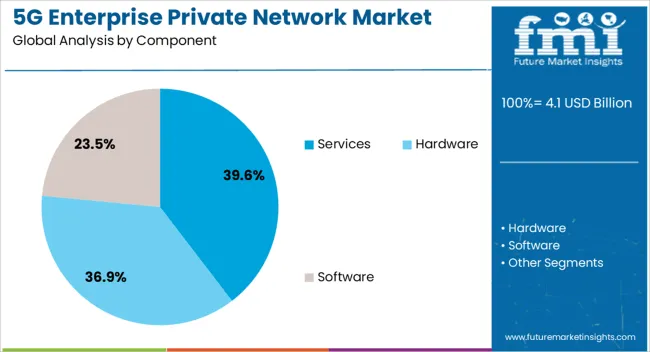

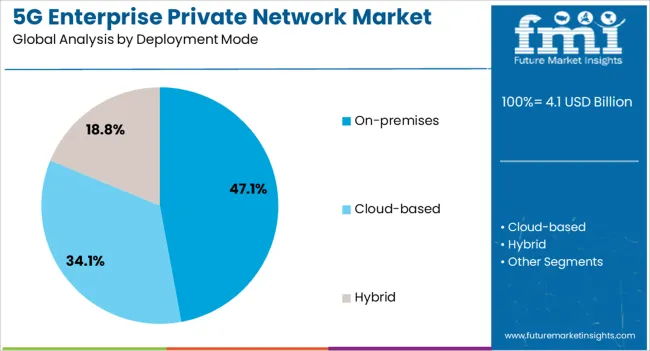

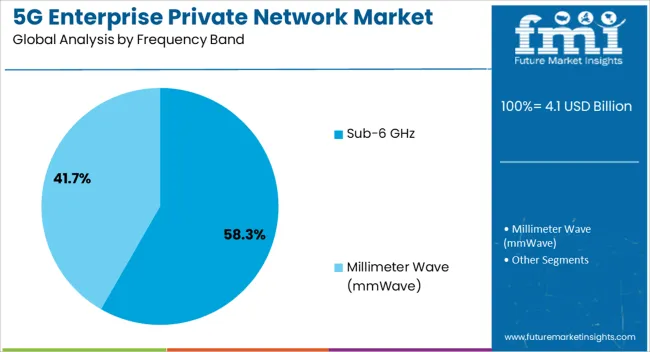

The 5G enterprise private network market is segmented by component, deployment mode, frequency band, organization size, end use, and geographic regions. By component, the 5G enterprise private network market is divided into Services, Hardware, and Software. In terms of deployment mode, 5G enterprise private network market is classified into On-premises, Cloud-based, and Hybrid. Based on frequency band, 5G enterprise private network market is segmented into Sub-6 GHz and Millimeter Wave (mmWave). By organization size, 5G enterprise private network market is segmented into Large Enterprises and SMEs.

By end use, 5G enterprise private network market is segmented into Manufacturing, Healthcare, Transportation and Logistics, Retail, Energy and Utilities, Smart Cities, and Others. Regionally, the 5G enterprise private network industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Services are expected to dominate with a 39.60% share in 2025, making them the leading revenue contributor within the 5G enterprise private network components. This dominance is driven by the growing complexity of network design, deployment, and maintenance, prompting enterprises to rely on specialized managed service providers.

Demand for integration support, security services, and lifecycle management is increasing, especially as organizations implement customized use cases such as autonomous machinery, remote operations, or smart facilities.

The services segment also benefits from hybrid models where service providers offer end-to-end packages that include infrastructure rollout, edge orchestration, and performance optimization.

On-premises deployment mode is projected to account for 47.10% of the market share in 2025, making it the preferred approach among enterprises. This trend is largely influenced by the need for secure, ultra-reliable, and low-latency connectivity within controlled environments.

On-premise models allow enterprises full control over network access, security protocols, and bandwidth allocation, which is especially crucial in sectors such as manufacturing, defense, and energy. Furthermore, on-prem deployments enable better integration with legacy systems and facilitate real-time monitoring of operational workflows.

As enterprises increasingly seek data sovereignty and compliance with stringent regulatory standards, the on-premises model continues to gain traction.

The sub-6 GHz frequency band is anticipated to lead with 58.30% market share in 2025, reflecting its critical role in private 5G network deployment. This band offers a balanced combination of coverage and capacity, making it highly suitable for a broad range of enterprise applications.

It provides stronger signal penetration through buildings and across industrial environments compared to mmWave, thus ensuring more reliable connectivity. Governments around the world have also made sub-6 GHz spectrum more accessible for private networks, supporting faster and cost-effective adoption.

As enterprises scale up their private 5G infrastructure, the sub-6 GHz band will remain the foundation of their network architecture.

The 5G enterprise private network market is growing as enterprises seek secure, high-speed, and low-latency connectivity for industrial, manufacturing, healthcare, and logistics applications. Demand is driven by the need for real-time data transfer, IoT integration, and mission-critical operations requiring dedicated network infrastructure. Challenges include high deployment costs, spectrum licensing, interoperability issues, and complex network management. Opportunities exist in cloud-based network management, edge computing integration, and vertical-specific solutions. Trends highlight AI-driven network optimization, enhanced security protocols, and hybrid public-private deployments.

Enterprises across manufacturing, healthcare, logistics, and energy sectors are increasingly adopting private 5G networks to ensure secure, high-speed, and low-latency communication. These networks support real-time monitoring, autonomous systems, robotics, and IoT device connectivity. The demand is further accelerated by digital transformation initiatives, Industry 4.0 adoption, and the need for uninterrupted operational performance. Private networks allow enterprises to isolate critical applications from public networks, improving security and reliability. Enhanced throughput, ultra-reliable low-latency communication (URLLC), and network slicing capabilities enable mission-critical operations such as remote diagnostics, AR-assisted maintenance, and automated material handling. Suppliers offering customizable network architecture, spectrum management, and seamless integration with existing IT infrastructure are well-positioned to drive enterprise adoption globally.

Deployment of private 5G networks faces challenges related to high initial capital expenditure, spectrum licensing, and infrastructure setup costs. Integration with legacy IT and operational technology (OT) systems can be complex, requiring specialized technical expertise. Regulatory requirements vary by country, with spectrum allocation, security compliance, and data sovereignty adding additional layers of complexity. Network interoperability, end-to-end security, and ongoing maintenance require significant operational investment. Limited availability of certified devices and edge computing solutions can further constrain deployment speed. Enterprises increasingly prefer vendors offering complete deployment solutions, technical support, and predictable service-level agreements (SLAs) to mitigate operational risks and ensure reliable performance in critical applications.

Opportunities are strongest in industrial automation, healthcare facilities, and smart logistics operations. Manufacturing plants leverage private 5G for robotic automation, real-time process monitoring, and predictive maintenance. Hospitals adopt private networks for remote diagnostics, AR-assisted surgeries, and secure patient data transfer. Logistics companies utilize ultra-reliable connectivity for asset tracking, automated warehousing, and fleet management. Cloud-based orchestration, edge computing, and network slicing create further scope for customized enterprise solutions. Early adopters in Asia-Pacific, Europe, and North America are demonstrating tangible productivity gains, reducing downtime, and improving operational efficiency. Vendors providing vertically tailored solutions, managed services, and end-to-end network deployment are likely to secure long-term contracts and repeat business.

The market is trending toward AI-driven network optimization, predictive maintenance, and intelligent traffic management. Edge computing integration allows low-latency processing for mission-critical applications and reduces dependency on centralized cloud infrastructure. Hybrid deployments combining private and public 5G networks are gaining traction for cost efficiency and scalability. Network slicing and virtualization enable enterprises to allocate dedicated bandwidth for specific applications, improving reliability and security. Partnerships between telecom operators, equipment vendors, and IT service providers are enhancing integration, technical support, and lifecycle management. Suppliers offering advanced, flexible, and fully managed private 5G network solutions are best positioned to meet the evolving connectivity needs of enterprise clients across multiple verticals.

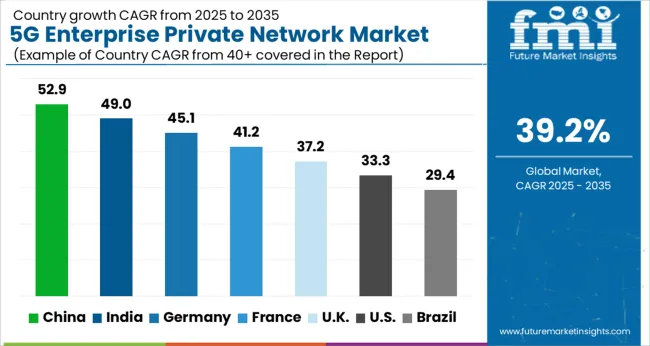

| Country | CAGR |

|---|---|

| China | 52.9% |

| India | 49.0% |

| Germany | 45.1% |

| France | 41.2% |

| UK | 37.2% |

| USA | 33.3% |

| Brazil | 29.4% |

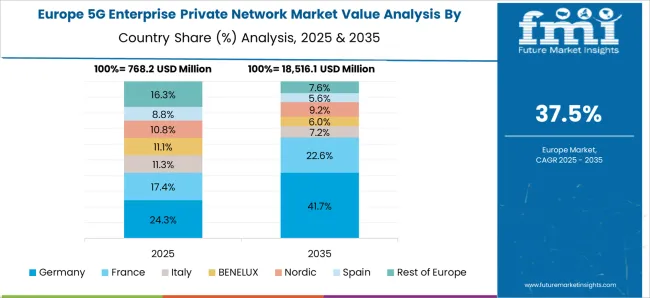

The global 5G enterprise private network market is projected to grow at a CAGR of 39.2% from 2025 to 2035. China leads at 52.9%, followed by India at 49.0%, Germany at 45.1%, the UK at 37.2%, and the USA at 33.3%. Growth is driven by industrial digitization, smart manufacturing, logistics automation, and secure enterprise communication. Asia, especially China and India, exhibits rapid expansion due to industrial modernization and government-backed smart infrastructure programs. Europe emphasizes Industry 4.0 adoption, smart factories, and connected mobility, while North America focuses on healthcare, aerospace, and critical infrastructure. Integration with edge computing, AI, and network slicing enhances operational efficiency, automation, and secure data management worldwid The analysis includes over 40+ countries, with the leading markets detailed below.

The 5G enterprise private network market in China is projected to grow at a CAGR of 52.9% from 2025 to 2035, fueled by rapid digital transformation initiatives and widespread industrial automation. Enterprises across manufacturing, logistics, healthcare, and smart city projects are deploying private 5G networks to enhance operational efficiency, low-latency communications, and secure data exchange. Telecom providers and technology vendors are collaborating to deliver end-to-end solutions, including edge computing and network slicing. Government-backed industrial digitization and smart city programs accelerate adoption in urban and industrial clusters. Enterprises prioritize reliable, scalable, and low-latency networks to support robotics, AI-driven analytics, and AR/VR applications in manufacturing and logistics.

Demand for 5G enterprise private network in India is expected to expand at a CAGR of 49.0%, driven by enterprise digitization, Industry 4.0 adoption, and rapid telecom infrastructure expansion. Large manufacturers, logistics hubs, and IT companies are deploying private 5G networks for secure communication, low-latency data transmission, and advanced analytics. Telecom operators are partnering with global solution providers to offer customized private network solutions for factories, ports, and data centers. Edge computing and AI integration further enhance operational efficiency, enabling predictive maintenance, automated workflows, and real-time decision-making. Government programs supporting digital transformation, smart manufacturing, and connected infrastructure bolster adoption across urban and industrial regions.

5G enterprise private network market in Germany is forecasted to grow at a CAGR of 45.1%, supported by strong industrial base, Industry 4.0 adoption, and advanced research infrastructure. Automotive manufacturers, industrial equipment producers, and logistics operators are implementing private 5G networks for low-latency machine-to-machine communication, autonomous vehicles, and robotics coordination. Enterprises are investing in secure, high-bandwidth networks to support cloud integration, AR-assisted manufacturing, and digital twin solutions. Government initiatives promoting smart factories and connected mobility accelerate deployment. Private 5G solutions also enhance operational reliability, supply chain efficiency, and industrial cybersecurity.

The UK market is projected to grow at a CAGR of 37.2%, driven by digital transformation initiatives across manufacturing, healthcare, and logistics sectors. Private 5G networks are being deployed to enable secure, low-latency communication, support IoT devices, and improve real-time operational analytics. Telecom operators and solution providers are collaborating with enterprises to deliver customized private network deployments with network slicing and edge computing capabilities. Demand for private networks is rising in urban infrastructure, ports, and smart campuses. Integration with AR/VR solutions, AI analytics, and cybersecurity frameworks further strengthens adoption.

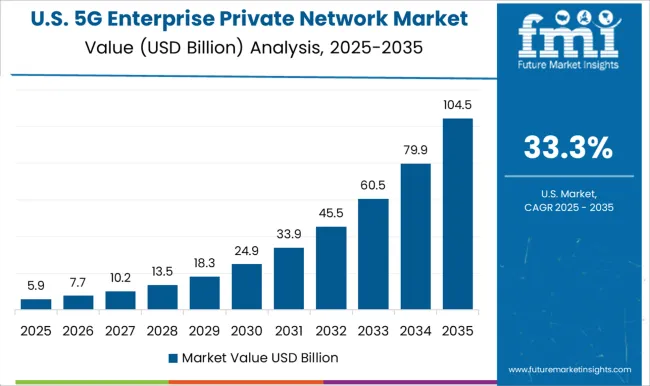

The USA market is expected to grow at a CAGR of 33.3%, driven by enterprise digitization, smart manufacturing, and secure communication requirements. Companies in healthcare, aerospace, logistics, and critical infrastructure are adopting private 5G networks for high-bandwidth, low-latency applications. Telecom providers collaborate with technology firms to offer managed private networks with network slicing, cloud integration, and edge computing capabilities. Enterprise deployments focus on operational efficiency, automation, predictive maintenance, and secure data management. Growing demand from smart campuses, industrial automation, and data-intensive applications ensures continued market expansion.

Competition in the 5G enterprise private network market is defined by low-latency performance, security, and end-to-end integration. Huawei Technologies leads through turnkey 5G solutions, radio access networks, and core network expertise, targeting manufacturing, logistics, and smart city deployments. Cisco Systems, AT&T, and AWS (Amazon Web Services) focus on cloud-connected private networks, edge computing, and software-defined networking, emphasizing seamless integration with enterprise IT systems. Microsoft Azure and IBM compete with hybrid cloud offerings, analytics, and AI-driven network management. Accenture positions itself as a systems integrator, enabling private 5G rollout, consulting, and operational efficiency. Chipset and hardware providers like Qualcomm, NVIDIA, and Hewlett Packard Enterprise (HPE) differentiate through high-performance 5G radios, edge servers, and AI-enabled processing. Deployment speed, spectrum utilization, and network slicing capabilities are marketed as key differentiators.

Industry-specific solutions are prioritized for manufacturing automation, healthcare IoT, energy grids, and logistics tracking. Interoperability with existing enterprise IT infrastructure and multi-vendor environments is emphasized to reduce integration risk and accelerate adoption. Product brochure content is explicit and technical. Solutions highlight 5G radio units, private core networks, edge computing nodes, and cloud orchestration tools. Network slicing, latency benchmarks, throughput metrics, and security protocols are detailed. Deployment models include on-premises, hybrid, and cloud-managed configurations. Management platforms provide dashboards for analytics, monitoring, and predictive maintenance. Integration with IoT devices, AI workloads, and enterprise applications is specified.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Component | Services, Hardware, and Software |

| Deployment Mode | On-premises, Cloud-based, and Hybrid |

| Frequency Band | Sub-6 GHz and Millimeter Wave (mmWave) |

| Organization Size | Large Enterprises and SMEs |

| End Use | Manufacturing, Healthcare, Transportation and Logistics, Retail, Energy and Utilities, Smart Cities, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Huawei Technologies, Accenture, AT&T, AWS (Amazon Web Services), Cisco Systems, Hewlett Packard Enterprise (HPE), IBM, Microsoft Azure, NVIDIA, and Qualcomm |

| Additional Attributes | Dollar sales by network type (standalone, non-standalone), deployment model (on-premise, cloud-managed, hybrid), and application (manufacturing, logistics, healthcare, smart cities). Demand dynamics are driven by enterprise digital transformation, low-latency connectivity needs, and secure data handling. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by industrial automation initiatives, government 5G policies, and adoption of IoT and AI-enabled enterprise solutions. |

The global 5G enterprise private network market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the 5G enterprise private network market is projected to reach USD 111.4 billion by 2035.

The 5G enterprise private network market is expected to grow at a 39.2% CAGR between 2025 and 2035.

The key product types in 5G enterprise private network market are services, consulting, managed services, support and maintenance, hardware, radio access network (RAN), core network, edge computing infrastructure, software, network management software, security software, network slicing software and automation and orchestration tools.

In terms of deployment mode, on-premises segment to command 47.1% share in the 5G enterprise private network market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

5G RAN Market Size and Share Forecast Outlook 2025 to 2035

5G Security Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

5G System Integration Market Insights - Demand & Growth Forecast 2025 to 2035

5G Chipset Market Analysis - Growth & Forecast through 2034

5G Fixed Wireless Access Market

5G-Enhanced Surveillance Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA