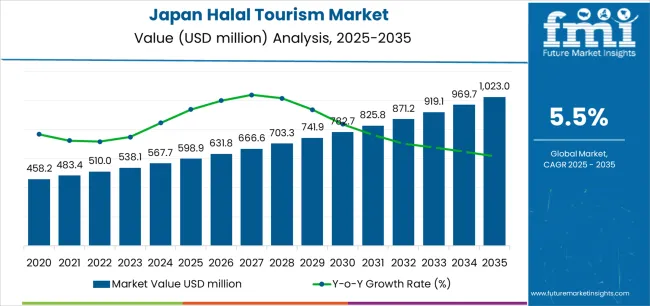

The Japan halal tourism market stands at the threshold of a decade-long expansion trajectory that promises to reshape hospitality services and Islamic travel accommodation solutions across the nation's sophisticated tourism infrastructure. The market's journey from USD 598.9 million in 2025 to USD 1,023.0 million by 2035 represents substantial growth, demonstrating the accelerating adoption of halal-certified services and Muslim-friendly travel principles across hospitality facilities, tourism operations, and destination management sectors throughout Japan's diverse cultural and urban landscapes.

The first half of the decade (2025-2030) will witness the market climbing from USD 598.9 million to approximately USD 782.7 million, adding USD 183.8 million in value, which constitutes 42% of the total forecast growth period. This phase will be characterized by the rapid adoption of halal-certified hospitality services, driven by increasing Muslim traveler volumes from Southeast Asia and Middle East regions, alongside the growing need for comprehensive Islamic travel solutions across Japanese destinations. Enhanced halal dining options and prayer facility provisions will become standard expectations rather than premium offerings in major tourism centers like Tokyo, Osaka, and Kyoto.

The latter half (2030-2035) will witness continued growth from USD 782.7 million to USD 1,023.0 million, representing an addition of USD 240.3 million or 58% of the decade's expansion. This period will be defined by mass market penetration of specialized halal tourism services, integration with comprehensive travel management platforms, and seamless compatibility with Japan's advanced tourism infrastructure. The market trajectory signals fundamental shifts in how Japanese hospitality providers approach Muslim traveler accommodation and service delivery, with participants positioned to benefit from growing demand across multiple service categories and destination segments throughout the archipelago.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Accommodation services (hotels, ryokans, guesthouses) | 38% | Halal-certified properties, prayer mat provisions |

| Food & dining experiences | 28% | Halal restaurants, Muslim-friendly establishments | |

| Tour packages & cultural experiences | 22% | Temple visits, cultural workshops, nature tours | |

| Transportation & logistics | 12% | Airport transfers, rail passes, guided transport | |

| Future (3-5 yrs) | Integrated halal ecosystems | 35-40% | End-to-end Muslim traveler solutions, omotenashi adaptation |

| Digital platforms & apps | 20-25% | Japanese-language halal apps, AI translation services | |

| Premium cultural experiences | 18-22% | Luxury ryokan stays, exclusive tea ceremonies | |

| Medical & wellness tourism | 10-15% | Halal health checkups, onsen experiences | |

| Business travel management | 8-10% | Corporate Muslim travel, MICE services | |

| Rural tourism development | 5-8% | Countryside experiences, agritourism |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 598.9 million |

| Market Forecast (2035) | USD 1,023.0 million |

| Growth Rate | 5.5% CAGR |

| Leading Segment | International Tourism |

| Primary Demographic | 26-35 Years Age Group |

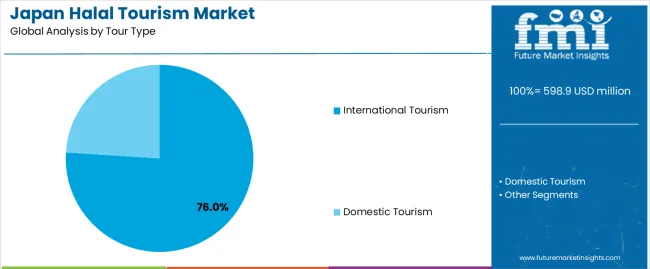

The market demonstrates strong fundamentals with international halal tourism capturing a dominant share through comprehensive Islamic travel services and culturally sensitive accommodation provisions. Young professional and family travelers drive primary demand, supported by Japan's strategic initiatives to attract Muslim visitors ahead of major international events and tourism recovery programs. Geographic expansion remains concentrated in major metropolitan areas with established international connectivity, while regional destinations show accelerating adoption rates driven by tourism diversification initiatives and local government support programs.

Primary Classification: The market segments by tour type into domestic and international tourism categories, representing the evolution from limited local Muslim travel to sophisticated international Islamic tourism solutions for comprehensive Japanese cultural experience optimization.

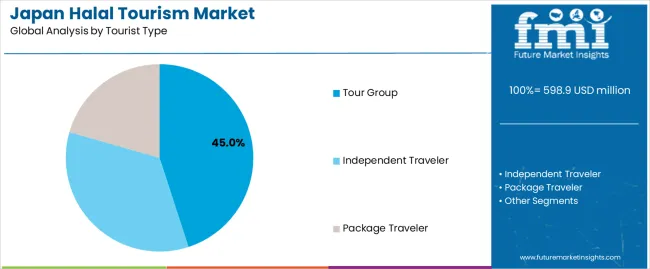

Secondary Classification: Tourist type segmentation divides the market into independent travelers, tour groups, and package travelers, reflecting distinct requirements for travel flexibility, guided cultural interpretation, and comprehensive service provision standards within Japan's unique tourism landscape.

Tertiary Classification: Tourist demography covers men, women, and families, while age groups span less than 26 years, 26-35 years, 36-45 years, 46-55 years, and over 55 years segments, each requiring tailored service approaches adapted to Japanese cultural contexts.

Quaternary Classification: Booking channels include online booking, phone booking, and in-person booking methods, with digital platforms leading adoption while traditional channels maintain relevance for group bookings and specialized arrangements.

The segmentation structure reveals service progression from basic tourism offerings toward sophisticated halal-compliant solutions with enhanced cultural bridge-building and religious accommodation capabilities, while demographic diversity spans from young technology-savvy travelers to multi-generational family groups requiring comprehensive Islamic travel services within Japan's distinctive cultural environment.

Market Position: International tourism commands the leading position in the Japan halal tourism market with 76% market share through comprehensive service offerings, including superior accommodation options in major cities, diverse halal dining facilities, and unique cultural experience provisions that enable Muslim travelers to achieve optimal travel satisfaction across Japan's diverse prefectures and destinations.

Value Drivers: The segment benefits from Japan's unique cultural appeal, world-class transportation infrastructure, and growing reputation as a Muslim-friendly destination that provides exceptional service quality, technological innovation, and religious accommodation without compromising authentic Japanese experiences. Advanced tourism facilities enable seamless travel experiences, prayer facility access, and integration with Japan's sophisticated tourism infrastructure, where cultural authenticity and service excellence represent critical traveler requirements.

Competitive Advantages: International tourism differentiates through Japan's unique positioning as a safe, technologically advanced destination with increasing halal infrastructure, multilingual support capabilities expanding beyond major cities, and comprehensive halal certification systems that enhance traveler confidence while maintaining optimal service standards suitable for diverse Muslim traveler segments from Indonesia, Malaysia, Middle East, and other Islamic regions.

Key market characteristics:

Domestic halal tourism maintains a 24% market position in the Japan halal tourism market, primarily serving Japan's growing Muslim population including residents, students, and naturalized citizens. This segment appeals to domestic Muslim communities seeking local travel experiences while maintaining religious observances. Market growth is driven by weekend trips to halal-friendly destinations, family vacations during school holidays, and religious gatherings, emphasizing accessible halal services through expanding domestic networks.

Market Context: Tour groups demonstrate the highest market share in the Japan halal tourism market with 45% penetration due to language barriers, cultural complexity navigation needs, and preference for organized experiences that ensure halal compliance while maximizing destination exploration within limited timeframes.

Appeal Factors: Muslim tour groups prioritize comprehensive packages with guaranteed halal meals, prayer time accommodations, and knowledgeable guides who understand both Japanese culture and Islamic requirements. The segment benefits from established tour operator relationships and group discount structures that make Japan travel more accessible to price-sensitive Muslim markets.

Growth Drivers: Southeast Asian middle-class expansion drives group travel demand, while Japanese government initiatives supporting Muslim tourism increase specialized tour offerings that comply with Islamic principles while showcasing Japanese cultural highlights.

Market Challenges: Balancing group schedules with prayer times and managing diverse halal interpretation standards across different nationalities.

Application dynamics include:

Independent Muslim travelers capture increasing market share through improved halal infrastructure visibility, digital resource availability, and growing confidence in navigating Japan autonomously. These travelers demand flexible options with reliable halal information while maintaining freedom to explore off-beaten paths.

Package travelers account for steady market share, including honeymoon couples, small families, and business-leisure combinations requiring pre-arranged halal solutions for accommodation, dining, and activity optimization.

Market Position: Family travelers command significant market position with 42% share through comprehensive service requirements meeting multi-generational needs within Japanese cultural contexts.

Value Drivers: Family segments drive volume through larger group sizes, longer stay durations, and higher per-trip spending on accommodations, dining, and activities suitable for various age groups while maintaining Islamic values.

Growth Characteristics: The segment benefits from Japan's reputation for safety, cleanliness, and family-friendly attractions, alongside expanding halal infrastructure at theme parks, museums, and cultural sites.

Market Context: The 26-35 years demographic leads growth with 35% market share, reflecting peak travel capability during career establishment phases and pre-family or young family stages.

Travel Patterns: Young Muslim professionals and couples drive demand for experiential travel combining cultural immersion, technology exploration, and Instagram-worthy destinations while maintaining halal standards.

Digital Engagement: This demographic's technological proficiency aligns with Japan's digital infrastructure, enabling seamless travel through apps, QR codes, and cashless payments.

Market Context: Online booking channels capture 62% market share with highest growth trajectory, reflecting digital transformation accelerated by pandemic-driven behavioral changes.

Platform Evolution: Specialized halal travel platforms gain traction alongside mainstream OTAs adding halal filters, while Japanese platforms increasingly offer English and Muslim-market language options.

Technology Integration: Online channels enable real-time availability checking, instant confirmations, detailed halal verification, and user reviews from Muslim travelers that build booking confidence.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Government tourism recovery initiatives & 2025 Osaka Expo | ★★★★★ | Official support accelerates halal infrastructure development; major events create urgency for Muslim-friendly services across hospitality sectors |

| Driver | Southeast Asian economic growth & visa liberalization | ★★★★★ | Expanding middle class from Indonesia, Malaysia creates sustained demand; simplified visa processes remove entry barriers |

| Driver | Technology adoption & digital transformation | ★★★★☆ | QR codes, translation apps, digital payments reduce language barriers; enhances accessibility for Muslim travelers |

| Restraint | Language barriers & cultural complexity | ★★★★☆ | Limited English/Arabic speaking staff; complex cultural protocols may intimidate first-time Muslim visitors |

| Restraint | Limited rural halal infrastructure | ★★★☆☆ | Halal services concentrated in major cities; restricts comprehensive Japan exploration for Muslim travelers |

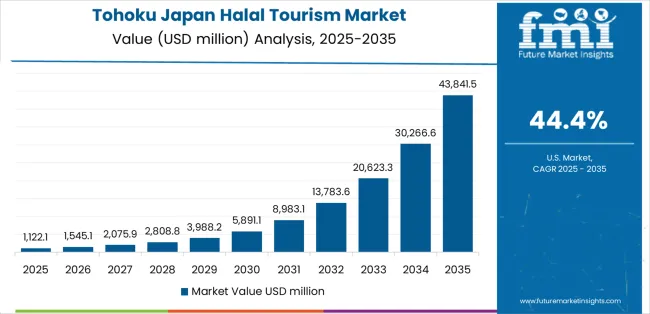

| Trend | Experiential tourism beyond Tokyo-Kyoto-Osaka | ★★★★★ | Muslim travelers seeking unique experiences; Kyushu, Tohoku, Shikoku developing halal capabilities |

| Trend | Integration of Muslim-friendly services in mainstream hospitality | ★★★★☆ | Major hotel chains adding prayer mats, qibla markers; convenience stores stocking halal products becomes normalized |

Japan’s halal tourism opportunity centers on city access, family pacing, prayer-space mapping, and dining confidence. Growth concentrates where airlift, rail hubs, and theme districts convert short stays into two-to-five day circuits. Visitors respond to itineraries that pair cultural icons with prayer-time aligned stops, clear dining labels, and privacy-aware lodging choices. Packages that combine urban walks, outlet shopping, calm nature segments, and children’s attractions lift length of stay and review scores.

| Region | 2025–2035 Growth | How to Win | What to Watch Out |

|---|---|---|---|

| Kanto (Tokyo, Yokohama) | 5.6% | City clusters with mosque proximity, certified dining maps, stroller-friendly routes | Peak crowding, venue slot caps |

| Kansai (Osaka, Kyoto, Nara, Kobe) | 5.3% | Culture+shopping loops with prayer stops and guided temple etiquette | Narrow lanes, queue risk at icons |

| Kyushu | 5.0% | Nature-hot springs-city triads; airport meet-and-greet to prayer-mapped hotels | Weather swings, rural transit gaps |

| Chubu (Nagoya, Alps, Fuji perimeter) | 4.8% | Outlet+castle+lake circuits; private vans with prayer kit boxes | Distance between sights, altitude fatigue |

| Hokkaido | 4.6% | Seasonal snow/flower programs; lodge clusters with clear dining assurances | Winter closures, road conditions |

| Tohoku | 4.4% | Quiet nature+heritage loops; rail-linked prayer points | Limited beds near small towns |

| Chugoku & Shikoku | 4.2% | Island bridges and coastal drives; compact city walks | Sparse prayer rooms on rural legs |

| Okinawa | 4.9% | Beach-villa privacy and calm marine days; direct airport transfers | Typhoon windows, limited stock in peaks |

Kanto anchors inbound demand with dense attractions, strong airlift, and easy metro navigation that suits short family stays. Guests often start with a city core triad: Shibuya crossing and nearby viewpoints for photos, Asakusa’s temple quarter for heritage context, and Ueno or Odaiba for child-friendly museums. Confidence rises when tours publish prayer room locations inside malls, stations, and major attractions, along with walking times and lift access for strollers. Dining choice is wide; the win is curation—clear lists of certified kitchens, seafood and vegetarian fallbacks, private-room options, and Arabic/English menu support. Tokyo-Bay cruises and Yokohama waterfront loops provide evening scenery without long transfers. Day trips to Kamakura or Nikko fit well with mid-day prayer windows if guides pick cafés with nearby facilities. Shopping-led parties value outlet runs balanced with city parks so elders can rest. Hotels that offer connecting rooms, ablution-friendly bathrooms, in-room Qibla markers, and late checkout for evening flights gain repeat business.

Market Intelligence Brief:

Kansai converts culture seekers through compact circuits that mix Osaka’s energy with Kyoto’s heritage lanes and Nara’s parks. Programs work when guides coach etiquette around shrines and temples while signposting nearby prayer spaces and respectful photo points. Families enjoy half-day segments: Kyoto’s Gion and Kiyomizu slopes in the morning, a riverside stroll with dessert break, then an Osaka evening of views and shopping. Dining certainty comes from prebooked certified spots, seafood diners with clear labeling, and private rooms for groups. Nara’s deer park and nearby sites suit children and elders when paired with shaded rest points and short walks. Kobe adds waterfront and sweets districts, which help balance temple days with light treats. Crowd-buildup at headline temples calls for timed entries and alternate lanes; small craft streets provide quiet intervals. Hotels near stations reduce transfers and make it easy to pause for prayer. Tailored photo walks, kimono rentals with modest options, and language support deepen comfort for first-time visitors.

Strategic Market Indicators:

Kyushu suits travelers who want a calm pace with nature segments, hot-spring towns, and coastal views linked by reliable airports. Fukuoka serves as the entry hub, with markets, river walks, and easy day trips. Families appreciate two-night bases that add Beppu’s steam districts or Aso’s viewpoints without long hauls. Prayer time planning is straightforward when itineraries anchor stops near stations or malls with designated rooms; drivers carry mat sets for roadside contingencies. Dining confidence comes from seafood and chicken specialists that label ingredients and offer private rooms on request. Nagasaki’s hillside views and heritage quarters balance outdoor days, while Kagoshima’s ferry edges introduce light adventure with short durations suitable for mixed-age groups. Guides brief heat, wind, and onsen etiquette so guests feel at ease around bathing towns while selecting privacy-aware facilities. For return visitors, farm cafés, craft studios, and coastal cycling provide variety without crowd stress.

Market Intelligence Brief:

Chubu links city comfort with mountain air and historic towns, creating strong two-center trips. Nagoya provides castles, science museums, and outlet shopping, while Takayama and Shirakawa-go offer timber villages and calm lanes that fit family photos and gentle walks. Kanazawa’s garden and crafts quarter brings color without long climbs. Drivers and guides plan prayer breaks at highway service areas or station complexes that offer clean rooms and family space. Around Fuji’s perimeter, lakeside boardwalks and ropeway viewpoints suit strollers and photo stops, with cafés selected for labeled menus and nearby facilities. Private vans help bridge distances and carry prayer kits, warm layers, and child seats for altitude shifts. When alpine routes open, guests enjoy short snow views and light walks balanced with city nights. Clear pacing matters—no more than three anchors per day keeps elders comfortable. Hotels with connecting rooms, larger bathrooms, and coin laundries ease longer itineraries.

Strategic Market Considerations:

Hokkaido excels at seasonal contrast: winter snow parks and light festivals, spring blooms, summer fields, and autumn colors. Families respond to lodge clusters where transfers are short, meals are prebooked, and prayer corners are set aside by agreement with property managers. Sapporo and Otaru deliver city comforts and easy day trips, while Furano and Biei add field views and photo stops that work well with children. In winter, guides plan warmup cafés near prayer spots and keep walks brief between viewpoints; shuttles reduce exposure for elders. Ingredient certainty is managed through curated dining lists that include seafood, soups, and grilled options with clear labeling. Gentle sledding, snowshoes, and ice villages offer variety without long technical skills. In warmer months, flower routes and farm cafés suit stroller-friendly days. Lodge staff trained on room privacy, extra blankets for late prayer, and early breakfast packs improve ratings across family groups.

Market Intelligence Brief:

Tohoku appeals to travelers seeking quiet nature, onsen towns, and heritage that sits away from headline crowds. Sendai works as a rail hub with coastal walks and tree-lined avenues, while Aomori and Akita add lakes, castles, and regional museums. Programs succeed when each day combines a scenic loop with an indoor segment and a simple prayer plan near stations or civic centers. Dining confidence comes from carefully chosen seafood, rice bowls, and sweets houses that post ingredients, along with private rooms at family-run inns. Because distances can stretch, vans or limited-express trains are paired with two or three concise stops rather than many short hops. Guides schedule shaded parks for children and select viewpoints with benches for elders. Onsen towns are introduced with clear notes on private slot reservations and modest facilities. Photo walks around lakes and cedar paths provide calm, and souvenir markets add light shopping without dense crowding.

Strategic Market Considerations:

This twin-region circuit blends coastal drives, island bridges, and compact city walks. Hiroshima anchors with museums and riverside parks that pair well with quiet reflection and nearby prayer options. Okayama’s gardens, Kurashiki’s canals, and Matsue’s castle quarter create gentle days for families who prefer level paths and frequent seating. Crossing to Shikoku, the island bridges support scenic drives and short cycling bursts that suit teens, while Takamatsu’s gardens and Ehime’s castles add variety. Operators succeed when they pre-arrange prayer corners at visitor centers and pick dining rooms with labeled menus and family privacy. Because rural legs can have sparse services, drivers carry prayer mats, snacks, and coolers. Ferry timings are folded into day plans to avoid late returns with children. The story is quiet charm: orange groves, small shrines, and sea views that photograph well without pushing long hikes. Guests appreciate clear plans that balance two highlights per day with ample rest.

Strategic Market Considerations:

Okinawa delivers warm-water days, villa privacy, and short transfers that fit family rhythms. Direct flights into Naha, plus links to Ishigaki and Miyako, enable two-center beach stays. Programs work when airport meet-and-greet leads straight to villas or resorts that offer private dining setups, room service plans, and clear halal-friendly menus. Prayer is simple to plan if properties set aside a quiet corner or meeting room during key windows; guides carry mats for beachside pauses where privacy allows. Marine choices range from glass-bottom rides and calm snorkeling lagoons to easy paddle routes suited to beginners. Midday breaks protect children from sun and allow parents to reset. For elders, promenade walks, craft markets, and garden visits provide gentle activity. In peak weeks, stock is tight, so early block bookings for adjoining rooms and vans are essential. Photo packages at sunset and short cultural shows help families create shared memories without long transfers.

Strategic Market Considerations:

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Specialized tour operators | Package design, guide networks, supplier relationships | Cultural bridging, language support, halal guarantee | Technology adoption, scale limitations |

| Digital platforms | Booking technology, user data, market reach | Convenience, price comparison, review systems | Local nuances, service delivery |

| Traditional hospitality | Physical assets, service delivery, location premium | Established operations, quality consistency | Islamic requirements, cultural adaptation |

| Government agencies | Policy framework, promotion budgets, infrastructure investment | Coordinated development, international marketing | Private sector agility, market dynamics |

| Certification bodies | Standards setting, compliance verification, market trust | Credibility building, quality assurance | International harmonization, cost burden |

| Item | Value |

|---|---|

| Quantitative Units | USD 598.9 million (2025) to USD 1,023.0 million (2035) |

| Tour Type | Domestic (24%), International (76%) |

| Tourist Type | Independent Traveler, Tour Group, Package Traveler |

| Tourist Demography | Men, Women, Families |

| Age Group | Less than 26 Years, 26-35 Years, 36-45 Years, 46-55 Years, Over 55 Years |

| Booking Channel | Online Booking, Phone Booking, In-Person Booking |

| Geographic Focus | Japan (primary), with comparisons to China, India, Germany, USA, UK |

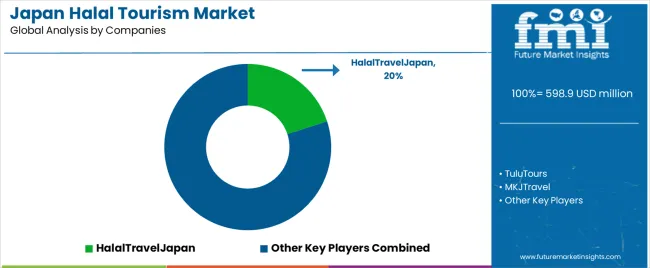

| Key Companies Profiled | TuluTours, MKJTravel, HalalTravelJapan, SafarSakura, HalalTripJepang |

| Additional Attributes | Revenue analysis by tourist segments and booking preferences, regional adoption patterns across Japanese prefectures, competitive dynamics with specialized operators and mainstream providers, Muslim traveler preferences for Japanese cultural experiences, integration challenges with traditional hospitality systems, innovations in halal food preparation maintaining Japanese culinary standards, and development of Muslim-friendly interpretations of traditional Japanese hospitality |

The global japan halal tourism market is estimated to be valued at USD 598.9 million in 2025.

The market size for the japan halal tourism market is projected to reach USD 1,023.0 million by 2035.

The japan halal tourism market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in japan halal tourism market are international tourism and domestic tourism.

In terms of tourist type, tour group segment to command 45.0% share in the japan halal tourism market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Halal Tourism Services

Halal Tourism Market Analysis by Tour Type, Tourist Type, Tourist Demography, Age Group, and by Booking Channel - Forecast for 2025 to 2035

Japan Golf Tourism Market Analysis

Japan Space Tourism Market Trends – Innovations, Demand & Growth 2025-2035

UK Halal Tourism Market Analysis – Growth, Applications & Outlook 2025-2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Diving Tourism Market Analysis – Size, Share & Industry Trends 2025-2035

United States Halal Tourism Market Outlook – Trends, Demand & Forecast 2025–2035

Japan Outbound Tourism Market Analysis – Growth & Forecast 2025 to 2035

Japan Adventure Tourism Market Report – Demand, Size & Forecast 2025–2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Germany Halal Tourism Market Report – Trends & Innovations 2025-2035

Japan Special Interest Tourism Market Trends – Innovations, Growth & Forecast 2025-2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

GCC Countries Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Demand for Ecotourism in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Medical Tourism in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Cultural Tourism in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA