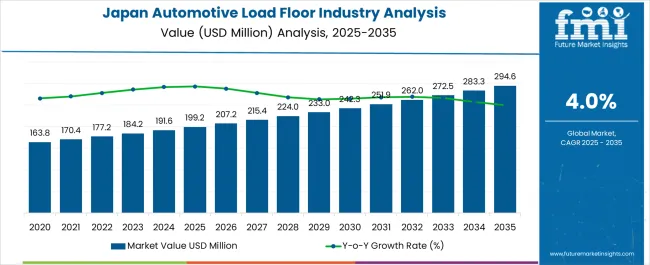

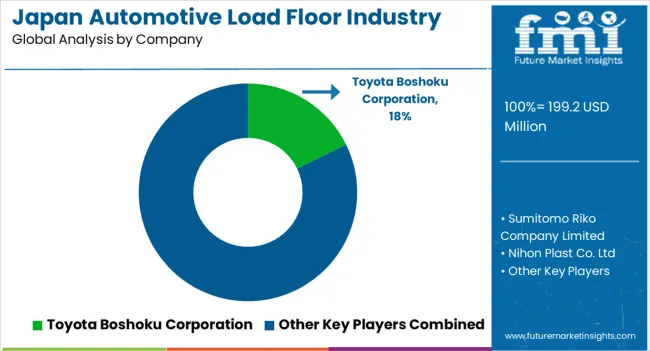

The Japan Automotive Load Floor Industry Analysis is estimated to be valued at USD 199.2 million in 2025 and is projected to reach USD 294.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Japan Automotive Load Floor Industry Analysis Estimated Value in (2025 E) | USD 199.2 million |

| Japan Automotive Load Floor Industry Analysis Forecast Value in (2035 F) | USD 294.6 million |

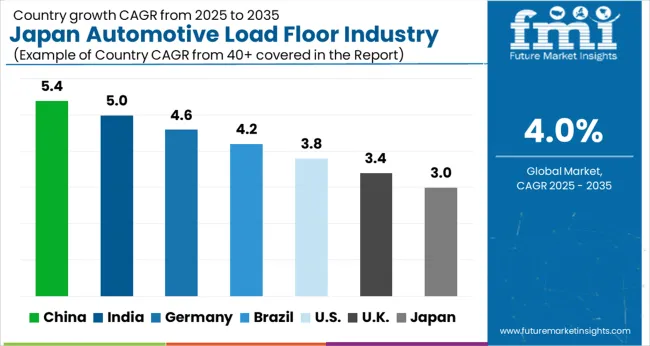

| Forecast CAGR (2025 to 2035) | 4.0% |

The Japan automotive load floor industry is experiencing steady growth. Demand is being driven by increasing production of passenger vehicles, rising consumer preference for lightweight and durable components, and the adoption of advanced manufacturing technologies. Current market dynamics reflect a focus on safety, comfort, and functional design, alongside regulatory pressures on vehicle weight reduction and fuel efficiency.

The future outlook is characterized by continued investments in material innovation, integration of composite solutions, and expansion of interior modular systems. Growth rationale is supported by the need for high-strength, lightweight materials that enhance vehicle performance, reduce environmental impact, and meet stringent industry standards. Technological advancements in manufacturing processes and material engineering are facilitating efficiency and design flexibility.

Strategic collaborations between OEMs and material suppliers are enabling optimized supply chains Collectively, these factors are expected to drive sustained adoption, improved component functionality, and consistent market expansion across Japan’s automotive segment.

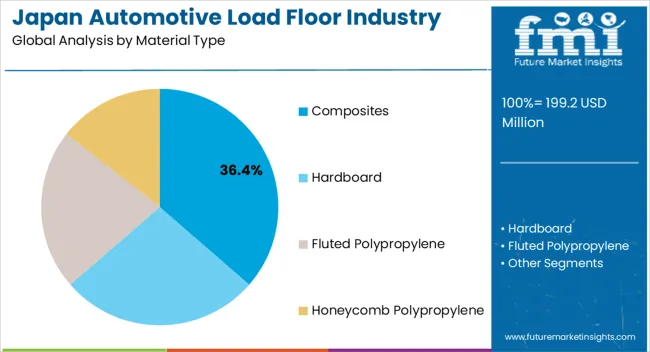

The composites segment, holding 36.40% of the material type category, has maintained leadership due to its high strength-to-weight ratio, durability, and compatibility with modern vehicle design requirements. Adoption has been facilitated by advancements in manufacturing processes, including molding and curing technologies, which have improved production efficiency and reduced material waste.

The segment’s share has been supported by increasing integration into interior systems and modular vehicle architectures. Performance reliability, regulatory compliance, and resistance to environmental stressors have further reinforced market preference.

Strategic partnerships with OEMs and continuous innovation in composite formulations are expanding applicability across vehicle segments The composites segment is expected to sustain its market share as manufacturers increasingly prioritize lightweight, high-performance materials that contribute to fuel efficiency and overall vehicle safety.

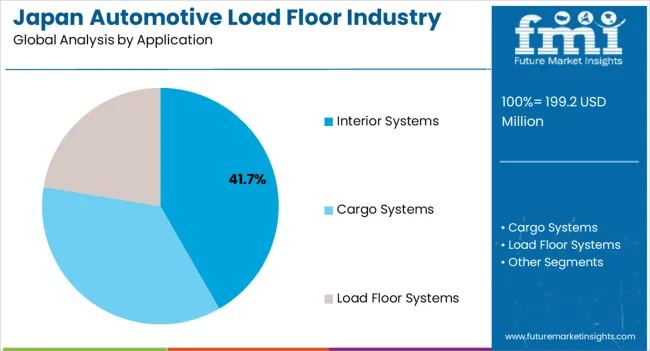

The interior systems segment, representing 41.70% of the application category, has led the market owing to its direct impact on passenger comfort, functional utility, and aesthetic appeal. Adoption has been driven by growing demand for ergonomic and customizable interior solutions, while integration with advanced materials, such as composites, has enhanced performance and durability.

The segment has benefitted from regulatory standards emphasizing safety and environmental sustainability. Consumer expectations for high-quality, lightweight interiors have reinforced preference, and ongoing innovations in modular design and assembly processes are improving production efficiency.

Continued investment in research and development and collaboration with material suppliers are expected to sustain segment growth, ensuring that interior systems remain a primary focus within the Japan automotive load floor market.

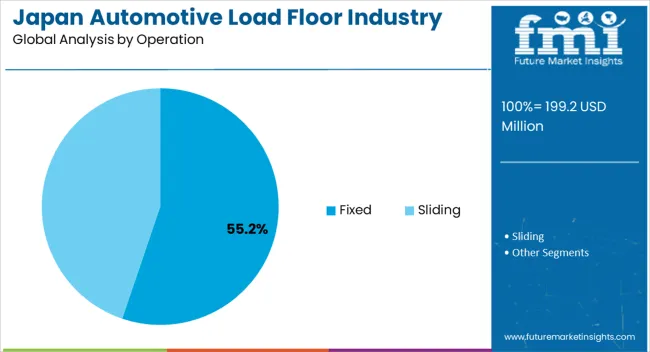

The fixed operation segment, holding 55.20% of the operation category, has emerged as the leading configuration due to its structural stability, ease of integration, and alignment with standard vehicle assembly processes. Adoption has been reinforced by the need for durable and secure load floors that meet passenger safety and cargo management requirements.

Manufacturing efficiency, cost-effectiveness, and compatibility with various interior layouts have further strengthened market preference. The segment has benefitted from regulatory compliance and standardization within automotive production lines.

Technological improvements in fastening and support mechanisms, combined with material innovations, are expected to sustain its market share Fixed load floor configurations are anticipated to remain predominant, supported by continued demand for reliable, durable, and high-performance automotive interior solutions.

Automotive manufacturers in this region often integrate advanced technology into load floors, such as intelligent storage solutions, sensors, and connectivity options, catering to tech-savvy consumers. The high volume of e-commerce and delivery services in Kanto drives the industry demand.

Load floors in vans and smaller vehicles are optimized to handle various cargo types, catering to the growing demand for efficient last-mile delivery solutions. With increased environmental consciousness in Kanto, the demand for eco-friendly materials load floor has expanded.

The prominence of automotive production in Chubu contributes to the growth of various automotive components, including load floors. Chubu hosts several major automotive companies and manufacturing facilities. This region is pivotal in developing and producing automobiles, including designing and implementing innovative load floors.

The demand for load floors with adaptability and customization options, such as configurable layouts, adjustable cargo spaces, and modular designs, has increased in the region owing to the demand for compact vehicles. The rise of e-commerce and the growing demand for efficient delivery services drive the demand for the automotive load floor in Chubu.

Based on the material, the automotive load floor in Japan is likely to be dominated by the composites segment, with a share of 31.9%. Despite being lightweight, composite materials can be solid and durable. This strength allows load floors to support heavy cargo without compromising structural integrity. Lightweight load floor contributes to improved fuel efficiency and overall vehicle performance.

Composite materials offer a high degree of design flexibility. Manufacturers can mold and shape composite materials to fit specific load floor designs, allowing for innovative and space-efficient solutions in vehicles with limited cargo space.

The demand for composite materials in automotive load floors aligns with the industry's pursuit of lightweight, durable, and versatile solutions that optimize space while meeting stringent performance and safety standards.

| Attribute | Details |

|---|---|

| Material | Composites |

| Value Share | 31.9% |

Based on operations, the automotive load floor in Japan is likely to be dominated by the fixed segment, with a share of 79.1%. Fixed-load floors are often designed to withstand repeated use and heavy loads, contributing to their durability and longevity. This reduces maintenance requirements and enhances the overall lifespan of the vehicle's cargo area.

Manufacturers can incorporate foldable or adjustable sections within the fixed load floor, providing a balance between stability and adaptability. Fixed load floors offer increased safety by minimizing the risk of cargo movement or shifting, reducing the potential for accidents or damage to the vehicle or its occupants. This is particularly important for ensuring passenger safety during sudden stops or maneuvers.

| Attribute | Details |

|---|---|

| Operations | Fixed |

| Value Share | 79.1% |

Acquisitions and mergers are the default expansion strategies of players operating on the automotive load floor in Japan. Key manufacturers of automotive load floors in Japan focus on facility expansions, product innovations, and promotional activities to increase sales and gain a competitive edge.

Key Developments in the Automotive Load Floor Landscape in Japan

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 199.2 million |

| Projected Industry Size in 2035 | USD 294.6 million |

| Anticipated CAGR between 2025 to 2035 | 4.0% CAGR |

| Historical Analysis of Automotive Load Floor in Japan | 2020 to 2025 |

| Forecast for Deployment of Automotive Load Floor in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Deployment of Automotive Load Floor in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Local Providers in Japan. |

| Key Region Analyzed While Studying Opportunities in the Automotive Load Floor in Japan | Kanto Region, Chubu Region, Kinki (Kansai), Kyushu and Okinawa, Tohoku |

| Key Companies Profiled | Toyota Boshoku Corporation; Sumitomo Riko Company Limited; Nihon Plast Co., Ltd; Mitsubishi Electric Corporation; Denso Corporation; Gemini Group, Inc.; SA Automotive; UFP Technologies, Inc.; Huntsman International LLC; Grudem; Conform Automotive |

The global Japan automotive load floor industry analysis is estimated to be valued at USD 199.2 million in 2025.

The market size for the Japan automotive load floor industry analysis is projected to reach USD 295.3 million by 2035.

The Japan automotive load floor industry analysis is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in Japan automotive load floor industry analysis are composites, hardboard, fluted polypropylene and honeycomb polypropylene.

In terms of application, interior systems segment to command 41.7% share in the Japan automotive load floor industry analysis in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Japan Conference Room Solution Market Growth - Trends & Forecast 2025 to 2035

Japan Communications Platform as a Service Market Growth - Trends & Forecast 2025 to 2035

Japan Visitor Management System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA