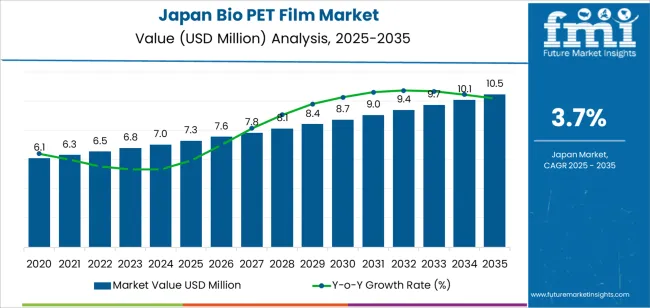

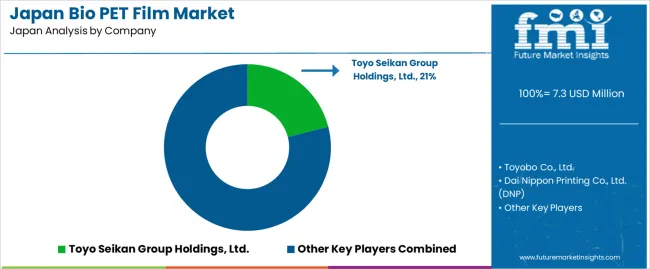

The Japan bio PET film demand is valued at USD 7.3 million in 2025 and is projected to reach USD 10.5 million by 2035, reflecting a CAGR of 3.7%. Demand is influenced by increased utilization of bio-based packaging materials, expanded sustainability commitments across consumer-goods sectors, and the introduction of low-carbon film alternatives in food, personal-care, and industrial applications. Rising compliance requirements related to recyclability and reduced environmental impact also contribute to adoption.

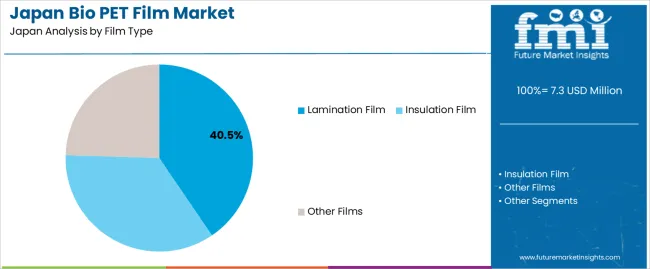

Lamination films lead the product landscape. These films are selected for barrier stability, clarity, printability, and suitability for multilayer packaging structures. Their use in flexible packaging, labels, and protective coatings supports continued preference, particularly among converters seeking bio-based alternatives to conventional PET. Improvements in mechanical strength, processing efficiency, and heat resistance further reinforce their application versatility.

Kyushu & Okinawa, Kanto, and Kinki represent the key utilization centers. These regions have a high concentration of packaging converters, printing companies, and food-processing industries that integrate bio-derived film solutions into established supply systems. Their infrastructure, logistics networks, and manufacturing bases support consistent procurement and deployment across diverse end-use categories. Key suppliers include Toyo Seikan Group Holdings, Ltd., Toyobo Co., Ltd., Dai Nippon Printing Co., Ltd. (DNP), Unitika Ltd., and Iwatani Corporation. These companies provide bio PET lamination films and specialty-grade variants used in packaging, industrial laminates, and environmentally focused product lines.

Peak-to-trough dynamics in Japan’s bio-PET-film segment show a measured and predictable progression without pronounced cyclical swings. The early period reflects a modest peak phase supported by gradual adoption of bio-based packaging materials across food, personal-care, and industrial applications. Demand rises as companies expand sustainable-packaging portfolios and integrate bio-derived films into pilot and small-batch production lines. This creates a steady initial lift, though not a steep escalation, as adoption remains selective.

A mild trough appears in the mid period when procurement patterns stabilize and users balance cost considerations with environmental targets. Bio-PET films face competition from conventional PET and other bio-based materials, which moderates the pace of transition. The trough remains shallow because regulatory pressure and corporate sustainability commitments sustain baseline demand even during periods of slower adoption.

Late-period performance reflects a renewed peak as more firms integrate bio-derived inputs into long-term packaging strategies. Incremental improvements in film performance, clarity, and processing compatibility increase suitability for wider applications, supporting a gradual rebound. The segment’s peak-to-trough structure therefore remains controlled, shaped by steady sustainability initiatives, measured industrial adoption, and incremental technological refinement across Japan’s packaging sector.

| Metric | Value |

|---|---|

| Japan Bio PET Film Sales Value (2025) | USD 7.3 million |

| Japan Bio PET Film Forecast Value (2035) | USD 10.5 million |

| Japan Bio PET Film Forecast CAGR (2025-2035) | 3.7% |

Demand for bio PET film in Japan is increasing because packaging producers, food processors and consumer-goods manufacturers seek materials with lower environmental impact while maintaining mechanical strength and clarity. Bio PET made from partially renewable feedstocks supports corporate ecofriendly targets and aligns with Japanese policies that encourage reduced reliance on fossil-based plastics. The material offers compatibility with existing PET processing and recycling streams, which allows converters and brand owners to adopt it without major equipment changes.

Growth in applications such as food trays, beverage labels, flexible packaging and personal-care containers reinforces stable demand across retail sectors. Interest in eco-labelled products among Japanese consumers further strengthens adoption. Constraints include higher production cost for bio PET compared with standard PET, variability in supply of renewable feedstocks and the need for certification to confirm bio-based content. Some converters postpone full transition until pricing consistency and long-term feedstock availability are clear.

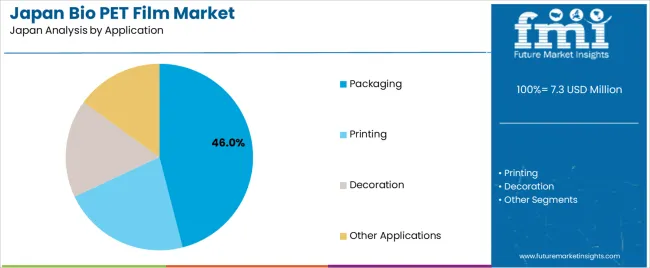

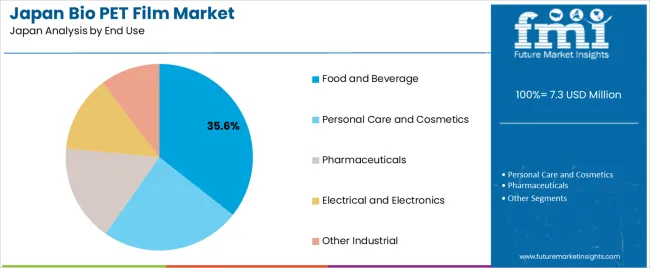

Demand for bio PET film in Japan reflects the use of plant-derived polyester films in packaging, lamination, printing, decorative applications, and specialized industrial processes. Film selection depends on durability, thermal properties, clarity, and suitability for contact with consumer goods or electronics. Application distribution shows how Japanese manufacturers incorporate bio-based films into flexible packaging and visual printing workflows. End-use patterns illustrate adoption across food, cosmetics, pharmaceuticals, and electronics where regulated materials and stable performance are required.

Lamination film holds 40.5% of national demand and represents the leading film type in Japan. It supports protective surface coating, document finishing, label reinforcement, and retail packaging that require durable and transparent coverage. Insulation film accounts for 35.0%, used widely in electrical and electronic settings where thermal resistance and dielectric properties are important. Other films represent 24.5%, covering speciality formats for printing, barriers, and decorative layers. Film-type distribution reflects Japan’s requirements for clarity, mechanical strength, and temperature stability across manufacturing workflows involving consumer goods, electronics, and packaging operations.

Key drivers and attributes:

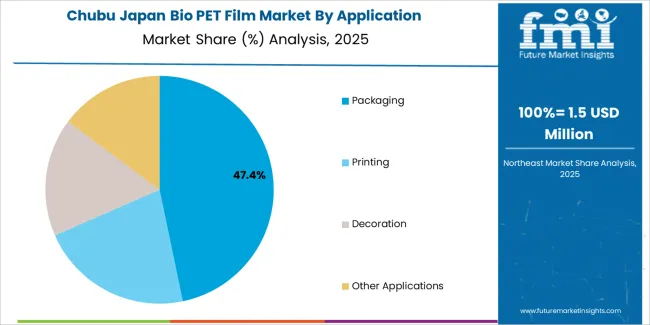

Packaging holds 46.0% of national demand and represents the leading application category for bio PET film in Japan. The material supports flexible pouches, wrappers, and product labels requiring transparency, mechanical durability, and food-contact suitability. Printing applications account for 22.0%, where consistent surface properties support ink adhesion and colour clarity. Decoration represents 17.0%, serving labels, interior elements, and design components requiring visual uniformity. Other applications hold 15.0%, spanning industrial wrapping, technical layers, and non-food packaging. Application distribution reflects Japan’s emphasis on high-quality packaging performance and the need for reliable bio-derived alternatives.

Key drivers and attributes:

Food and beverage holds 35.6% of national demand and represents the primary end-use category in Japan. Bio PET film supports packaging for snacks, ready meals, beverages, and dry goods that require clarity, barrier performance, and regulatory compliance. Personal care and cosmetics account for 24.1%, using film for labels, pouches, and protective layers in consumer products. Pharmaceuticals represent 16.8%, applying bio PET film in blister components, outer wraps, and stability-focused packaging. Electrical and electronics hold 13.2%, requiring insulation or protective layering. Other industrial uses account for 10.3%, supporting specialized manufacturing needs.

Key drivers and attributes:

Expansion of green packaging programs, growth of beverage and confectionery manufacturers using plant-based materials, and corporate compliance with Japan’s plastic-resource-circulation policies are driving demand.

In Japan, major food and beverage companies headquartered in Kanto and Kansai are increasing adoption of bio PET film to reduce dependence on petroleum-based packaging. Retailers and consumer-goods producers align procurement with the Plastic Resource Circulation Act, which encourages use of recyclable and biomass-derived materials. Confectionery, ready-to-drink tea and functional beverage manufacturers use bio PET film for labels and flexible packaging to meet internal sustainability metrics. Large supermarkets and convenience-store chains introduce more environmentally conscious private-label packaging, strengthening steady demand for bio PET film across national distribution networks.

Higher cost compared with standard PET, limited domestic biomass-processing scale and strict quality requirements restrain adoption.

Bio PET film commands a price premium due to the cost of biomass feedstocks and limited domestic processing capacity. Japan relies heavily on imported sugarcane-based intermediates, which increases exposure to global price fluctuations and constrains supply stability. Packaging producers must satisfy strict performance standards for heat resistance, transparency and printability, and some small manufacturers hesitate to switch formats without long-term assurance of consistent film performance. These factors slow broad transition from conventional PET to biomass-derived alternatives.

Shift toward high-clarity film for beverage labels, expansion of biomass-content certification programs and increased use in electronics and industrial packaging define key trends.

Japanese beverage producers are adopting high-clarity bio PET films for shrink-sleeve and wraparound labels to support recycling of PET bottles under local collection schemes. Certification systems for biomass content, used by many domestic brands to assure consumers of material authenticity, are expanding across packaging categories. Electronics and precision-component manufacturers in regions such as Nagano and Shizuoka are evaluating bio PET films for protective and anti-static packaging to reduce environmental impact without compromising technical requirements. These trends support gradual but stable growth of bio PET film utilization in Japan.

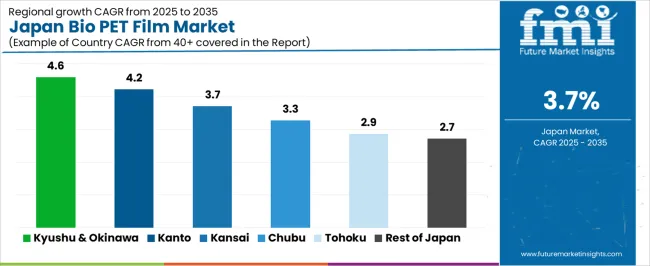

Demand for bio PET film in Japan is rising through 2035 as packaging manufacturers, food processors, electronics firms, and printing-service providers shift toward bio-based materials aligned with domestic ecofriendly policies. Bio PET film supports flexible packaging, label applications, thermoformed trays, electronics insulation, and protective films used across industrial and consumer sectors. Growth differences reflect regional manufacturing clusters, logistics networks, food-processing density, and adoption of bio-based packaging among local businesses. Kyushu & Okinawa leads at 4.6%, followed by Kanto (4.2%), Kinki (3.7%), Chubu (3.3%), Tohoku (2.9%), and Rest of Japan (2.7%). Demand is reinforced by waste-reduction policies, film-processing upgrades, and corporate procurement of green packaging materials.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 4.6% |

| Kanto | 4.2% |

| Kinki | 3.7% |

| Chubu | 3.3% |

| Tohoku | 2.9% |

| Rest of Japan | 2.7% |

Kyushu & Okinawa grows at 4.6% CAGR, supported by strong food-processing activity, expanding logistics networks, and regional adoption of bio-based flexible packaging across Fukuoka, Kumamoto, Kagoshima, Nagasaki, and Okinawa. Food companies in Fukuoka and Kagoshima use bio PET film for snack packaging, ready-meal trays, and sealed containers. Beverage producers rely on bio-based label films to meet environmental-compliance targets. Logistics and agricultural exporters increase use of protective bio PET wraps for produce transportation. Printing facilities in Kumamoto incorporate bio PET film for labels and specialty printing applications. Okinawa tourism-linked retailers adopt green packaging for confectionery and local goods.

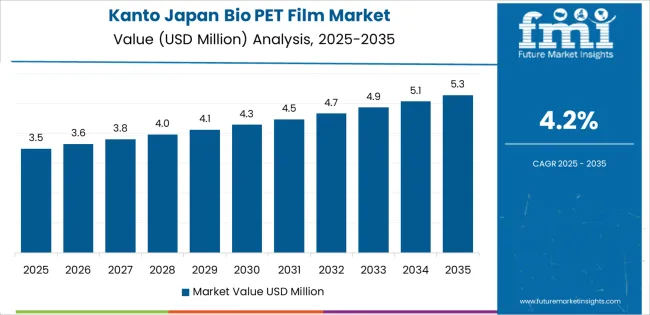

Kanto grows at 4.2% CAGR, driven by dense manufacturing activity, large retail distribution systems, and strong ecofriendly commitments across Tokyo, Kanagawa, Chiba, Saitama, and Ibaraki. Packaging companies in Tokyo and Kanagawa scale production using bio PET film for food, cosmetics, and household-goods applications. Retailers increase procurement of bio-based packaging aligned with corporate ecofriendly programs. Printing and labeling companies adopt bio PET substrates for product labels, thermal films, and multi-layer laminates. Electronics firms in Ibaraki and Saitama use durable bio PET films for device insulation and protective layers. Metropolitan municipalities reinforce recycling frameworks that encourage broader use of bio-based materials.

Kinki grows at 3.7% CAGR, supported by packaging converters, electronics manufacturers, and strong retail channels across Osaka, Kyoto, Hyogo, Nara, Wakayama, and Shiga. Packaging companies in Osaka and Hyogo incorporate bio PET film into food wrappers, label stock, and multi-layer barrier applications. Electronics firms adopt bio PET for insulation films used in small appliances and device components. Retailers expand shelf-ready packaging using bio-based films to comply with corporate waste-reduction standards. Kyoto’s printing and craft-product businesses adopt bio PET sheets for labeling, specialty printing, and transparent protective layers used in traditional-product packaging.

Chubu grows at 3.3% CAGR, shaped by automotive-materials demand, packaging conversion activity, and industrial film usage across Aichi, Shizuoka, Gifu, Mie, and Nagano. Automotive suppliers in Aichi use bio PET film for interior components, protective layers, and insulation sheets. Food processors in Shizuoka and Mie adopt bio-based films for snack and frozen-food packaging. Printing companies in Gifu integrate bio PET films into labels, decals, and flexible packaging laminates. Electronics and precision-manufacturing firms rely on bio PET protective films for component handling and storage. Regional ecofriendly programs reinforce adoption of bio-based materials across manufacturing sectors.

Tohoku grows at 2.9% CAGR, supported by food processing, agricultural exports, and steady industrial film usage across Miyagi, Aomori, Fukushima, Akita, Iwate, and Yamagata. Food-processing plants adopt bio PET film for frozen seafood packaging, ready-meal trays, and sealed convenience foods. Agricultural producers use bio-based wraps and label films for fruit and vegetable shipments. Printing firms adopt bio PET substrates for labeling and packaging decoration. Public ecofriendly programs encourage businesses to shift toward recyclable and bio-based packaging materials. Regional manufacturers use bio PET films for protective storage layers in industrial facilities.

Rest of Japan grows at 2.7% CAGR, supported by smaller packaging companies, regional retail channels, agricultural producers, and community-level ecofriendly initiatives. Local food processors rely on bio PET film for basic flexible packaging and pouch applications. Agricultural cooperatives use bio-based label films for produce shipments. Printing companies supply bio PET labels for small manufacturers and retailers. Regional municipalities promote adoption of bio-based packaging through waste-reduction targets. Industrial facilities use bio PET film for protective coverings, storage layers, and handling sheets across smaller manufacturing clusters.

Demand for bio-PET film in Japan is shaped by domestic packaging, materials, and conversion companies with established production capacity and long-term supply relationships across food, beverage, industrial, and consumer-goods applications. Toyo Seikan Group Holdings, Ltd. holds an estimated 21.0% share, supported by controlled polymer-processing capability, consistent film-orientation quality, and reliable supply to major Japanese beverage and packaging manufacturers. Its position is reinforced by verifiable integration with bottling, flexible-packaging, and ecofriendly -driven material programmes.

Toyobo Co., Ltd. maintains strong participation through bio-derived polyester films engineered for stable mechanical strength, consistent clarity, and dependable heat-resistance behaviour. These films are widely adopted in food packaging and industrial laminations requiring predictable processing performance. Dai Nippon Printing Co., Ltd. (DNP) contributes significant capacity as a major converter, supplying bio-PET films with controlled barrier properties and verified suitability for multilayer packaging, printed laminates, and high-volume consumer products.

Unitika Ltd. supports domestic demand through polyester-based films offering reliable dimensional stability and consistent converting characteristics used in industrial packaging and speciality applications. Iwatani Corporation adds depth through its role in distributing and supplying bio-origin materials and film products, supporting downstream converters and brand owners seeking renewable-content solutions.

Competition across this segment centres on film orientation quality, barrier stability, thermal resistance, renewable-content verification, processability in converting lines, and reliable domestic distribution. Demand continues to rise as Japanese manufacturers adopt bio-derived polyester films to support decarbonisation goals and ensure consistent performance across food, beverage, and industrial packaging applications.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Film Type | Lamination Film, Insulation Film, Other Films |

| Application | Packaging, Printing, Decoration, Other Applications |

| End Use | Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Electrical and Electronics, Other Industrial |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Toyo Seikan Group Holdings, Ltd., Toyobo Co., Ltd., Dai Nippon Printing Co., Ltd. (DNP), Unitika Ltd., Iwatani Corporation |

| Additional Attributes | Dollar sales by film type, application category, and end-use industry; regional consumption patterns across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of bio-based PET film manufacturers and converters; analysis of bio-based feedstock adoption, recyclability improvements, and regulatory incentives for green packaging; integration with food packaging supply chains, electronics insulation materials, flexible printing substrates, and cosmetic/pharmaceutical packaging innovations in Japan. |

The demand for bio PET film in japan is estimated to be valued at USD 7.3 million in 2025.

The market size for the bio PET film in japan is projected to reach USD 10.5 million by 2035.

The demand for bio PET film in japan is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in bio PET film in japan are lamination film, insulation film and other films.

In terms of application, packaging segment is expected to command 46.0% share in the bio PET film in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio PET Film Market Size, Share & Forecast 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

APET Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Bio-Plasticizers Market Analysis – Size, Share & Forecast 2025-2035

Japan PET Preform Market Trends – Size, Share & Forecast 2025-2035

Pet Prebiotics Market Analysis - Size, Growth, and Forecast 2025 to 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

Japan 3D Bioprinted Human Tissue Market Trends – Demand & Innovations 2025-2035

Biopolymer Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Cling Film Market Analysis – Trends & Insights 2025-2035

Synbiotic Pet Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Anti-biofilm Wound Dressing Market - Demand & Innovations 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Overview of Key Trends Shaping Postbiotic Pet Food Industry.

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

BOPET Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA