The Feeder Container market is experiencing steady growth driven by the increasing demand for efficient and flexible cargo transportation solutions in regional and short-sea shipping networks. The market outlook is influenced by the rising trade volumes of goods, particularly in food and beverage, retail, and manufacturing sectors. Investments in port infrastructure, modernization of container fleets, and adoption of standardized container handling practices are further supporting market expansion.

Operational efficiency, cost reduction, and faster turnaround times are key factors motivating shipping companies and logistics providers to invest in feeder containers. The ongoing focus on optimizing the supply chain, coupled with the need for sustainable and safe transport solutions, is expected to drive long-term growth.

Increasing integration of tracking and monitoring technologies enhances visibility across transportation networks, enabling real-time management of containerized cargo As regional trade grows and companies seek to improve logistics flexibility, the Feeder Container market is anticipated to witness continued adoption across various commercial sectors, creating substantial opportunities for manufacturers and service providers.

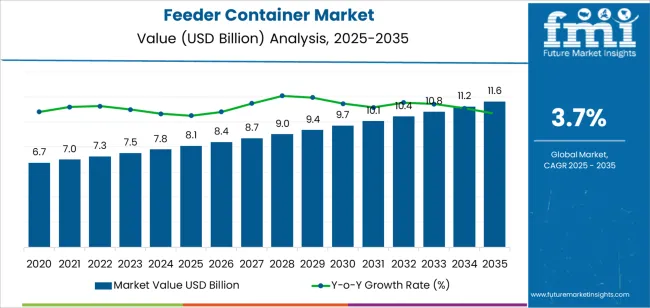

| Metric | Value |

|---|---|

| Feeder Container Market Estimated Value in (2025 E) | USD 8.1 billion |

| Feeder Container Market Forecast Value in (2035 F) | USD 11.6 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

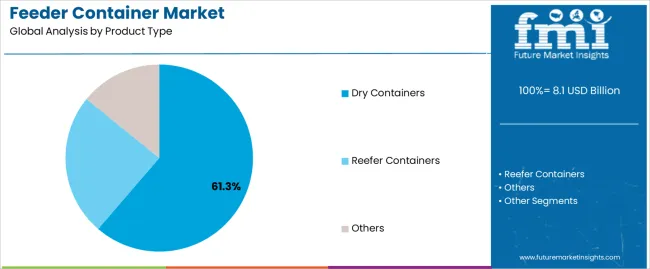

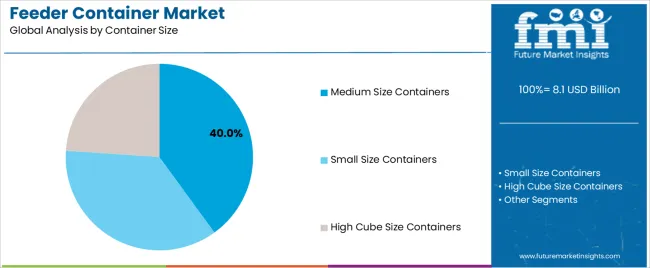

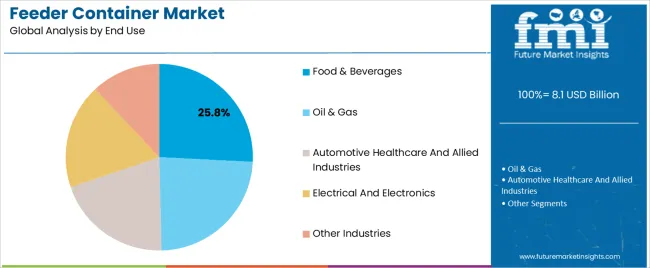

The market is segmented by Product Type, Container Size, and End Use and region. By Product Type, the market is divided into Dry Containers, Reefer Containers, and Others. In terms of Container Size, the market is classified into Medium Size Containers, Small Size Containers, and High Cube Size Containers. Based on End Use, the market is segmented into Food & Beverages, Oil & Gas, Automotive Healthcare And Allied Industries, Electrical And Electronics, and Other Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dry containers segment is projected to hold 61.30% of the Feeder Container market revenue share in 2025, establishing it as the leading product type. This segment’s growth is driven by the broad applicability of dry containers for transporting non-perishable goods, providing secure and efficient cargo handling.

The standardized design allows easy stacking, handling, and integration with existing port and shipping infrastructure, which enhances operational efficiency. Increasing trade of consumer goods, machinery, and packaged products has reinforced the adoption of dry containers, while their durability and low maintenance requirements have made them a preferred choice for shipping operators.

Additionally, advancements in material quality and container design have improved lifespan and reliability, supporting sustained demand The segment continues to benefit from global trade expansion and the emphasis on cost-effective, scalable transportation solutions.

The medium size containers segment is expected to account for 40.00% of the Feeder Container market revenue share in 2025, positioning it as the leading container size. The growth of this segment is driven by the operational flexibility offered by medium size containers, which allow shipping companies to efficiently transport moderate cargo volumes without compromising on handling or storage efficiency.

These containers are suitable for a wide range of goods, particularly for regional shipping and feeder services, which require rapid turnaround and easy integration with intermodal transportation networks. Increasing demand from ports and logistics providers for adaptable and cost-effective container solutions has further reinforced adoption.

Medium size containers provide an optimal balance between capacity and operational convenience, which is critical for meeting the growing trade requirements in short-sea and regional transport networks.

The food and beverages end use segment is anticipated to hold 25.80% of the Feeder Container market revenue share in 2025, making it the leading application segment. The growth is driven by the rising demand for safe, reliable, and temperature-controlled transport solutions for perishable and packaged products.

Feeder containers provide secure storage, minimizing damage and spoilage during transit, which is critical for food and beverage supply chains. The segment has benefited from expanding global trade in processed foods, beverages, and packaged goods, which requires scalable and flexible containerized logistics.

Additionally, the adoption of advanced container handling and monitoring technologies ensures quality control, compliance with food safety regulations, and improved operational efficiency As demand for efficient regional transport of food and beverages continues to rise, this segment is expected to maintain its dominant market position.

The above table presents the expected CAGR for the global feeder container market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 3.8%, followed by a slightly lower growth rate of 3.3% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1 | 3.8% (2025 to 2035) |

| H2 | 3.3% (2025 to 2035) |

| H1 | 3.5% (2025 to 2035) |

| H2 | 3.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 3.5% in the first half and remain relatively moderate at 3.7% in the second half. In the first half (H1) the market witnessed a decrease of 30 BPS while in the second half (H2), the market witnessed an increase of 40 BPS.

Remote Container Management Technology Trending Across Shipping Industry

Shipping Containers now can monitor pressure temperature, pressure and other characteristics at any time during the journey. The remote container management technology unit uses the same technology similar to SIM cards, Wi-Fi and GPS.

Remote container management systems provide end-users with the advantage of predictive and remote maintenance of their products. Instead of being physically present at all times and avoiding corrective actions, end-use manufacturers can restore the correct settings of containers from anywhere.

Furthermore, if the problem in the container or goods is irreparable, the shipper can inform the logistical partner or client before the arrival of cargo, in return which helps to form an uninterrupted supply chain.

The Feeder operators can benefit from the increased adaption of technological advancements by using the latest communication gadgets and means to offer uninterrupted tracking and connectivity to the clients wherever and wherever they sail.

Growth in E-commerce Sector and Changes in Consumption Patterns Driving Demand

The sharp rise of the retail industry and the recent boost experienced across the global e-commerce sector have resulted in increased demand for containerized goods, which has further fueled the demand for containers. The rise in the movement of containers will eventually profit feeder service operators.

The pandemic has induced a shift in shopping as well as consumption patterns. The pandemic has led to increased digitalization, which is accelerating the growth of the e-commerce sector. As per UNCTAD, ecommerce sales reached USD 28 trillion in 2025 showcasing 10% growth rate. These growth have bolstered the demand for feeder containers and increased the revenue for feeder service operators.

The rise of the e-commerce sector offers new business opportunities for feeder service operators, in particular for warehousing & distribution facilities at seaports. For instance, some container shipping companies and ports, such as DP World, Maersk, and others, have started to position themselves as door-to-door service integrators. Feeder service operators can gain an advantage from the ports located near a large population, as e-commerce sales are high in these places during the pandemic.

Overall, the movement of containers increased due to the rise in the e-commerce sector, which further increased the demand for containerized goods. This rise in container movement drives the demand for feeder service operators as containers need to be deployed at ports from the mother vessel or vice versa.

Catastrophic Events and Blockades Impacting Demand for Feeder Service Operators

Catastrophic events cause losses to various shipping companies and shipping container manufacturers. This ultimately affects the feeder service operator market. Blockades also hamper the market growth as they result in the delay of ships’ arrival at the port. Moreover, the rise in freight rates is also becoming an obstacle to the growth of the feeder service operator market. This again hurts the feeder service operator market since the rise in freight rates will result in high prices for the services offered.

The global feeder container industry recorded a CAGR of 2.0% during the historical period between 2020 and 2025. The growth of the feeder container industry was positive as it reached a value of USD 8.1 billion in 2025 from USD 6.7 billion in 2020.

The exponential expansion of the food & beverages sector in various countries, along with rising demand from the e-commerce sector is boosting the requirement for feeder containers for the transportation of goods in this sector. Growing adoption of effective containers, the use of low-emission and greener fuels, and the introduction of smart containers are expected to spur demand for feeder containers. By using these containers, shippers are making the best use of available spaces. It saves time and money and offers greater handling and protection.

Further, the surging adoption of smart containers will bode well for the growth in the market. These containers use technologies such as IoT devices, sensors, and GPS to improve security and track location and product contamination while transiting. The aforementioned factors are expected to continue pushing sales in the market over the forecast period. Besides, these containers are cost-effective, reduce transportation costs and provide safety and security for a wide range of goods, foods, and machinery.

Bulk materials and food & beverage goods are best stored in feeder containers. Increasing inclination toward environmental conservation consciousness is spurring demand in the market. These containers are widely being adopted for the transportation of oil & gas, healthcare, and electric products. The usage of eco-friendly fuel solutions is gaining popularity in the container industry, thereby making feeder containers a viable option.

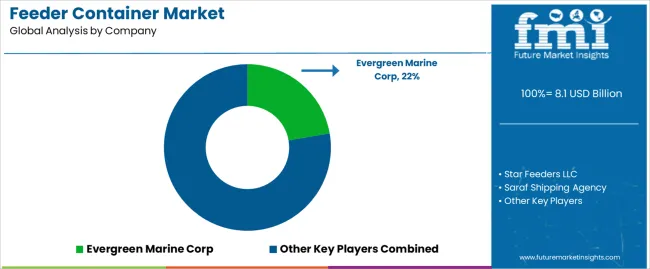

Tier 1 companies comprise market leaders with a market revenue of above USD 300 million capturing a significant market share of 20% to 30% in the global market.

These market leaders are characterized by high production capacity and a wide product portfolio. These players are distinguished by their extensive expertise in manufacturing across multiple products across different applications and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of products utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 encompass CIMC, Dong Fang International Containers, A.P. Moller-Maersk, and CXIC Group.

Tier 2 companies include mid-size players with revenue of USD 100 to 300 million having presence in specific regions and highly influencing the regional market. These are characterized by a limited international presence and well-maintained market knowledge.

These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Evergreen Marine Corp, Star Feeders LLC, Hapag-Lloyd AG, FeederTech (Unifeeder Group), and CMA CGM Group.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets having revenue below USD 100 million. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have very limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis of the feeder container market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Western Europe, Eastern Europe, and others, is provided.

In MEA GCC countries is anticipated to register a moderate growth with a value share of more than 43% through 2035. In North America, US is leading with 75% of value share showcasing a sluggish growth in upcoming decade.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.4% |

| Germany | 1.4% |

| UK | 2.1% |

| Brazil | 2.8% |

| India | 5.2% |

| China | 4.8% |

| Japan | 1.9% |

| GCC Countries | 4.5% |

The USA is anticipated to hold more than 75% of the value share in North America in 2025 expanding at a 2.4% growth rate till the year 2035.

According to the data provided by the Federal Reserve Bank of St. Louis, retail sales of the food and beverage industry were recorded at USD 93,799 million in April 2025 which increased from USD 89,000 million in April 2025.

This data showcases the increasing demand for food and beverage products in the country. The adoption of feeder containers is expected to be driven by the presence of a robust food & beverage sector in the country, along with increasing international trade activities for food and beverage products.

Germany’s market is leading among the Western Europe region poised to exhibit a sluggish CAGR of 1.4% between 2025 and 2035. The chemical industry is one of the country’s most important industrial sectors which plays a key role in its economic development.

According to the European Chemical Industry Council (CEFIC), chemical is the third largest industry in Germany and recorded a turnover of around USD 7.8 billion in 2024. This consistent development of the chemical industry is creating significant demand for industrial packaging solutions such as feeder containers for efficient and safe transportation.

China is expected to have firm strength when it comes to industrial expansion and is projected to account for almost 45% of value share in East Asia. According to the Ministry of Industry & Information Technology of China, total imports and exports value of china recorded in October 2025 was USD 496.72 billion (3,541.7 billion yuan) as stated by National Bureau of Statistics of China.

The recorded value of exports was 1,973.6 billion yuan and imports was 1,568.1 billion yuan in October 2025. The rising production, import and exports of goods in china will generate high demand for feeder container market in future.

Trade barriers imposed by countries hamper business growth and offer manufacturer’s limited access to trading with one of the world’s largest trading countries. Malaysia is one of the 15 signatory nations of the Regional Comprehensive Economic Partnership (RCEP) forming the world’s largest free trade agreement. In this agreement, Malaysia holds a key position representing 30% of the global population and GDP which is further expected to increase up to 50% by 2035.

Malaysia currently holds 16 Free Trade Agreements (FTAs) with the potential market size extending up to USD 3.3 billion. The nation has signed bilateral FTAs with key players like Japan, Pakistan, India, New Zealand, Chile, Australia, and Turkey. These ties will flourish the trading between Malaysia and other countries resulting in more requirement of packaging solutions like feeder containers for efficient and safe transportation.

The section contains information about the leading segments in the industry. Dry containers are anticipated to gain value share more than 60% through 2035. Food and beverage cans are projected to showcase significant growth at 4.5% CAGR through 2035.

| Product Type | Dry Containers |

|---|---|

| Value Share (2035) | 61.3% |

Dry containers are growing at a significant rate and are anticipated to hold more than 60% of the market share expanding at 4.9% through 2035.

Dry containers are versatile as they are useful across a wide range of industries such as electronics, machinery, textiles and other nonperishable items. These containers are available at a low cost compared to specialized containers and reduce the overall transportation cost. They are more frequently used in global trading across regions for bulk cargo. These containers are more aligned with the needs of emerging countries and as global trade increases the demand for dry containers will rise.

| Product Type | Food and Beverage |

|---|---|

| Value Share (2035) | 25.8% |

The significantly rising demand for fresh food and beverage items in the global market is boosting the demand for the feeder container market. Feeder container specially designed for perishable products maintains the quality and safety of products with efficient and timely transportation.

Rising international trade activities need a seamless and integrated supply chain. Feeder containers fulfill the global shipping requirements for food and beverage products which is boosting the demand for the feeder container market.

Food and beverage are projected to reach USD 3.5 billion expanding at 4.7% CAGR during the assessment period.

Leading companies operating in the global feeder containers market are seeking to increase their global reach, diversify their product offering, and accelerate their development processes to improve sales.

Leveraging technology, these companies prioritize safety, product quality, and customer satisfaction to expand their customer base. They are adopting a merger & acquisition strategy to expand their resources and are developing new products to meet customer needs.

Recent Industry Developments in Feeder Container Market

In terms of product type, the industry is segregated into dry containers, reefer containers, and others.

In terms of container size, the industry is segregated into small size containers, medium size containers, and high cube size containers.

The industry is classified by end use as oil & gas, food & beverages, automotive healthcare and allied industries, electrical and electronics, and other industries.

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and Middle East and Africa (MEA), have been covered in the report.

The global feeder container market is estimated to be valued at USD 8.1 billion in 2025.

The market size for the feeder container market is projected to reach USD 11.6 billion by 2035.

The feeder container market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in feeder container market are dry containers, reefer containers and others.

In terms of container size, medium size containers segment to command 40.0% share in the feeder container market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Belt Feeders Market Size and Share Forecast Outlook 2025 to 2035

Weft Feeder Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Part Feeder Market

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Chicken Feeder and Drinkers Market Size and Share Forecast Outlook 2025 to 2035

Poultry Feeder Market Size and Share Forecast Outlook 2025 to 2035

Vibratory Feeder Machine Market Size and Share Forecast Outlook 2025 to 2035

Horse Bunk Feeder Market Size and Share Forecast Outlook 2025 to 2035

Goat Creep Feeder Market Analysis by Material, Operation, Application and Region: A Forecast for 2025 and 2035

Horse Grain Feeders Market Size and Share Forecast Outlook 2025 to 2035

Sheep Creep Feeder Market – Innovations & Market Outlook 2025-2035

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Cattle Mineral Feeder Market Size and Share Forecast Outlook 2025 to 2035

Vibrating Gravity Feeder Market Size and Share Forecast Outlook 2025 to 2035

Oxygen-Scavenger Sachet Feeders Market Forecast and Outlook 2025 to 2035

Container-based Firewall Market Size and Share Forecast Outlook 2025 to 2035

Container Fixed Fittings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA