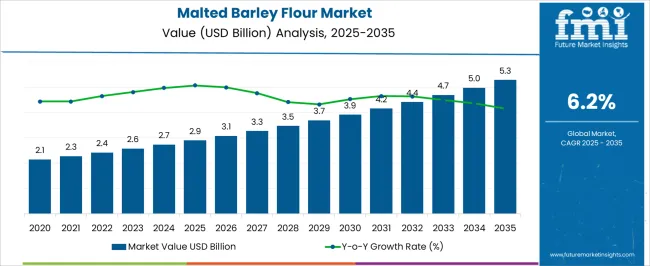

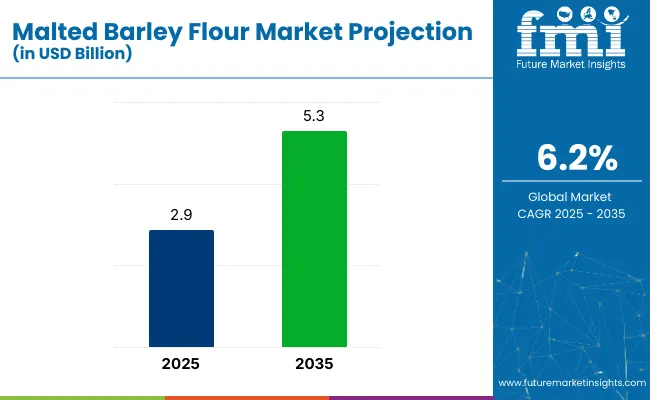

The global malted barley flour market is valued at USD 2.9 billion in 2025 and is expected to reach USD 5.3 billion by 2035, at a CAGR of 6.2%.

The primary drivers of this market's growth include increasing consumer awareness about health benefits, a rising shift towards whole grains, and the expanding demand for gluten-free products. The craft beer industry, which uses malted barley flour as a primary ingredient, is also expected to fuel the market’s growth during the forecast period.

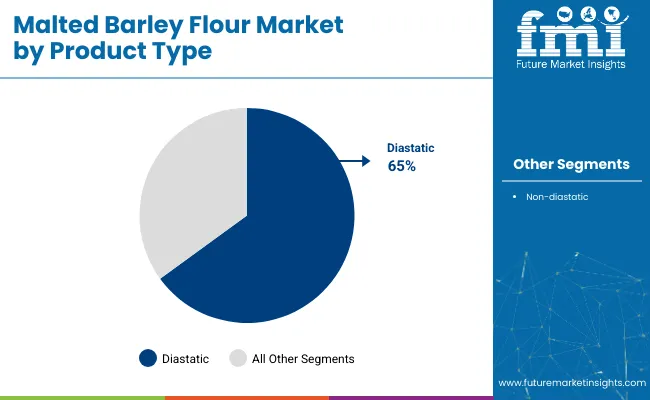

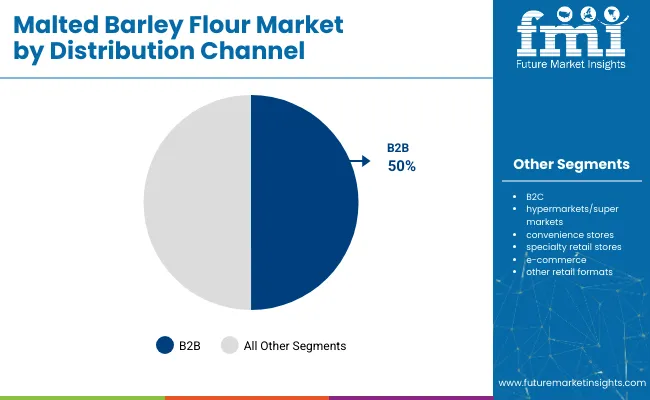

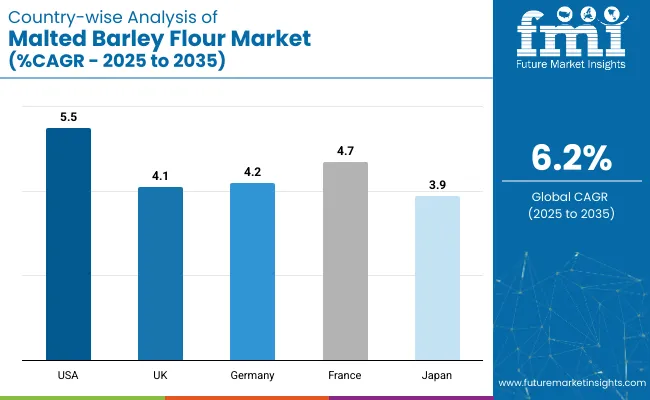

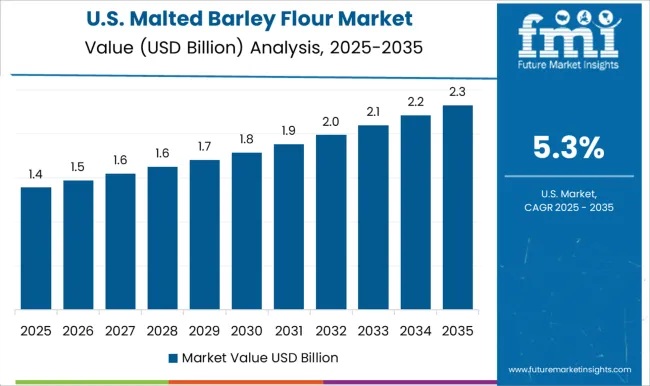

In 2025, the market is projected to experience solid growth, driven by the increasing consumer demand for healthier food options. The USA is expected to maintain its dominance in the market, growing at a prominent CAGR of 5.5%. Meanwhile, Germany and France closely follow this rapid growth, rising at significant CAGRs of 4.2% and 4.7% respectively. Diastatic, by product type, leads the market with 65% share in 2025, while the B2B channel is expected to dominate the distribution channel with 50% of the market share.

The market holds a small but significant share within its parent markets. In the barley market, it accounts for approximately 8-10%, given its role as a processed form of barley. Within the broader flour market, the share is relatively smaller at about 2-3%, as barley flour is a niche product compared to wheat flour. In the grain-based ingredients market, malted barley flour holds around 4-5%. Its presence is more prominent in specialized markets like the brewing ingredients market, where it accounts for 10-15% due to its use in brewing and craft beer production.

With increasing consumer interest in organic, gluten-free, and healthy food products, the malted barley flour market is expected to continue its upward trajectory. Companies are innovating to improve the nutritional profiles of their products, and governments are supporting the expansion of organic food sectors. The craft beer industry will likely remain a key driver of demand, and market players will continue to invest in expanding their footprint in emerging markets like Asia-Pacific.

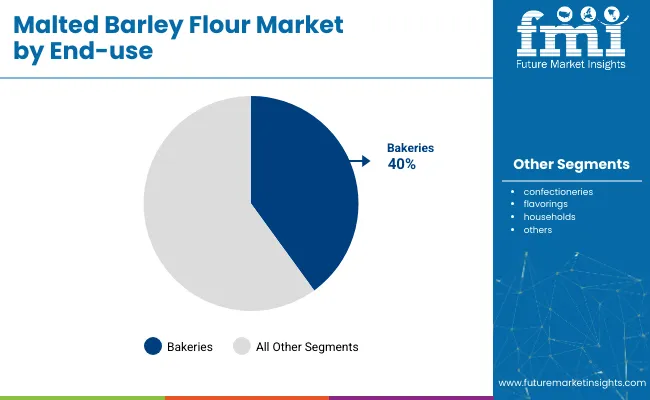

The global malted barley flour market is segmented by product type, end use, source, distribution channel, and region. The primary product types include diastatic and non-diastatic. The end use segments include bakeries, confectioneries, flavorings, households, and others (such as animal feed, food processing, etc.).

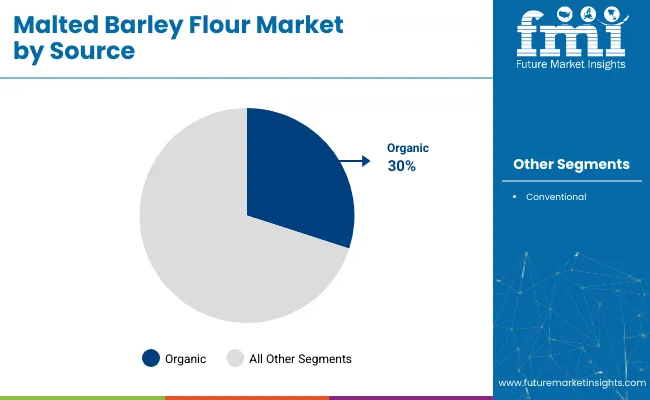

For the source, the market is divided into organic and conventional. In terms of distribution channels, the market is segmented into b2b, b2c, hypermarkets/supermarkets, convenience stores, specialty retail stores, e-commerce, and other retail formats. By region, it covers North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The Diastatic segment holds a significant share of 65% in the malted barley flour market, accounting for the majority of the product type segment due to its critical role in fermentation and brewing applications. Diastatic malt is widely used in the food and beverage industry, particularly in brewing, where it enhances enzymatic activity for fermentation.

The Bakeries segment is the most lucrative end-use category, holding the largest share of 40% among all the sub-segments. This is driven by the widespread application of diastatic malt in bread, cakes, and other bakery products to improve texture and dough conditioning. The growing demand for healthier, whole-grain, and organic bakery products is further fueling this segment's growth.

The organic segment is gaining momentum due to the increasing consumer shift toward clean-label, sustainable, and health-conscious products. Organic malted barley flour is particularly popular in the bakery and snack industries, where health-conscious consumers prefer natural, chemical-free ingredients. The organic segment is expected to account for around 30% of the market share by 2025.

The B2B distribution channel is the most lucrative segment in terms of market share, with a major share driven by the food manufacturing and brewing sectors. B2B sales are crucial for industrial applications of malted barley flour, where it is used in large-scale food production and beverage manufacturing. This channel is holds 50% of the market share due to the high demand from businesses in the food and beverage industry.

Recent Trends in the Malted Barley Flour Market

Challenges in Malted Barley Flour Market

The United States stands out as a dynamic hub for malted barley flour, fueled by growing demand from the craft beer sector and a noticeable consumer shift toward wholesome and nutrient-rich baking ingredients. In Germany, the product continues to enjoy stable demand, deeply rooted in the country's brewing heritage, while also seeing uptake in organic and artisanal food segments.

France and the United Kingdom are both experiencing a gradual diversification in usage, with bakers and food processors increasingly incorporating malted barley flour into rustic bread, pastries, and health-forward offerings. Meanwhile, in Japan, rising interest in Western-style baked goods and wellness-oriented formulations has made malted barley flour a quietly expanding niche, particularly in premium and functional food categories.

The malted barley flour revenue in the USA is projected to grow at a CAGR of 5.5% from 2025 to 2035. The USA is the largest producer and consumer of malted barley flour, with a strong presence in both the food and beverage industries. The craft beer segment, in particular, is driving the demand for diastatic malt, while increasing health-consciousness among consumers boosts the organic malt flour market.

The malted barley flour market in the UK is forecasted to rise at a CAGR of 4.1% from 2025 to 2035. With a longstanding tradition in brewing, the UK remains a leading producer and consumer of malted barley flour, particularly in beer production. Additionally, the demand for organic and clean-label ingredients in bakery products is rising.

The sales of malted barley flour in Germany are projected to grow at a CAGR of 4.2% from 2025 to 2035. The country's strong brewing heritage and dominance in the European beer market continue to make it a key player in the malted barley flour market. Additionally, Germany’s increasing interest in health-conscious products and sustainable food practices is promoting demand for organic and gluten-free malted barley flour.

The revenue from malted barley flour in France is set to flourish at a CAGR of 4.7% from 2025 to 2035. France, known for its rich culinary culture, has a steady demand for malted barley flour in bakeries, particularly for premium and artisanal products. The increasing focus on organic ingredients, coupled with France's expanding craft beer sector, is driving market expansion.

The malted barley flour market in Japan is predicted to expand at a CAGR of 3.9% from 2025 to 2035. Japan’s increasing interest in Western food products, particularly bakery items, has significantly contributed to the growth of malted barley flour demand. Additionally, the rising awareness of health and wellness among the Japanese population is pushing demand for organic and gluten-free alternatives.

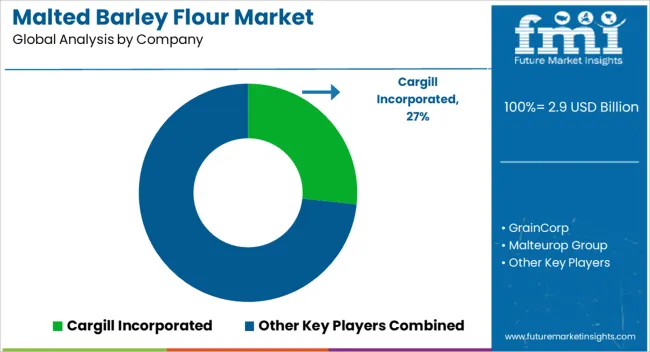

The malted barley flour market is moderately fragmented, with several global players competing for market share. Leading suppliers such as Cargill Incorporated, GrainCorp, Malteurop Group, and Soufflet Group dominate the space, leveraging their vast supply chains and production facilities.

These companies focus on diversifying their portfolios, expanding in key growth regions, and enhancing product offerings through innovation. Key strategies include pricing flexibility, enhancing supply chain efficiencies, and forming strategic partnerships to cater to the rising demand for organic, gluten-free, and clean-label products.

Company strategies often revolve around cost-effective production, advanced R&D, and market expansion. Companies are also focusing on tapping into emerging markets and enhancing their digital presence to streamline distribution. Major players are investing in organic product lines, innovating in brewing and baking applications, and improving their environmental footprints. Their competitive strategies are anchored in providing high-quality, consistent products that meet the growing demand for sustainable and health-conscious alternatives in the food industry.

Recent Malted Barley Flour Industry News

Archer Daniels Midland Company (ADM) and Ardent Mills are actively focusing on product advancements, including the development of fortified and organic malted barley flours. These innovations are driven by consumer demand for healthier, more nutritious, and functional food ingredients.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.9 billion |

| Projected Market Size (2035) | USD 5.3 billion |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Product Type | Diastatic, Non-Diastatic |

| By End Use | Bakeries, Confectioneries, Flavorings, Households and Others |

| By Distribution Channel | B2B, B2C, Hypermarkets/Supermarkets, Convenience Stores, Specialty Retail Stores, e-Commerce, Other Retail Formats |

| Regions Covered | North America, Latin America, Europe, Middle East & Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Cargill Incorporated, GrainCorp, Malteurop Group, Soufflet Group, Crisp Malting Group, Global Malt Gmbh & Co. KG, IREKS Gmbh, Muntons Plc, Mirfak Pty Ltd, Delco Foods, ADM, ARDENT MILLS, Briess Malt & Ingredients, Imperial Malts Ltd., Malt Company (India) Pvt Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global malted barley flour market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the malted barley flour market is projected to reach USD 5.3 billion by 2035.

The malted barley flour market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in malted barley flour market are diastatic and non-diastatic.

In terms of end use, bakeries segment to command 48.6% share in the malted barley flour market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Malted Milk Market Size and Share Forecast Outlook 2025 to 2035

Malted Milk Powder Market Trends - Growth & Industry Forecast 2025 to 2035

Malted Rye Flour Market Size and Share Forecast Outlook 2025 to 2035

Malted Wheat Flour Market

Barley Flake Market Size and Share Forecast Outlook 2025 to 2035

Barley Market Size, Growth, and Forecast for 2025 to 2035

Barley Protein Market – Growth, Demand & Plant-Based Protein Trends

Feed Barley Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flour Mixes Market Growth – Specialty Baking & Industry Trends 2025 to 2035

Flour Substitutes Market Analysis by Baked Goods, Noodles, Pastry, Fried Food, Pasta, Bread, Crackers Applications Through 2035

Flour Conditioner Market

Flour Improvers Market

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Bean Flour Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Bean Flour Manufacturers

Pulse Flours Market Size and Share Forecast Outlook 2025 to 2035

Vegan Flour Market Growth - Plant-Based Innovation & Industry Demand 2025 to 2035

Cereal Flour Market Size and Share Forecast Outlook 2025 to 2035

Silica Flour Market Size and Share Forecast Outlook 2025 to 2035

Banana Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA