The demand for ecotourism in Japan is expected to grow from USD 14.4 billion in 2025 to USD 24.7 billion by 2035, reflecting a CAGR of 5.6%. Ecotourism, which focuses on environmentally responsible travel and nature conservation, is becoming increasingly popular as travelers seek sustainable tourism options. Japan, with its rich natural heritage, including national parks, hot springs, and coastal areas, presents a prime destination for eco-friendly tourism experiences. The demand for ecotourism is driven by growing environmental awareness, rising interest in experiential travel, and a desire to reduce carbon footprints while traveling. Japan's initiatives to promote sustainable tourism practices and preserve its biodiversity will continue to attract both domestic and international travelers, further expanding the ecotourism market.

The government’s ongoing focus on the Sustainable Development Goals (SDGs) and green tourism is driving the growth of ecotourism. Japan’s well-established reputation for nature conservation and cultural heritage preservation aligns with the increasing demand for tourism experiences that promote responsible consumption and environmental stewardship. As more travelers prioritize destinations that offer eco-friendly and culturally enriching experiences, the demand for nature-based tours, wildlife experiences, and sustainable accommodations in Japan will continue to rise.

From 2025 to 2030, the demand for ecotourism in Japan will grow from USD 14.4 billion to USD 18.9 billion, adding USD 4.5 billion in value. This phase will experience a steady upward trend, marked by a relatively consistent peak-to-trough pattern. As environmental awareness continues to rise and Japan’s tourism sector adopts more sustainable practices, the demand for ecotourism will gain traction. While growth will remain steady, it could experience some minor fluctuations due to external factors, such as economic conditions and international travel restrictions. However, the general demand for nature-based travel and sustainable tourism will continue to push the market upwards during this phase, with an overall positive momentum.

From 2030 to 2035, the market will grow from USD 18.9 billion to USD 24.7 billion, contributing an additional USD 5.8 billion in value. During this period, the growth rate will continue but experience some moderate deceleration as the market reaches higher levels of maturity. The demand for ecotourism will still increase, but the rate of growth may slow slightly due to market saturation and increased competition in the ecotourism sector. Despite this, the shift towards more personalized and sustainable travel experiences and the rise of eco-conscious tourism will maintain steady demand, ensuring gradual but sustained market growth. The peak-to-trough pattern in this phase will show more stabilized growth, with fewer dramatic fluctuations as ecotourism becomes a standard offering in Japan's travel and tourism industry.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 14.4 billion |

| Industry Forecast Value (2035) | USD 24.7 billion |

| Industry Forecast CAGR (2025-2035) | 5.6% |

Demand for ecotourism in Japan is rising as both domestic and international travellers seek more nature based experiences and avoidance of crowded urban destinations. The Japanese market for ecotourism was estimated at around USD 13 billion in 2024 and is projected to reach over USD 34 billion by 2033 at a compound annual growth rate (CAGR) of approximately 11.5%. This growth reflects expanding interest in regional landscapes, biodiversity rich islands, and cultural heritage sites managed through sustainable tourism approaches.

Another driver is ageing infrastructure, regional revitalisation campaigns, and sustainability policy. Local governments and tourism entities in Japan are promoting off season travel, rural lodges, and ecologically preserved areas to distribute visitor flow beyond major cities and reduce environmental pressure. Increased awareness of environmental impact, visitor capacity management, and community based tourism models are supporting this shift. Constraints in littoral areas, mountainous terrain, and limited multilingual support may restrict immediate access in some zones. Nonetheless, the alignment of traveller preferences, national policy direction, and regional development objectives implies that demand for ecotourism in Japan will continue to expand.

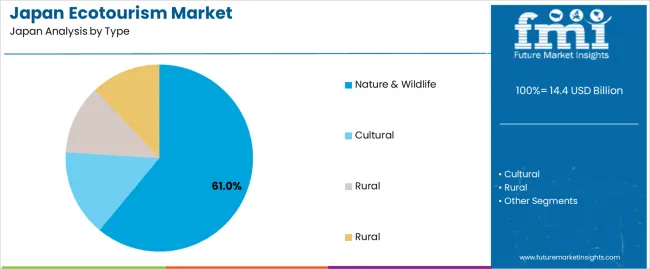

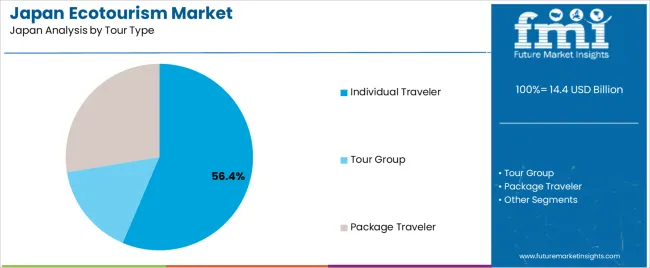

The demand for ecotourism in Japan is primarily driven by type and tour type. The leading type is nature and wildlife, capturing 61% of the market share, while individual travelers are the dominant tour type, accounting for 56.4% of the demand. Ecotourism in Japan focuses on providing travelers with authentic and sustainable experiences in nature, cultural heritage sites, and rural landscapes, driven by the increasing interest in environmentally conscious travel options.

Nature and wildlife is the leading type of ecotourism in Japan, accounting for 61% of the demand. Japan's diverse ecosystems, from mountain ranges and forests to coastal areas, offer numerous opportunities for nature-based tourism. Wildlife viewing, birdwatching, and visiting protected national parks are among the most popular activities. These experiences allow travelers to engage with the natural environment while maintaining sustainability principles.

The demand for nature and wildlife ecotourism is driven by the growing interest in responsible travel and conservation efforts. As more tourists seek out immersive experiences that promote environmental protection, nature and wildlife tourism in Japan continues to thrive. The popularity of hiking, nature trails, and wildlife sanctuaries, combined with Japan's rich biodiversity, ensures that nature-based tourism will remain a dominant segment in the country's ecotourism market.

Individual travelers are the dominant tour type for ecotourism in Japan, holding 56.4% of the demand. This segment reflects the trend of travelers seeking personalized, flexible travel experiences that cater to their specific interests in nature, culture, and sustainability. Individual travelers often prefer more independent, self-guided ecotourism experiences, such as hiking, nature walks, or visiting rural areas, which allow for deeper engagement with local communities and the environment.

The demand for individual ecotourism is driven by the desire for more customized, authentic travel experiences that align with personal values, such as environmental responsibility and cultural preservation. As more tourists prioritize sustainability, individual travelers are increasingly choosing ecotourism options that provide greater freedom, flexibility, and a closer connection to nature and wildlife. This trend is expected to continue as individual travel experiences in ecotourism grow in popularity in Japan.

Demand for ecotourism in Japan is growing as both domestic and international travellers seek nature based, low impact travel experiences focused on conservation, culture and community interaction. Government initiatives promoting sustainable regional development and ecosystem preservation support growth of eco lodges, guided nature trails and rural tourism. At the same time, limited infrastructure in remote natural areas and competition with established mainstream tourism segments moderate expansion. These factors together shape the market trajectory for Japan’s ecotourism sector.

Several factors underpin the expansion of ecotourism. Growing environmental awareness among younger global travellers encourages choice of trips with lower carbon impact and local community benefits. Japan’s rural regions offer rich natural heritage, forest, coastal and mountainous areas that support wildlife, hiking and cultural nature experiences. National and regional policies promoting revitalisation of depopulated areas provide funding and infrastructure for local eco tourism initiatives. The recovery of the inbound tourism market and rising interest in off season and off route destinations also increase pressure on traditional tourism and open new eco friendly travel opportunities.

Despite favourable conditions, several constraints apply. Infrastructure in many rural and natural settings lacks sufficient accommodation, transport links and multilingual services, which limits access and visitor comfort. Seasonal climate extremes, such as heavy snow or typhoons, restrict operation periods and increase risk for nature travel providers. Concerns about overtourism and environmental degradation of fragile ecosystems can create local opposition or regulatory restrictions. Additionally, price sensitivity among travellers and higher cost of specialised eco tourism services may reduce demand among cost conscious segments.

Important trends include greater interest in immersive and participatory nature experiences, such as guided forest bathing, traditional village stays and wildlife observation tours, which align with ecotourism values. Digital tools mobile apps, GPS based trail guides, multilingual information platforms are being used to manage visitor flows and amplify remote region access while minimising environmental impact. Collaboration between tourism operators and local communities is increasing, with more eco lodges and regional brands promoting "travel that supports community resilience". Also, the shift toward sustainable transport, regional dispersal of visitors and off peak travel helps distribute demand beyond major urban destinations.

The demand for ecotourism in Japan is driven by increasing awareness of environmental sustainability, a growing interest in nature-based travel experiences, and the country’s diverse natural landscapes, including mountains, forests, and coastal areas. As travelers become more environmentally conscious, there is a rising preference for tourism that emphasizes the protection of natural resources, wildlife conservation, and local community involvement. Ecotourism in Japan encompasses activities such as hiking, wildlife watching, cultural heritage tours, and visits to national parks, all aimed at offering sustainable travel experiences that minimize environmental impact.

Additionally, Japan’s government initiatives promoting eco-friendly tourism and conservation efforts have contributed to the growth of the ecotourism sector. Regional demand for ecotourism varies based on local attractions, environmental policies, and the accessibility of natural areas that are suitable for eco-friendly travel experiences.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.9% |

| Kanto | 6.4% |

| Kinki | 5.6% |

| Chubu | 4.9% |

| Tohoku | 4.3% |

| Rest of Japan | 4.1% |

Kyushu & Okinawa leads the demand for ecotourism in Japan with a CAGR of 6.9%. This is largely due to the region’s rich biodiversity, unique ecosystems, and its focus on preserving natural resources. Okinawa, with its subtropical climate, coral reefs, and rich marine life, attracts a growing number of ecotourists seeking to experience its unique environment. Kyushu, known for its volcanic landscapes, national parks, and hot springs, also draws significant ecotourism interest.

The region’s commitment to sustainable tourism and environmental conservation, coupled with local community involvement in preserving natural heritage, has created a favorable environment for ecotourism. As more travelers seek authentic, nature-based experiences that minimize their environmental footprint, the demand for ecotourism in Kyushu & Okinawa continues to rise.

Kanto shows strong demand for ecotourism with a CAGR of 6.4%. While Kanto is known for its urban sprawl, including Tokyo, the region also boasts a range of natural attractions that draw ecotourists, such as Mount Fuji, national parks, and coastal areas. The growth of ecotourism in Kanto is driven by the region’s increasing focus on sustainable tourism practices, including promoting eco-friendly accommodations and tour operators that offer nature-based experiences.

In addition, Kanto’s accessibility and robust infrastructure make it an attractive base for ecotourism, providing easy access to natural sites while offering a blend of city and nature. As more travelers in the region become aware of the environmental impact of traditional tourism, there is a growing trend towards eco-conscious travel experiences.

Kinki, with a CAGR of 5.6%, shows steady demand for ecotourism. This region, which includes cities like Osaka, Kyoto, and Kobe, is famous for its cultural heritage and historical sites, but it also offers rich natural attractions such as Mount Koya and the Kumano Kodo pilgrimage route. The steady growth of ecotourism in Kinki is influenced by the region’s balance of cultural tourism and nature-based travel experiences.

While the region’s urban development presents challenges for large-scale ecotourism initiatives, local conservation efforts and the promotion of outdoor activities in the region’s national parks and rural areas help to attract eco-conscious travelers. Kinki’s focus on integrating nature with its cultural heritage further supports the region’s growing ecotourism sector.

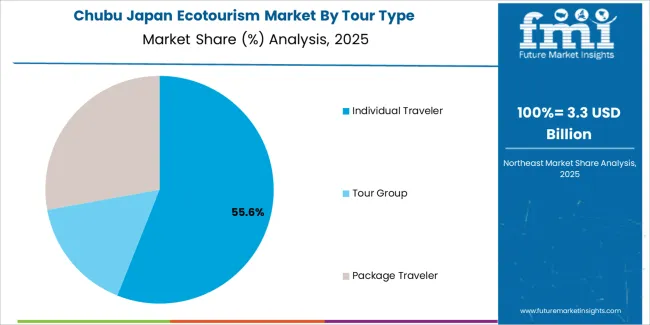

Chubu shows moderate growth in the demand for ecotourism with a CAGR of 4.9%. The region, home to the Japanese Alps and several national parks, offers significant potential for nature-based tourism activities such as hiking, skiing, and wildlife watching. While Chubu has natural attractions that appeal to ecotourists, the region's demand is somewhat limited compared to more famous ecotourism destinations like Okinawa or the national parks in Hokkaido.

However, as more tourists seek off-the-beaten-path destinations and eco-friendly travel options, the demand for ecotourism in Chubu is expected to grow. The region’s emphasis on environmental conservation and the promotion of sustainable tourism practices are likely to drive continued growth in ecotourism over time.

Tohoku, with a CAGR of 4.3%, and the Rest of Japan, with a CAGR of 4.1%, show slower growth in ecotourism demand compared to more developed regions. These areas are less urbanized and more rural, which can sometimes limit accessibility for large numbers of international tourists. However, the regions' natural beauty such as the mountains, lakes, and hot springs in Tohoku has begun to attract a growing number of eco-conscious travelers seeking quieter, more remote destinations.

Despite slower growth, these regions are investing in sustainable tourism infrastructure and promoting lesser-known natural attractions, which is expected to gradually increase their appeal to the growing ecotourism market in Japan. As awareness of rural and nature-based travel options continues to grow, the demand for ecotourism in these regions is likely to rise over time.

The ecotourism industry in Japan is expanding, driven by increasing consumer demand for sustainable travel experiences and nature-based tourism. Companies like China CYTS Tours Holding (holding approximately 40% market share), Farm To Farm Tours, Royal Arabian Destination Management, A.C.T. Tours, AAA Travel, and AGRILYS Voyages are active participants in the market. Japan’s government has supported this growth through initiatives aimed at promoting responsible tourism, especially in rural areas and lesser-known regions. The rise of ecotourism reflects a global shift toward environmentally conscious travel, with consumers seeking experiences that are not only immersive but also sustainable.

Competition within the Japanese ecotourism market revolves around offering unique, eco-friendly travel options, creating authentic cultural experiences, and ensuring minimal environmental impact. Companies are focusing on low-impact accommodations, guided nature tours, and activities that emphasize conservation and sustainability. Many are collaborating with local communities to provide tourists with a more personalized and educational experience, such as traditional crafts, local farming, and nature preservation activities.

Additionally, some companies are utilizing technology, such as mobile apps and online booking platforms, to streamline the travel process and ensure that eco-friendly practices are followed. Marketing strategies often emphasize environmental certifications, local partnerships, and the authenticity of experiences. By aligning their offerings with the growing demand for responsible and enriching travel, these companies are positioning themselves to capture more of Japan’s rapidly expanding ecotourism market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Japan |

| Type | Nature & Wildlife, Cultural, Rural |

| Tour Type | Individual Traveler, Tour Group, Package Traveler |

| Tourist Type | Domestic, International |

| Demography | Men, Women, Children |

| Age Group | 15 to 25 Years, 26 to 35 Years, 36 to 45 Years, 46 to 55 Years, 56 to 65 Years |

| Tourism Channel | Online Platforms, Travel Agencies, Direct Bookings, Luxury Tour Operators, Online Platforms |

| Key Companies Profiled | China CYTS Tours Holding, Farm To Farm Tours, Royal Arabian Destination Management, A.C.T. Tours, AAA Travel, AGRILYS Voyages |

| Additional Attributes | The market analysis includes dollar sales by type, tour type, tourist type, demography, and tourism channel categories. It also covers regional demand trends in Japan, driven by the increasing interest in ecotourism, particularly in nature, wildlife, and rural experiences. The competitive landscape highlights key companies focusing on providing sustainable and culturally enriching travel experiences. Trends in the growing demand for individual and group ecotourism tours, with a focus on younger demographics and international tourists, are explored, along with advancements in online booking platforms and luxury tour operators focusing on ecotourism. |

The demand for ecotourism in japan is estimated to be valued at USD 14.4 billion in 2025.

The market size for the ecotourism in japan is projected to reach USD 24.7 billion by 2035.

The demand for ecotourism in japan is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in ecotourism in japan are nature & wildlife, cultural, rural and rural.

In terms of tour type, individual traveler segment is expected to command 56.4% share in the ecotourism in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA