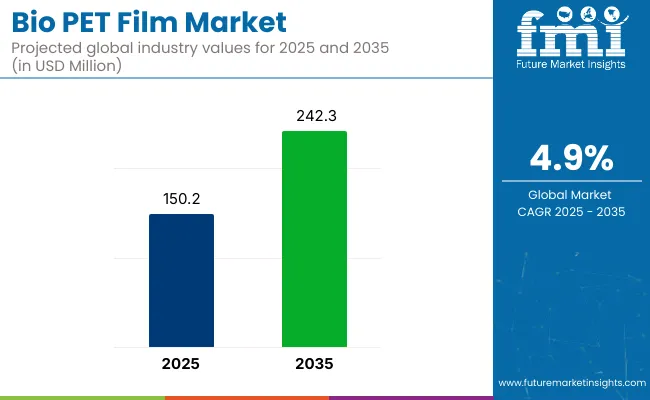

The Bio PET film market is projected to grow from USD 150.2 million in 2025 to USD 242.3 million by 2035, registering a CAGR of 4.9% during the forecast period. Sales in 2024 reached USD 143.1 million, driven by increased demand for sustainable, lightweight alternatives to petroleum-based films.

| Attributes | Description |

|---|---|

| Estimated Market Size (2025E) | USD 150.2 million |

| Projected Market Value (2035F) | USD 242.3 million |

| Value-based CAGR (2025 to 2035) | 4.9% |

Bio PET films have gained preference in food packaging, labels, and thermoformed containers due to their excellent clarity, tensile strength, and recyclability. As manufacturers across India and global markets push toward bio-based solutions, this segment is being recognized for its dual advantage of carbon footprint reduction and functional performance in multilayer structures.

In February 2024, Mylar Specialty Films, a leader in the production of differentiated polyester films, unveiled its global rebranding initiative highlighted by a change in name from DuPont Teijin Films to Mylar Specialty Films. ”Proudly building on our 70-years of producing Mylar® polyester films, this rebranding is a salute to our history as well as signals our continued commitment to innovation and leadership in the market,” said Steve Gendreau, CEO of Mylar Speciality Films. “Mylar Specialty Films is poised to not only meet the evolving needs of our industry, but to also anticipate them and set industry standards with our commitment to excellence and to our customers worldwide.”

Investments in sugarcane-derived MEG and renewable PTA have enabled Bio PET films to meet increasingly stringent sustainable packaging objectives. More brands are turning to bio-PET-based films, drawn by their compatibility with current recycling infrastructures and the minimal costs required to make the switch from traditional materials.

Advances in co-extrusion and metallization technologies have significantly enhanced the barrier properties of these films, all while maintaining their recyclability. Such sustainable innovations are being widely adopted by both multinational FMCG companies and local packaging converters, who are responding to evolving regulatory requirements and the growing trend toward material substitution in the packaging industry.

With increasing emphasis on material transparency, biodegradability, and carbon footprint reduction, the Bio PET film market is poised to experience significant growth among exporters, eco-conscious brands, and institutional buyers. Notable opportunities are emerging in applications such as flexible laminates, heat-sealable films, and pharmaceutical overwraps, as industries seek sustainable alternatives for diverse packaging needs.

As regulatory requirements become more stringent and green procurement practices become more widespread, the competitive landscape will increasingly center on the ability to scale production cost-effectively and establish robust partnerships for sourcing regional bio-based feedstock’s.

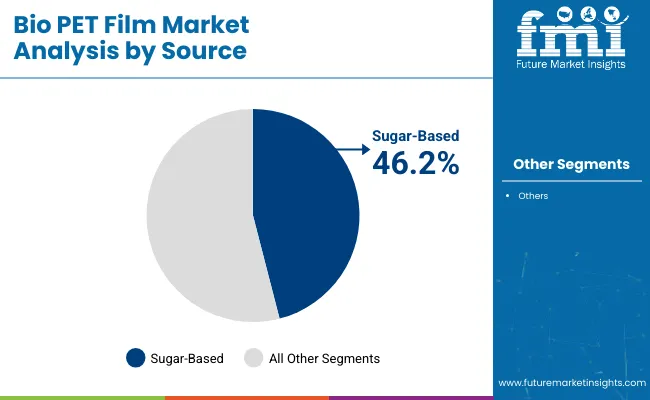

The market is segmented based on source, thickness, packaging application, end use, and region. By source, the segmentation includes sugar-based, corn-based, cellulose-based, and mixed-source, with corn-based variants favored for cost-efficiency and compatibility with biodegradable packaging standards.

Thickness categories span less than 30 microns, 30-90 microns, and more than 90 microns, each tailored to different strength and barrier property requirements. Packaging applications include trays, clamshell packaging, bottles and containers, pouches, bags, blister packaging, and seed bags, with pouches and clamshells being widely used across retail and food sectors.

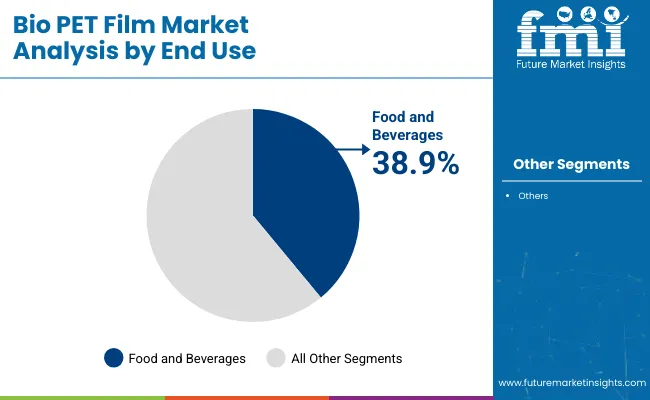

End-use industries comprise food & beverages, cosmetics & personal care, pharmaceuticals, consumer goods, industrial goods, electrical & electronics, and others driven by regulatory push for sustainable packaging. Regionally, the market spans North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and Middle East & Africa.

Sugar-based Bio PET films are projected to account for approximately 46.2% of the global market share by 2025. These films have been produced using bio-ethanol derived from sugarcane or sugar beet, offering a renewable and cost-effective alternative to petroleum-based polymers. Favorable agricultural output and established fermentation processes have supported stable sourcing and scalability.

High optical clarity, thermal resistance, and barrier properties have made sugar-based variants suitable for diverse packaging applications. Global packaging converters have favored sugar-based Bio PET due to ease of integration with existing PET production lines. These films have been deployed in flexible laminates, thermoforming applications, and high-speed labeling operations.

Regulatory support and sustainability goals have driven increased usage across regions including Europe, Asia-Pacific, and South America. Strong brand positioning by beverage giants using sugarcane-derived packaging has boosted commercial awareness.

Sugar-based Bio PET films have demonstrated strong compatibility with recycling streams, supporting circular economy initiatives. Their performance parity with conventional PET films has enabled seamless adoption without requiring changes to machinery or ink systems. Market players have expanded sugarcane-based production capacity in Brazil and Thailand to meet rising demand.

Applications in shrink sleeves, blister packaging, and film lids have further accelerated their usage. Growth in FMCG packaging, along with pressure to reduce carbon emissions, has sustained sugar-based Bio PET's market dominance. Partnerships between raw material producers and film manufacturers have been formed to stabilize supply and pricing.

Transparent sourcing and life-cycle assessments have reinforced credibility with end-use industries. As sustainability disclosure becomes mandatory, sugar-derived PET is expected to gain further traction in global procurement strategies.

The food & beverages industry is expected to hold a commanding 38.9% share of the Bio PET film market by 2025. Bio PET films have been widely utilized for flexible food pouches, beverage labels, lids, and container wraps due to their strength, clarity, and gas barrier properties. Major food processors and beverage bottlers have adopted these films to align with green packaging goals and reduce fossil-fuel reliance.

Visual appeal and protective features have supported usage across refrigerated, frozen, and ambient products. Brand owners have selected Bio PET films for their compatibility with high-resolution printing and complex graphics. This has enabled premium branding for snacks, ready-to-drink beverages, and nutritional products. The films' transparency and gloss have enhanced shelf visibility while maintaining freshness. Integration into multi-layer laminates has extended shelf life for perishable food items.

Global beverage corporations and packaged food leaders have initiated voluntary commitments to shift toward 100% recyclable or bio-based packaging. As a result, Bio PET films have become integral in eco-labeling and marketing sustainability. Applications in bottled water labels, yogurt cup lids, and fresh produce packs have increased substantially. Bio PET’s heat-sealing properties and machinability have supported broad industrial-scale deployment.

Increased demand for bio-based solutions across quick-service restaurants, meal kits, and food delivery platforms has strengthened Bio PET's role. Retail chains have launched private-label products with bio-based packaging to attract environmentally conscious consumers. Regulations on plastic use and single-use packaging have further incentivized industry-wide transition to alternatives like Bio PET. Continued focus on carbon footprint reduction is expected to sustain high demand from the food and beverages sector.

| Key Drivers | Key Restraints |

|---|---|

| Rising Consumer Demand for Sustainable Packaging | High Production Costs of Bio PET Films |

| Advancements in Bio-based Material Technology | Limited Availability of Raw Materials |

| Government Regulations Promoting Sustainability | Slow Adoption in Certain Industries |

| Increasing Investment in Recycling Technologies | Challenges in Bio PET Film Recycling |

| Growing Preference for Bio plastics Across Industries | Complexity in Bio plastic Manufacturing |

Impact Assessment of Key Drivers

| Key Drivers | Imapct Level |

|---|---|

| Rising Consumer Demand for Eco-friendly Packaging | High |

| Advancements in Manufacturing Technologies | Medium |

| Government Regulations Promoting Sustainability | High |

| Growing Preference for Bio plastics Across Industries | Medium |

| Increase in Recycling Technologies | High |

| Key Restraints | Impact Level |

|---|---|

| High Production Costs of Bio PET Films | High |

| Limited Availability of Raw Materials | Medium |

| Slow Adoption in Industries | Medium |

| Challenges in Recycling Bio PET Films | Low |

| Complexity in Bio plastic Manufacturing | Medium |

The overall revenues in the bio PET film industry in the USA is expected to grow at a rate of 3.4% per year until 2025. This is because more people want eco-friendly packaging options. With regulations on plastic waste becoming stricter and consumers becoming increasingly aware, industries ranging from food, beverages, and pharmaceuticals are switching to bio-based alternatives.

Such investments by the country for enhanced bio PET production and functionality for research and development will drive the growth of the industry further. The USA will maintain its dominance in the production capacity and consumption of bio PET films as companies take action toward their eco-friendly objectives.

In 2025 Canada is anticipated to witness a steady growth for the bio PET film industry, driven by growing consumer demand for sustainable packaging products. Growing environmental awareness and the Canadian government's regulations to address plastic waste will drive the industry's growth.

We expect the food and beverage packaging, cosmetics, and personal care products industries to create demand for bio PET films. Canada’s industry will continue to grow steadily due to the robust government support for biodegradable materials and the growing adoption of bio-based alternatives that cater to eco-conscious consumers and industries aimed at achieving long-term carbon reduction.

The UK bio PET film industry is estimated to come to a 4.5% annual growth rate until 2025 due to mounting regulatory pressure to cut down plastic waste. With going green at the forefront of industrial transformation, all the industries, most importantly, food and beverages, are rushing to shift towards eco-friendly packaging materials.

Increased technological innovations in bio PET production are also creating films with better performance for various applications. The UK will also remain an important player in Europe’s transition toward more sustainable packaging solutions.

Bio PET film industry in France, as sales and production activities were significantly affected due to pandemic-related restrictions in place during the forecast period. France has a strong commitment to reducing plastic waste and proactive policies to ensure environmental sustainability, which is expected to fuel the adoption of bio-PET films.

With growing consumer awareness about eco-friendly products, brands are becoming more interested in packaging solutions that minimize environmental footprint. The country is investing in advancements in bio PET production technology and is focused on meeting regulatory guidelines, which will continue to drive the industry in the country.

By 2025, we expect the German bio PET film industry to grow at a rate of 2.8% in terms of revenue and volume. Germany's strict policies regarding sustainability and recycling support the trend toward higher adoption of bio-PET films across food, beverages, and pharmaceuticals. Consumer preferences for biodegradable and recyclable materials will fuel demand for eco-friendly packaging.

Moreover, government support for decreasing plastic waste and encouraging sustainable packaging will drive firms to invest in bio-PET film production. Germany shall continue to lead the industry of bioplastics as a pioneer in eco-innovation.

The bio PET film industry in South Korea is expected to grow steadily through 2025, driven by increasing environmental concerns among consumers and industries. The South Korean industry is rapidly expanding, adding numerous processes to reduce plastic waste, which significantly contributes to the growth of the bio PET films industry.

The food and beverage industry will play a key role since it is transitioning toward sustainable packaging options. Government policies supporting biodegradable materials and the drive towards greener manufacturing technologies will boost the adoption of bio PET films and make South Korea a leading bio PET film sector in the Asia-Pacific region.

The Japanese bio PET film industry is estimated to reach a CAGR of 3.7% until 2025. The bio PET film market in Japan is driven by increasing efforts toward environmental sustainability and consumer demand for bio-based packaging solutions.

The growing scope of bio PET films, with companies integrating sustainable packaging materials in their manufacturing processes in industries such as food and beverages, construction, and cosmetics, will cause the demand for bio PET films to grow rapidly.

Established manufacturing capabilities and technological proficiency in bio PET production are likely to boost the industry in Japan. The regulatory support from the government and consumer preference will contribute to the industry's growth in biodegradable materials in the country.

It is anticipated that China, as a fast-growing market, is expected to reach a bio PET film industry valuation of approximately USD 4.94 billion by 2025, with a growth rate of 6.1%. The stringency of environmental regulations in China is increasing as people pay more attention to environmental issues, and the impact of sustainability is driving the adoption of bio-based materials.

Bio PET films are widely used in end-user industries comprising food & beverage packaging, pharmaceuticals, and personal care products. Government regulations promoting the use of biodegradable and partially recyclable materials will support the growing demand for bio PET films.

China already has a lot of production capacity, and the current push for sustainable alternatives will help cement its role as a big player in the global bio PET industry.

The bio PET film industry in India is anticipated to grow rapidly through 2025 owing to rising environmental awareness and government initiatives for the reduction of plastic waste. In India, the industry for bio PET films is anticipated to grow strongly, especially due to the higher demand from areas like food and beverages, pharmaceuticals, and personal care.

As consumer demand for sustainable packaging increases, Indian manufacturers are gradually transitioning to bio-based alternatives. Government incentives and the adoption of more sustainable production methods will further drive the industry growth. With the Indian industry rapidly moving toward eco-consciousness, the bio PET film sector is set to thrive.

The industry's highly consolidated nature means that the top few companies account for approximately 90% of the bio-PET film industry. The industry plays a central role because they can scale production, invest heavily in research and development, and implement cutting-edge technology.

However, with a focus on sustainable, eco-friendly solutions, they will continue to be at the forefront of meeting the growing demand for bio-PET films across various sectors.

Covering a smaller section of the industry, small players and regional manufacturers cater to niche regional applications. But they struggle to compete against larger companies because they cannot afford to fund production capacity.

Such funding remains crucial for commercializing innovations, particularly those such as biodegradable films and custom applications. The growing demand for greener solutions should allow new entrants to carve out stakes despite the industry's concentration.

The trends may not be as pronounced in small and regional manufacturers, who continue to make up a smaller segment of the landscape, but they still hold an outsized share of the industry's trends. A major step forward was Terphane's announcement that it would be working with Origin Materials. Its objective is to design and commercialize high-performance bio-polymer films, cementing the industry's commitment to sustainable technology.

In 2024, Hyundai has introduced the all-electric IONIQ 6, featuring an interior made with sustainable materials, highlighting the automotive industry's growing interest in bio-PET films.

However, monitoring of bio-PET usage has so far only focused on packaged goods, meaning that other applications that also use the material will be observed too, which will speak of a positive outlook for various kinds of sustainable materials.

Geography divides the Global Bio PET Film Industry into five districts: North America, Europe, Asia Pacific, Middle East and Africa, and South America. The bio PET film industry, unlike some of the more consolidated segments, has a myriad of companies involved in bio PET film, from the more traditional plastic manufacturers to innovative new entrants concentrating on sustainable alternatives.

Some players dominate the industry, but there are also smaller companies and newer entrants, which help keep it fragmented.

Several factors contribute to the fragmentation. While the cost of entry is substantial, it is lower than in more technology- or capital-intensive sectors. This has opened up opportunities for smaller companies and start-ups to enter the industry, particularly with the increasing trend toward sustainable and eco-friendly packaging solutions.

The relatively low barrier for producing bio-based PET films from natural resources also makes it easy for smaller players to enter and focus on niche segments.

But with the need for technology and expertise, consolidation is inevitable, just happening slowly. Developing high-quality bio-PET films requires substantial R&D investment, bioplastics expertise, and manufacturing capabilities.

In the coming years and scale production will be well-positioned in this industry for the next years to come. More consolidation may happen because bigger companies are better able to deal with regulations and get the money they need to grow. This is because regulations are pushing for more sustainable solutions and eco-friendly packaging is becoming more and more important.

This steady growth is driven by increasing adoption in sustainable packaging, regulatory support, and technological advancements in bio-based materials. Industries such as food packaging, pharmaceuticals, and consumer goods are expected to contribute significantly to the rising demand for bio PET films in 2025.

Bio PET films are a sustainable alternative made from renewable resources and help reduce plastic waste and carbon footprints.

Bio PET films are used in packaging, textiles, automotive, consumer goods, and electronics for their versatility and environmental benefits.

The demand for sustainable packaging solutions and stricter regulations on plastic waste are key growth drivers for bio PET films.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Biopsy Device Market Forecast and Outlook 2025 to 2035

Bio-wax Market Forecast and Outlook 2025 to 2035

Bioliquid Heat and Power Generation Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Solutions Market Size and Share Forecast Outlook 2025 to 2035

Biocement Market Size and Share Forecast Outlook 2025 to 2035

Biomedical Refrigerator and Freezer Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bionic Glove's Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Insulated Panel Market Size and Share Forecast Outlook 2025 to 2035

Biopotential Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biomaterial Tester Market Size and Share Forecast Outlook 2025 to 2035

Biocompatible Materials Market Size and Share Forecast Outlook 2025 to 2035

Bio Based Paraxylene Market Size and Share Forecast Outlook 2025 to 2035

Biomass Pellets Market Size and Share Forecast Outlook 2025 to 2035

Biosimilar Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA