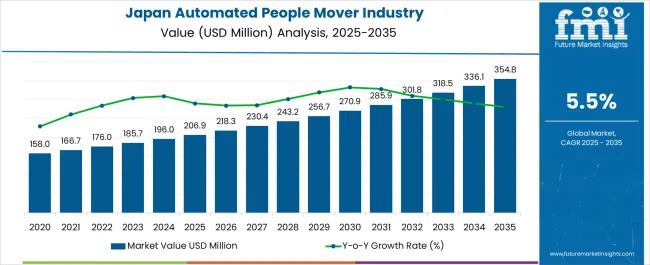

The Japan Automated People Mover Industry is estimated to be valued at USD 206.9 million in 2025 and is projected to reach USD 354.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Japan Automated People Mover Industry Estimated Value in (2025 E) | USD 206.9 million |

| Japan Automated People Mover Industry Forecast Value in (2035 F) | USD 354.8 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Japan automated people mover industry is demonstrating strong growth momentum. Rising urban density, the need for efficient mobility solutions, and government support for sustainable transport infrastructure are driving demand. Current market conditions reflect increased investment in modernizing public transit systems and integrating advanced technologies to improve operational efficiency.

Adoption of automated people movers is being supported by their ability to reduce congestion, enhance safety, and provide reliable connectivity within urban corridors and large facilities. Future growth will be influenced by expanding urban transit networks, the push toward eco-friendly transportation modes, and strategic investments in automation and digital control systems.

Long-term industry expansion is also being reinforced by alignment with Japan’s smart city initiatives, the rising focus on reducing emissions, and the demand for scalable mobility systems capable of meeting fluctuating passenger volumes These factors are collectively underpinning steady growth prospects, ensuring that automated people movers will remain a critical component of Japan’s evolving transportation ecosystem.

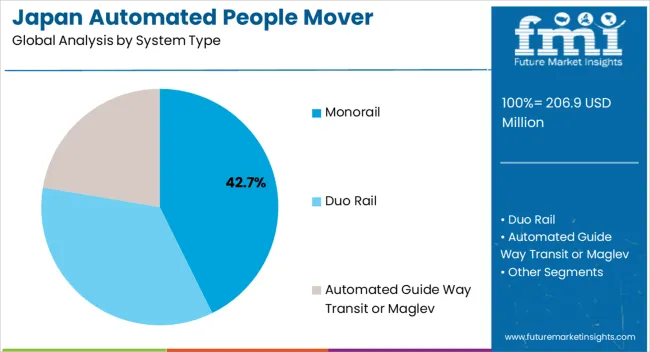

The monorail segment, holding 42.70% of the system type category, has been leading the market owing to its long-standing role in Japan’s urban mobility infrastructure. Its dominance is supported by high passenger-carrying capacity, adaptability to complex urban layouts, and efficient land-use benefits. Investment in monorail projects has been reinforced by strong government backing and long-term operational reliability.

Technological improvements in automation, control systems, and energy efficiency have further strengthened its competitiveness. Passenger acceptance has remained high due to comfort, speed, and integration with other transit systems.

Market positioning is also being enhanced by ongoing upgrades and extensions to existing lines, which are improving connectivity across major cities With rising demand for low-emission and space-efficient mobility, the monorail segment is expected to maintain its leadership and contribute substantially to industry growth in the coming years.

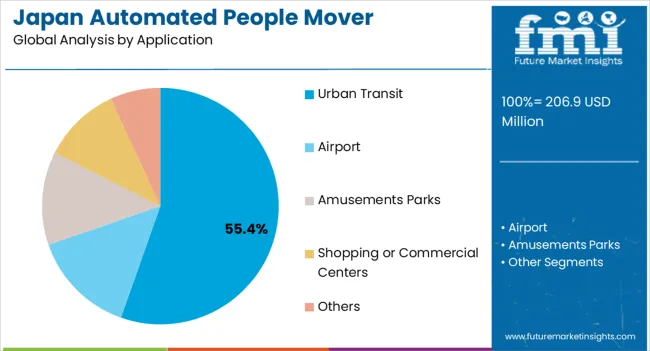

The urban transit segment, representing 55.40% of the application category, has maintained prominence due to its alignment with Japan’s rapid urbanization and the demand for efficient intra-city mobility. Automated people movers have become essential in easing congestion in densely populated areas and ensuring timely connectivity across residential, commercial, and industrial hubs.

This segment’s leadership is supported by extensive integration with railway and metro systems, which ensures seamless passenger flow across multimodal networks. Operational efficiency, reduced environmental impact, and scalability for high-traffic corridors have reinforced preference for urban transit deployment.

Continued government investment in smart city and green transport projects is expected to drive sustained growth The segment’s market share is also being supported by rising passenger expectations for reliability, safety, and reduced travel times, positioning urban transit as the cornerstone of automated people mover applications in Japan.

Tokyo, situated in the Kanto region, is among the highly populated and densely inhabited urban areas globally. As urbanization continues and population density increases, there is a greater need for efficient and convenient transportation solutions, potentially driving the demand for automated people mover.

Several important airports, including Tokyo Haneda International Airport and Narita International Airport, serve the Kanto region. Automated people mover is commonly used in airports to transport passengers between terminals and facilities. Continued airport expansion and modernization projects could contribute to the growth of automated people mover industry.

Tokyo and other cities in the Kanto region are actively involved in smart city initiatives, focusing on incorporating advanced technologies to enhance urban living. Automated people mover is likely to play a role in these initiatives by providing efficient and technology-driven transportation solutions. The Kanto region includes key business districts and commercial areas. Automated people mover can provide convenient connectivity within these districts, linking office complexes, shopping centers, and public transit hubs.

Chubu is a crucial industrial and economic hub in Japan, housing various manufacturing and technology companies. As industrial activity grows, there may be an increased demand for efficient transportation solutions within industrial complexes and business districts.

Ongoing and planned transportation infrastructure projects in the region, including airport expansions, urban development, and connectivity improvements, may drive the demand for automated people mover. The region's key airport, Chubu Centrair International Airport, could be a key focal point for APM utilization.

As urbanization and population growth occur, the need for efficient and sustainable transportation solutions within urban centers and suburban areas may increase, contributing to the demand for APM systems.

In 2025, the duo rail segment is likely to account for an industry share of 81%. Duo rail takes up less area horizontally and vertically than traditional rail systems. Duo rail vehicles are broader than the beam and are frequently elevated, requiring just a small footprint for support pillars. These factors are expected to fuel sales of duo rail systems in the forthcoming years.

| Attribute | Details |

|---|---|

| System | Duo Rail |

| Value Share in 2025 | 81% |

In 2025, the airport segment is projected to hold an industry share of 61.5%. People mover systems are used in many international airports worldwide to convey passengers between terminals or inside a terminal. Airports often have multiple terminals, each serving different airlines or flight operations. APMs provide a quick and efficient means of connecting passengers between terminals, reducing the time and effort required for transit.

| Attribute | Details |

|---|---|

| Application | Airports |

| Value Share in 2025 | 61.5% |

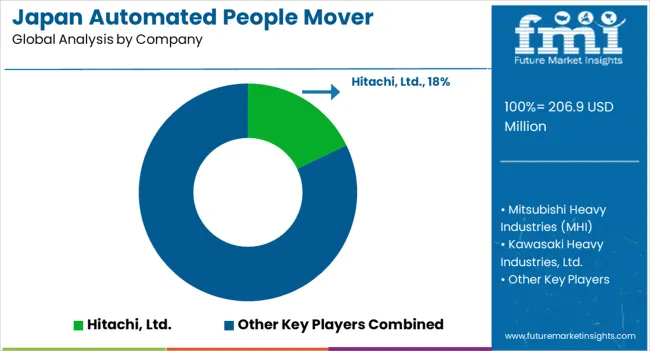

Acquisitions and mergers are the default expansion strategies for players operating in the automated people mover industry in Japan. Key manufacturers of automated people mover in Japan focus on facility expansions, product innovations, and promotional activities to increase sales and gain a competitive edge. Key players in the automated people mover ecosystem are also investing to enhance their manufacturing capabilities and geographical footprint, aiming to increase their industry share.

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 206.9 million |

| Projected Industry Size by 2035 | USD 354.8 million |

| Anticipated CAGR between 2025 to 2035 | 5.5% CAGR |

| Historical Analysis of Demand for Automated People Mover in Japan | 2020 to 2025 |

| Demand Forecast for Automated People Mover in Japan in Japan | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Automated People Mover in Japan, Insights on Global Players and their Industry Strategy in Japan, Ecosystem Analysis of Local Providers in Japan |

| Key Cities Analyzed while Studying Opportunities in Automated People Mover in Japan | Kanto, Chubu, Kinki (Kansai), Kyushu and Okinawa, Tohoku, Rest of Japan |

| Key Companies Profiled | Mitsubishi Heavy Industries (MHI); Hitachi, Ltd.; Kawasaki Heavy Industries, Ltd.; Mitsui Engineering & Shipbuilding Co., Ltd; Nippon Sharyo, Ltd; Toshiba Infrastructure Systems & Solutions Corporation |

The global Japan automated people mover industry is estimated to be valued at USD 206.9 million in 2025.

The market size for the Japan automated people mover industry is projected to reach USD 354.8 million by 2035.

The Japan automated people mover industry is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in Japan automated people mover industry are monorail, duo rail and automated guide way transit or maglev.

In terms of application, urban transit segment to command 55.4% share in the Japan automated people mover industry in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Japan Inkjet Printer Market - Industry Trends & Forecast 2025 to 2035

Japan HVDC Transmission System Market - Industry Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA