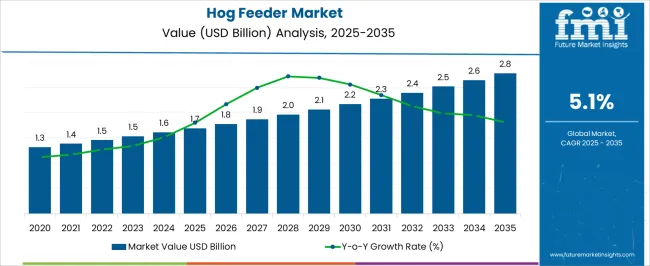

The Hog Feeder Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Hog Feeder Market Estimated Value in (2025 E) | USD 1.7 billion |

| Hog Feeder Market Forecast Value in (2035 F) | USD 2.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The hog feeder market is witnessing consistent growth driven by increasing demand for efficient and sustainable livestock feeding solutions. Growing focus on optimizing feed consumption and improving animal health has led to widespread adoption of advanced feeder designs. The market dynamics are influenced by the rising scale of commercial hog farming operations and the push for mechanization to reduce labor costs.

Innovations in feeder technology that enhance feed delivery accuracy and minimize wastage are gaining traction across different farm sizes. Furthermore, growing awareness around biosecurity and animal welfare practices is promoting the use of feeders that support hygienic feeding environments.

Regulatory pressures and initiatives encouraging modern farming practices are also contributing to the expansion of the market. These factors collectively are creating a favorable environment for ongoing product development and broader adoption of efficient hog feeder systems.

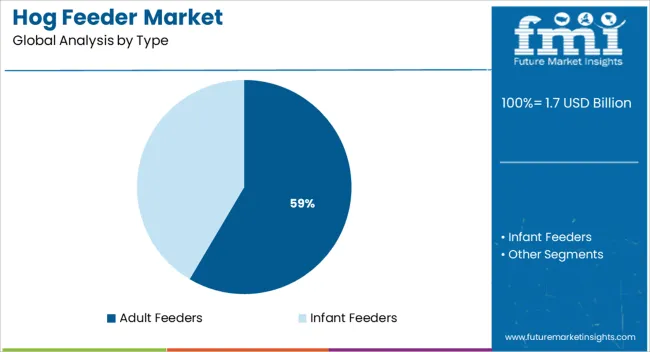

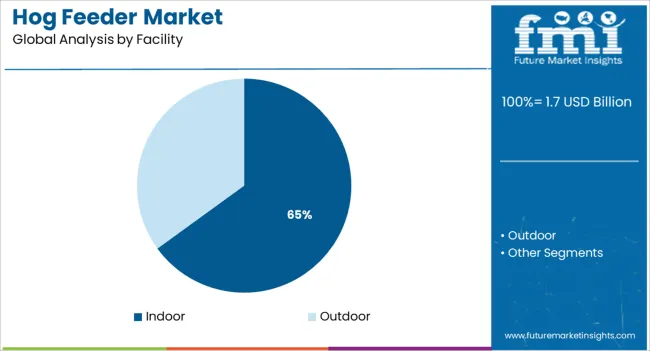

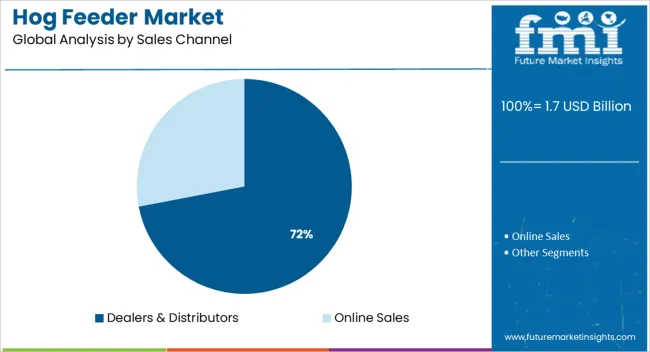

The market is segmented by Type, Facility, Sales Channel, and Application and region. By Type, the market is divided into Adult Feeders and Infant Feeders. In terms of Facility, the market is classified into Indoor and Outdoor. Based on Sales Channel, the market is segmented into Dealers & Distributors and Online Sales. By Application, the market is divided into Domestic Farm and Hunting. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the type segment, adult feeders hold a revenue share of 58.5% in 2025, making them the leading subsegment. This dominance is driven by the necessity to meet the nutritional requirements of mature hogs that consume higher feed volumes compared to younger animals.

The design of adult feeders has been optimized to provide consistent feed availability while reducing feed spillage and contamination risks. Enhanced durability and ease of cleaning have further supported their adoption.

Feed efficiency improvements realized through these feeders have helped producers achieve better growth rates and feed conversion ratios, which are critical for profitability. As a result, adult feeders have become integral in large-scale hog production systems focused on operational efficiency and animal health management.

The indoor facility segment accounts for 65.0% of the revenue share in 2025, reflecting its leading role within the market. The preference for indoor hog farming has driven demand for feeders that are specifically designed for controlled environments.

These feeders contribute to improved feed management by allowing precise delivery and reducing feed wastage in confined spaces. Additionally, indoor feeders support biosecurity measures by minimizing feed contamination from external elements.

The controlled environment enables better monitoring of feed intake and animal behavior, facilitating timely interventions to improve herd performance. Growing investments in modern indoor hog farming infrastructure have reinforced the adoption of indoor-specific feeders, supporting their dominant market position.

Dealers and distributors represent the leading sales channel segment with a revenue share of 72.0% in 2025. This strong position is attributed to their extensive networks and deep market reach, which enable efficient distribution of hog feeders across diverse geographic regions.

These intermediaries provide critical support services including product education, after-sales support, and localized inventory management, which facilitate purchase decisions and enhance customer satisfaction. The relationship-driven nature of livestock farming markets benefits from the personalized service and technical expertise offered by dealers and distributors.

Their role in bundling feeders with complementary products and services has also increased their influence. The scale and reliability of this channel have been essential in driving widespread adoption of hog feeders, particularly among medium and small-scale producers seeking trusted suppliers.

Hog production is forecast to increase as a result of the high demand for animal protein, particularly in the form of meat, which is also anticipated to accelerate the expansion of the hog feeder industry. Hog is quite well-liked by the inhabitants of various economies due to its reasonable pricing structure.

Additionally, the high consumer favorability of pig products like bacon, ham, and others owing to their flavor and texture is likely to increase the demand for a hog feeder. During the forecast period, it is anticipated that established pork markets in western nations and rising commerce in livestock products and pork across several worldwide economies are likely to further drive the sales of hog feeders.

The global market for hog feeders is anticipated to have significant growth over the anticipated period. The demand for automated hog feeders has risen as manual machines were inefficient and labor costs for handling manual or semi-automatic feeders were pretty high. The manufacturers are developing hog feeder machines that are very easy to use and convenient.

The sales of automatic hog feeders have increased due to the rising population of hogs and growing disposable income. These are the driving forces behind the expansion of automatic hog feeder equipment globally.

Additionally, the rise in demand for hog meat and related products throughout the world has increased farmers' interest in using autonomous hog feeder equipment to decrease labor requirements and boost hog production. As a result, these factors are likely to boost the adoption of hog feeder machines during the forecast period.

| Report Attributes | Details |

|---|---|

| Hog Feeder Market Value (2025) | USD 1.7 billion |

| Hog Feeder Market CAGR (2025 to 2035) | 5.1% |

| Anticipated Hog Feeder Market Value (2035) | USD 2.8 billion |

According to Future Market Insights, the market for hog feeders rose at a CAGR of 4.6% from USD 1,218.41 Million in 2020 to USD 1,458.54 Million in 2025.

During the forecast period, demand for hog feeders is anticipated to rise due to several other factors in a variety of residential and industrial applications. Radiation causes the production of enzymes to proceed slowly, which eventually slows down food ripening, sprouting, and rotting. Hog Feeders for residential use have seen a considerable increase in sales as a result in recent years.

| Attribute | Valuation |

|---|---|

| 2025 | USD 1,690.09 Million |

| 2035 | USD 1,962.09 Million |

| 2035 | USD 2,394.03 Million |

The market is anticipated to grow at a CAGR of 5.1% from 2025 to 2035, surpassing USD 2,516 Million by 2035.

Short Term (2025 to 2025): The demand for hog feeders among animal husbandry farms is rising, which is projected to considerably contribute to the market's growth. Hog feeders are beneficial to animal husbandry processes by boosting process efficiency and lowering operational expenses. As a result, the manufacturers are devising growth strategies keeping expansion to different markets a priority.

Medium Term (2025 to 2035): It is projected that rising demand for automated production line operations among manufacturers across a variety of industry verticals is likely to boost sales of hog feeders and, therefore, the market's expansion.

Long Term (2035 to 2035): Increased use of cutting-edge technologies in the manufacture of a hog feeder machine is likely to aid in the growth of the market during the forecast period. With the hog population set to rise, managing the herd manually is likely to become more challenging. As a result, there is a growing demand for hog feeder equipment since they routinely feed hogs and aid in herd management.

With an anticipated CAGR of 6.9% throughout the forecast period, the bunk feeder category is expected to lead the market for hog feeders. The advantages of bunk feeders, such as improved feed intake and increased animal weight growth, are what essentially drives the demand for bunk feeders. Pellet production is increasing significantly as a result of the expanding demand for nutrient-dense feed, which also encourages company investment in the hog bunk feeder manufacturing sector. These benefits have also reduced waste during the eating process. Additionally, lucrative opportunities for market expansion are likely to be generated by emerging countries' growing knowledge of the product's effectiveness.

Due to stainless steel's corrosion resistance, tensile strength, and durability, the stainless-steel hog feeders segment is expected to increase at a CAGR of more than 5.89% by 2035. Market expansion is projected to be fueled by manufacturers of hog feeders' rising demand for stainless steel. The high toughness, ductility, and minimal maintenance of stainless steel have led to a growth in the product's use in hog feeder equipment, which is expected to drive up demand for stainless steel during the forecast period.

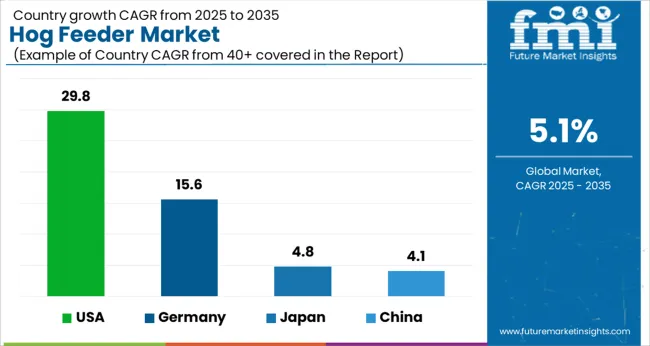

| Country | The USA |

|---|---|

| CAGR (2025 to 2035) | 29.8% |

| Market Value by 2035 (in USD Million) | 2.8 |

| Country | Germany |

|---|---|

| CAGR (2025 to 2035) | 15.6% |

| Market Value by 2035 (in USD Million) | 227.0 |

| Country | Japan |

|---|---|

| CAGR (2025 to 2035) | 4.8% |

| Market Value by 2035 (in USD Million) | 70.6 |

| Country | China |

|---|---|

| CAGR (2025 to 2035) | 4.1% |

| Market Value by 2035 (in USD Million) | 219.5 |

Due to the rising demand for premium swine meat and other goods in the area, North America is expected to experience significant growth over the next years. The market in the area is anticipated to expand as a result of the presence of major industry players in the USA Another factor that might contribute to the future expansion of the quality swine feed sector in nations like the USA and Canada is the high profitability gained from exporting hog.

The USA hog feeder market is anticipated to surpass USD 2.8 Million by 2035, rising at a CAGR of 8.3% during the forecast period. Furthermore, the expansion of this market in the US is being influenced by the rising consumption of pork-based products.

Due to factors like increasing corporate focus on technological developments in feeding management, effectively managing animal nutritional requirements, and rising adoption of hog feeders in hog farming, Germany is currently dominating the European hog feeder industry. Germany is likely to witness significant growth prospects in the market. The German hog feeder industry is anticipated to be worth USD 227.0 Million by 2035, growing at a CAGR of 15.6% during the forecast period.

For instance, Trioliet introduced new feeding equipment called Solomix 3 in September 2020 to attract major European cattle farms, grow their business, and add to their current product line.

Japan's hog feeder industry is to reach USD 270.6 million by 2035, expanding at a strong CAGR of 4.8% over the projected period. The sales of hog feeders in the region are growing due to urbanization and rising middle-class incomes. The demand for hog feed is consequently driven by the growing price of raw materials for animal use. The processed meat sector, which is expanding healthily and demands premium hog meat, also contributes to market growth.

China accounts for a 10.1% share of the hog feeder industry, growing at a CAGR of 4.1% during the forecast period. By 2035, due to high hog consumption in the region, China's hog feeder industry is anticipated to surpass USD 219.5. The market is primarily driven by the growing concentration of hog feeder equipment companies, technological advancements, and government incentives for mechanization due to population growth. The development of the nation's hog industry and the development of export potential for other nations are both significantly aided by China's hog feeder industry.

The market for hog feeders is slightly competitive due to the presence of some of the major giants. The hog feeder industry has a medium level of market concentration, with several prominent companies using tactics including product innovation, mergers, and acquisitions to get an edge over rivals.

To expand their market share in the international market, major businesses are similarly choosing mergers and acquisitions and working with regional players. Government, equipment manufacturers, commercial distribution utilities, and service providers are heavily engaging in research and development operations to decrease power outages and increase the need for automated feeding systems to gain a competitive edge.

Brehmer Mfg.

Brehmer Mfg. is a leading manufacturer of stainless-steel hog feeder equipment since 1982. Brehmer Mfg. has previously worked as a contract maker for several well-known feeder brands. We identified locations where these feeders may be strengthened as a result of our years of expertise. We decided to take the risk and create our line of hog-producing machinery.

A specialized barn is used by the family-owned Brehmer Mfg. to test its products. Brehmer uses 304 stainless steel to construct all goods according to your demands while continuously innovating its designs. As a consequence, you can rely on the reliability and usability of a Brehmer Feeder.

Hog Slat

Hog Slat manufactures and distributes a variety of hog feeders that aid the hogs from farrowing to market. Hog Slat stocks models of baby pig creep feeders, nursery feeders, finishing feeders, and sow feeders. They also developed the most innovative sow feeding system on the market with the introduction of the SowMax Ad Lib Feeder.

Recent Developments in the Hog Feeder Industry:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.1% from 2025 to 2035 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Segments Covered | By Product Type, By Material, By Application, By Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific excluding Japan (APEJ); Japan; Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Hog Slat; Sioux Steel Company; Osborne Livestock Equipment; PS Operating Company LLC.; CountyLine; Miller Manufacturing Company; Behlen Country; Big Herdsman Machinery; O'Mara; Fancom BV |

| Customization scope | Available Upon Request |

| Pricing and Purchase Option | Avail of Customized purchase options to meet your exact research needs. |

The global hog feeder market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the hog feeder market is projected to reach USD 2.8 billion by 2035.

The hog feeder market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in hog feeder market are adult feeders and infant feeders.

In terms of facility, indoor segment to command 65.0% share in the hog feeder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automatic Hog Feeder Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Hogshead Barrel Market

Echogenic Catheters Market

Lithography Equipment Market Size and Share Forecast Outlook 2025 to 2035

Lithographic Printing Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Pathogen Reduction Systems Market

Belt Feeders Market Size and Share Forecast Outlook 2025 to 2035

Weft Feeder Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Part Feeder Market

Cattle Feeder Panels Market Size and Share Forecast Outlook 2025 to 2035

EUV Lithography Market Size and Share Forecast Outlook 2025 to 2035

Cattle Feeder Market Size and Share Forecast Outlook 2025 to 2035

Chicken Feeder and Drinkers Market Size and Share Forecast Outlook 2025 to 2035

Poultry Feeder Market Size and Share Forecast Outlook 2025 to 2035

Food Pathogen Testing Market Analysis by Contaminant Type, Technology, Application, and Region through 2035

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

Vibratory Feeder Machine Market Size and Share Forecast Outlook 2025 to 2035

Stencil Lithography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA