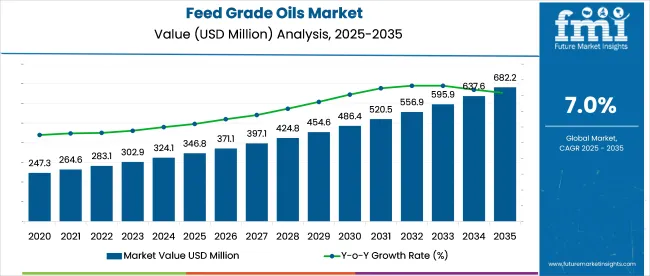

The feed grade oils market is anticipated to expand from USD 346.8 million in 2025 to USD 682.2 million by 2035, registering a CAGR of 7.0% through the forecast period. Growth is being fueled by increased focus on enhancing animal productivity, gut health, and feed palatability across poultry, swine, and aquaculture sectors.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 346.8 million |

| Industry Value (2035F) | USD 682.2 million |

| CAGR (2025 to 2035) | 7.0% |

Consumption is being driven by the rising cost of cereal-based ingredients and the push for higher daily weight gain through concentrated lipid supplementation. Fish oil and soybean oil are gaining traction due to their high levels of essential fatty acids, which improve feed conversion and reproductive performance.

In Southeast Asia, palm oil is being integrated into layer diets to stabilize yolk color and texture, while in Northern Europe, cold-pressed rapeseed oil is being adopted in non-GMO poultry systems. Supply chains are becoming more localized due to volatility in sunflower oil exports, particularly following geopolitical disruptions in the Black Sea region.

Precision feed mills are now using micro-encapsulation techniques to enhance shelf life and improve nutrient bioavailability, signaling a shift toward more functional and targeted lipid delivery within feed systems.

As of 2025, the feed grade oils market is being recognized as a key segment within broader animal nutrition and feed industries. Within the global feed ingredients market, feed grade oils are estimated to hold around 4-6%, as they are valued for high-energy content and essential fatty acids. In the overall animal nutrition market, a share of approximately 3-5% is being attributed to these oils due to their role in enhancing nutrient uptake and animal performance.

Within the livestock feed sector, feed grade oils represent 2-4% of formulated diets, especially in swine and poultry. In the aquaculture feed market, about 1-3% of feeds include these oils to support growth and health. In the specialty oils market, feed grade oils contribute roughly 5-7%, owing to their tailored use in formulated animal feeds.

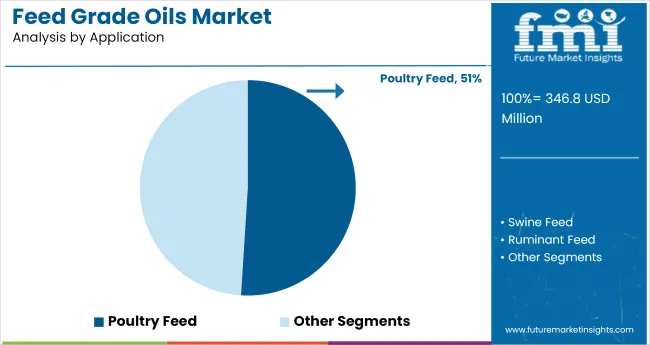

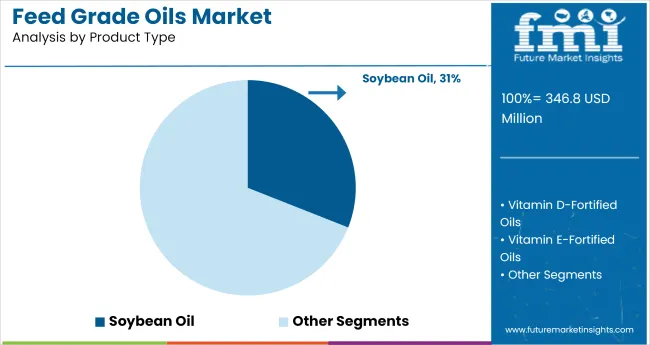

The market is witnessing strong adoption across poultry feed applications and soybean oil as a key product type. Growth is driven by the need for energy-dense diets, improved feed conversion ratios, and enhanced nutrient absorption in commercial animal farming.

Poultry is projected to lead the application segment in the market, securing a 51% share by 2025. High energy demands, rapid growth cycles, and intensive production systems in broiler and layer farming are fueling demand for lipid-rich diets.

Soybean oil is anticipated to account for 31% of the total market share by 2025. Rich in linoleic acid and energy, it serves as a cost-effective fat source across poultry, swine, and dairy sectors. Its consistent supply and compatibility with other ingredients further support its dominance.

The market is expanding due to heightened demand for energy-dense feed ingredients and improved animal performance. In 2024, global consumption surpassed 2.9 million metric tons, with palm oil and soybean oil holding over 68% of total volume.

Energy Enhancement in Commercial Poultry and Swine Diets

Feed oils are used to increase caloric density in animal rations and improve feed conversion ratios. In Southeast Asia, over 34% of broiler feed formulations in 2024 contained palm-based oils. Fat inclusion rates are optimized for faster weight gain and enhanced carcass quality, particularly in high-growth meat production regions.

Price Volatility and Sustainability of Feedstock Influencing Choices

Sourcing stability and price volatility of vegetable oils are influencing formulation trends. In 2024, fluctuations in soybean and rapeseed oil prices led to increased use of palm fatty acid distillate (PFAD) and recycled edible oils in feed. Sustainability certifications are becoming a key purchase criterion in Europe and North America.

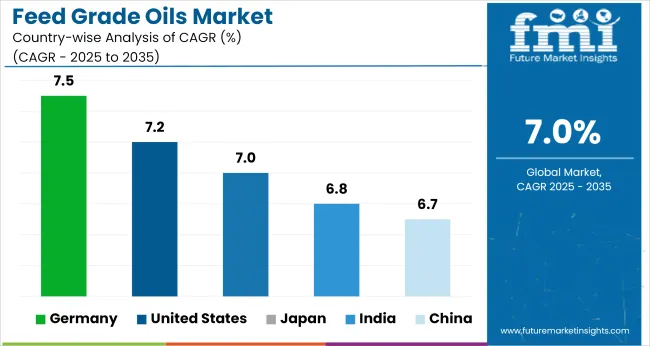

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.5% |

| United States | 7.2% |

| Japan | 7.0% |

| India | 6.8% |

| China | 6.7% |

The market is forecast to expand at a 7.0% CAGR globally from 2025 to 2035. While most major economies are closely aligned with this trajectory, subtle disparities remain. Germany (OECD) leads with 7.5%, outperforming the global average by 0.5 percentage points, supported by strong integration of oil-based feed formulations in livestock systems.

The USA (OECD) follows at 7.2%, marginally above trend, benefiting from consistent demand across commercial poultry and swine sectors. Japan (OECD) holds steady at 7.0%, showing neutral alignment with global expectations. China (BRICS), at 6.7%, falls 0.3 percentage points below the global CAGR, limited by regulatory inconsistencies and intermittent raw material imports.

India (BRICS) records 6.8%, just under the baseline, reflecting variability in oilseed supply and domestic processing infrastructure. Together, these markets reflect both alignment and divergence, shaped by feed conversion priorities, nutritional mandates, and industrial processing capacities across OECD and BRICS regions.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Registering a CAGR of 7.5% from 2025 to 2035, Germany is witnessing strong momentum in the adoption of feed grade oils across swine and ruminant sectors. Sustainability standards in German livestock farming are encouraging the use of vegetable-based oils, particularly rapeseed and sunflower.

Feed formulators are optimizing energy density while reducing the need for synthetic additives. There is also a push for traceable, non-GMO oil sources to meet consumer and export regulations. The country’s advanced feed manufacturing infrastructure further supports the integration of precision-blended oils.

Growing at a CAGR of 7.2% through 2035, the USA feed grade oils market is driven by a pivot toward energy-rich rations in poultry and beef industries. Large-scale feedlots and integrated animal operations are increasingly relying on soybean, corn, and canola oils to boost feed efficiency.

The need for improved weight gain and feed conversion is prompting higher oil inclusion rates, particularly in Midwest and Southern states. Rising meat exports and productivity benchmarks are further pushing innovation in feed formulations.

Japan’s feed industry is forecast to grow at a CAGR of 7.0% from 2025 to 2035, with feed grade oils gaining traction in compact, intensive farming systems. A heavy reliance on oil imports has led Japanese feed manufacturers to prioritize purity, oxidative stability, and formulation efficiency.

Fishmeal alternatives in aquafeed and energy-boosting solutions in dairy farms are both key drivers. There is a growing trend toward using blends of palm and rice bran oils that meet both nutritional and regulatory criteria.

India is projected to record a CAGR of 6.8% during the forecast period, fueled by rising poultry and dairy output across major agricultural states. Regional feed mills are turning to locally available oils like rice bran, mustard, and palm oil to increase feed energy density at a competitive cost.

With rising feed prices, oil integration is helping optimize total input costs and improve animal performance. Growing adoption of compound feed and nutritional supplements further supports oil utilization.

China’s market is on track to expand at a CAGR of 6.7% from 2025 to 2035, supported by structural shifts in livestock and aquaculture sectors. Following herd restocking and recovery in swine production, feed producers are prioritizing higher energy inputs, including soybean and fish oils.

Urban consumption trends and rising meat quality standards are influencing feed upgrades. Encapsulated oil technologies are also gaining traction, especially for heat-sensitive regions and export-focused feed formulations.

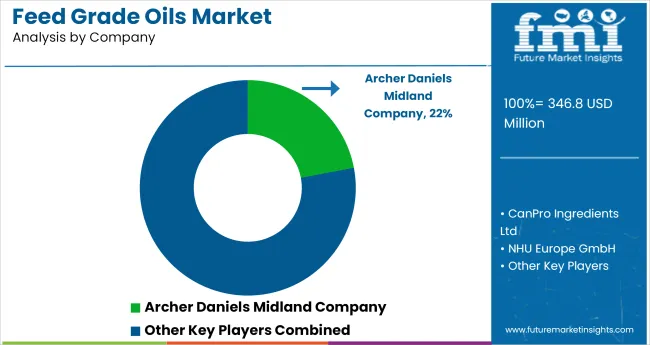

ADM remains the market leader with an estimated 22% global share, supported by its extensive oilseed crushing capacity and integrated feed supply chains. DAR PRO Ingredients controls approximately 12% of the North American feed oil market, leveraging its rendering operations to supply cost-efficient lipid sources.

NHU Europe and Xiamen Kingdomway dominate the specialty oil segment in Asia-Pacific, jointly accounting for 18% of the region’s omega-rich feed oil usage. CanPro Ingredients, with a strong foothold in Canada, supplies over 45,000 MT of plant-based feed oils annually.

Double S Liquid Feed Services ranks among the top USA suppliers of liquid oils to feedlots, shipping over 30 million gallons per year. Mid-tier players are focusing on sustainability certifications and tailored blends to differentiate.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 346.8 million |

| Projected Market Size (2035) | USD 682.2 million |

| CAGR (2025 to 2035) | 7.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Applications Analyzed (Segment 1) | Poultry Feed, Swine Feed, Ruminant Feed |

| Product Types Analyzed (Segment 2) | Vitamin D-Fortified Oils, Vitamin E-Fortified Oils, Soybean Oil, Palm Oil, Canola Oil, Fish Oil, Other Specialized Formulations |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | CanPro Ingredients Ltd, NHU Europe GmbH, Xiamen Kingdomway Group Company, Double S Liquid Feed Services, Inc., DAR PRO Ingredients, Renkert Oil, Inc., Archer Daniels Midland Company, Valley Proteins, Inc., Other Emerging Players |

| Additional Attributes | Dollar sales by species and oil type, rising incorporation of functional oils in feed nutrition, increased demand for vitamin-enriched formulations, and growing emphasis on digestibility and immune support in livestock. |

The market is valued at USD 346.8 million in 2025.

The market is forecast to reach USD 682.2 million by 2035.

The market is anticipated to grow at a CAGR of 7.0% between 2025 and 2035.

The poultry segment leads with a 51% market share in 2025.

Germany is the fastest-growing country, with a CAGR of 7.5% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grain Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Barley Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Binder Market

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Phosphate Market Analysis by Product, Livestock, and Region through 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Attractants Market Analysis by Composition, Functionality, Livestock, Packaging Type and Sales Channel Through 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Feed Amino Acids Market Analysis by Product, Application, and Region through 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA