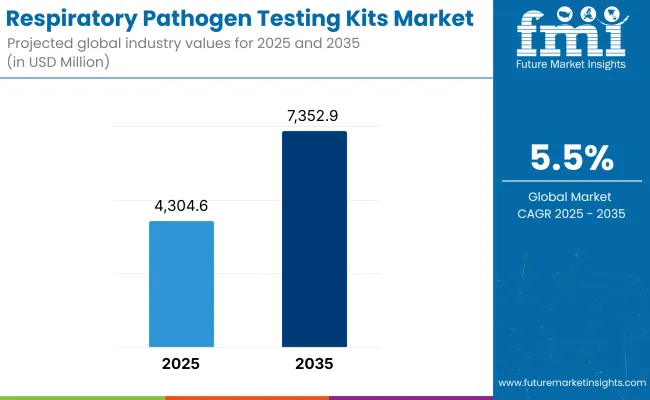

The respiratory pathogen testing kits market may rise from USD 4,304.6 Million in 2025 to USD 7,352.9 Million by 2035, with a CAGR of 5.5% over the forecast period. The global respiratory pathogen testing kits market is very competitive due to the rise in respiratory diseases and government efforts for better healthcare services.

From 2025 to 2035, the respiratory pathogen testing kits market will grow a lot. This is because more people get breathing infections, technology gets better for tests, and people learn early check-ups help. More cases of the flu, COVID-19, lung infections, and other breathing sicknesses show the need for quick and correct detection. The need for easy-to-use and home tests is also driving the market growth.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 4,304.6 Million |

| Market Value (2035F) | USD 7,352.9 Million |

| CAGR (2025 to 2035) | 5.5% |

The market for respiratory pathogen testing kits is strong in North America. This is due to good healthcare, high spending on health, and many key companies being based there. The United States is ahead in this area. This is because of more cases of lung infections, more awareness about diseases you can catch, and consistent investments in tests. The rise in use of home test kits and point-of-care diagnostics is also pushing market growth.

Europe is the largest revenue-generating region for respiratory pathogen testing kits market, with Germany, the United Kingdom, and France forming the top three countries. Supporting it are government investments towards infectious disease control, an increasing geriatric population vulnerable to respiratory illness and growing investments in innovation in the healthcare sector. Additionally, in Europe the market grows driven by a preference for non-invasive and rapid diagnostic tools.

The Asia-Pacific area will grow fast because of more breathing diseases, more people living in cities, and better health information. Places like China, India, and Japan will see big growth because their health system is good, pollution makes more breathing problems, and the government is working to stop sickness. The area's growth is also due to more home testing and better health care investing.

High Costs and Regulatory Barriers

Expensive test kits are a big problem that can slow down the growth of the market for respiratory testing kits. These high costs can make it hard for folks in poorer countries to access them. Also, strict rules and approval processes can make it tough for new businesses to start selling their products quickly, hindering quick changes and widespread use.

Expansion of Point-of-Care and At-Home Testing Solutions

The need for home tests and quick health checks is growing. This creates big chances for businesses. Fast test kits give results on the spot, making it easy for people to use them. Tech like AI diagnostic tools and telehealth are helping spot and track breathing problems early. This sets the stage for market growth.

The market for breathing test kits is set to grow. More lung infections, new tech, and quick tests are boosting this trend. Constant updates and more need for easy tests mean this market will be key in managing and stopping lung diseases in years to come.

The respiratory pathogen testing kits market showed Growth during 2020 to 2024 at strong base due to COVID-19 pandemic. The sheer demand for new, efficient diagnostics initiated an unprecedented growth in the field of molecular testing, especially RT-PCR, antigen and serology based assays.

There was pivotal global buildup of awareness on respiratory related infections along with many requirement for scalable efficient diagnostic solutions which lay the foundation for widely adoptable point-of-care (PoC) testing for rapid detection and management of the disease.

They forecast that the market would grow from 2025 to 2035, owing to the increasing prevalence of respiratory diseases including influenza, RSV, pneumonia, respiratory infections, and newly arising viral infections. Moving forward, multiplex PCR technologies will enable the simultaneous detection of multiple pathogens, resulting in greater diagnostic accuracy and efficiency.

The combination of AI-based diagnostic platforms and machine learning algorithms will help to make sense of results, minimizing diagnostic errors and improving turnaround times. In addition, the miniaturization of diagnostic devices will drive demand for portable and home-based testing kits, increasing access to underserved populations.

Market Shifts: 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Emergency approvals for COVID-19 testing kits. |

| Technological Advancements | Adoption of PCR, antigen, and antibody tests. |

| Testing Format | Predominantly laboratory-based testing. |

| Multiplex Testing | Limited multi-pathogen testing availability. |

| Supply Chain & Distribution | High demand led to global shortages. |

| Market Growth Drivers | COVID-19 pandemic drove mass testing adoption. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulatory policies for multi pathogen diagnostics. |

| Technological Advancements | AI-driven rapid diagnostics and CRISPR-based testing. |

| Testing Format | Shift toward home-based and POC (Point-of-Care) testing. |

| Multiplex Testing | Widespread use of syndromic panels detecting multiple pathogens simultaneously. |

| Supply Chain & Distribution | Streamlined supply chains with decentralized production. |

| Market Growth Drivers | Rising incidence of seasonal and emerging respiratory infections. |

The respiratory pathogen testing kits market is growing in the US. This is because more people are getting sick with breathing problems, and more people are using quick test kits. The government backs plans to watch for these diseases. The FDA and CDC check these test kits for safety and usefulness.

Some trends are on the rise. There is more need for tests that can check for many germs at once. Home test kits and tests done at the site of care are also getting more popular. New tech for these tests is improving. Tests that check for flu, RSV, and COVID-19 at the same time are getting more attention too.

| Country | CAGR (2025 to 2035) |

|---|---|

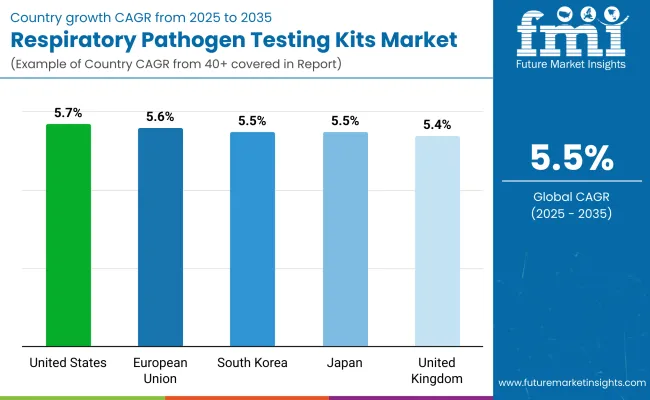

| USA | 5.7% |

The respiratory pathogen testing kits market in the UK is growing. This is because of higher healthcare spending, more knowledge about lung diseases, and more use of quick and PCR-based tests. The UK MHRA and NHS oversee how these kits get approved and paid for, and also manage disease control plans.

In the market, quick antigen and molecular tests are becoming more popular. There's more money going into digital diagnostic tools, and people want more flu and RSV combo tests. Government efforts to find diseases early help the market grow, too.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.4% |

The respiratory pathogen testing kits market in Europe is seeing steady growth. Strong rules, more cases of breathing sickness, and more use of home test kits help this rise. The EMA and ECDC control product approvals and watch over disease spread.

Germany, France, and Italy are top in the market. This is due to better healthcare systems, more money for new test tech, and strong government action to control breathing sickness. There is also more need for smart and cloud-based test solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.6% |

The respiratory pathogen testing kits market is growing in Japan. This is because more people want to stop these illnesses early, and they use better testing tools. The government helps a lot for public health checks. Two groups, MHLW and PMDA, are in charge of allowing testing kits and making health rules.

Important trends show more people want small and quick tests. Using AI in finding breathing germs is going up. Home testing is also getting more attention. Japan likes very accurate tests, which makes PCR test kits more needed.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The respiratory pathogen testing kits market in South Korea is growing fast. More people and doctors are using new ways to diagnose illnesses. Public health plans and support from the government are helping detect diseases early. The Korea Food and Drug Administration and the Korea Centers for Disease Control and Prevention set the rules for these kits.

Trends in the market show an increased need for real-time PCR and quick test kits that look for antigens. There's more money going into smart tools and AI that help find diseases faster. The healthcare system is also getting better at handling breathing illnesses.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

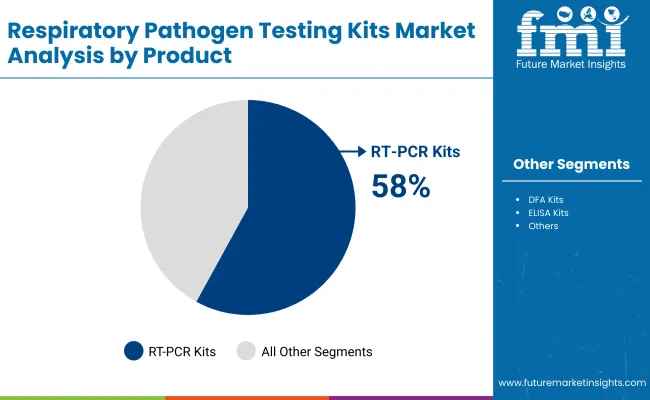

The respiratory pathogen testing kits market is growing. This is due to more breathing illnesses, the need for fast test results, and better test tech. The best kits are RT-PCR Kits as they are very good, spot many bugs at once, and give correct results. For the kind of bug, flu tests are on top. This is due to yearly flu seasons, new flu strains, and the need for quick treatment choices.

Market Share by Product (2025)

| Product | Market Share (2025) |

|---|---|

| RT-PCR Kits | 58.0% |

The RT-PCR Kits segment dominates the market with a 58% market share, as these kits enable accurate, reliable and rapid detection of several respiratory pathogens, like those of influenza viruses, coronaviruses, and respiratory syncytial virus (RSV). Furthermore, RT-PCR tests can detect multiple pathogens from a single sample, provide quantitative analysis, and achieve better specificity than conventional PCR tests, allowing them to be the most widely used tests in hospitals, diagnostic laboratories, and point-of-care testing centers.

Microfluidics, portable PCR systems, and automated testing platforms are among the rapidly developing technologies that enable faster and more accessible RT-PCR diagnostics, propelling the market growth. The use of AI-based analysis and cloud-connected testing solutions helps streamline disease surveillance and early outbreak detection.

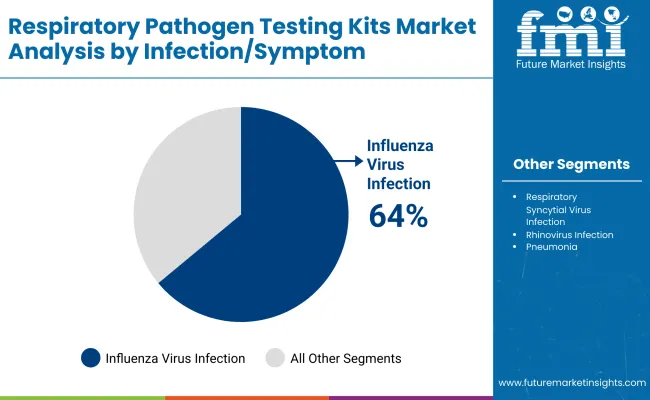

Market Share by Infection/Symptom (2025)

| Infection/Symptom | Market Share (2025) |

|---|---|

| Influenza Virus Infection | 64.0% |

With 64% of the market share, Influenza Virus Infection Testing is dominated by seasonal flu epidemics (notably, the 2009 pandemic caused by H1N1), the emergence of novel viral variants, and pandemic preparedness. Due to the high morbidity and mortality rates associated with influenza infections, especially in elderly, immunocompromised, and young children, early detection, and rapid testing, have become valuable tool for disease management29.

Intensive investment in influenza surveillance programs and enabling access to point-of-care diagnostic kits at primary healthcare facilities are some of the steps governments and healthcare partners are taking to facilitate early detection of influenza strains. The increasing adoption of combination tests, which identify influenza, RSV, and COVID-19 in a single test, is also driving market growth.

The respiratory pathogen testing kits market is experiencing significant growth due to the increasing prevalence of respiratory infections, and the growing demand for rapid diagnostic solutions and advancements in molecular testing technologies. Some of the key factors driving the market are the demand for rapid and accurate identification of respiratory pathogens, the growing use of point-of-care (POC) testing and the incorporation of multiplex testing capabilities.

High-sensitivity PCR-based assays, antigen detection kits, and at-home testing solutions: All are being developed by companies to improve accessibility, accuracy, and efficiency in SARS-CoV-2 detection. Participating stakeholders in the growth of respiratory pathogen detection in the diagnostic market cover top diagnostic manufacturers, biotechnology organizations, and healthcare organizations.

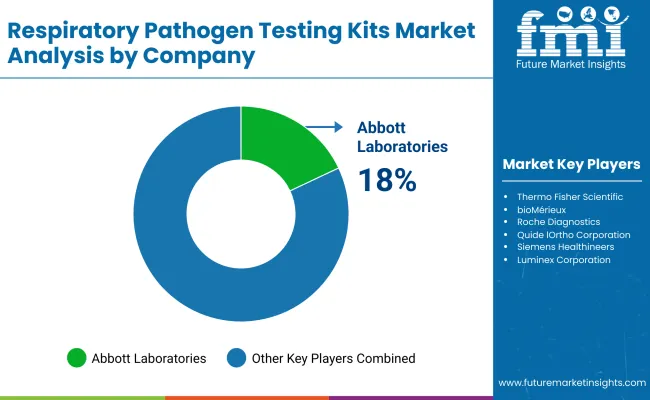

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 18-22% |

| Thermo Fisher Scientific | 14-18% |

| bioMérieux | 12-16% |

| Roche Diagnostics | 10-14% |

| Quide lOrtho Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | In 2024, they launched new fast antigen tests for flu and RSV with better sensitivity. |

| Thermo Fisher Scientific | In 2025, they rolled out high-throughput PCR testing panels to detect many respiratory pathogens. |

| bioMérieux | In 2024, they made their BioFire respiratory panel bigger to find more viral and bacterial germs. |

| Roche Diagnostics | In 2025, they created smart diagnostic methods using AI for quicker and more exact respiratory tests. |

| Quidel Ortho Corporation | In 2024, they enhanced lateral flow immunoassay tech for home COVID-19 and flu testing. |

Key Company Insights

Abbott Laboratories (18-22%)

Abbott leads the market with high-performance rapid antigen and molecular respiratory testing solutions.

Thermo Fisher Scientific (14-18%)

Thermo Fisher excels in PCR tests that can detect many respiratory problems at once.

bioMérieux (12-16%)

bioMérieux works on making their tests better to find and diagnose respiratory illnesses.

Roche Diagnostics (10-14%)

Roche uses AI to make quick and precise respiratory tests.

Quidel Ortho Corporation (6-10%)

Quidel Ortho is important for quick at-home and on-the-spot tests for breathing issues.

Other Key Players (30-40% Combined)

Several companies contribute to advancements in respiratory pathogen testing, multiplex assay development, and rapid diagnostics, including:

The overall market size for the respiratory pathogen testing kits market was USD 4,304.6 Million in 2025.

The respiratory pathogen testing kits market is expected to reach USD 7,352.9 Million in 2035.

Rising prevalence of respiratory infections, increasing demand for rapid and accurate diagnostic solutions, advancements in multiplex testing technologies, and growing adoption in point-of-care and home testing settings will drive market growth.

The USA, China, Germany, Japan, and the UK are key contributors.

The polymerase chain reaction (PCR)-based segment is expected to lead due to its high accuracy, sensitivity, and ability to detect multiple pathogens simultaneously.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Infection, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Infection, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Infection, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Infection, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Product, 2023 to 2033

Figure 38: North America Market Attractiveness by Infection, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Infection, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Infection, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Infection, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Product, 2023 to 2033

Figure 78: Europe Market Attractiveness by Infection, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Infection, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Product, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Infection, 2023 to 2033

Figure 99: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Infection, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Infection, 2023 to 2033

Figure 119: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Infection, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Product, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Infection, 2023 to 2033

Figure 139: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Infection, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Infection, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Infection, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Infection, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 157: MEA Market Attractiveness by Product, 2023 to 2033

Figure 158: MEA Market Attractiveness by Infection, 2023 to 2033

Figure 159: MEA Market Attractiveness by End User, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Pathogen Testing Market Analysis by Contaminant Type, Technology, Application, and Region through 2035

Fungal Testing Kits Market Analysis – Size, Trends & Forecast 2025 to 2035

Cortisol Testing Kits Market Size and Share Forecast Outlook 2025 to 2035

Oxytocin Testing Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Rapid RNA Testing Kits Market Trends- Growth & Forecast 2025 to 2035

Paediatric & Neonatal Testing Kits Market – Growth & Forecast 2025 to 2035

Respiratory Trainer Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Analysers Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Heaters Market Trends and Forecast 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Respiratory Inhaler Devices Market Report – Size & Forecast 2025-2035

Understanding Market Share Trends in Respiratory Inhaler Devices

Respiratory Gating Market Analysis – Size, Share & Forecast 2025-2035

Respiratory Device Market Insights – Growth & Forecast 2024-2034

Global Respiratory Biologics Market Analysis – Size, Share & Forecast 2024-2034

Pathogen Reduction Systems Market

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA