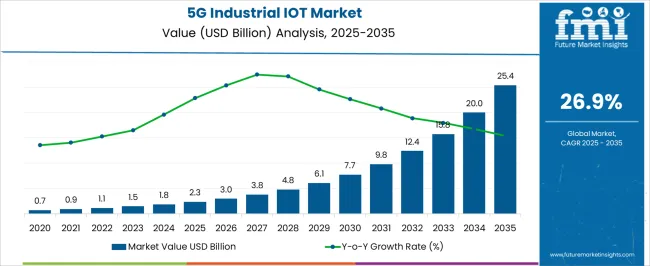

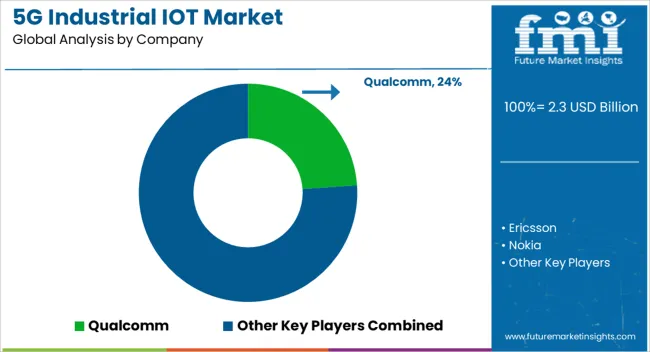

The 5G Industrial IOT Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 25.4 billion by 2035, registering a compound annual growth rate (CAGR) of 26.9% over the forecast period.

| Metric | Value |

|---|---|

| 5G Industrial IOT Market Estimated Value in (2025 E) | USD 2.3 billion |

| 5G Industrial IOT Market Forecast Value in (2035 F) | USD 25.4 billion |

| Forecast CAGR (2025 to 2035) | 26.9% |

The 5G industrial IOT market is expanding rapidly due to the convergence of advanced connectivity, automation, and data driven manufacturing ecosystems. The deployment of 5G networks is enabling ultra reliable low latency communication, which is critical for industrial automation, robotics, and remote monitoring.

Industries are leveraging 5G to enhance operational efficiency, improve worker safety, and support large scale device connectivity in complex manufacturing environments. The growing focus on predictive maintenance, energy management, and smart logistics is reinforcing the adoption of 5G enabled solutions.

Governments and enterprises are also making significant investments in industrial digitalization and smart factory initiatives, which are creating strong demand for 5G powered platforms. The market outlook remains highly positive as enterprises accelerate transformation strategies to achieve resilience, agility, and sustainability in their industrial operations.

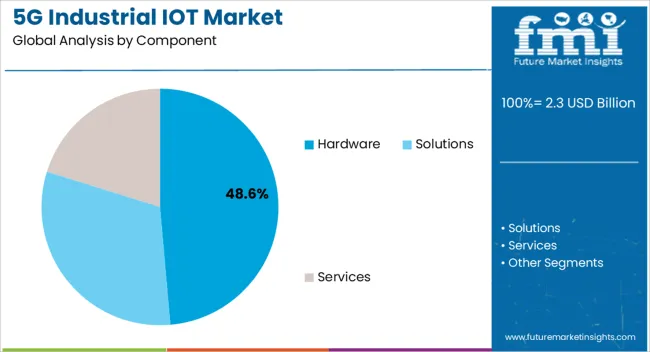

The hardware segment is expected to represent 48.60% of total market revenue by 2025 within the component category, making it the leading segment. This growth is being driven by the high demand for sensors, gateways, modules, and edge devices that enable real time data collection and seamless communication across industrial networks.

Hardware forms the foundation of industrial connectivity and its deployment ensures robust data transmission, low latency, and secure network access. Continuous advancements in chipsets and communication modules are further enhancing efficiency and integration with 5G infrastructure.

As industries seek reliable connectivity and automation capabilities, the hardware segment continues to dominate due to its critical role in enabling industrial IOT systems.

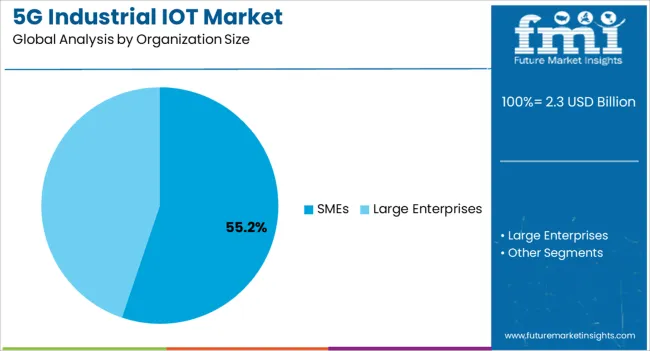

The SMEs segment is projected to hold 55.20% of total revenue by 2025 within the organization size category, positioning it as the largest segment. This growth is fueled by the increasing adoption of 5G enabled solutions by small and medium enterprises that are aiming to modernize operations and remain competitive in global markets.

SMEs are investing in scalable industrial IOT applications to optimize productivity, reduce downtime, and improve resource utilization. Affordable 5G solutions tailored for SMEs are further accelerating adoption.

With flexibility, agility, and strong focus on digital transformation, SMEs are driving large scale implementation of industrial IOT technologies, establishing their leadership within this segment.

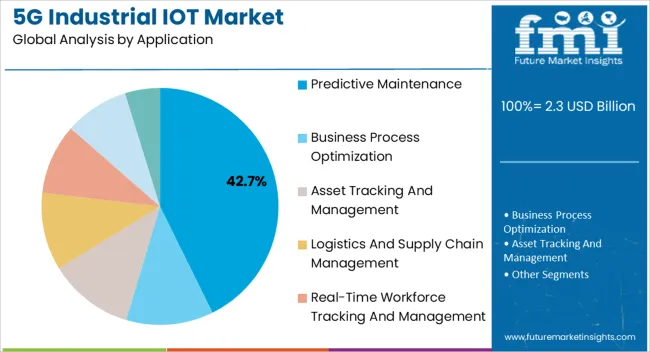

The predictive maintenance application is anticipated to contribute 42.70% of total market revenue by 2025 within the application category, making it the most significant area of use. Its dominance is driven by the ability to reduce unplanned downtime, extend asset life, and minimize operational costs.

5G powered predictive maintenance leverages real time monitoring, AI based analytics, and edge computing to predict failures before they occur. Industries such as manufacturing, energy, and transportation are increasingly implementing predictive maintenance to achieve operational efficiency and safety compliance.

The scalability and cost saving potential of predictive maintenance have reinforced its adoption, making it the leading application segment in the 5G industrial IOT market.

The global 5G industrial IoT industry size developed at a CAGR of 26.1% from 2020 to 2025. In 2020, the global market size stood at USD 2.3 million. In the following years, the market witnessed significant growth, accounting for USD 1,123.1 million in 2025.

5G industrial IoT has contributed assistance to the manufacturing sector as with the help of this they can automate the production process with great precision reducing errors and with safety. Of this, productivity has increased without rendering quality and safety issues. There is a huge demand for 5G industrial IoT due to its fast connectivity and reliable service, many industries are adopting the technology to overcome the data traffic and uninterrupted connections. With the development of various M2M associations across manufacturing industries 5G industrial IoT sector is projected to record a CAGR of 28.2% over the coming 10 years.

The implementation of 5G technologies can markedly revolutionize the workplace's management and influence workforce planning at the office. 5G, together with the Internet of Things, has the opportunity to robotize the office of executive directors' actions, such as booking tasks and organizing resources and licenses for each one of the employees on the assembling floor.

5G, together with IoT-enabled linked comfort-driven trade arrangements, may gain addressing abilities at a superior level, making work environments more productive, smooth, secure, and useful. Likewise in a wide range of industries, the adoption of technology is boosting the market.

Businesses around the world have sought to integrate this business for fast set-up and mass transmission, owing to its ultrahigh reliability that's sparked usage in the world's most critical industries. Connectivity is of vital significance to make the worldwide community intact and that's carried out by utilizing the 5G networks in most industries.

5G industrial Internet of Things has attracted the manufacturing sector and discrete industries in a big way, contributing to the growth of the overall market. In discrete industries, Industry Internet of Things-enabled items serves as an efficient method for increasing the quality of the item's functional elements and providing a unique motivation for the clients to purchase them.

5G innovative IoT setups help to boost the entire productivity of the consumer electronics area of the media little organization (IoT) through the stabilization of a larger network among all IoT gadgets.

5G technology has decreased the cost of Internet of Things (IoT) devices, sensors, and electronics, which has contributed to many trying to keep up with the devices after a short while.

This momentum has contributed to the market in a positive direction. 5G is anticipated to ensure the most extreme double-dealing skills of IT devices by optimizing the link between them and supplying a considerable increase of 10 Gbps at the start of a link and enhancing the scope and ability to connect devices and items.

5G components speed up the execution of Industry 4.0 and incorporate Enhanced Mobile Broadband (eMBB), which gives higher data transfer capacity and rates in densely populated regions and industrial areas, like manufacturing plants.

Broadband network is relied upon to improve security by allowing users to make use of telematics devices in factories working during the Fourth Industrial Age. Industry 4.0 of assembling process changes incorporate autonomous vehicles, commercial and industrial robots, 3D printing with advanced materials, better sensors, etc.

5G organizations work with mindful and sensible incorporation of these developments leading to increased awareness and resourcefulness, capability, and adaptability in manufacturing processes.

In 2025, the solutions segment by component is expected to create an enormous revenue stream during the forecast period. In 2025, the solutions segment captured 45.20% shares in the global market. The 5G industrial IoT solution components are designed to meet the unique requirements of various industries.

They provide features tailored for specific domains, like supply chain optimization, asset tracking, remote monitoring, predictive maintenance, and more. For businesses working across a variety of industries, this industry-focused strategy raises the value and relevance of solution components.

Large enterprises show a huge potential for growth in the 5G Industrial IoT industry in the organization size segment. Revenue through large enterprises is expected to record a CAGR of 28% during the next ten years. In 2025, the large enterprise segment by organization size captured 61.2% of shares in the global market.

Large enterprises are very much attracted to the technology due to its vast range of applications in industries. Large enterprises have large funds to invest in their 5G IoT infrastructure, as compared to SMEs.

They use 5G technology to efficiently manage direct or remote their assets across the globe. To connect and look after the processes high speed and reliable service are required for that purpose there is a huge pull for 5G across industries.

For workforce tracking, predictive maintenance, and business process optimization large enterprises are agile in using the 5G industrial IoTs and implementing these applications. Several industries use technology in logistics and supply chain management, owing to which they have increased efficiency and have shown subsequent growth in the business.

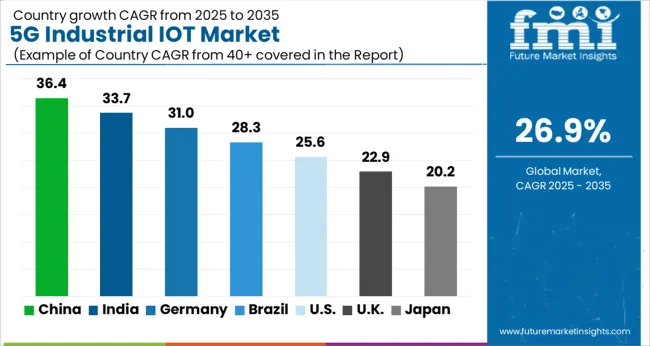

The market is relied upon to develop at a significant rate in the forthcoming years. The market in the Asia Pacific is relied upon to enroll a high CAGR during the forecast period because of expanded interest in 5G industrial IoT.

The region is set to rule 5G, edge processing, blockchain, and 5G center innovation, because of its size, variety, and the essential lead taken by countries, including South Korea, China, and Japan.

The Association of Southeast Asian Nations (APAC) is seeing a vast increase in the adoption of 5G technology and the development of manufacturing industries within the area. The government is taking action to help develop the technology by granting the necessary concessions for infrastructure and research & development.

India dominated the global market in 2025. India captured 28.4% shares in the global market in 2025. The population of India is enormous, and its economy is expanding quickly. For the adoption and deployment of 5G industrial IoT solutions, the market's sheer size presents impressive prospects.

Intending to transform India into a society where everyone has access to the internet, the Indian government has been supporting the Digital India campaign. Along with the implementation of 5G technology, this plan calls for the establishment of smart cities, digital infrastructure, and the Internet of Things (IoT). India is recognized for its highly qualified software developers and engineers and has a thriving IT services sector.

Key players such as Qualcomm; Ericsson; Nokia; Huawei; Cisco adopt several technological strategies to enhance their revenue and market standings. These strategies include research and development investments, mergers, acquisitions, partnerships, collaborations, and others.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Component, Organization Size, Application, End-user, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global 5G industrial IoT market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the 5G industrial IoT market is projected to reach USD 25.4 billion by 2035.

The 5G industrial IoT market is expected to grow at a 26.9% CAGR between 2025 and 2035.

The key product types in 5G industrial IoT market are hardware, solutions and services.

In terms of organization size, smes segment to command 55.2% share in the 5G industrial IoT market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

5G Solid State Switches Market Size and Share Forecast Outlook 2025 to 2035

5G Gain Block Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Market Size and Share Forecast Outlook 2025 to 2035

5G Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

5G RAN Market Size and Share Forecast Outlook 2025 to 2035

5G Security Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G technology market Analysis by Technology Type, Application, Vertical, and Region – Growth, trends and forecast from 2025 to 2035

5G in Automotive and Smart Transportation Market by Solution ,Application,Industry , Warehousing & Logistics, Warehousing & Logistics, Public Safety and Others & Region Forecast till 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA