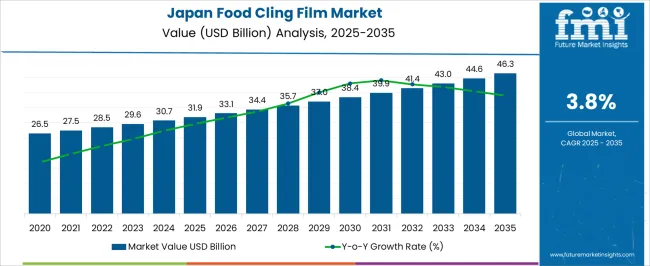

The Japan Food Cling Film Market is estimated to be valued at USD 31.9 billion in 2025 and is projected to reach USD 46.3 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Japan Food Cling Film Market Estimated Value in (2025 E) | USD 31.9 billion |

| Japan Food Cling Film Market Forecast Value in (2035 F) | USD 46.3 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The Japan food cling film market is expanding steadily, supported by rising household consumption, evolving packaging preferences, and the country’s strong emphasis on food safety and hygiene. Demand is being further reinforced by the growth of convenience food, ready-to-eat meals, and retail packaging where cling films are widely used for freshness preservation.

Technological improvements in film production, including enhanced barrier properties and eco-friendly material development, are contributing to long-term adoption. Regulatory encouragement for sustainable packaging materials is also shaping product innovation, with manufacturers focusing on recyclable and biodegradable film solutions.

The outlook remains positive as cling films continue to play a critical role in both domestic and commercial food storage applications, aligning with consumer expectations of safety, quality, and sustainability.

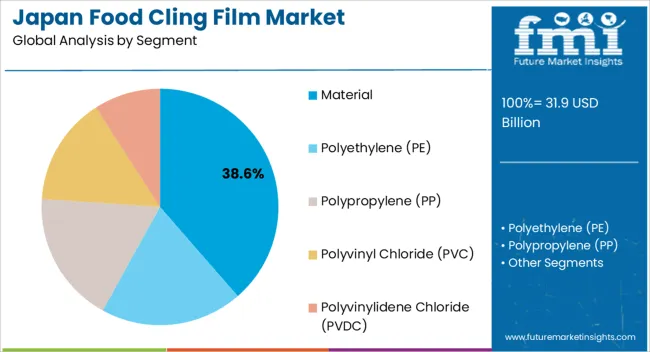

The material segment is projected to hold 38.60% of the total market revenue by 2025, establishing it as a key contributor within the market. The demand is being driven by its ability to provide durability, flexibility, and reliable performance in preserving food across both household and commercial settings.

Increasing regulatory encouragement for sustainable alternatives has further enhanced interest in advanced materials that maintain performance while reducing environmental footprint.

The consistent requirement for high quality packaging in Japan’s food industry continues to reinforce the prominence of this segment.

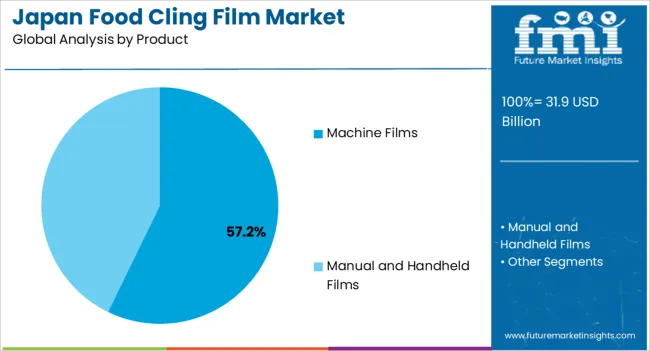

The machine films segment is expected to account for 57.20% of the total market revenue by 2025, making it the leading product category. This dominance is linked to its efficiency in large scale food packaging operations and its ability to deliver uniform wrapping and high throughput.

Food manufacturers and distributors benefit from reduced waste, optimized film usage, and enhanced packaging speed with machine films.

Rising adoption within the organized retail and food processing sectors has consolidated the strength of this product segment.

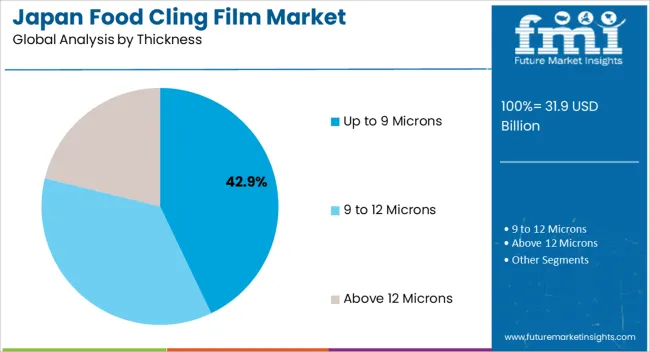

The up to 9 microns thickness segment is projected to represent 42.90% of the market share by 2025, positioning it as the largest thickness category. Its popularity is attributed to its balance between strength, flexibility, and cost effectiveness, making it well suited for both retail and household applications.

The lightweight nature reduces overall material consumption while maintaining effective food protection and shelf life extension.

As sustainability goals encourage material optimization, this thickness category continues to dominate by aligning with both performance and environmental considerations.

Sales of food cling films in Japan grew at a CAGR of 2.5% during the historic period (2020 to 2025). Total market valuation increased from USD 26.5 million in 2020 to USD 31.9 million by 2025.

Over the projected period, Japan food cling film industry will register a growth rate of 3.6% CAGR. It will create an incremental growth opportunity of USD 14.5 million.

Growth in the market is driven by preference for convenience foods, expansion of food & beverage industry, and the widespread availability of cling film in supermarkets and retail outlets.

The market for food cling film in Japan will expand further with an emphasis on innovation, sustainability, and satisfying consumer preference for premium packaging options that are also practical.

In the upcoming years, demand for food cling films will be fueled by the rising popularity of online meal delivery services and the expansion of the e-commerce sector. Overall, the market forecast for food cling films in Japan is promising, with room for expansion and innovation in the years to come.

The market has, however, also encountered difficulties, such as the rising environmental consciousness and the damaging effects of plastic trash on the environment. This has caused a shift towards environmentally friendly and sustainable packaging options, such as cling film that is compostable and biodegradable.

Rising Demand for Eco-Friendly Packaging to Bolster Food Cling Film Sales in Japan

Government policies and programs aimed at decreasing plastic waste and promoting sustainability in creating high demand for eco-friendly packaging.

The government of Japan has implemented measures to lessen the amount of plastic garbage generated. This includes a ban on single-use plastic bags in supermarkets and convenience stores. The market for food cling film in Japan is therefore anticipated to see an increase in demand for eco-friendly cling films.

Manufacturers are creating compostable and biodegradable cling films that are manufactured from substances such as corn flour, PLA, or cellulose. Similar functions, such as food protection, and preservation, are provided by these cling films, but they have less of an influence on the environment.

As consumers and businesses look for more sustainable solutions, the market for food cling film in Japan is benefiting from the increased need for eco-friendly packaging.

Growing demand for sustainable and eco-friendly cling films will therefore open up new business opportunities for distributors and producers.

Growing Food & Beverage Sector to Boost Japan Food Cling Film Industry

According to Future Market Insights (FMI), robust growth of food industry across Japan will continue to create need for food preservation and packaging solutions. This in turn will boost the market for food cling films.

The food and beverage business in Japan has been gradually expanding over the past few years, with a market size of about USD 30.7 billion in 2024, according to the Japanese Ministry of Agriculture, Forestry, and Fisheries.

Growing demand for convenience meals, changing dietary patterns, an aging population, and other reasons all contribute to this expansion. As a result, there is a growing need for food cling films in Japan since they offer a practical and affordable method of packaging and preserving food.

Further, increasing usage of food cling films in various food-related businesses, including bakery, confectionery, and dairy as well as households will fuel market expansion.

Various Advantages of Machine Films Fueling Market Demand

In comparison to hand-wrapped cling films, machine films are more consistent, efficient, and quick. They are made to work with particular automated packaging machines, which produce consistent and uniform food product packaging. By doing this, the amount of wasted film is decreased, saving businesses money.

Employment of machine films in the food business contributes to the quality and safety of the product. Machine films are made to wrap food products tightly and securely, preserving freshness and reducing the risk of contamination.

In the food sector, where safety and sanitary standards are extremely vital, demand for machine food cling film will continue to rise at a significant pace. As per Future Market Insights (FMI), machine films segment will hold around 71.2% value share of Japan market by 2025.

Polyethylene to Remain the Preferred Material for Producing Food Cling Films

Based on material, polyethylene segment will continue to dominate Japan food cling film industry. This is due to rising usage of polyethylene for manufacturing food cling films by Japan-based companies.

Due to its affordability, adaptability, and convenience, polyethylene (PE) is the most lucrative material for producing food cling films in Japan. The food sector uses PE cling films extensively because they provide an efficient barrier against moisture, oxygen, and other pollutants, preserving the quality and freshness of the food.

PE cling films are a preferred option for homes and small companies since they are convenient to use and handle. They can be customized based on particular demands because they come in a range of thicknesses and widths.

PE cling films are also inexpensive, which makes them a preferred option for companies trying to cut expenditures.

Growing popularity of LDPE food grade cling films will further boost the targets segment. As per the latest report, polyethylene segment will reach a valuation of USD 31.9 million in 2025.

Retail Sales Channel Will Generate Lucrative Revenues Through 2035

As per Future Market Insights (FMI), retail segment will hold around 58.5% value share of Japan market in 2025. Because of the widespread availability of cling film in supermarkets and retail stores, the retail sector dominates the market for food cling films.

Customers have a simple and practical alternative for buying domestic cling film at retail establishments. The market for cling films is also fueled by the retail industry's sizable client base, which includes families, small companies, and food service providers.

With the rise of contemporary retail forms including supermarkets, hypermarkets, and convenience stores, the retail industry has been growing quickly in recent years. The number of retail establishments has increased as a result of this expansion, resulting in a broad distribution network for food cling films.

To meet the varying needs of clients, the retail industry also provides a variety of cling films in a range of sizes, materials, and thicknesses.

Leading food cling film manufacturers are improving their market value by developing new products. Recent strategies adopted by companies in this space include mergers, collaboration, partnerships, and new product launches. For instance,

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 31.9 billion |

| Projected Market Value (2035) | USD 46.3 billion |

| Anticipated Growth Rate (2025 to 2035) | 3.8% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material, Thickness, Product, Sales Channel, End Use, Country |

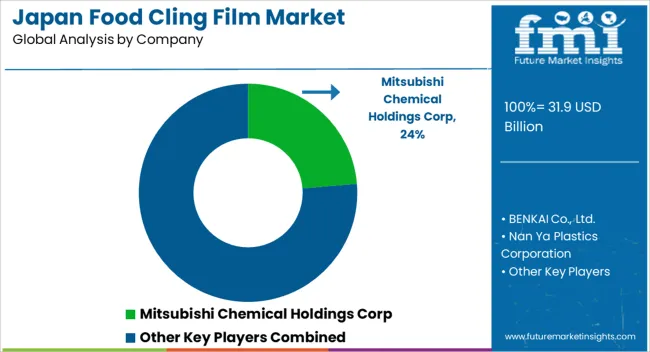

| Key Companies Profiled | Mitsubishi Chemical Holdings Corp; BENKAI Co., Ltd.; Nan Ya Plastics Corporation; Dalian Samyoung Chemical Co., Ltd; Anhui Jumei Biological Technology Co., Ltd; Shin-Etsu Polymer Co., Ltd.; Kureha Corporation; Riken Technos Corp; Asahi Kasei Group; KOHJIN Film & Chemicals; Jiangyin Centry Plastic Products Co., Ltd.; LongYouRu packing Co., Ltd. |

The global japan food cling film market is estimated to be valued at USD 31.9 billion in 2025.

The market size for the japan food cling film market is projected to reach USD 46.3 billion by 2035.

The japan food cling film market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in japan food cling film market are material, polyethylene (pe), _low density polyethylene (ldpe), _linear low-density polyethylene (lldpe), _high density polyethylene (hdpe), polypropylene (pp), polyvinyl chloride (pvc) and polyvinylidene chloride (pvdc).

In terms of product, machine films segment to command 57.2% share in the japan food cling film market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Cling Film Market Analysis – Trends & Insights 2025-2035

Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Cling Film Industry

PVC Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

USA Cling Film Market Trends – Size, Demand & Growth 2025-2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

ASEAN Cling Film Market Growth – Trends & Industry Forecast 2025-2035

Germany Cling Film Market Report – Growth, Share & Forecast 2025-2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Multi-layer Film Recycling Market Size and Share Forecast Outlook 2025 to 2035

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Bio PET Film in Japan Size and Share Forecast Outlook 2025 to 2035

Oxygen Barrier Films And Coatings For Dry Food Market Size and Share Forecast Outlook 2025 to 2035

Demand for Food Grade Dipotassium Phosphate in Japan Size and Share Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Compostable Foodservice Packaging in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA