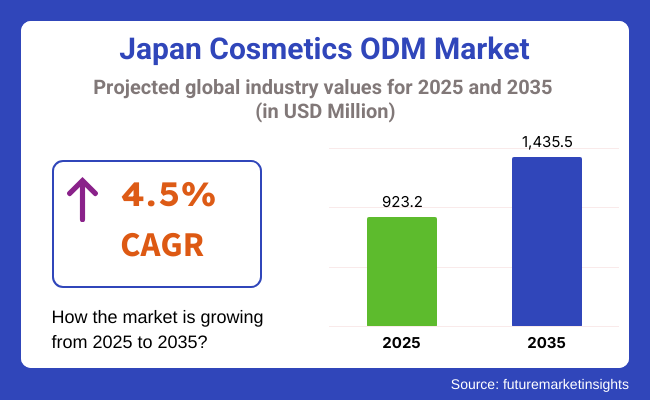

The Japan cosmetics ODM market is poised to register a valuation of USD 923.2 million in 2025. The industry is slated to grow at 4.5% CAGR from 2025 to 2035, witnessing USD 1,435.5 million by 2035. The industry growth is led by a mix of demographic transition, changing consumer behavior, and international industry forces. Japan's reputation in skincare and beauty products is one of the most significant drivers of growth.

Japanese cosmetics are heavily praised for their high level of formulation, safety, and efficacy standards. This mindset inspires both local and foreign brands to partner with Japanese ODM companies, tapping into their high-tech R&D capabilities and manufacturing skills without having to invest in infrastructure.

The global growth of indie and boutique beauty brands has spurred demand for ODM services. These smaller firms usually do not have the resources to manufacture their own products and hence seek out established Japanese ODM companies to develop high-quality cosmetics under their own brands. Japan's ODM companies stand to benefit from this trend because of their flexibility, formulation expertise, and capacity to adapt products to suit various requirements in different markets, ranging from clean beauty trends, sustainability considerations, to regional regulatory needs.

Another key driver of growth is the growing trend of J-beauty (Japanese beauty) in Asia, North America, and Europe. With the rising interest in simple skincare regimens and age-old beauty beliefs, brands are looking to pick up Japanese aesthetics and ingredients and add them to their product lines. ODM producers in Japan act as a liaison, enabling overseas businesses to create products that suit Japanese beauty ideals and cultural demand.

Japan and other industrialized nations' aging populations are fuelling demand for high-performance anti-aging skincare products, an area in which Japanese companies are leaders. Combined with advances in cosmetic science technologies-encapsulation, fermentation, and biomimetic ingredients, for instance-the industry is set to grow further.

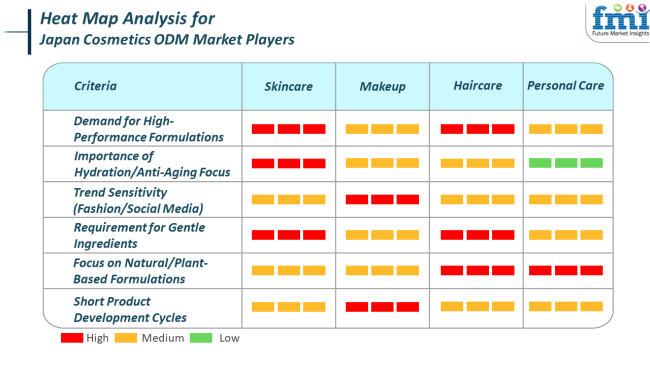

The Japan cosmetics ODM market is experiencing dynamic growth across major end-use segments-skincare, makeup, haircare, and personal care-each influenced by unique trends and consumer needs. Skincare dominates the industry, led by Japan's minimalist beauty concept and increasing worldwide interest in high-performance, science-driven formulations.

Consumers value hydration, anti-aging benefits, and gentle ingredients, leading brands to look for ODM partners with sophisticated R&D capabilities and experience in stable, multifunctional formulations. In cosmetics, fashion and social media dictate trends, with rising interest in natural finish, cross-category skincare-makeup hybrids, and new formats. ODM choice in this category relies on trend-sensitive shade response, distinct texture, and short development cycles.

Hair care and personal care categories are changing, too, with clean beauty and sustainability as key drivers. In hair care, there is increased demand for scalp-centric and plant-based formulations, prompting brands to prefer ODMs that offer safe, dermatologically tested options with no harsh chemicals. In the personal care category, eco-friendliness is the key, such as refillable packs, biodegradable ingredients, and sensorial product experiences.

In this space, ODM partners are selected based on sustainable manufacturing and packaging practices, in addition to their capacity to uphold product quality and efficacy. In all segments, brands appreciate ODMs that provide customization, regulatory compliance, and flexibility to match rapidly evolving industry trends and varied consumer tastes.

Between 2020 and 2024, the Japan cosmetics ODM business underwent tremendous change fueled by both global disruption and shifting consumer values. The COVID-19 pandemic initially changed industry momentum, as demand slowed for color cosmetics and demand shifted toward hygiene and skincare.

But during this time, digital transformation also picked up pace, with ODMs evolving to help e-commerce-driven businesses and provide nimble, small-batch production options. Consumer attention turned towards wellness, safety, and simplicity, with clean-label offerings, fewer ingredients, and multifunctional formulas driving demand. Also, Japanese ODMs invested more in R&D to capture growing worldwide interest in J-beauty philosophies, which highlight purity, performance, and age-old botanicals.

During the forecast period, the Japan cosmetics ODM market will continue steady growth, influenced by a number of trends that will shape its direction. Personalization and AI-based formulation will become increasingly popular, allowing ODMs to create more customized solutions based on customer information and skin analysis.

Sustainability will increasingly be part of the paradigm, with an emphasis on biodegradable packaging, carbon-neutral manufacturing, and refillable or reusable containers. Clean beauty will become "conscious beauty," with ethical sourcing, inclusivity, and transparency throughout the supply chain. Moreover, biotechnology and innovative materials-like fermented ingredients, plant stem cells, and encapsulation technologies-will propel product innovation.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The arrival of COVID-19 radically changed consumer priorities. Makeup demand was reduced owing to mask mandates and work-from-home policies, while skin care, hand care, and hygiene product demands increased. | With consumers becoming more intentional about skin health, beauty will continue to converge with wellness. ODMs will more and more develop products based on ingredients addressing the skin barrier, microbiome balance, and inflammation. |

| With in-store retail limited, beauty brands went digital-first. This forced ODMs to be more flexible, providing quick sampling, low MOQs, and digital collaboration tools. They accommodated the requirements of e-commerce and D2C brands, who needed quick turnaround and trend-sensitive products. | The fusion of AI and data analytics will enable ODMs to create hyper-personalized products by considering each person's individual skin types, surroundings, and tastes. Virtual consultations and smart diagnostics will become more prominent in R&D, resulting in more targeted and efficient cosmetic solutions. |

| Consumers became more ingredient-savvy, looking for clean, safe, and straightforward products. Japanese ODMs adapted by giving emphasis to short ingredient lists, staying away from detrimental additives, and increasing transparency in labeling. | Clean beauty will expand to become a larger movement called "conscious beauty," addressing not just the safety of ingredients but also the ethics of sourcing, cruelty-free testing, product inclusivity, and sustainability. |

| Pandemic-induced disruptions in global logistics caused brands to reassess their manufacturing dependencies. Japanese ODMs garnered attention for their dependability, compliance with regulations, and quality reputation. | As globalization rolls on, ODMs in Japan will further provide localized versions in response to various geographies-climate, skin colors, regulatory requirements, and cultural tendencies. This will enable international brands to expand more quickly while staying relevant in each region. |

The Japan cosmetics ODM market, though steadily growing, is not risk-free. Supply chain exposure, especially for foreign-sourced ingredients and packaging materials, is one of the main issues. Global instability, such as geopolitical tensions, shipping delays due to pandemics, or natural disasters, may impact the timely supply of raw materials.

Considering Japan's geographical susceptibility to earthquakes and typhoons, domestic manufacturing activities also risk operational disruptions. These interruptions may cause delays in production, higher costs, and a strained relationship with client brands that depend on just-in-time delivery.

A second major threat is regulatory and compliance sophistication, particularly for ODMs producing for global customers. With changing international cosmetic standards relating to clean beauty, sustainability, and ingredient safety, manufacturers need to be ahead of emerging requirements in a variety of regions.

Non-compliance can result in batch rejections, fines, or brand reputation loss. Moreover, heightened attention to product claims, labeling, and testing processes (e.g., allergen declarations, cruelty-free status) necessitates ODMs to continually invest in regulatory acumen and quality control systems.

J-beauty customers tend toward skin care and personal care formulas featuring plant ingredients, ancient botanicals from Japan (green tea, rice bran, camellia oil, for example), and actives from fermentation processes. ODMs are key in assisting brands to develop products that are natural and organic certification-compliant while keeping the high performance and safety Japanese cosmetics are known for.

With their knowledge in sourcing ingredients, clean formulation processes, and conformance to domestic and foreign regulations, they are indispensable allies to natural and organic beauty brands who want to keep purity and effectiveness in balance. Furthermore, as sustainability plays a more central role in buying decisions, ODMs are playing a bigger role in incorporating environmentally friendly packaging and ethical sourcing into product lines.

Tubes are particularly sought after for face care products like cleansers, sunscreens, and moisturizers. They are simple to dispense and suited for products where controlled application is needed. Consumers in Japan value precision and ease in their personal care routines, and tubes oblige on both counts. They are economical for ODM manufacturing, simple to customize, and readily available in biodegradable packaging, which responds to Japan's rising focus on sustainability.

Bottles-specifically airless and pump bottles-are widely applied to serums, lotions, toners, and emulsions. They are popular for the preservation of active ingredients, avoidance of oxidation, and hygienic dispensing. In the upscale skincare industry, which is very dominant in Japan, bottles also serve a more luxurious look and feel, significant for both local brands and overseas labels cooperating with Japanese ODMs.

The Japan cosmetics ODM industry is extremely competitive, with local and foreign players both contributing to its growth. Local players like Natural Laboratories Co. Ltd and Nippon Shikizai have established themselves strongly in Japan's beauty industry, capitalizing on their thorough understanding of domestic consumer trends and the constantly changing demand for high-quality, innovative cosmetic products.

These players concentrate on providing a varied portfolio of formulations, be it natural, organic, or synthetic, that have become the epitome of Japan's beauty culture. Intercos Group, being a well-known ODM player globally, however, continues to dominate the industry with its varied portfolio and advanced technologies that address the needs of the local as well as international cosmetics brands that seek to enter the Japanese industry.

Also, niche players such as BioTruly Group and Toyo Beauty Co. Ltd provide specialized solutions, riding on the increasing trend of sustainability and biotechnology in the cosmetics sector. This provides a diversified environment where established and new companies collaborate to address the needs of the ever-competitive beauty industry.

| Company Name | Estimated Market Share (%) |

|---|---|

| Natural Laboratories Co. Ltd | 7-9% |

| Nippon Shikizai | 8-10% |

| Toyo Beauty Co. Ltd | 10-12% |

| Colmar Co. Ltd | 5-7% |

| Milliona | 6-8% |

| Intercos Group | 12-14% |

| Oracle OEM | 3-5% |

| Viaderm Limited | 4-6% |

| Herrco Ltd | 2-4% |

| BioTruly Group | 7-9% |

| Others (local companies, small brands) | 15-20% |

Key Company Insights

At an estimated 7-9%

Industry share, Natural Laboratories has established itself as a player in the rising trend for natural and organic cosmetics. Natural Laboratories specializes in eco-friendly, plant-based formulations popular among health-oriented consumers seeking clean beauty products. Its emphasis on ingredient transparency and sustainability makes Natural Laboratories a popular ODM collaborator among organic beauty brands.

With anindustry share of 8-10%

Nippon Shikizai is particularly notable for its creative application of color cosmetics and specialty ingredients. Nippon Shikizai has a reputation for its technical competence in formulating for high-end as well as mass-market beauty products. With high demand for high-performance makeup within Japan, Nippon Shikizai's cutting-edge manufacturing methods have kept it ahead, especially within the beauty and personal care sectors.

Toyo Beauty Co. Ltd

The industry leader with a 10-12% share, famous for its wide range of products, such as skincare, haircare, and color cosmetics. The company has established itself as a go-to ODM for brands looking for the latest formulations and innovative packaging solutions. Their robust production capacity and commitment to quality position them as the choice partner for both domestic and international beauty brands.

A niche but significant company in the industry, Colmar enjoys a market share of 5-7%. They specialize in creating niche skincare lines, especially those addressing sensitive skin or certain dermatological requirements. Their smaller industry share is compensated by strong customer loyalty among those that value dermatological attention and highly specialized items.

Milliona's 6-8%

Industry share is indicative of its increasing presence in both skincare and cosmetic product formulation. Milliona is recognized for its capability to produce at high volumes without sacrificing quality. Focusing on skin-health-driven beauty solutions, Milliona's products are most attractive to consumers looking for performance as well as luxury.

Holding a market-leading position of 12-14%

Intercos Group is a market leader in the global cosmetics ODM industry, especially in Japan. It is best at delivering cutting-edge cosmetic formulations and packaging technologies that meet high-demanding categories such as skincare and color cosmetics. Its extensive collaboration with international beauty brands has made it one of the most powerful players in the industry.

Oracle OEM maintains a 3-5%

Industry share and offers ODM services focused on product development for mid-segment beauty companies. Oracle OEM is recognized for offering affordable solutions with quick turnaround times, thus becoming a feasible partner for emerging brands looking to launch in the industry with attractive prices.

With a 4-6%

Industry share, Viaderm Limited is a trusty ODM with a variety of skincare and personal care items. The firm's emphasis on science-based formulas and dermatologically tested products has placed it firmly in the skincare category, particularly for brands dealing with sensitive or aging skin.

Herrco Ltd enjoys a smaller presence in Japan's ODM market with a market share of 2-4%. However, it is significant in providing customized formulations, especially in the specialty segments of skincare and haircare products. Its high-quality products and long-standing relationships with regional brands make it a significant player despite its lower industry share.

BioTruly Group, holding a market share of 7-9%

Recognized for its emphasis on sustainable and biotechnology-based cosmetic solutions. Its concentration on the areas of plant stem cell technology, fermentation, and other high-technology skincare technologies places it in a strong position as a partner for upscale, environmentally-friendly beauty brands in Japan.

In terms of product type, the industry is classified into skin care, hair care, makeup, body care, and others.

Based on nature type, the market is divided into natural/organic and synthetic.

With respect to packaging format, the industry is divided into bottles, compact cases, droppers, folding cartons, jars, pouches, pumps and dispensers, roll-ons, roll-on sticks, sachets, sticks, and tubes.

Based on end use, the industry is divided into prestige brands, private brands, mass brands, and indie brands.

Based on region, the market is classified into Kanto, Chubu, Kinki, Kyushu & Okinawa, Tohoku, and the rest of Japan.

The industry is expected to reach USD 923.2 million in 2025.

The industry is projected to witness USD 1,435.5 million by 2035.

The industry is projected to witness 4.5% CAGR during the study period.

Tubes are widely popular.

Leading companies include Natural Laboratories Co. Ltd, Nippon Shikizai, Toyo Beauty Co. Ltd, Colmar Co. Ltd, Milliona, Intercos Group, Oracle OEM, Viaderm Limited, Herrco Ltd, and BioTruly Group.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Industry Analysis and Outlook Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 4: Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 6: Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 8: Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 9: Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 10: Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 11: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 12: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 13: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 14: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 15: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 16: Kanto Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 17: Kanto Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 18: Kanto Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 19: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 20: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 21: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 22: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 23: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 24: Chubu Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 25: Chubu Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 26: Chubu Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 27: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 28: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 29: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 30: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 31: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 32: Kinki Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 33: Kinki Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 34: Kinki Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 35: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 36: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 37: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 38: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 39: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 40: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 41: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 42: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 43: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 44: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 45: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 46: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 47: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 48: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 49: Tohoku Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 50: Tohoku Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Table 51: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Product Type, 2019 to 2034

Table 52: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Product Type, 2019 to 2034

Table 53: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Nature Type, 2019 to 2034

Table 54: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Nature Type, 2019 to 2034

Table 55: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Packaging Format, 2019 to 2034

Table 56: Rest of Industry Analysis and Outlook Volume (Units) Forecast by Packaging Format, 2019 to 2034

Table 57: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 58: Rest of Industry Analysis and Outlook Volume (Units) Forecast by End Use, 2019 to 2034

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 4: Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 5: Industry Analysis and Outlook Value (US$ Million) by Region, 2024 to 2034

Figure 6: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 7: Industry Analysis and Outlook Volume (Units) Analysis by Region, 2019 to 2034

Figure 8: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 9: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 10: Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 11: Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 12: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 13: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 14: Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 15: Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 16: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 17: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 18: Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 19: Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 20: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 21: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 22: Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 23: Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 24: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 25: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 26: Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 27: Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 28: Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 29: Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 30: Industry Analysis and Outlook Attractiveness by Region, 2024 to 2034

Figure 31: Kanto Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 32: Kanto Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 33: Kanto Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 34: Kanto Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 35: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 36: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 37: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 38: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 39: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 40: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 41: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 42: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 43: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 44: Kanto Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 45: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 46: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 47: Kanto Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 48: Kanto Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 49: Kanto Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 50: Kanto Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 51: Kanto Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 52: Kanto Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 53: Kanto Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 54: Kanto Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 55: Chubu Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 56: Chubu Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 57: Chubu Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 58: Chubu Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 59: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 60: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 61: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 62: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 63: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 64: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 65: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 66: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 67: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 68: Chubu Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 69: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 70: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 71: Chubu Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 72: Chubu Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 73: Chubu Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 74: Chubu Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 75: Chubu Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 76: Chubu Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 77: Chubu Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 78: Chubu Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 79: Kinki Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 80: Kinki Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 81: Kinki Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 82: Kinki Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 83: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 84: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 85: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 86: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 87: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 88: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 89: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 90: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 91: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 92: Kinki Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 93: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 94: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 95: Kinki Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 96: Kinki Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 97: Kinki Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 98: Kinki Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 99: Kinki Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 100: Kinki Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 101: Kinki Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 102: Kinki Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 103: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 104: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 105: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 106: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 107: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 108: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 109: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 110: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 111: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 112: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 113: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 114: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 115: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 116: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 117: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 118: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 119: Kyushu & Okinawa Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 120: Kyushu & Okinawa Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 121: Kyushu & Okinawa Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 122: Kyushu & Okinawa Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 123: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 124: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 125: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 126: Kyushu & Okinawa Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 127: Tohoku Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 128: Tohoku Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 129: Tohoku Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 130: Tohoku Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 131: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 132: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 133: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 134: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 135: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 136: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 137: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 138: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 139: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 140: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 141: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 142: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 143: Tohoku Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 144: Tohoku Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 145: Tohoku Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 146: Tohoku Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 147: Tohoku Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 148: Tohoku Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 149: Tohoku Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 150: Tohoku Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Figure 151: Rest of Industry Analysis and Outlook Value (US$ Million) by Product Type, 2024 to 2034

Figure 152: Rest of Industry Analysis and Outlook Value (US$ Million) by Nature Type, 2024 to 2034

Figure 153: Rest of Industry Analysis and Outlook Value (US$ Million) by Packaging Format, 2024 to 2034

Figure 154: Rest of Industry Analysis and Outlook Value (US$ Million) by End Use, 2024 to 2034

Figure 155: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Product Type, 2019 to 2034

Figure 156: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Product Type, 2019 to 2034

Figure 157: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Product Type, 2024 to 2034

Figure 158: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Product Type, 2024 to 2034

Figure 159: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Nature Type, 2019 to 2034

Figure 160: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Nature Type, 2019 to 2034

Figure 161: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Nature Type, 2024 to 2034

Figure 162: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Nature Type, 2024 to 2034

Figure 163: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Packaging Format, 2019 to 2034

Figure 164: Rest of Industry Analysis and Outlook Volume (Units) Analysis by Packaging Format, 2019 to 2034

Figure 165: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Packaging Format, 2024 to 2034

Figure 166: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Packaging Format, 2024 to 2034

Figure 167: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 168: Rest of Industry Analysis and Outlook Volume (Units) Analysis by End Use, 2019 to 2034

Figure 169: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 170: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 171: Rest of Industry Analysis and Outlook Attractiveness by Product Type, 2024 to 2034

Figure 172: Rest of Industry Analysis and Outlook Attractiveness by Nature Type, 2024 to 2034

Figure 173: Rest of Industry Analysis and Outlook Attractiveness by Packaging Format, 2024 to 2034

Figure 174: Rest of Industry Analysis and Outlook Attractiveness by End Use, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Japan Nutricosmetics Market Report – Trends, Demand & Outlook 2025-2035

Japan Natural Cosmetics Market Analysis - Size, Share & Trends 2025 to 2035

Western Europe Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Korea Cosmetics ODM Market Analysis – Size, Share & Trends 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA