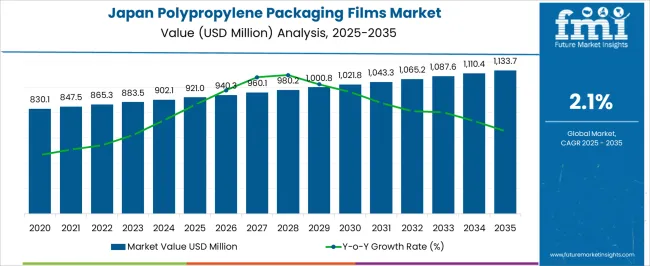

The Japan Polypropylene Packaging Films Market is estimated to be valued at USD 921.0 million in 2025 and is projected to reach USD 1133.7 million by 2035, registering a compound annual growth rate (CAGR) of 2.1% over the forecast period.

| Metric | Value |

|---|---|

| Japan Polypropylene Packaging Films Market Estimated Value in (2025 E) | USD 921.0 million |

| Japan Polypropylene Packaging Films Market Forecast Value in (2035 F) | USD 1133.7 million |

| Forecast CAGR (2025 to 2035) | 2.1% |

The Japan polypropylene packaging films market is expanding steadily owing to rising demand for lightweight, durable, and cost efficient packaging solutions across diverse industries. Increasing consumer preference for sustainable and recyclable materials has supported the adoption of polypropylene films in food, beverages, and personal care packaging.

The ability of these films to provide superior moisture resistance, extended shelf life, and excellent printability is driving greater utilization by brand owners and retailers. Technological advancements in biaxial orientation and film coating have enhanced barrier properties, making them suitable for high performance applications.

Regulatory emphasis on reducing single use plastics and the growing focus on circular economy practices in Japan are also reinforcing the demand. The market outlook remains favorable as manufacturers continue to invest in thinner, more versatile films that align with sustainability goals while meeting consumer and regulatory expectations.

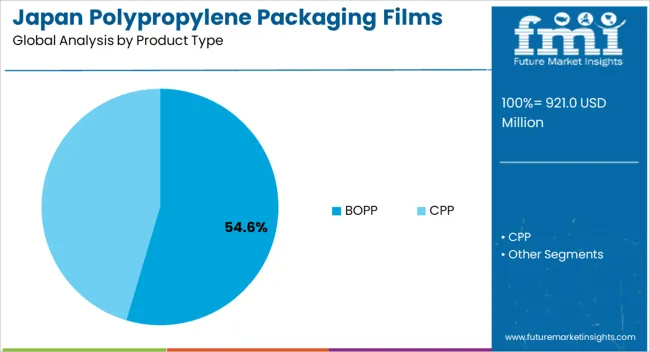

The BOPP product type segment is projected to contribute 54.60% of total revenue by 2025 within the product category, establishing it as the dominant segment. Its leadership is supported by superior clarity, tensile strength, and barrier properties that are valued in packaging applications across food and consumer goods.

BOPP films also offer cost effectiveness in production and flexibility in converting processes such as printing and lamination. With the ability to provide extended shelf life and enhanced visual appeal, BOPP films have become a preferred choice for manufacturers and retailers.

Continued innovations in coating technologies and recyclability enhancements are further reinforcing their strong market position.

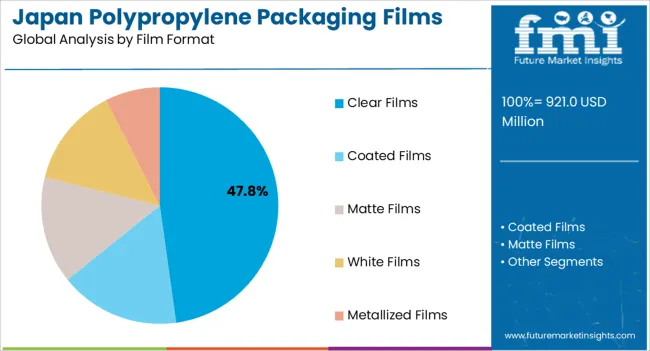

The clear films format segment is anticipated to hold 47.80% of total revenue by 2025, positioning it as the leading segment within film format. This dominance is attributed to increasing consumer demand for transparent packaging that allows visibility of the product, thereby enhancing trust and purchasing decisions.

Clear films offer an advantage in retail environments by enabling shelf appeal and brand differentiation. Their compatibility with high quality printing and labelling has further strengthened their adoption in food, beverages, and personal care.

The balance of aesthetic appeal and functional protection provided by clear films has made them integral to packaging strategies, ensuring their continued leadership.

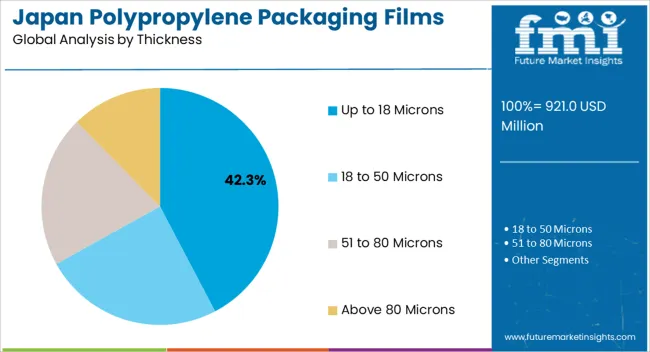

The up to 18 microns thickness segment is expected to account for 42.30% of the total market revenue by 2025, making it the most prominent thickness range. Its popularity is due to the combination of lightweight design, material efficiency, and cost effectiveness.

Films within this range offer sufficient strength and protection for a wide array of packaging applications while minimizing material usage and waste. This aligns with Japan’s emphasis on sustainability and resource efficiency.

Additionally, thinner films enable lower shipping costs and reduced environmental impact without compromising barrier properties. These factors have positioned the up to 18 microns segment as the preferred choice across packaging applications.

Japan polypropylene packaging films market expanded at a CAGR of 1.6% during the historic period. Total market value in Japan increased from USD 830.1 million in 2020 to USD 921 million by 2025. Overall sales of polypropylene packaging films in Japan are set to rise at 2.1% CAGR through 2035.

Growth in the market is driven by increasing adoption of flexible packaging films in various industries. Similarly, rising awareness about the benefits of PP packaging films over other plastic food packaging films will boost sales.

The growing markets of food & beverage, electronics, and cosmetics & personal care in Japan are significantly impacting polypropylene packaging film demand.

Japan is the second leading producer of plastic waste per capita, as per the Heinrich-Böll-Stiftung (HBS). It is a high-income country where nearly every product in supermarkets is wrapped in plastic packaging.

Japan has been consuming a vast amount of plastic in the packaging industry. This has developed the need for sustainable and recyclable packaging films in Japan. Due to the ban on plastic import by China, Japan has been increasing its local recycling facilities to cater to the plastic recycling demand.

BOPP packaging films are sustainable and recyclable which will push the application of these films in Japan. Growth in recycling of the plastic waste in Japan will also create opportunities for manufacturers.

The government of Japan has established a new plastic circulation strategy that aims to recycle 60% of plastic packaging and reduce single-use plastic by one-fourth by 2035. This factor might slow down market development and reduce the demand for single-use shopping bags, sacks, pouches, and sachets made of polypropylene films.

Implementation of these regulations will eliminate the usage of single-use plastic. This situation will generate demand for recyclable and sustainable polypropylene films.

Increasing Packaged Food Sales in Japan Boosting the Polypropylene Packaging Films Industry

Growth in retail industry in the last five years has been driving the polypropylene packaging films market. The food & beverage industry is consuming a large amount of polypropylene packaging films due to its protective and high barrier properties in packaged food.

According to the Food Export Association, packaged food market in Japan gained retail sales of USD 921 billion in 2025 which represents an increase of 10.5% from 2020. Total retail sales of food & beverages in Japan totaled USD 902.1 billion in 2024.

Beef, meat, and pork are among the leading consumed foods in Japan. These food products consume the most amount of packaging film to ensure the safety and quality of the products.

Rising inclination towards packaged food products will play a key role in bolstering polypropylene packaging film sales across Japan.

Multi-faceted Attributes of BOPP Films to Bolster Polypropylene Packaging Film Sales

BOPP (biaxially oriented polypropylene) films are manufactured by stretching polypropylene films in the transverse and machine direction. These films are used in multiple applications such as lamination, packaging, and labeling.

BOPP films are a highly preferred substrate in food packaging owing to their inherent properties. This includes moisture resistance, shelf appeal, high clarity, seal ability, and graphic presentation.

These films provide an exceptional moisture barrier, and their metalized variant provides a finer oxygen barrier to products. These properties of BOPP films recreate an important function in food packaging for extending the product shelf life and reducing food waste.

BOPP films provide constant and superior sealing properties because of their little gauge spread. Lower seal initiation temperature, exemplary heat seal strength, broad sealing window, good machinability, and broad sealing window further benefit the food packaging industry by guarding food quality.

BOPP films are commonly used in flexible packaging because of their density. The low density offered by these films increases the yield during conversion and consumes less plastic per product.

Considering the above-mentioned features and versatility of BOPP films, demand for polypropylene packaging films will rise significantly.

Aesthetic Appeal Provided by Polypropylene Packaging Films to Boost Sales in Japan

Customers’ inclination towards eye-catchy and glossy presentation enhances any product's demand. Exceptional transparency in clear polypropylene films provides a high grade of aesthetic captivation to product packaging.

Polypropylene packaging films have a high gloss and excellent clarity, which provide excellent aesthetic appeal. Their controlled slope properties also make them appropriate to function well on different form-fill-seal (FFS), converting, and overwrapping machines to enhance or uphold high productivity.

Product printing and packaging enhance the product's sales appeal on the shelf due to good optical properties and printability. Halftone printing jobs along with multi-color printing can be carried out with ease on these films for high-quality graphical representation.

The white opaque film variant, high opacity, superb gloss, and excellent whiteness provide an appealing look to product packaging. Metalized films give a premium metallic appearance to the product to make it stand out.

Post-lamination operations such as UV spot coating, foil stamping, and embossing can be carried out because of good surface tension of these films. This will enhance the appearance of the product and provide brand recognition and differentiation. All these factors will boost the sales of polypropylene packaging films.

Attractive Features of CPP Fueling its Adoption Across Japan

Based on product type, Japan market is segmented into BOPP and CPP. Among these, BOPP segment holds a prominent share of the market while CPP segment will witness higher growth. This is due to various benefits offered by CPP films.

CPP packaging films are getting popular among various industries due to their high tear resistance and impact resistance. Cast polypropylene packaging films provide better heat-sealing properties and cold-temperature performance. This makes them ideal for food packaging.

Thanks to their higher clarity and gloss as well as better heat resistance, CPP films are replacing polyethylene in various traditional flexible packaging applications. These clear polypropylene films offer high performance and great appearance.

The CPP segment is set to register a CAGR of 2.7% between 2025 and 2035. The target segment will create an incremental opportunity of USD 1133.7 million through 2035.

Metalized and Coated Films to Gain Wider Popularity Across Japan Through 2035

As per Future Market Insights, demand for metalized polypropylene films and coated polypropylene films will rise at a steady pace. This is due to their rising popularity across Japan.

Metalized films provide a silver appearance and attractive aesthetics along with enhanced barrier properties. This makes it suitable for enhancing the packaging appearance and improving the shelf life of the product.

Metalized film segment is likely to progress at a CAGR of 2.8% from 2025 to 2035. It will create an incremental opportunity of USD 60.0 million during the forecast period.

On the other hand, coated films are set to create incremental growth of 1.3 times the current market value. The target segment will record a CAGR of 2.6% between 2025 to 2035.

Coated films have become ideal for high barrier packaging. This is due to their high aroma barrier, oxygen barrier, excellent print reception, and broad sealing range. These films ensure the safety of the product and maintain the quality of packaged products.

Metalized and coated polypropylene films together will generate lucrative revenue throughout the forecast period.

Adoption of Polypropylene Packaging Films Remain High in Food & Beverage Industry

The food & beverage industry is creating lucrative growth opportunities for Japan's polypropylene packaging films market. This is due to rising usage of these films for packaging a wide range of food products.

Thanks to their excellent barrier properties, polypropylene films have become ideal food packaging solutions. They protect food items from external factors and extend their shelf life. They have gained wider popularity in Japan food packaging.

The growth in packaged food consumption has generated a demand for protective and reliable packaging films such as PP films. Rising demand for packaged food products across Japan will continue to boost polypropylene film sales.

Similarly, growth of retail and e-commerce market in Japan along with high demand for PP shrink films will elevate polypropylene packaging film demand. The food & beverage segment is set to generate a market value of USD 472.9 million in 2035. It will create an incremental opportunity of USD 65.1 million during the forecast period.

The Electrical & electronics industry will also remain a key consumer of PP packaging films. It is likely to register a CAGR of 4.2% during the next decade owing to the technological developments and introduction of the latest products.

Rising demand for electronics and electrical equipment in Japan will propel the demand for polypropylene packaging films.

Leading polypropylene packaging film manufacturers in Japan are focusing on developing new products. They are also using tactics such as price reduction, mergers, acquisitions, partnerships, and collaborations to strengthen their positions.

For instance:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 921.0 million |

| Projected Market Value (2035) | USD 1133.7 million |

| Anticipated Growth Rate (2025 to 2035) | 2.1% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Tonnes and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Product Type, Film Format, Thickness, Application, End Use |

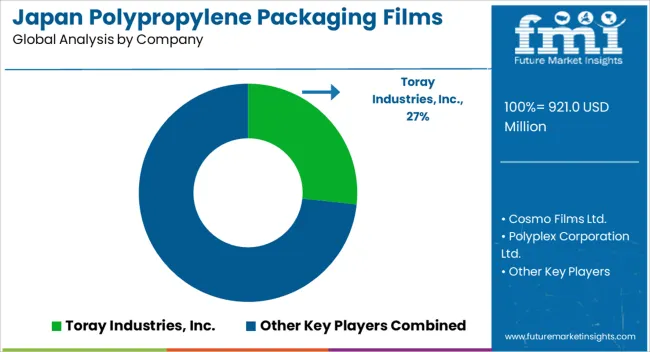

| Key Companies Profiled | Toray Industries, Inc.; Cosmo Films Ltd.; Polyplex Corporation Ltd.; Futamura Chemical Co., Ltd; Toyobo Co., Ltd.; Mitsui Chemicals Tohcello, Inc; Takigawa Corporation; Idemitsu Unitech Co., Ltd. (Idemitsu Kosan Company, Ltd.); Kisco Ltd.; Toppan, Inc.; OG Film Co. Ltd. (OG Corporation); DIC CORPORATION; GUNZE LIMITED; Innovia Films (CCL Industries Inc.); Flex Films (Uflex Limited) |

The global japan polypropylene packaging films market is estimated to be valued at USD 921.0 million in 2025.

The market size for the japan polypropylene packaging films market is projected to reach USD 1,133.7 million by 2035.

The japan polypropylene packaging films market is expected to grow at a 2.1% CAGR between 2025 and 2035.

The key product types in japan polypropylene packaging films market are BOPP and cpp.

In terms of film format, clear films segment to command 47.8% share in the japan polypropylene packaging films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA