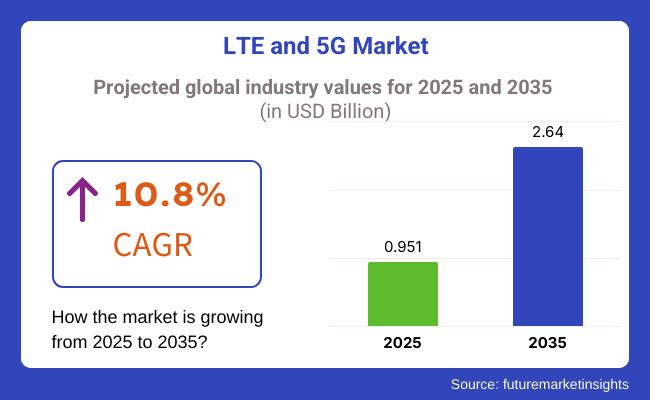

The LTE and 5G market is expected to grow at a CAGR of 10.8% between 2025 and 2035. Hence, the industry size will be around USD 951.53 million in 2025 and will grow enormously to USD 2.64 billion by 2035.

The growth of this industry is chiefly driven by the expedient deployment of 5G networks, increasing demand for high-speed mobile broadband, and global LTE infrastructure proliferation. Substantial growth of the industry hints towards an emerging role of next-gen connectivity solutions to deliver seamless communication, industrial automation, and digitalization.

The industry unleashed a new business model based on ultra-high speed connectivity, low latency, and a high network capacity that reshaped the telecommunications business.

While LTE is still a mainstay for cellular communications, this shift to 5G is also creating opportunities in segments such as autonomous vehicles, smart cities, telemedicine, and industrial Internet of Things. With emerging markets racing to roll out LTE and 5G coverage, a record rush of deployment of network infrastructure and spectrum resources is taking place to meet the various emerging consumer and business requirements.

Some of the key contributors to the Industry include the rising number of data-intensive applications such as video streaming, gaming, and cloud computing that need faster and more reliable networks. It is also making big investments in network coverage expansion, small cell infrastructure deployments, and enhancing 5G spectrum capacity.

Increasing adoption of private 5G networks across industries, including manufacturing, healthcare, and logistics, also fuels industry growth. Similarly, edge computing and AI-driven network optimization are further boosting the performance and efficiency of networks.

While the industry outlook is promising, several challenges hinder the smooth implementation of LTE and 5G networks. Telecommunications operators are confronted with economic challenges due to the significant expenditure associated with network densification and spectrum purchasing for the deployment of infrastructure. In addition, cybersecurity and data privacy challenges continue to be high-pressure as 5G networks connect more devices and support more mission-critical applications. Additional impediments to rapid adoption include regulatory barriers, delays in spectrum allocation, and the difficulties of interoperability between existing LTE networks and the coming 5G technologies.

Technological innovation and emerging consumer and enterprise needs will fuel the future of the industry. The use of machine learning and AI in network administration is expected to enhance predictive analytics and make network performance management more efficient.

O-RAN technology enables interoperability between vendors, reducing the cost of deployment and enabling a more agile network structure. In addition, the increasing focus on green networking and energy-efficient 5G infrastructure is affecting the industry's long-term development. (liberalizing) the whole internetworking.

LTE & 5G, all sectors ride on top of the LTE & 5G, will definitely be the key to industries' demography, closing the digital divide and enabling the next golden period of innovation within international communications.

| Segment | Value Share (2025) |

|---|---|

| FDD LTE | 67.6% |

FDD LTE is forecasted to account for 67.6% industry share by 2025. It has made it the best charge of several wireless systems like mobile and broadband services. This component provides excellent assistance in both territorial and urban locales and is the reason for everyone to adopt it in general.

Despite the challenges, the growth of FDD LTE can be attributed to factors such as its capacity for high data rates and extensive coverage in heterogeneous terrains. With mobile data usage around the world expected to grow steadily in the coming years, FDD LTE is still at the heart of many telecom networks, as it brings reliable and effective connectivity to everyone in both rural and urban environments.

These factors are going to push FDD LTE deeper into the next-gen wireless communication life cycle with leading professionals such as Ericsson, Nokia, and Huawei continuing to deploy, operate and roll-out FDD LTE networks all over the world.

However, TDD LTE (Time Division Duplex Long-Term Evolution) is likely to hold burning growth as it is expected to account for approximately 32.4% of the industry by 2025. TDD LTE (Time-Division Duplex Long-Term Evolution) is also gaining traction as it enables better utilization of the available spectrum and supports evolution in dense environments where raising the data traffic is mainly focused.

Its ability to allow data-heavy services from 5G connectivity through to the progression of mobile broadband is even more crucial. With TDD LTE's flexibility in managing asymmetrical traffic patterns, network resources can be optimized to perform better for high-bandwidth applications such as video streaming, online gaming, and IoT.

| Segment | Value Share (2025) |

|---|---|

| Rel 8 | 37.9% |

Rel 8 is predicted to lead the industry, holding around 37.9% of the share by 2025. Rel 8, is a very important step for LTE as it marked the introduction of Mobile broadband for the masses. It was the basis for high-speed mobile communication capable of peak download speeds of up to 300Mbps and upload speeds of 75Mbps.

The wide deployment of Rel 8 in 4G LTE networks around the world, together with its efficacy and scaling, made it a pivotal development in wireless communication. Environmental influences also cause further debate in the fact that the protocol becomes a secondary means by which to transmit data. Ericsson, Huawei, Qualcomm, and others have been using Rel 8 and building on top of it as they create and optimize 4G and 5G networks.

Although the new Rel 9 is being adopted, it will still have a industry share of only about 27.5% in 2025. The boost in LTE spectrum efficiency and latency in Rel 9 was unprecedented as compared to Rel 8. Operators are inching closer to Rel 9, which is a major step requiring many basics like enhancing handover and adding VoLTE (Voice over LTE). It's a critical version for operators moving from 4G to 5G networks as it enables smoother deployments and provides faster data services.

The industry is experiencing rapid growth due to the high demand for high-speed, low-latency connectivity across different industries. The telecommunication industry remains at the forefront of 5G deployment, with a focus on improving network infrastructure and spectrum efficiency.

The auto sector is using 5G for connected and autonomous cars with a focus on ultra-low latency and reliable communication. In healthcare, 5G facilitates remote patient monitoring, telemedicine, and AI-based diagnostics with the need for high security and reliability.

The Industrial Internet of Things (IIoT) industry utilizes real-time monitoring and automation with scalable and economical networks. The smart cities implement LTE and 5G to use for public safety, traffic management, and infrastructure monitoring and focus on the network's scalability and coverage.

The industry is changing due to developments in edge computing, AI-optimized network performance, and private 5G networks, defining future global connectivity.

Contract & Deals Analysis

| Company | Contract Value (USD millon) |

|---|---|

| Nokia | Approximately USD 150 - USD 160 |

| Ericsson | Approximately USD 140 - USD 150 |

| Huawei | Approximately USD 130 - USD 140 |

| Qualcomm | Approximately USD 110 - USD 120 |

| ZTE | Approximately USD 100 - USD 110 |

From 2024 to early 2025, the industry expanded significantly based on the growing need for speed, upgrades, and new-gen technologies. Established players such as Nokia, Ericsson, Huawei, Qualcomm, and ZTE are entering significant contracts and alliances that steer the focus of such players toward raising network capacities, security, and mobile communication innovation. Progress like this ensures that there is dedication within the industry to bridging gaps in connectivity to build a digital infrastructure that remains competitive and more resilient.

During 2020 to 2024, the industry witnessed exponential growth as companies leveraged high-speed connectivity to enhance business processes and data processing in real time. 5G network deployment offered ultra-low latency, higher bandwidth, and enormous device connectivity, and supported IoT, autonomous cars, and smart cities use cases.

Telecom companies invested heavily in installing 5G infrastructure focusing on improved coverage, network densification, and interoperability with existing LTE networks. Companies utilized LTE and 5G to enhance industrial automation, remote healthcare, and real-time streaming, enhancing the efficiency of operations and customer engagement. Network congestion, security threats, and availability of the spectrum continued to pose problems. Leading up to 2025 to 2035, the industry will evolve towards AI-driven, 6G-driven networks with near-instant connectivity and predictive intelligence.

AI-native network optimization will enable real-time traffic pattern changes and resource allocation, improving efficiency and reducing downtime. Edge AI and decentralized computing will support autonomous systems and smart infrastructure, allowing for faster decision-making with reduced latency. Quantum-secure encryption will secure networks against emerging cyber threats, and AI-driven self-healing networks will automatically identify and repair failures. Energy-efficient designs and AI-driven resource management will minimize environmental impact. 6G networks will facilitate hyper-personalized digital experiences, immersive AR/VR, and enhanced machine-to-machine communication, transforming industries and consumer experience.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Scaling up 5G infrastructure to support greater bandwidth and low latency. | 6G-enabled networks offer sub-millisecond latency and ultra-high-speed data transfer. |

| LTE and 5G utilized for industrial automation, smart cities, and healthcare. | AI-tuned 6G supports real-time autonomous systems and hyper-personalized services. |

| Network congestion and cybersecurity attacks posed challenges. | Quantum-secure encryption and AI-based threat intelligence enable connectivity to be secure. |

| AI-based network optimization maximized traffic management and resource allocation. | AI-native self-healing networks identify and repair faults automatically. |

| Edge computing based on 5G reduced latency for autonomous vehicles and IoT. | Edge networks with AI enhanced decision speed and deep learning at the edge. |

| LTE was used as a fallback in areas where 5G coverage was not available. | Smart, transparent AI integration over multi-cloud and decentralized networks. |

| Increased power usage due to network densification. | Green computing and AI-driven resource provisioning reduce environmental impact. |

The industry is growing fast, with the factors such as by rising demand for high-speed networking and low-latency services. Yet, high capital expenses, such as spectrum procurement, deployment of networks, and maintenance, are major financial risks.

Security risks continue to be a significant issue with the introduction of 5G networks, as they bring new threats of cyberattacks, data hacking, and espionage. The combination of IoT and cloud services creates greater risk exposure. Strong encryption, AI-based threat detection, and partnerships with cybersecurity companies are necessary for ensuring security risk reduction in LTE and 5G infrastructure.

Supply chain disruptions, such as semiconductor shortages and geopolitical trade restrictions, affect network equipment availability. Relying on limited suppliers for key components, such as base stations and chipsets, can cause project delays. Diversification of supply chains, investment in localized manufacturing, and the creation of contingency plans can help ensure steady production.

Some of the technological issues in the transition to 5G from LTE are legacy network backward compatibility as well as variability in adoption rates by regions. It becomes essential for organizations to adopt smooth migration planning, hybrid network support, and backward compatibility to enable large-scale adoption of 5G without disrupting existing services.

For sustained success, telecom operators must prioritize cost-efficient deployment, regulatory compliance, and sophisticated cybersecurity solutions. Investment in R&D on energy-efficient infrastructure, AI-empowered network optimization, and global collaborations will be the drivers for maintaining growth and resilience in the dynamic LTE and 5G marketplace.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 9.1% |

| France | 9.3% |

| Germany | 9.4% |

| Italy | 8.9% |

| South Korea | 9.8% |

| Japan | 9.3% |

| China | 10.2% |

| Australia | 8.7% |

| New Zealand | 8.5% |

The USA leads the LTE and 5G space decisively due to merciless investments in 5G infrastructure, spectrum, and AI-driven network automation. The Federal Communications Commission (FCC) proactively encourages 5G deployment throughout urban and rural America, delivering across-the-board high-speed, low-latency connectivity. Edge computing, private 5G networks, and cloud-native platforms are transforming verticals such as smart cities, autonomous vehicles, and digital health. The USA telecom environment is also witnessing increased enterprise-grade 5G deployment, which is facilitating industrial automation and the development of IoT solutions.

Telecom operators like Verizon, AT&T, and T-Mobile are also driving large-scale national 5G coverage with mmWave, network slicing, and predictive analytics based on AI. USA technology leaders like Qualcomm and Cisco are leading in 5G chipset innovation and network security. The meteoric ascent of Cloud gaming, video streaming, and AI-powered virtual assistants further boosts the demand for ultra-low and ultra-high latency networks. Strong policy support, as well as government and private investments, place the nation in a leading position to embrace 5G worldwide.

It is set to record a 9.1% CAGR between 20252035. The UK is moving steadily in the 5G and LTE arena, supported by government-backed innovation drives, increasing deployments of fiber-optic networks, and increased demand for low-latency networks. The Department for Digital, Culture, Media & Sport (DCMS) has a critical role to play in enabling 5G uptake, private network tests, and AI-powered spectrum management to achieve optimal national connectivity. The UK 's spending on smart city initiatives and industrial automation is fueling the demand for 5G-based IoT solutions.

Telecom service leaders such as BT Group, Vodafone, and Three UK are pioneering network virtualization, edge computing, and AI-based predictive maintenance to develop service reliability. Cloud gaming, AR, and hybrid work solutions are fueling demand for high-speed, uninterrupted connectivity. Besides, UK-based technology firms are investing in AI-powered network optimization and cybersecurity to enhance user experience. Continuous standalone 5G network deployment and private 5G implementation will further intensify industry expansion.

France is witnessing steady growth in the LTE and 5G segment, thanks to digital transformation plans backed by the government and increasing interest in AI-based network automation. The French telecommunications industry is reaping fiber-optic infrastructure investment, 5G spectrum expansion, and research on 6G technology. The push of the country towards smart industries like AI-based logistics and industrial connectivity is fueling the use of 5G networks.

Telecom leaders such as Orange, Bouygues Telecom, and SFR are also investing in network slicing based on AI, cybersecurity, and cloud-native architecture to enhance connectivity. French operators also dominate the construction of private 5G networks for businesses with high-performance and secure connections for mission-critical applications. The revolution in digital services, from telemedicine to automation with AI, is driving demand for efficient and higher wireless solutions.

The German 5G and LTE industry is growing strongly through industrial automation, smart mobility, and government-sponsored digital infrastructure initiatives. The country is a leader in manufacturing through 5G and smart factories, and it is a center for industrial technology. The government is promoting AI-powered network security, autonomous mobility solutions, and high-speed telecom infrastructure to take care of rising expectations from connected industries.

Deutsche Telekom, Vodafone Germany, and Telefónica Deutschland are ultra-broadband, AI-based cybersecurity and edge computing investors in 5G innovation pioneers. Growing private 5G network demand across automotive, logistics, and energy sectors is further fueling the industry growth. Moreover, Germany's focus on 6G technology research and 5G borderless connectivity leadership positions it as a wireless evolution leader in the future.

Italy is continually expanding its 5G and LTE coverage, and the rising need for smart cities, healthcare connectivity, and network automation via AI is propelling the growth. The government is making 5G deployment easier through infrastructure investment and spectrum auctions to provide the facility everywhere in the country. Italy's growing reliance on AI-driven applications in logistics and entertainment is also fueling the adoption of high-speed networks.

Telecom operators such as TIM, Vodafone Italy, and Wind Tre are leading 5G services with investments in network slicing, ultra-low latency applications, and artificial intelligence-based predictive maintenance. The rising digital economy of Italy and the growing demand for cloud gaming and over-the-top services are compelling telecom operators to develop stronger and more efficient wireless solutions.

Australia's 5G and LTE industry is growing steadily with the help of efficient government initiatives, increasing ultra-high-speed mobile broadband demands, and increased enterprise implementations of private 5G networks. The Australian Communications and Media Authority (ACMA) has been striving to open up the spectrum and construct 5G infrastructure for improving country-level connectivity. Australia's focus on smart mining, AI-driven agriculture, and remote healthcare solutions is fueling the use of 5G.

Key telcos such as Telstra, Optus, and TPG Telecom are investing in 5G stand-alone networks, AI-based network slicing, and ultra-high-speed connectivity solutions to improve customer experience. Australia's tech sector is also building AI-based cybersecurity and cloud computing technologies, further accelerating industry growth. 5G-smart cities and IoT applications deployment will drive Australia's digital revolution.

New Zealand is building LTE and 5G network infrastructure through enhanced investment in digital infrastructure, rural coverage rollout, and deployment of AI-based telecommunication solutions. The government is enabling 5G deployment to boost mobile broadband in the country and support innovation in industries such as smart agriculture and autonomous transport.

Telecom providers like Spark, Vodafone New Zealand, and 2degrees are rolling out 5G networks with a focus on high-speed data services, enterprise solutions, and AI-powered network management. New Zealand's desire for green technology solutions and smart city development is also propelling the greater adoption of 5G-enabled applications. The country's focus on digital innovation places it at the forefront of the evolving world telecoms landscape.

The 5G and LTE industry is in the midst of rapid change, driven by increasing demand for next-gen applications and gigabit-class connectivity. Network vendors and tech players are stepping up investments in spectrum, infrastructure, and software-defined networking to boost coverage and efficiency. Private 5G networks are likewise transforming business operations by facilitating customized connectivity solutions in industries such as manufacturing, transportation, and healthcare.

As 5G is increasingly adopted, companies are using AI and automation to enhance network management, reduce operating costs, and enhance service quality. Edge computing is aiding in addressing latency and allowing real-time applications, driving innovations like driverless automobiles and smart cities. Cloud-native telecom operations are also becoming inevitable to ensure flexibility and scalability, allowing the operators to scale and orchestrate the network at a faster pace.

Its competitive landscape consists of top telecom operators, network infrastructure vendors, and semiconductor firms coming together to shape the future of wireless technology. Collaboration and partnership are fueling innovation, and regulatory policy and spectrum auctions regulate industry forces. With more and more businesses and consumers relying on high-speed and low-latency connectivity, LTE and 5G innovation will be crucial to facilitate the future digital ecosystem.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Huawei Technologies | 25-30% |

| Ericsson | 20-25% |

| Nokia Corporation | 15-20% |

| Qualcomm Technologies | 10-14% |

| Samsung Networks | 6-10% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Huawei Technologies | Pioneers in 5G infrastructure, private networks, and AI-driven network automation. |

| Ericsson | Specializes in 5G radio access networks (RAN), cloud-based telecom solutions, and edge computing. |

| Nokia Corporation | Innovates in Open RAN, private 5G solutions, and network slicing for enterprise applications. |

| Qualcomm Technologies | Leads in 5G chipsets, mobile network innovation, and AI-powered network performance. |

| Samsung Networks | Focuses on 5G mmWave technology, massive MIMO solutions, and next-gen connectivity for telecom providers. |

Key Company insights

Huawei Technologies (25-30%)

Huawei leads the LTE and 5G space with its leading-edge network infrastructure with AI-driven automation and industry private network solutions across the world.

Ericsson (20-25%)

Ericsson leads 5G deployment with its leading-edge RAN solutions and cloud-native technology to facilitate telecom operators' seamless 5G transition.

Nokia Corporation (15-20%)

Nokia leads Open RAN and private 5G uptake with scalable enterprise-grade solutions for industrial automation and smart cities.

Qualcomm Technologies (10-14%)

Qualcomm is one of the largest 5G chipset leaders that drives fast mobile broadband, IoT connectivity, and AI-optimized network enhancement.

Samsung Networks (6-10%)

Samsung is leading the advancement of 5G mmWave technology deployment, complementing telecommunication operators and businesses with high-capacity networks.

Other Key Players (20-30% Combined)

These include:

The industry covers Long-term Evolution Frequency Division Duplex (FDD LTE) and Long-term Evolution Time Division Multiplex (TDD LTE).

The industry includes Rel 8, Rel 9, Rel 10, Rel 11, Rel 12, and Rel 13.

The industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa (MEA).

The Industry is expected to generate USD 951.53 million in revenue by 2025, driven by increasing mobile data consumption, network expansions, and the growing adoption of IoT devices.

The industry is projected to reach USD 2.64 billion by 2035, growing at a CAGR of 10.8%.

Key players include Huawei Technologies, Ericsson, Nokia Corporation, Qualcomm Technologies, Samsung Networks, Intel Corporation, Cisco Systems, ZTE Corporation, NEC Corporation, and telecom giants such as Verizon, AT&T, and T-Mobile.

Asia-Pacific and North America, driven by rapid 5G rollout, government initiatives for digital transformation, and increasing demand for ultra-fast wireless connectivity.

5G New Radio (NR) technology dominates due to its ability to provide high-speed, low-latency, and massive connectivity for next-generation mobile applications.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Release, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Spectrum, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Release, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Release, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 13: Global Market Attractiveness by Spectrum, 2023 to 2033

Figure 14: Global Market Attractiveness by Release, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Release, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 28: North America Market Attractiveness by Spectrum, 2023 to 2033

Figure 29: North America Market Attractiveness by Release, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Release, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Spectrum, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Release, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Release, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Spectrum, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Release, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Release, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Spectrum, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Release, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Release, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Spectrum, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Release, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Release, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Spectrum, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Release, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Spectrum, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Release, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Spectrum, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Spectrum, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Spectrum, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Release, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Release, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Release, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Spectrum, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Release, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

LTE And 5G NR-Based CBRS Networks Market Size and Share Forecast Outlook 2025 to 2035

LTE and 5G Broadcast Market – Future of Video Streaming

5G Electromechanical RF Switch Market Size and Share Forecast Outlook 2025 to 2035

5G Solid State Switches Market Size and Share Forecast Outlook 2025 to 2035

5G Gain Block Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Driver Amplifier Market Size and Share Forecast Outlook 2025 to 2035

5G Millimeter Wave RF Transceiver Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

5G in Healthcare Market Analysis Size and Share Forecast Outlook 2025 to 2035

5G Temperature-Compensated Crystal Oscillator (TCXO) Market Size and Share Forecast Outlook 2025 to 2035

5G Remote Surgery System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

5G Telemedicine Platform Market Size and Share Forecast Outlook 2025 to 2035

5G Industrial IOT Market Size and Share Forecast Outlook 2025 to 2035

5G IoT Market Size and Share Forecast Outlook 2025 to 2035

5G in Defense Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Private Network Market Size and Share Forecast Outlook 2025 to 2035

5G Edge Cloud Network and Services Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

5G Enterprise Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA