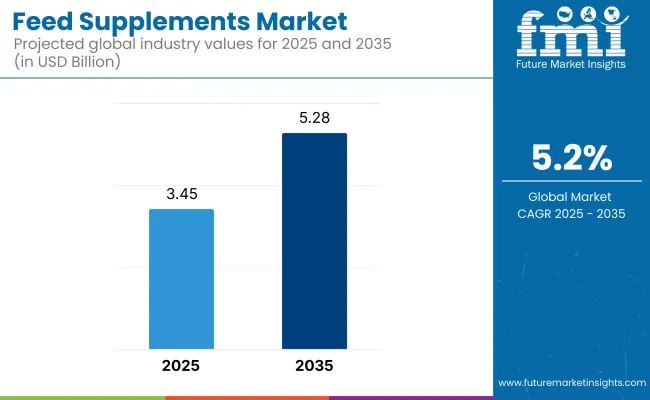

The global Feed Supplements Market, valued at USD 3.45 billion in 2025, is set to reach USD 5.28 billion by 2035, expanding at a CAGR of 5.2%. Growth is being driven by rising awareness of animal nutrition among livestock farmers and advances in probiotic, prebiotic, enzyme, and amino-acid formulations that improve feed-efficiency and animal health.

| Market Attribute | Value |

|---|---|

| Market Size in 2025 | USD 3.45 billion |

| Market Size in 2035 | USD 5.28 billion |

| CAGR (2025 to 2035) | 5.2% |

Factors driving this growth include increasing demand for high-quality meat and dairy products and stricter regulations on antibiotic-free feed formulations. Key trends in this market include the rising adoption of precision nutrition and digital feed-monitoring technologies.

The non-commercial regulatory framework for feed supplements in the United States is governed by the Association of American Feed Control Officials (AAFCO), which was established in 1909 to harmonize feed ingredient definitions, labeling standards, and laboratory methods across states. As a voluntary membership organization of state, federal, and international feed regulators, AAFCO publishes its Official Publication annually providing model regulations that are adopted into law by member jurisdictions to ensure consistency in feed safety and quality.

The Asia-Pacific region is anticipated to account for the largest share of the market over the forecast period, driven by the rapid industrialization of livestock farming and rising protein consumption. Government initiatives in China and India are being implemented to modernize feed mills and support precision-feeding programs. Meanwhile, North America is expected to maintain steady growth as producers increasingly adopt probiotic and enzyme-enhanced formulations to meet stringent animal-welfare standards and sustainability targets.

Several challenges are being encountered that could temper market expansion. Volatility in raw-material prices-particularly for corn and soybean meal-is being exacerbated by supply-chain disruptions and adverse weather events. Regulatory complexity is also being heightened in key markets as authorities tighten rules around antibiotic alternatives and environmental impact reporting. Additionally, small and mid-sized feed manufacturers are being challenged by the capital intensity required for advanced processing technologies and digital-monitoring systems.

Significant opportunities are being unlocked by ongoing technological innovation and sustainability trends. Investment in digital feed-management platforms is being prioritized to enable real-time adjustment of supplement dosing, which is expected to improve feed-conversion ratios by up to 8% in pilot trials.

The development of insect-derived proteins and microencapsulated nutrients is being accelerated to meet consumer demand for eco-friendly animal products. Blockchain-enabled traceability solutions are also being piloted, ensuring ingredient authenticity and fostering greater transparency across the feed-supply chain.

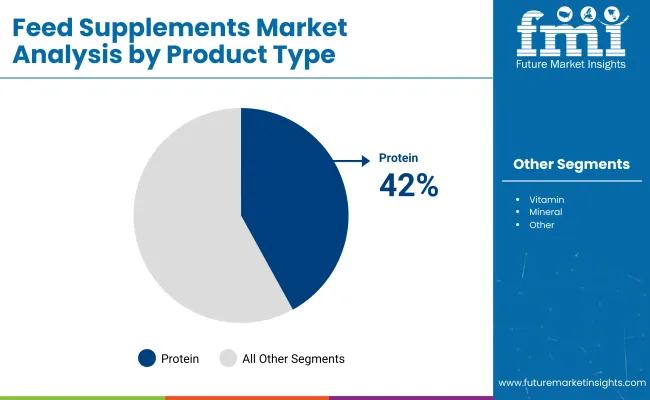

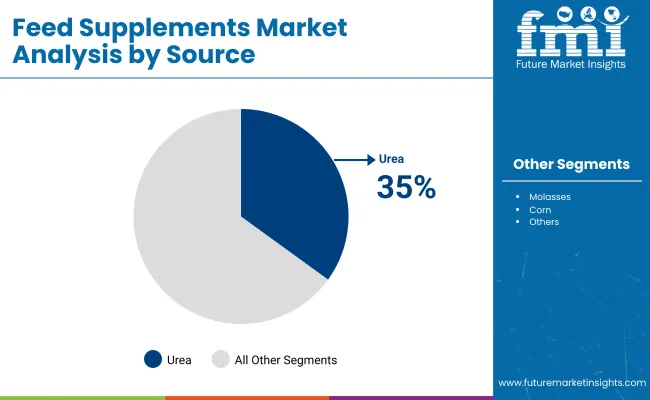

The Feed Supplements Market is segmented across four primary dimensions. By product type, it is divided into Vitamins & Amino Acids, Protein, Minerals, and Others. By source, it encompasses Urea, Molasses, Corn, and Others. By livestock, the market is categorized into Ruminants, Poultry, Swine, Aquaculture, and Others. Finally, by region, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa

Protein-based feed supplements are characterized by their provision of essential amino acids that livestock cannot synthesize, making them indispensable for muscle development and overall growth performance. Their high digestibility and nitrogen retention properties support optimal feed efficiency, which is particularly valued in beef cattle, swine, and aquaculture applications.

Key aspects:

Urea-based supplements accounted for 35% of the source category in 2025, driven by their low cost and high non-protein nitrogen content suitable for ruminant nutrition. Their controlled-release formulations improve rumen efficiency and reduce nitrogen waste. Adoption is highest in large-scale dairy and beef operations where feed cost optimization is critical.

Key aspects:

Ruminant animals-primarily dairy cattle and beef cattle accounted for approximately 40% of feed supplement consumption in 2025. Their complex digestive systems benefit most from non-protein nitrogen sources and targeted amino-acid formulations, driving higher uptake of both urea and protein supplements.

Key aspects:

Regulatory Compliance and Sustainable Sourcing

Adverse Regulatory Landscape: Some of the challenges facing the feed supplements market are complying with stringent regulations regarding feed safety, nutritional labelling, and antibiotic alternatives. Different regions have different stringent regulations as to what is allowed as an additive, which means that manufacturers will have to make a concerted effort in compliance as well as ingredient sourcing that can be seen through to consumers.

Concerns about the sustainability of fishmeal and soy-based supplements also have fuelled a demand for alternative protein sources. Overcoming these challenges will need higher R&D investments in new feed formulations, regulatory alignment approaches, and sustainable sourcing of raw materials.

Expansion of Functional Feed Additives and Precision Nutrition

During the past few years and especially within the last year, we have seen the emergence of more targeted nutrition strategies involving probiotics, prebiotics, and enzyme-enhanced supplements targeted toward animal health and feed efficiency.

Also, digital feed monitoring along with AI-driven feed optimization will continue to improve on productivity and sustainability. And moving forward, with consumers increasingly becoming more conscious of their food choices and wanting to eat sustainably produced as well as high-nutrient animal products, the demand for evidence-based feed supplements is expected to grow and expand immensely over the next ten years.

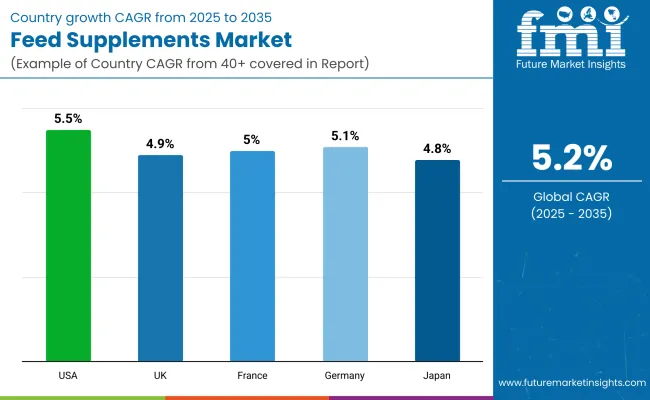

The USA feed supplements market is expected to expand at a CAGR of 5.5% from 2025 to 2035, underpinned by advanced livestock nutrition practices and stringent feed-safety regulations. Growth is being propelled by the adoption of precision feeding technologies and the integration of digital monitoring systems. Several large-scale dairy and beef operations are investing in enzyme-enhanced and probiotic formulations to boost productivity and animal health.

The UK feed supplements market is forecast to grow at a CAGR of 4.9% through 2035, driven by consumer demand for ethically sourced animal products and government initiatives promoting antibiotic-free farming. The region’s strict welfare standards have resulted in increased uptake of natural mineral and vitamin formulations. Precision livestock farming methods are being mainstreamed to meet both productivity and welfare objectives.

France is projected to record a CAGR of 5.0% from 2025 to 2035, fueled by the country’s leading position in dairy and poultry farming. Emphasis is being placed on gut-microbiome enhancers and eco-friendly protein supplements to comply with national antibiotic-reduction targets. Feed-mill modernization programs are facilitating the local production of advanced supplement blends.

Germany’s feed supplements market is set to grow at a CAGR of 5.1% over the forecast period, supported by strong regulatory alignment with EU animal-welfare directives. The country’s focus on alternative feed sources has led to increased trials of lab-grown protein supplements and novel enzyme combinations. Precision-feeding trials are being scaled up in both dairy and swine sectors.

Japan’s feed supplements market is anticipated to expand at a CAGR of 4.8% from 2025 to 2035, spurred by government incentives for precision aquaculture and livestock nutrition. High-value probiotic and enzyme supplements are being prioritized to support specialty livestock such as wagyu cattle and ornamental fish. Advanced digital feeding systems are being integrated into both small and large operations.

The feed supplements market is structured with a clear hierarchy of Tier 1 and Tier 2 participants. Tier 1 players such as Cargill, ADM, DSM, BASF, and Nutreco maintain global R&D centers and extensive distribution networks. They focus on product innovation (e.g., AI-driven formulation, encapsulation technologies) and strategic partnerships with biotech firms to sustain leadership. Tier 2 players including Alltech, Evonik, Novus, Kemin, and Biomin-specialize in niche technologies (probiotics, mycotoxin binders) and often pursue collaborations with academic institutions to validate efficacy and gain regulatory approvals.

Key strategic priorities across the market include:

Latest Feed Supplements Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 3.45 billion |

| Projected Market Size (2035) | USD 5.28 billion |

| CAGR (2025 to 2035) | 5.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Vitamins & Amino Acids; Protein; Minerals; Others |

| Source Types Analyzed | Urea; Molasses; Corn; Others |

| Livestock Segments Analyzed | Ruminants; Poultry; Swine; Aquaculture; Others |

| Regional Coverage | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia Pacific; Middle East & Africa |

| Countries Covered | United States; Canada; Brazil; Germany; United Kingdom; France; China; India; Japan; South Korea |

| Key Players Influencing the Market | Cargill, Incorporated; Archer Daniels Midland (ADM); DSM Nutritional Products; BASF SE; Nutreco N.V.; Alltech Inc.; Evonik AG; Novus International, Inc.; Kemin Industries; Biomin GmbH |

| Additional Attributes | Blockchain-enabled traceability; Digital feed-monitoring adoption; Insect-derived protein trials; Microencapsulation technologies |

The feed supplements market size in 2025 is estimated at USD 3.45 billion.

The feed supplements market is projected to reach USD 5.28 billion by 2035.

The feed supplements market is forecast to grow at a CAGR of 5.2% during 2025 to 2035.

Protein supplements lead the feed supplements market with a 42% share in 2025.

Growth is driven by rising demand for high-quality meat and dairy products and precision nutrition.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Liquid Feed Supplements Market Analysis by Product Type, Source, Livestock, and Region Through 2035

Anti-Stress Feed Supplements Market – Growth, Demand & Livestock Health

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Micronutrients Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA