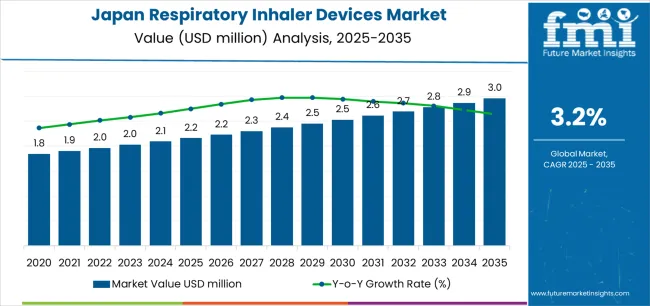

The Japan respiratory inhaler devices market is projected to reach USD 2,961.0 million by 2035, recording an absolute increase of USD 800.1 million over the forecast period. The market is valued at USD 2,160.9 million in 2025 and is set to rise at a CAGR of 3.2% during the assessment period. The overall market size is expected to grow by approximately 1.4 times during the same period, supported by an aging population with increasing prevalence of respiratory diseases, growing awareness about advanced inhaler technologies, and rising healthcare expenditure on chronic disease management across Japan. However, stringent regulatory requirements for new device approvals and high competition from established pharmaceutical companies may pose challenges to market expansion.

Between 2025 and 2030, the Japan respiratory inhaler devices market is projected to expand from USD 2,160.9 million to USD 2,610.5 million, resulting in a value increase of USD 449.6 million, which represents 56.2% of the total forecast growth for the decade. This phase of development will be shaped by rising prevalence of asthma and COPD among Japan's aging population, product innovation in smart inhaler technologies with digital health integration, as well as expanding adoption of personalized medication delivery systems. Companies are establishing competitive positions through investment in advanced inhaler technologies, patient-centric device designs, and strategic partnerships with healthcare providers and respiratory specialists.

From 2030 to 2035, the market is forecast to grow from USD 2,610.5 million to USD 2,961.0 million, adding another USD 350.5 million, which constitutes 43.8% of the overall ten-year expansion. This period is expected to be characterized by the expansion of digitally operated inhaler devices with real-time monitoring capabilities, strategic collaborations between device manufacturers and pharmaceutical companies for combination therapies, and an enhanced focus on patient adherence and treatment outcomes. The growing emphasis on connected healthcare solutions and telemedicine integration will drive demand for comprehensive smart inhaler systems across diverse respiratory disease management applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,160.9 million |

| Market Forecast Value (2035) | USD 2,961.0 million |

| Forecast CAGR (2025-2035) | 3.2% |

The Japan respiratory inhaler devices market grows by enabling healthcare providers and patients to optimize respiratory disease management while accessing advanced medication delivery technologies that ensure precise dosing and improved treatment outcomes. Healthcare facilities and patients face mounting pressure to improve medication adherence rates and reduce hospitalization costs, with advanced inhaler devices typically providing 75-85% higher adherence rates compared to traditional inhaler alternatives, making smart devices essential for effective respiratory disease management. The healthcare industry's need for real-time medication monitoring and patient-specific treatment optimization creates demand for comprehensive inhaler solutions that can provide superior accuracy, maintain consistent drug delivery, and ensure reliable operation without compromising patient convenience or treatment efficacy.

Government initiatives promoting preventive healthcare and chronic disease management drive adoption in asthma, COPD, and pulmonary arterial hypertension applications, where proper medication delivery has a direct impact on patient quality of life and healthcare system efficiency. The Japanese government's focus on reducing healthcare costs through better chronic disease management and the Super-Aging Society policies create favorable conditions for advanced inhaler device adoption. However, device complexity constraints during patient training phases and the cost considerations for advanced smart inhaler systems may limit accessibility among elderly patients and healthcare facilities in rural regions with limited digital health infrastructure.

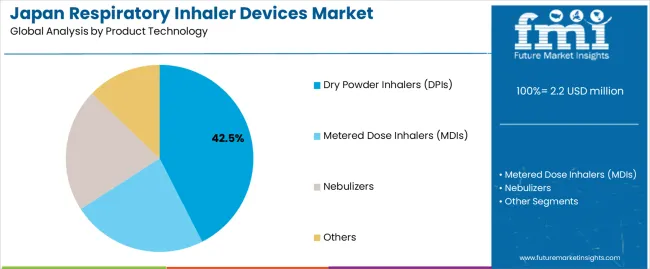

The market is segmented by product technology, disease indication, sales channel, and company. By product technology, the market is divided into dry powder inhalers (DPIs), metered dose inhalers (MDIs), nebulizers, and others. Based on disease indication, the market is categorized into asthma, chronic obstructive pulmonary disease (COPD), pulmonary arterial hypertension (PAH), and others. By sales channel, the market is segmented into institutional sales and retail sales. Key companies include GSK, AstraZeneca, Boehringer Ingelheim, Novartis Pharma, and Philips Healthcare.

The dry powder inhalers (DPIs) segment represents the dominant force in the Japan respiratory inhaler devices market, capturing approximately 42.5% of total market share in 2025. This established technology category encompasses devices featuring breath-activated delivery mechanisms and propellant-free formulations, including advanced multi-dose reservoirs and dose-counting technologies that enable superior medication delivery and patient convenience across all respiratory conditions. The DPIs segment's market leadership stems from its superior ease-of-use capabilities, with devices capable of delivering precise doses without coordination requirements while maintaining consistent drug delivery standards and operational reliability across all patient demographics.

The metered dose inhalers (MDIs) segment maintains a substantial 34.2% market share, serving patients who require pressurized medication delivery with enhanced portability features for on-the-go respiratory management. These devices offer compact medication solutions for diverse patient populations while providing sufficient dosing accuracy capabilities to meet regional treatment protocols and clinical efficacy demands. The nebulizers segment accounts for approximately 18.6% of the market, primarily serving patients with severe respiratory conditions requiring continuous medication delivery, particularly in hospital and home care settings. The other segment, including soft mist inhalers and emerging digital inhaler technologies, accounts for approximately 4.7% of the market, serving niche applications requiring specialized delivery mechanisms or connected health features.

Key technological advantages driving the DPIs segment include:

Asthma applications dominate the Japan respiratory inhaler devices market with approximately 45.8% market share in 2025, reflecting the high prevalence of asthma among Japan's population and the critical role of inhaler devices in supporting long-term asthma management and acute symptom relief nationwide. The asthma segment's market leadership is reinforced by increasing environmental pollution concerns, rising allergy prevalence trends, and growing awareness about proactive asthma management through controller medications and rescue inhalers across developed urban and suburban markets.

The chronic obstructive pulmonary disease (COPD) segment represents the second-largest disease indication category, capturing 38.4% market share through specialized treatment requirements for progressive lung disease management, maintenance therapy optimization, and exacerbation prevention applications. This segment benefits from Japan's rapidly aging population, with COPD prevalence increasing significantly among elderly demographics, creating sustained demand for long-acting bronchodilators and combination therapy inhalers that meet specific treatment protocols and disease progression management requirements in chronic care environments.

The pulmonary arterial hypertension (PAH) segment accounts for 11.2% market share, serving specialized treatment applications for rare lung conditions requiring continuous prostacyclin therapy and advanced medication delivery systems across tertiary care sectors. Other respiratory indications, including cystic fibrosis and bronchiectasis, represent 4.6% market share, encompassing specialized respiratory conditions requiring targeted medication delivery and comprehensive disease management approaches.

Key market dynamics supporting disease indication growth include:

The market is driven by three concrete demand factors tied to respiratory health outcomes. First, Japan's rapidly aging population creates increasing demand for respiratory disease management devices, with the elderly population (65+ years) expected to comprise over 35% of total population by 2035, requiring comprehensive inhaler device infrastructure. Second, government initiatives promoting preventive healthcare and chronic disease management drive increased adoption of advanced inhaler systems, with many healthcare facilities implementing digital health integration goals for medication adherence monitoring by 2030. Third, technological advancements in smart inhaler technologies and sensor-enabled devices enable more accurate medication tracking and adherence improvement solutions that reduce hospitalizations while improving patient outcomes and treatment cost-effectiveness.

Market restraints include high device costs for advanced smart inhalers that can deter adoption among price-sensitive patients and healthcare facilities, particularly in rural regions where healthcare budgets remain constrained. Patient training requirements and device complexity pose another significant challenge, as advanced inhalers demand proper technique education and ongoing usage monitoring, potentially causing increased healthcare provider burden and implementation barriers. Regulatory approval timelines and stringent quality standards across Japan create additional operational challenges for device manufacturers, demanding ongoing investment in clinical trials and compliance documentation.

Key trends indicate accelerated adoption of digitally operated inhaler devices with Bluetooth connectivity and mobile application integration, enabling real-time adherence tracking and personalized treatment adjustment. Technology integration trends toward artificial intelligence-powered dose optimization, predictive analytics for exacerbation prevention, and integrated telemedicine solutions enable proactive respiratory care approaches that reduce emergency department visits and minimize disease progression. However, the market thesis could face disruption if alternative drug delivery methods such as oral medications or long-acting injectable therapies reduce reliance on traditional inhaler-based respiratory disease management.

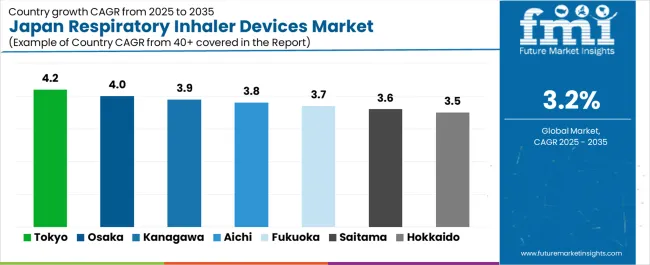

Demand concentrates where specialist clinics, aging populations, air-quality sensitivities, and pharmacy density intersect. Growth Leaders include Tokyo and Osaka through large patient pools, specialist networks, and device-switch programs. Steady Performers such as Kanagawa, Aichi, and Fukuoka benefit from balanced hospital ecosystems and active primary care. Mature yet expanding areas—Hokkaido, Saitama, Hyogo, Chiba, and Shizuoka—grow through adherence initiatives, home-care linkages, and pharmacy-led education. Across Japan, wins come from patient training, clean dose-tracking workflows, and payer-friendly value cases that lower exacerbations and cut readmissions.

| Prefecture/Metro | CAGR (2025–2035) |

|---|---|

| Tokyo | 4.2% |

| Osaka | 4.0% |

| Kanagawa | 3.9% |

| Aichi | 3.8% |

| Hokkaido | 3.5% |

| Fukuoka | 3.7% |

| Saitama | 3.6% |

| Hyogo | 3.6% |

| Chiba | 3.6% |

| Shizuoka | 3.5% |

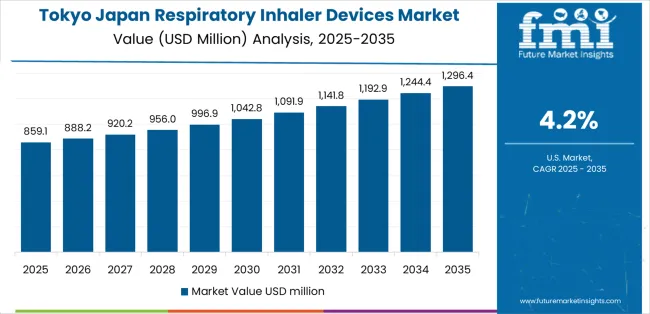

Tokyo concentrates the largest pool of respiratory patients across teaching hospitals, municipal clinics, and dense pharmacy corridors. Success starts with clinic traffic flow: brief, repeatable training that fits five-minute counseling slots and still delivers correct inhalation technique. Hospital discharge teams respond to turnkey bundles that pair controller and rescue inhalers with spacers and pictorial guides. City buyers value data that shows fewer exacerbations and shorter stays when patients switch to devices with clearer dose cues. Retail chains want shelf sets that reduce confusion between look-alike SKUs, alongside QR-driven video coaching for first use at home. The commuter rhythm shapes adherence; programs that align refills with salary days and offer late-evening pick-ups lock in persistence. Districts with higher pollen counts and PM peaks support seasonal campaigns, while pediatric flows require softer mouthpieces and parent-focused visuals. KOL-led roundtables in university hospitals unlock protocol change across affiliated clinics and encourage consistent device selection pathways.

Market Intelligence Brief:

Osaka’s metro area blends large tertiary centers with active neighborhood GPs, giving vendors a platform for coordinated step-therapy. City buyers emphasize clear pairing of controller and reliever across one visit to limit gaps that drive ER returns. Rehab centers near major hospitals welcome simple breath coaching tools and compact peak-flow meters tied to weekly tracking cards. Pharmacies around transport hubs carry high volumes; evening coaching counters and repeat-visit stamps increase persistence among shift workers. Weather swings and spring pollen create seasonal loads; pre-emptive action plans distributed through clinics keep patients stable and protect capacity. Hospital administrators look for evidence that aligned device families cut nurse training time and reduce bedside errors during admissions. Community events tied to sports and parks attract families dealing with wheeze and exercise-induced symptoms, opening doors for school outreach and athletic club briefings. Distribution reliability matters, as clinics prefer zero stock-outs when switching multiple patients in a single week.

Strategic Market Indicators:

Kanagawa, anchored by Yokohama and Kawasaki, values integrated programs that link hospital specialists with suburban clinics and high-capacity pharmacies. Buyers ask for remote check options so patients can confirm technique without long commutes; simple video prompts and checklists meet this need. Pharmacies appreciate weekend spirometry days that route flagged patients to GPs with fast appointments. Device families that maintain similar hand-feel across dose strengths reduce confusion when stepping up or down. Employers in logistics and port services see respiratory management as a way to protect attendance during pollen and dust periods, creating interest in onsite screening tables and quick counseling. Pediatric clinics favor color-coded spacers and mask sizes with clear age labels. City health offices respond to neighborhood-level dashboards that show lower ER use after device education drives. Vendor teams win trust by placing part-time educators inside busy clinics for launch months, smoothing the switch process and keeping callbacks low.

Market Intelligence Brief:

Aichi’s core in Nagoya mixes industrial employers, commuter clinics, and teaching hospitals. Workplace screening agreements open new diagnosis funnels, especially for staff with exposure to particulates or night shifts that disrupt routines. Clinics close to factories benefit from device lines that teach fast and record dose counts clearly, easing follow-ups during limited appointment slots. Hospital teams respond to evidence packs showing fewer oral steroid bursts when patients receive structured technique coaching and early spacer use. Pharmacies near main stations handle large refill waves; pre-bagged kits with instruction cards and reminder stickers improve speed and reduce errors at busy times. Commuter patterns challenge adherence, so SMS nudges synced to paydays and shift calendars hold persistence. Pediatric demand tracks school nurse referrals; kits that include parent checklists and simple pictograms help at home. City administrators prefer vendor partners who support cross-clinic audits of technique errors and share anonymized trends that guide training plans.

Strategic Market Considerations:

Hokkaido’s climate shapes respiratory care with long cold periods, indoor heating cycles, and winter travel interruptions. Patients face flare risks during cold snaps and indoor dryness, so clinics value clear action plans, humidification tips, and sealed device cases that protect mouthpieces in bags. Regional hospitals coordinate with home-care teams that cover wide areas; devices with simple dose counters and printed technique steps keep instructions reliable when visits are infrequent. Pharmacies in Sapporo and Asahikawa run seasonal coaching booths to prepare for winter peaks. Rural legs require dependable resupply; wholesalers that pre-position stock near secondary towns gain favor. Tourist flows through ski areas introduce short-stay users who need quick counseling and clear rental or purchase options for spacers. Pediatric clinics prefer mask options that seal well in cold, where runny noses complicate fit. Training videos cached offline help during connectivity gaps, keeping post-dispense support consistent across the island.

Market Intelligence Brief:

Fukuoka and Kitakyushu operate as twin hubs that connect Kyushu’s wider clinic network to tertiary hospitals. City teams welcome vendor educators who rotate through outpatient blocks to standardize technique teaching and device choice across departments. Discharge coordinators seek simple controller-plus-rescue starter sets that prevent gaps after short stays. Pharmacies near subway lines run high volumes; labeling that groups devices by use scenario—daily control, as-needed relief—reduces mistakes. Tourist movements and student populations add churn, so clear transfer notes and refill handovers between pharmacies protect continuity. Pulmonary rehab centers prefer compact aids such as breathing trainers and laminated instruction cards that survive repeated cleaning. Outreach to school nurses and sports clubs mitigates exercise-related symptoms among teens. Data briefs that link adherence to fewer clinic returns persuade budget holders to back training hours. Fast replacement of defective units and steady spacer availability keep confidence high during citywide switchovers.

Market Intelligence Brief:

Saitama’s commuter profile rewards pharmacy-led coaching during early mornings and late evenings. Chains near major stations pilot “two-minute technique checks” where staff watch a single inhalation and correct posture, seal, and breath timing. Clinics prefer device families that limit retraining when stepping therapies. Pediatric flows benefit from stickers and simple gamified cards that track daily use for four weeks. City administrators look for population-level gains across suburbs; dashboards that show adherence hot spots help target nurse visits and school programs. Logistics for refills are critical during storms and heatwaves; carriers with next-day delivery to small clinics score well. Patients prize refill alerts sent at commuting times, with pharmacy pickup windows synced to train schedules. Cross-border coordination with Tokyo practices helps residents who work in the city but live in Saitama, so shared counseling templates and QR videos maintain uniform instruction.

Strategic Market Considerations:

Hyogo centers on Kobe’s tertiary hospitals, coastal suburbs, and inland towns. Port-area employers present screening opportunities for adults exposed to dust or diesel. Hospital departments want aligned device families to streamline nurse education and cut bedside confusion; vendors who stock training dummies and loaner kits accelerate rollouts. Pharmacies along commuter lines handle steady refills, so clear device grouping and spacer availability are essential. City clinics value simple adherence trackers that staff can review during short visits. Pediatric sites near parks and schools welcome color-coded masks and mouthpieces. Coordination across facilities matters because patients often move between private clinics and larger hospitals; uniform counseling cards reduce mixed messages. Outreach to elder centers covers spacer cleaning and storage to avoid mold issues. Logistics teams that hit promised delivery windows earn preference during broad switches that convert hundreds of patients within a month.

Strategic Market Considerations:

Chiba’s mix of airport corridors, coastal towns, and bedroom communities creates diverse demand pockets. Clinics near Narita see transient flows and need fast counseling scripts with multilingual leaflets for travelers and seasonal workers. Coastal humidity can aggravate symptoms, so pharmacies promote moisture-aware storage tips and anti-rust mouthpiece caps. Bedroom communities respond to weekend coaching events at large retail sites that combine spirometry checks with pharmacist demonstrations. Pediatric clinics look for compact spacers that fit school bags without leaks. City health offices appreciate vendor-provided reports that show improved control after community events, supporting repeat permits for pop-up booths. Device families with consistent grip and actuation help reduce first-use errors among occasional travelers. Delivery predictability matters during holiday peaks along the airport axis; wholesalers with extra vans win orders by preventing stock-outs when flights surge.

Strategic Market Considerations:

Shizuoka stretches along coastal cities and factory towns at the base of transport corridors. Clinics serve a mix of older residents, shift workers, and outdoor-active families near mountain and sea areas. Programs that combine brief training with clear rescue-plan cards reduce ER visits during allergy seasons. Employers value mobile screening vans that visit plants on rotating schedules, sending identified patients to nearby GPs with preset slots. Pharmacies like pre-assembled controller kits with calendars and sticker charts to build first-month habits. Coastal air and pollen shifts demand simple indoor air tips and spacer cleaning routines. Commuters need late pickup options at station-area outlets to keep refills on time. Device assortments that limit look-alike packaging cut errors at busy counters. Hospital teams respond to evidence summaries connecting adherence to fewer oral steroid courses, while administrators prefer single-brand conversions when training windows are short.

Strategic Market Considerations:

The Japan respiratory inhaler devices market features approximately 15-20 meaningful players with moderate to high concentration, where the top three companies control roughly 52-58% of market share through established pharmaceutical portfolios, extensive healthcare provider relationships, and comprehensive patient support programs. Competition centers on device innovation, medication efficacy, and patient adherence features rather than price competition alone.

Market leaders include GSK, AstraZeneca, and Boehringer Ingelheim, which maintain competitive advantages through comprehensive respiratory drug portfolios, advanced inhaler device technologies, and deep expertise in asthma and COPD management sectors, creating high switching costs for patients and healthcare providers. These companies leverage established prescriber relationships, ongoing clinical research programs, and extensive patient education initiatives to defend market positions while expanding into digital health integration and connected inhaler device applications.

Challengers encompass Novartis Pharma and Philips Healthcare, which compete through specialized inhaler solutions and strong market presence in specific disease indications or device categories. Technology specialists, including Teva Pharmaceutical Industries, Chiesi Farmaceutici, and Vectura Group, focus on specific device technologies or drug formulations, offering differentiated capabilities in generic inhalers, breath-activated devices, and novel drug-device combination products.

Regional players and emerging smart inhaler providers create competitive pressure through innovative digital health solutions and patient-centric device designs, particularly in the growing smart inhaler segment where connectivity features and adherence monitoring capabilities provide advantages in value-based care models. Market dynamics favor companies that combine advanced medication formulations with user-friendly device designs and comprehensive patient support services that address the complete respiratory care journey from initial prescription through long-term disease management and adherence optimization.

Japan respiratory inhaler devices represent a critical therapeutic technology that enables patients, healthcare providers, and caregivers to optimize respiratory disease management and improve quality of life without substantial medication complexity requirements, typically providing 75-85% higher adherence rates compared to oral medication alternatives. With the market projected to grow from USD 2,160.9 million in 2025 to USD 2,961.0 million by 2035 at a 3.2% CAGR, these devices offer compelling advantages - superior medication delivery, enhanced patient convenience, and improved treatment outcomes - making them essential for asthma management (45.8% market share), COPD treatment (38.4% share), and diverse respiratory applications seeking reliable medication delivery solutions. Scaling market penetration and device innovation requires coordinated action across healthcare policy, clinical guidelines, device manufacturers, pharmaceutical companies, and patient advocacy organizations.

| Item | Value |

|---|---|

| Quantitative Units | USD 2,160.9 million |

| Product Technology | Dry Powder Inhalers (DPIs), Metered Dose Inhalers (MDIs), Nebulizers, Others |

| Device Operation | Manually Operated Inhaler Devices, Digitally Operated Inhaler Devices |

| Disease Indication | Asthma, Chronic Obstructive Pulmonary Disease (COPD), Pulmonary Arterial Hypertension (PAH), Others |

| Sales Channel | Institutional Sales, Retail Sales |

| Key Companies Profiled | GSK, AstraZeneca, Boehringer Ingelheim, Novartis Pharma, Philips Healthcare, Teva Pharmaceutical Industries, Chiesi Farmaceutici, Cipla Inc., Vectura Group, 3M Healthcare |

| Additional Attributes | Dollar sales by product technology and disease indication categories, regional adoption trends across Japanese prefectures, competitive landscape with pharmaceutical companies and device manufacturers, healthcare facility requirements and patient education programs, integration with digital health platforms and telemedicine solutions, innovations in smart inhaler technology and adherence monitoring systems, and development of personalized medication delivery with treatment optimization capabilities. |

The global japan respiratory inhaler devices market is estimated to be valued at USD 2.2 million in 2025.

The market size for the japan respiratory inhaler devices market is projected to reach USD 3.0 million by 2035.

The japan respiratory inhaler devices market is expected to grow at a 3.2% CAGR between 2025 and 2035.

The key product types in japan respiratory inhaler devices market are dry powder inhalers (dpis), metered dose inhalers (mdis), nebulizers and others.

In terms of disease indication, asthma segment to command 45.8% share in the japan respiratory inhaler devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Respiratory Inhaler Devices Market Report – Size & Forecast 2025-2035

Understanding Market Share Trends in Respiratory Inhaler Devices

Germany Respiratory Inhaler Devices Market Insights – Demand, Trends & Outlook 2025-2035

South Korea Respiratory Inhaler Devices Market Insights – Trends, Demand & Growth 2025 to 2035

United States Respiratory Inhaler Devices Market Report – Trends, Demand & Outlook 2025 to 2035

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

Respiratory Measurement Devices Market Size and Share Forecast Outlook 2025 to 2035

Therapeutic Respiratory Devices Market Overview - Trends & Forecast 2025 to 2035

Demand for Homecare Medical Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Blood Collection Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cardiovascular Repair & Reconstruction Devices in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Trainer Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Respiratory Distress Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA