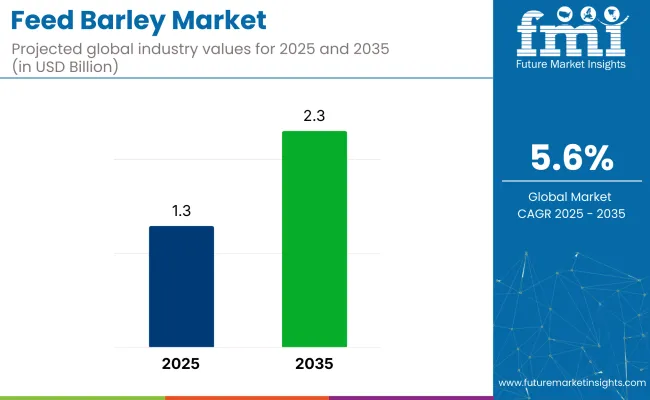

The global feed barley market is projected to grow from USD 1.3 billion in 2025 to USD 2.3 billion by 2035, registering a CAGR of 5.6%. Market growth is being fueled by the rising demand for protein-rich animal products and the adoption of sustainable, cost-effective livestock nutrition strategies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 2.3 billion |

| CAGR (2025 to 2035) | 5.6% |

Barley’s high fiber content, digestibility, and favorable energy profile make it a preferred feed grain in ruminant diets. The increasing emphasis on responsible farming practices and efficient feed conversion rates is further supporting the use of feed barley across cattle, poultry, and swine production systems.

The market holds an estimated 86% share within the overall barley used for animal feed, underscoring its primary application. It accounts for around 12% of the global feed grain market, standing alongside corn and wheat. Within the broader compound feed market, feed barley contributes approximately 5%, reflecting its significance in ruminant and monogastric diets.

It represents nearly 2.5% of the agricultural commodities market, highlighting its value in crop trade. However, in the vast food and beverage ingredients market, its share remains modest at below 0.03%, given its non-food classification and specialization in livestock nutrition.

Government regulations impacting the market are primarily linked to feed safety, quality control, and sustainable farming practices. Standards such as the Codex Alimentarius for animal feed, the European Feed Hygiene Regulation (EC) No 183/2005, and various national Good Manufacturing Practices (GMP) ensure that feed barley meets nutritional and safety benchmarks.

Additionally, in countries like China, Germany, and the United States, rising consumer awareness around traceability and animal welfare is driving demand for certified, high-quality feed barley, reinforcing the shift toward regulated and transparent supply chains.

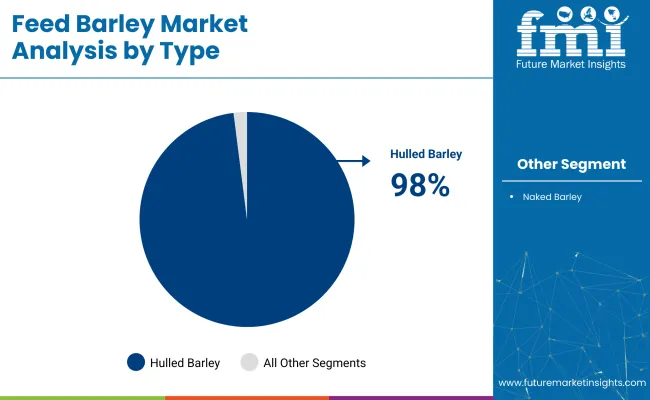

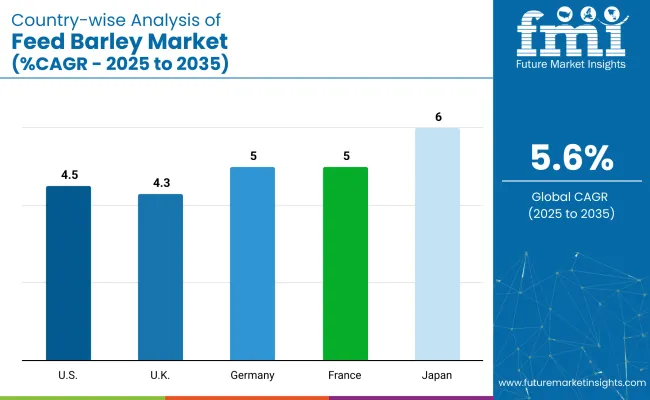

Japan is projected to be the fastest-growing market, expanding at a CAGR of 6% from 2025 to 2035. Livestock feed will dominate the application segment with an 86% share, while hulled barley will lead the type segment with a 98% share. The USA and Germany are also expected to grow steadily, with CAGRs of 4.5% and 5%, respectively.

The feed barley market is segmented by type, application, nature, and region. By type, the market is bifurcated into hulled barley and naked barley. Based on application, the market is segmented into aquaculture (fish, shrimp, shellfish, others), livestock (poultry, ruminants such as cattle, sheep, goats, swine, equine, others), and pet food (dogs, cats, horses).

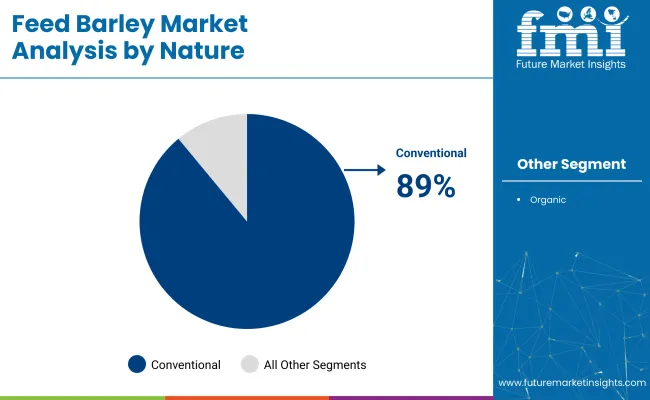

By nature, the market is bifurcated into organic and conventional. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The hulled barley is projected to lead the type segment, capturing 98% of the market share by 2025.

The livestock is expected to dominate the application category, accounting for 86% of the global market share in 2025.

The conventional is projected to capture 89% of the market share in 2025.

The global feed barley market is witnessing consistent growth driven by increasing demand for sustainable, high-energy livestock nutrition. Feed barley supports animal health and farm profitability, particularly in ruminant operations.

Recent Trends in the Feed Barley Market

Challenges in the Feed Barley Market

The feed barley market in Japan is gaining momentum through strong livestock nutrition strategies and a reliance on imported barley to meet domestic feed requirements. the feed barley markets in Germany and France maintain consistent demand due to EU-backed feed safety standards and support for sustainable livestock farming under the Common Agricultural Policy. In contrast, developed economies such as the USA (4.5% CAGR), UK (4.3%), and Japan (6.0%) are expanding at a steady 0.77-1.07x of the global growth rate.

Japan leads in feed barley demand growth, fueled by its reliance on imports and rising meat and dairy consumption. The market benefits from strict quality standards and a preference for high-grade barley in livestock diets. Germany and France follow closely, with robust EU-backed sustainability policies and intensive livestock systems supporting a 5.0% CAGR.

The USA market emphasizes region-specific usage, particularly in cattle feed operations across the northern plains, expanding at a moderate 4.5% CAGR. The UK, while stable, sees the slowest growth at 4.3%, shaped by traceability preferences and cautious post-Brexit investment in feed supply systems.

This report provides an in-depth analysis of more than 40+ countries; five top-performing OECD countries are highlighted below.

The feed barley market in Japan is growing at a CAGR of 6% from 2025 to 2035. Growth is driven by high demand for imported barley to support beef and dairy industries. Domestic production is limited due to land constraints, increasing reliance on exporters like Australia, Canada, and Ukraine. Japanese feed manufacturers prioritize grain quality, traceability, and residue-free standards, driving preference for premium barley imports.

The sales of feed barley in Germany areexpanding at a 5% CAGR during the forecast period. EU feed regulations and sustainability mandates support steady growth, especially in cattle and swine sectors. Germany benefits from efficient logistics, large-scale feed operations, and a preference for EU-grown barley varieties.

The French feed barley market is projected to grow at a 5% CAGR during the forecast period. National feed programs aim to reduce reliance on imported soy by increasing local barley usage. France’s cattle and poultry sectors absorb large volumes, supported by incentives for traceable and sustainable grain inputs.

The USA feed barley market is projected to grow at a 4.5% CAGR from 2025 to 2035, or 0.80x the global rate. Demand is concentrated in the northern plains and Pacific Northwest, where barley is grown as a rotational crop. It is widely used in cattle feed, especially in feedlots and backgrounding operations.

The UK feed barley revenue is projected to grow at a 4.3% CAGR from 2025 to 2035, the slowest among top OECD countries at 0.77x the global pace. Demand is driven by traceability standards and consumer preference for grain-fed livestock. Domestic barley production covers most feed needs, though post-Brexit uncertainty has affected long-term investment.

The feed barley market is moderately fragmented, with leading players like ADM, New Country Organics, Inc., Stone House Grain, The Scoular Company, and Highland Specialty Grains actively shaping supply and innovation. These companies offer barley for livestock, poultry, aquaculture, and specialty feed applications, with a focus on traceability and regional adaptability.

ADM delivers globally integrated supply chain solutions with emphasis on nutritional consistency and regulatory compliance. New Country Organics, Inc. is known for its certified organic feed barley tailored for small farms and specialty livestock. Stone House Grain focuses on regionally grown, non-GMO grains for sustainable agriculture. The Scoular Company supplies value-added barley ingredients with tailored feed formulations across North America. Highland Specialty Grains specializes in forage and high-protein barley for improved ruminant productivity.

Soufflet Group supports European feed operations with traceable, EU-compliant barley. GrainCorp plays a role in exporting Australian barley to Asia and the Middle East. Cargill, Incorporated combines procurement networks with feed R&D to optimize livestock health and growth. Ardent Mills contributes with its milling expertise and robust supply capabilities. AZMY GROUP LLC and other regional players provide locally adapted, nutrient-rich barley varieties that support national feed agendas.

Recent Feed Barley Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.3 billion |

| Projected Market Size (2035) | USD 2.3 billion |

| CAGR (2025 to 2035) | 5.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value / volume in Metric Tons (MT) |

| Type Analyzed | Hulled Barley and Naked Barley |

| Application Analyzed | Aquaculture (Fish, Shrimp, Shellfish, and others), Livestock (Ruminants, Poultry, Swine, Equine, and others), and Pet Food (Dogs, Cats, Horses) |

| Nature Analyzed | Conventional and Organic |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia |

| Key Players Influencing the Market | ADM, New Country Organics, Inc., Stone House Grain, The Scoular Company, Highland Specialty Grains, Soufflet Group, GrainCorp, Cargill Incorporated, Ardent Mills, AZMY GROUP LLC, Other Players |

| Additional Attributes | Dollar sales by equipment type, share by power, regional demand growth, policy influence, automation trends, competitive benchmarking |

The market is valued at USD 1.3 billion in 2025.

The market is forecasted to reach USD 2.3 billion by 2035, reflecting a CAGR of 5.6%.

Hulled barley will lead the type segment, accounting for 98% of the global market share in 2025.

Livestock feed will dominate the application segment with an 86% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 6% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA