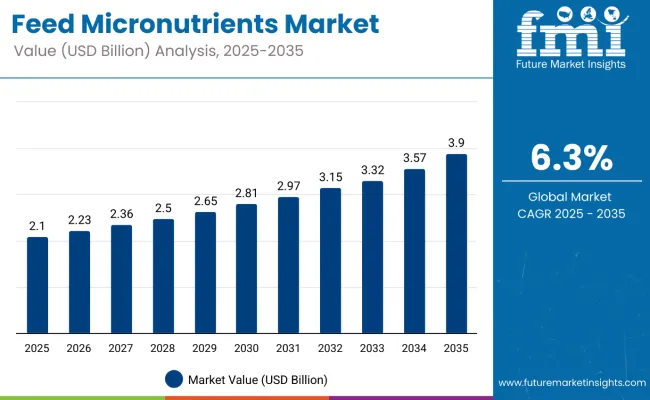

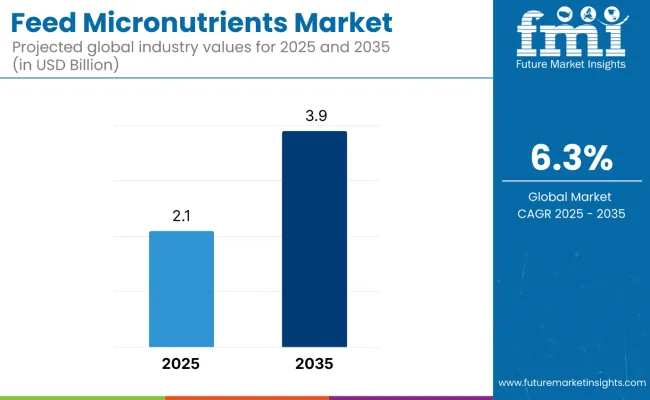

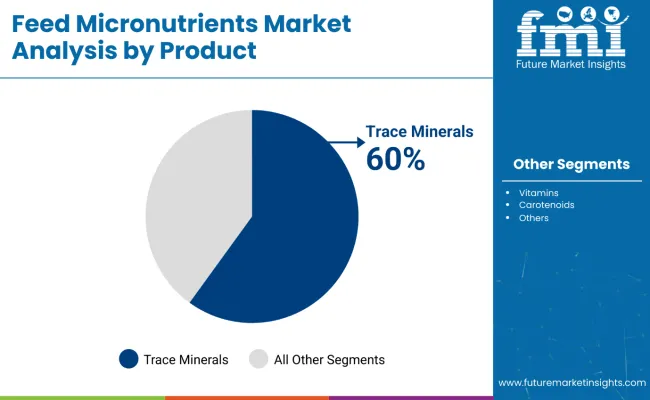

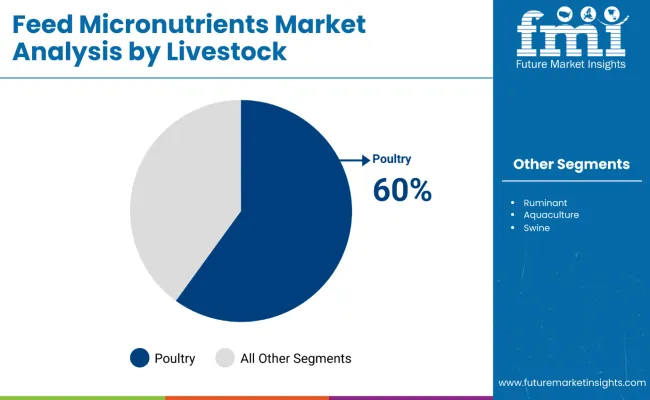

The feed micronutrients market is projected to grow steadily from USD 2.1 billion in 2025 to USD 3.9 billion by 2035, reflecting a CAGR of 6.3%. This growth is driven by increasing demand for micronutrient-enriched animal feed to enhance livestock health and productivity. The market shows a consistent upward trajectory with significant contributions from trace minerals, which hold the largest product share at 60%. Poultry dominates the livestock segment with a 60% market share, highlighting the critical role of the poultry industry in market expansion.

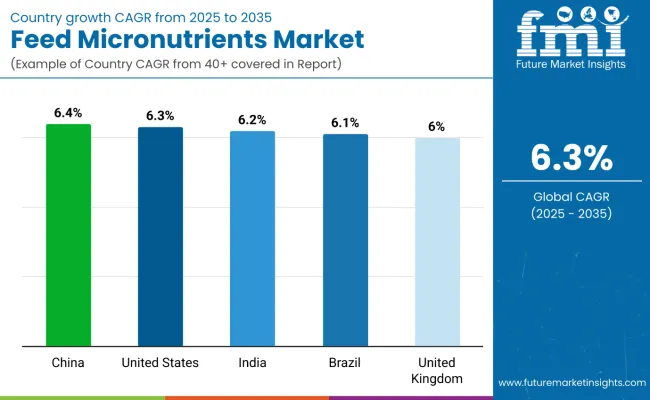

Geographically, the market is led by China, exhibiting the highest CAGR of 6.4%, closely followed by the United States and India. By 2030, the market is projected to reach USD 2.85 billion, representing an absolute dollar growth of USD 0.75 billion from the 2025 base of USD 2.1 billion. This steady increase indicates sustained momentum in the first half of the decade, driven primarily by expanding demand in key geographies and product segments such as trace minerals and poultry feed.

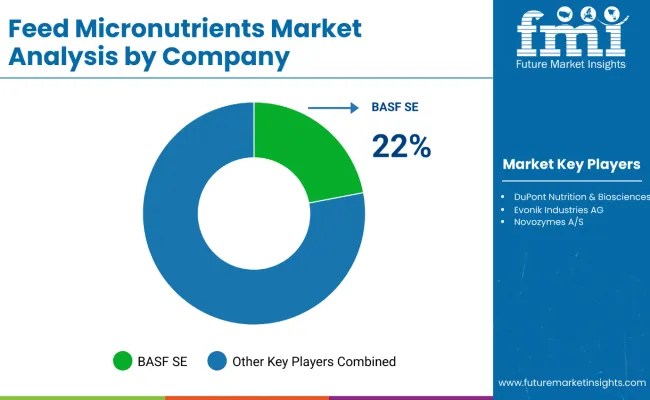

Companies such as BASF SE, DuPont Nutrition & Biosciences, and Evonik Industries AG are strengthening their competitive positions through strategic investments in product innovation, supply chain optimization, and sustainability initiatives. Innovation-led approaches focus on developing advanced micronutrient formulations that enhance livestock health and productivity, supporting expansion into poultry, ruminant, and aquaculture feed segments. Market performance is expected to be anchored by regulatory compliance, ingredient purity standards, and sustainable sourcing practices.

| Metric | Value |

|---|---|

| Estimated Market Value (2025) | USD 2.1 billion |

| Forecast Market Value (2035) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The market holds a crucial role within the broader animal nutrition industry, driven by its foundational impact on livestock health and productivity enhancement. It contributes significantly to improving feed efficiency and immune support across diverse livestock segments, particularly poultry, which dominates the market. The rising adoption of trace minerals and vitamin-enriched feed formulations underpins this market’s steady expansion globally.

The market is experiencing gradual structural evolution, with leading companies such as BASF SE, DuPont Nutrition & Biosciences, and Evonik Industries AG investing in innovative micronutrient blends and sustainable sourcing strategies. These advancements support integration across multiple livestock sectors, including poultry, ruminants, aquaculture, and swine, while regulatory compliance and quality standards continue to shape market dynamics.

The feed micronutrients market is growing primarily due to the increasing need to improve animal health, productivity, and overall feed efficiency. Micronutrients such as trace minerals, vitamins, and carotenoids play a critical role in supporting immune function, growth, and reproduction in livestock, making them essential additives in modern animal nutrition.

Rising awareness among farmers and feed manufacturers about the benefits of balanced micronutrient supplementation is driving adoption, particularly in high-demand sectors like poultry and aquaculture. Increasing consumer preference for safer and higher-quality animal products further propels the use of micronutrient-enriched feed formulations.

Additionally, advancements in micronutrient delivery technologies and sustainable sourcing practices are enhancing the efficacy and environmental footprint of these products. As the livestock industry continues to focus on sustainable growth and regulatory compliance, the demand for feed micronutrients is expected to maintain strong momentum across global markets.

The market is segmented by product, livestock, and region. By product, the market is divided into trace minerals, vitamins, carotenoids, and others (antioxidants and enzyme cofactors). Based on livestock, the market is categorized into poultry, ruminant, aquaculture, swine, and equine. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Trace minerals constitute the largest product segment, commanding 60% share in 2025. These essential minerals including iron, zinc, copper, manganese, and boron are vital for enhancing livestock health, growth, and productivity. Their critical role in supporting immune function and metabolic processes drives widespread adoption in animal feed formulations. Among livestock, the poultry segment overwhelmingly leads, also capturing around 60% of the market share.

This dominance is attributable to the rapidly growing poultry industry, which demands nutrient-rich feed to meet consumer preferences for high-quality meat and eggs. The combination of intensive poultry production systems and rising awareness of animal nutrition is fueling the sector’s expansion. Overall, trace minerals and poultry are key pillars of the feed micronutrients market, highlighting the role of targeted nutritional solutions in optimizing animal performance and supporting growth in the global livestock industry.

The market is segmented by livestock into poultry, ruminant, aquaculture, swine, and equine, with poultry dominating the market at a 60% share. This dominance is driven by the rapid growth of poultry farming worldwide, where micronutrient-enriched feed is essential to improve growth rates, bolster immune systems, and enhance overall productivity. Ruminants, including cattle and sheep, form the next significant segment, relying on micronutrients to aid digestion and maintain health.

Aquaculture is a fast-growing segment, reflecting increased global demand for fish and seafood, with precise nutrient formulations improving survival and growth rates. Swine farming represents another important segment, focusing on feed efficiency and reproductive performance through micronutrient supplementation. Although equine is the smallest segment, it remains vital for specialized horse nutrition, especially in racing and recreational markets. The unique nutritional requirements of these livestock categories collectively fuel the feed micronutrients market, with poultry as the primary growth driver.

From 2025 to 2035, the feed micronutrients market is driven by increasing emphasis on animal health, productivity, and sustainable livestock farming practices. Feed manufacturers are adopting advanced micronutrient formulations to enhance immune function, growth rates, and overall feed efficiency in poultry, ruminants, aquaculture, and swine. The integration of trace minerals, vitamins, and carotenoids into balanced feed solutions positions suppliers as key partners in improving livestock performance and supporting sustainable agriculture.

Rising Focus on Nutritional Efficiency Fuels Market Growth

Growing awareness of the critical role of micronutrients in optimizing animal health and productivity is the primary catalyst behind market expansion. Advances in feed additive technologies and enhanced delivery systems ensure better bioavailability and absorption of micronutrients. Regulatory emphasis on feed safety and quality further drives adoption. By 2025, feed producers increasingly focused on formulating nutrient-dense feeds tailored for different livestock species to meet consumer demand for safe and high-quality animal products.

Precision Nutrition and Sustainable Practices Create Market Opportunities

The market is evolving with the integration of precision nutrition approaches and sustainable sourcing practices. Improved micronutrient blends combined with digital feed management systems enable livestock farmers to optimize nutrient intake, reduce waste, and enhance production efficiency. Growing interests in eco-friendly feed additives and trace mineral sources underscore the sustainability focus. Companies that offer innovative, science-backed micronutrient solutions with proven efficacy are positioned to gain a competitive edge and capture growing global demand.

| Country | CAGR (%) |

|---|---|

| China | 6.4% |

| United States | 6.3% |

| India | 6.2% |

| Brazil | 6.1% |

| United Kingdom | 6.0% |

The market is experiencing steady growth across key countries, with China leading at a CAGR of 6.4%, driven by rapid modernization of livestock farming, government support for animal health, and expanding production infrastructure. The United States follows closely with a CAGR of 6.3%, supported by advanced animal agriculture, strong regulatory frameworks, and innovation in micronutrient delivery systems. India, growing at 6.2%, benefits from rapid expansion in poultry and dairy sectors, government-led awareness campaigns, and modernization of feed production facilities tailored to regional livestock needs. Brazil’s market grows at 6.1%, fueled by a robust meat export industry, sustainable nutrition practices, and investments in feed mill modernization. The United Kingdom sustains a steady CAGR of 6.0%, emphasizing sustainability, animal welfare, and regulatory compliance, backed by innovations in eco-friendly micronutrient blends.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Revenue from feed micronutrients in China is growing at a CAGR of 6.4%, driven by rapid industrialization and modernization of livestock farming, particularly in poultry and aquaculture. The government’s focus on animal health, food safety, and sustainable farming practices is boosting demand for micronutrient-enriched feeds. Increasing investments in local production facilities and R&D centers support higher output capacities across regions. Consumer demand for high-quality meat and seafood fuels market penetration. Advances in supply chain infrastructure and stringent quality control are improving product availability and trust. Expansion of trace mineral and vitamin formulations is prominent to meet diverse livestock needs. Leading players are forging partnerships to scale production and distribution. Overall, China is consolidating its position as the largest and fastest-growing market for feed micronutrients globally.

The USA feed micronutrients market is projected to grow at a CAGR of 6.3%, supported by large-scale, technologically advanced animal agriculture. Emphasis on improving feed efficiency and livestock health pushes output expansion in trace minerals and vitamin-enriched feeds. Strict regulatory frameworks ensure product efficacy and safety, supporting market growth. Innovation in micronutrient delivery and bioavailability enhancement is a key focus area. The shift toward sustainable farming practices and clean-label animal products increases adoption rates. Investment in feed manufacturing modernization boosts production capacity, facilitating supply consistency. Leading companies are leveraging digital technologies to optimize production and supply chain operations. Market maturity is reflected in robust demand across poultry, ruminant, and swine sectors.

Demand for feed micronutrients in India is growing at a CAGR of 6.2%, propelled by rapid growth in poultry and dairy production. Structural adoption involves modernization of feed production facilities and integration of micronutrient supplementation into traditional farming practices. Government schemes promoting livestock productivity and farmer education programs facilitate wider market penetration. Improving cold chain and distribution infrastructure enhance geographic reach. Rising demand for animal protein in urban areas drives volume growth. Manufacturers focus on cost-effective and innovative micronutrient blends tailored for regional livestock needs. Collaborations with local cooperatives accelerate product adoption among small-scale farmers. Overall, India’s market reflects robust structural changes supporting sustained growth.

Sales of feed micronutrients in Brazil are projected to grow at a CAGR of 6.1%, supported by the country’s strong meat export industry and significant poultry and cattle production. Market development trends include capacity expansion in feed additive manufacturing and a move toward sustainable nutrition practices. Government support for traceability and quality assurance boosts market confidence. Investments in feed mill modernizations facilitate higher precision in micronutrient blending. Growth in export-oriented livestock farming drives demand for premium feed formulations. Adoption of eco-friendly and nutrient-dense feed products is rising. Partnerships between local and global players strengthen supply chain resilience. Brazil is poised for continued growth fueled by these industry developments.

The UK feed micronutrients market is evolving with a CAGR of 6.0%, emphasizing sustainability and animal welfare. Market penetration is driven by consumer demand for high-quality, ethically produced meat and dairy products. Regulatory frameworks ensure micronutrient use complies with safety and environmental standards. Manufacturers are adopting eco-friendly feed blends and trace mineral sources. Innovations in feed additive formulation support improved animal health and reduced environmental impact. Strong supply chains guarantee consistent availability across livestock sectors. Investment in technology enhances micronutrient bioavailability and production efficiency. The UK market balances regulatory rigor with innovation to sustain growth.

The market is moderately consolidated, dominated by established ingredient suppliers with specialized expertise in micronutrient formulation and delivery technologies. BASF SE leads the market with a strong presence in trace mineral and vitamin feed additives, backed by advanced research capabilities and regulatory compliance. DuPont Nutrition & Biosciences distinguishes itself through innovative micronutrient blends and tailored solutions addressing specific livestock nutritional needs. Evonik Industries AG and Novozymes A/S focus on sustainable sourcing and enzyme-enhanced micronutrient products to improve feed efficiency and animal health in poultry, ruminant, and aquaculture sectors.

Regional players play a key role by leveraging local market knowledge and customized formulations that meet country-specific regulatory and livestock demands, ensuring consistent supply and quality. The market presents high entry barriers given the complexity of micronutrient bioavailability, stringent safety and purity standards, and the requirement for regulatory approvals in diverse global markets. Success in this competitive landscape depends on innovation in formulation technologies, adherence to regulatory frameworks, and the ability to demonstrate improved animal performance and sustainability.

Key Developments in the Feed Micronutrients Market

In January 2025, AAFCO approved a new regulatory pathway for animal food ingredients, replacing the previous FDA-linked process. Led by K-State Olathe, the initiative provides scientific review, expert evaluation, and streamlined approval, enhancing safety, efficiency, and innovation in the animal feed industry while ensuring broader regulatory recognition.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.1 Billion |

| Product | Trace Minerals, Vitamins, Carotenoids, Others (including antioxidants and enzyme cofactors) |

| Livestock | Poultry, Ruminant, Aquaculture, Swine, Equine |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA). |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Zinpro Corporation, Vamso Biotec Pvt. Ltd., Tanke Biosciences Corporation, Royal DSM, Archer Daniels Midland Company, Alltech , Inc., Ridley, Inc., Phibro Animal Health Corporation, Pancosma SA, QualiTech Corp., Mercer Milling Company, Inc., Davidsons Animal Feeds, Cargill, and Kemin Industries Inc. |

| Additional Attributes | Dollar sales by product and livestock segment; increasing adoption of micronutrient-enriched feed formulations; growing focus on sustainable livestock farming; advancements in micronutrient delivery and bioavailability; regulatory compliance and quality standards shaping market dynamics |

The global feed micronutrients market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the feed micronutrients market is projected to reach USD 3.9 billion by 2035.

The feed micronutrients market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in feed micronutrients market are feed micronutrients as trace minerals, _iron, _zinc, _manganese, _copper, _boron, feed micronutrients as vitamins, _vitamin a, _vitamin b, _vitamin c, _vitamin d, _vitamin k, _vitamin e and _carotenoids.

In terms of livestock, poultry segment to command 48.2% share in the feed micronutrients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Feed Mixer Market Forecast and Outlook 2025 to 2035

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Feed Electrolytes Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Flavors Market Size and Share Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Mycotoxin Binders Market Size and Share Forecast Outlook 2025 to 2035

Feed Phytogenics Market Size and Share Forecast Outlook 2025 to 2035

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Feed Grade Oils Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Packaging Market Size, Share & Forecast 2025 to 2035

Feed Mycotoxin Detoxifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Feed Premix Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Feed Phytogenic Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA