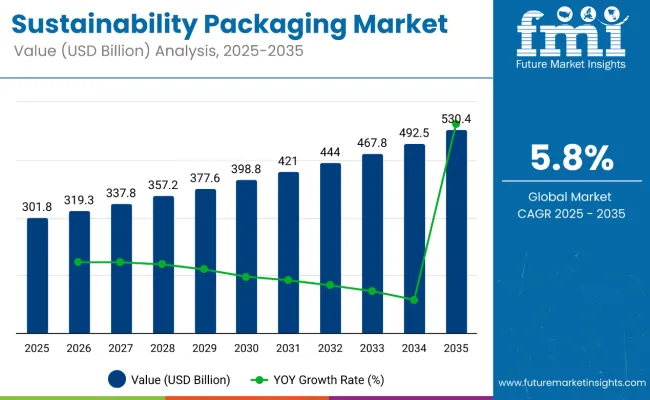

The sustainable packaging market is projected to grow from USD 301.8 billion in 2025 to USD 530.4 billion by 2035, registering a CAGR of 5.8% during the forecast period. Sales in 2024 reached USD 285.2 billion. Market expansion has been fueled by heightened consumer awareness, ESG-led procurement policies, and demand for recyclable, compostable, and bio-based materials.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 301.8 Billion |

| Industry Value (2035F) | USD 530.4 Billion |

| CAGR (2025 to 2035) | 5.8% |

Brand owners across the food & beverage, personal care, and e-commerce sectors have increased the adoption of recyclable mono-materials and minimalistic packaging formats. Smart packaging and digital printing have also been integrated to improve sustainability scores and brand traceability.

In April 2025, Ranpak Holdings Corp, a global leader in sustainable packaging automation technology and solutions, today announced the integration of PaperWrap, an innovative solution that replaces traditional plastic stretch film for pallet wrapping, to its portfolio. The partnership between Ranpak and PaperWrap will offer more sustainable and efficient approach to securing goods for transportation. “At Ranpak, sustainability is at the core of everything we do,” said Omar Asali, Chairman and CEO of Ranpak.

“This new partnership with PaperWrap represents a significant milestone as we continue to evaluate the most sustainable materials possible and deliver resources that will help businesses transition away from single-use plastics. Together, we are driving the future of sustainable packaging and creating a positive impact for generations to come.

Sustainability efforts in this market have been catalyzed by regulatory enforcement and retailer mandates favoring non-toxic, compostable, and recyclable formats. Investments have been directed into bioplastics, molded fiber, and paper-based laminates that meet certifications such as ASTM D6400 and EN 13432.

Rapid innovation in barrier coatings, including PVOH and water-based solutions, has enabled food packaging manufacturers to reduce dependency on multilayer plastics. Across Asia and Europe, eco-labeling and carbon impact disclosures have gained traction, pushing brands to improve packaging transparency.

The sustainable packaging demand is anticipated to grow over the next decade, driven by the ongoing expansion of various end-use industries and the increasing emphasis on sustainable packaging solutions. The market's trajectory suggests a steady rise in demand for innovative, eco-friendly packaging that caters to both consumer preferences and regulatory requirements.

Companies investing in research and development to create durable, cost-effective, and environmentally friendly packaging are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the sustainable packaging market.

Governments around the world are introducing and strengthening regulations to promote sustainable packaging practices and reduce the environmental impact of plastic and other non-biodegradable materials. These regulations are influencing how manufacturers design, source, and dispose of packaging materials, pushing the market toward eco-friendly alternatives such as recyclable, compostable, and biodegradable packaging.

The global trade of sustainable packaging materials is rapidly growing, driven by increasing environmental awareness, regulatory pressure, and rising demand for eco-friendly alternatives across industries such as food and beverage, cosmetics, healthcare, and e-commerce. As countries shift toward circular economy practices, international trade flows are evolving to support the exchange of recyclable, biodegradable, and compostable packaging solutions.

The below table presents the expected CAGR for the global sustainable packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 5.7% |

| H2(2024 to 2034) | 5.9% |

| H1(2025 to2035) | 4.8% |

| H2(2025 to2035) | 6.8% |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.7%, followed by a slightly higher growth rate of 5.9% in the second half (H2) of the same decade.

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.8% in the first half and remain relatively moderate at 6.8% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 90 BPS.

The market is segmented based on material type, packaging format, process type, end-use industry, and region. By material type, the market includes paper & paperboard, bioplastics, recycled plastics, glass, aluminum, and plant-based fibers. In terms of packaging format, the market is categorized into boxes & cartons, pouches & sachets, bottles & jars, trays & clamshells, wraps & films, and bags & sacks.

By process type, the market comprises recyclable packaging, compostable packaging, biodegradable packaging, reusable/refillable packaging, and upcycled packaging. In terms of end-use industry, the market includes food & beverage, personal care & cosmetics, pharmaceuticals, consumer electronics, household products, and e-commerce & retail. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

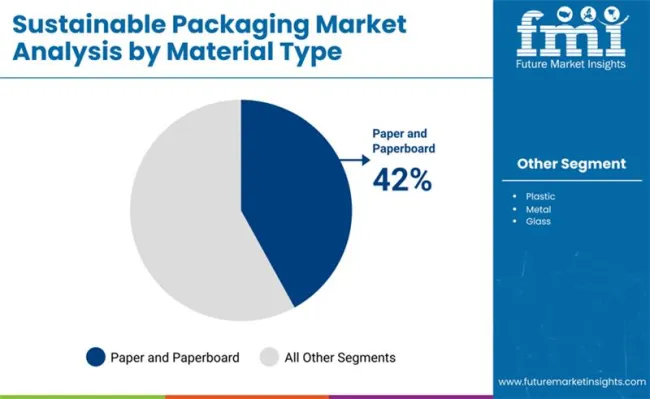

Paper and paperboard materials have been projected to dominate the sustainable packaging market with a 42% share in 2025, supported by their high recyclability and consumer preference for biodegradable formats. These materials have been utilized across multiple packaging applications due to their flexibility, cost-effectiveness, and minimal environmental impact.

They have been increasingly adopted by FMCG brands to reduce plastic dependency and meet environmental compliance targets. Regulatory backing for fiber-based alternatives has further accelerated their integration into packaging supply chains. Packaging companies have adopted FSC-certified and PEFC-certified paper sources to enhance sustainability claims.

Coatings made from water-based or compostable polymers have been applied to paperboard to improve barrier properties while maintaining eco-certifications. Light weighting and high-strength corrugated grades have been used to improve durability in transit. Several retailers have mandated paper-based outer packaging to simplify recycling at the consumer level.

Customization and branding have been enabled through improved printability and digital finishing on paperboard substrates. High-definition graphics and tactile finishes have supported premium product positioning. Easy folding, nesting, and stacking features have enhanced operational efficiency in warehousing and display.

Retail-ready formats have been optimized to reduce labor and handling costs in supply chains. Foodservice operators and e-commerce platforms have transitioned to molded fiber and rigid paperboard containers to reduce landfill waste. Government bans on expanded polystyrene and single-use plastics have driven conversions to compostable paperboard packaging. Zero-waste retail models have adopted paperboard containers for bulk and refillable packaging systems. Paper & paperboard have continued to lead sustainable material innovation through recyclability, design flexibility, and lower carbon footprints.

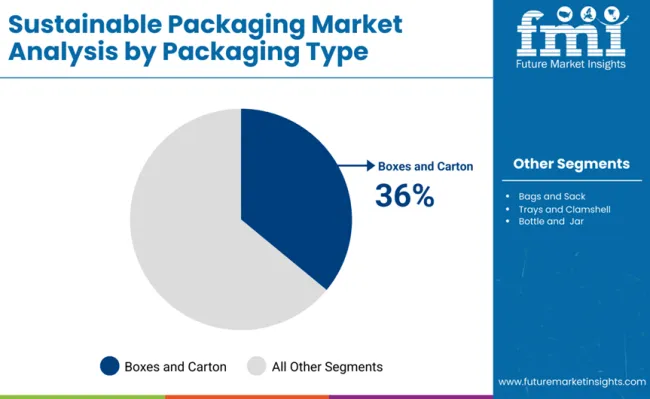

Boxes and cartons have been expected to capture 36% of the sustainable packaging market in 2025, driven by their structural integrity, branding surface area, and compatibility with recycled and renewable materials. These formats have been used extensively across food, cosmetic, pharmaceutical, and e-commerce applications due to their scalability and product protection. Corrugated and folding cartons have provided stacking strength and crush resistance for secondary and tertiary packaging.

Retailers have relied on printed cartons to elevate unboxing experiences and deliver messaging around sustainability. Advances in digital printing and die-cutting have enabled personalized and short-run packaging solutions. Carton board substrates with compostable linings or plastic-free coatings have gained traction for ready-to-eat meals and perishables. Nested packaging formats have been optimized for storage and transport efficiency. Tamper-evident closures and locking mechanisms have been incorporated to address regulatory requirements.

Several multinational brands have pledged to use only recyclable, reusable, or compostable cartons by 2030, spurring demand across global markets. Packaging vendors have invested in automation systems tailored to folding carton production for high-volume runs. Cartons made from post-consumer recycled content have achieved compliance with food-grade standards in key jurisdictions.

Box-in-box systems and paper-based inserts have reduced the need for non-renewable internal fillers. Sustainability certifications such as FSC and Carbon Neutral have been commonly displayed on carton packaging to align with ethical sourcing initiatives.

Cartons have offered superior product-to-package ratios, reducing material use without compromising protection. The format’s adaptability to shelf-ready and e-commerce channels has maintained its dominance in high-growth sectors. As regulations around packaging waste tighten, boxes & cartons have remained the most scalable and visible format for sustainable packaging adoption.

The market for sustainable packaging is in a sweet position with an impetus through growing consumer awareness on environmental issues and waste reduction. Consumers are seeking environmentally friendly, biodegradable, and recyclable packaging materials which are compelling businesses to turn to sustainable materials including paper, plant-based plastics, and compostable films.issues raised by plastic waste and land-filled trash have compelled producers toward adopting minimalist, reusable, and carbon-neutral packaging in their efforts to keep pace with their consumer demands and corporate sustainability agendas.

The rise of green consumerism compelled these big food & beverage, personal care, and e-commerce companies to invest heavily into alternatives that are plastic-free or recyclable. The social media campaign against single-use plastics has also placed pressure on businesses to adopt sustainable packaging practices. With increasingly environmentally aware consumer behavior becoming mainstream, need for innovative, eco-friendly packaging solutions will probably become a driving force for fast growth in the market.

Governments from around the world are implementing harsh rules and plastics prohibition worldwide against packaging waste and greenhouse emissions that restrict the environment; therefore, sustainable packaging continues to develop at an accelerated speed.

Certain worldwide policies such as EU Green Deal, Extended Producer Responsibility (EPR), and USA Plastic Waste Reduction Act pursue enforcing companies to opt for the biodegradable, recyclable, and reusable package material. Tax credits to green packaging or a penalty on excessive use of plastics has been implemented in the majority of countries, hence forcing companies to shift to new packaging norms.

Therefore, with increasing need for more environmentally friendly packaging materials perpetually in the aftermath of business compliance and governmental incentives, this will be increasing steadily around the world.

The biggest challenge of sustainable packaging is high expense and increased cost of production of green material and process. Green alternatives to Styrofoam and plastic such as bioplastics, recycled paper packaging, or compostable films are very expensive taking into consideration factors that affect availability of raw materials, high production processes, and low volume of production.

Large companies, however, can afford to absorb these expenses while their comparatively smaller counterparts may struggle to justify this cost. Unless costs are minimized through economies of scale, material innovation, or government subsidies, the cost mark of sustainable packaging solutions will discourage their mass adoption in most instances, particularly in emerging markets.

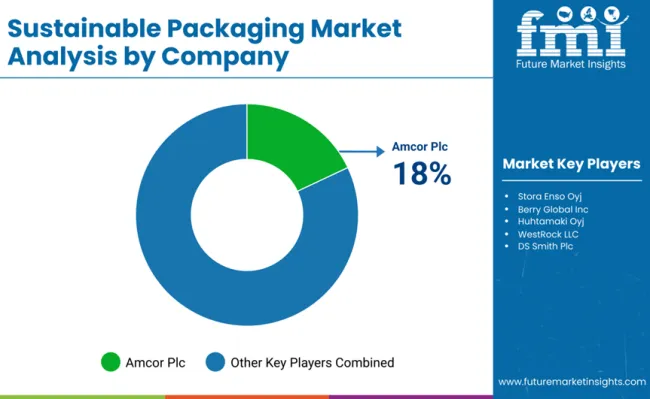

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 includeAmcor Plc, Stora Enso Oyj, Berry Global Inc., Huhtamaki Oyj, WestRock LLC, DS Smith Plc.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in tier 2 includeThe Mondi Group plc, International Paper Company, Detmold Group, Sealed Air Corporation, Dart Container Corporation, Duni AB, Vegware Ltd., Pactiv LLC, RKW Group, Novolex Holdings, Inc.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach.Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

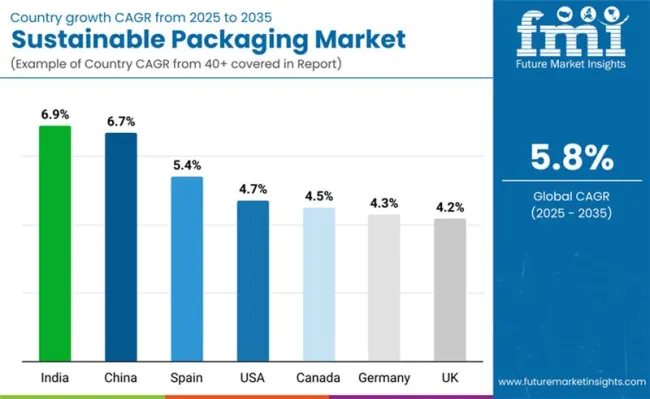

The section below covers the future forecast for the sustainable packaging marketin terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 4.7% through 2035. In Europe, Spainis projected to witness a CAGR of 5.4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

| Germany | 4.3% |

| China | 6.7% |

| UK | 4.2% |

| Spain | 5.4% |

| India | 6.9% |

| Canada | 4.5% |

In the United States, e-commerce expansion and need for eco-friendly shipping options are the most significant growth drivers of the sustainable packaging market. The higher the expansion of Amazon, Walmart, and Shopify-based businesses, the more there is a need for packaging that is environmentally friendly, lightweight, and recyclable.

Conventional plastic packaging is being substituted more and more with commercially available biodegradable fillers, recycled cardboard boxes, and water-based ink printing for waste reduction. In addition, the demand for plastic-free bare minimum packaging has evolved as a strong marketing strategy for firms trading in plant-based and compostable substitutes.

The legislative actions in America, including a state-wide prohibition of plastic bags and business commitments to sustainability, are therefore being employed to drive the circular economy of packaging. Big businesses are instead investing in new technologies such as edible packaging, refillable packs, and dissolvable films as strategies for sustainability. With green shopping habits and online shopping expansion in the USA, demand for sustainable, long-lasting, and biodegradable packaging material will increase.

Germany boasts some of the world's highest recycling rates, and businesses are thus encouraged to use sustainable materials such as FSC-certified paper, compostable bioplastics, and mono-materials that can be readily recycled. Moreover, German consumers are most eco-conscious and prefer brands with packaging that assures plastic-free and minimalist in content.

Refillable packaging systems, zero-packaging, and plant-based film applications in practice align with government policy and consumer demand in their food, cosmetic, and retail sectors. With increasing demand for sustainable and circular packaging solutions across industries amid Germany's steady advancements in green packaging, the trend must persist.

The Sustainable Packaging Market is experiencing rapid growth due to increasing consumer awareness, stringent environmental regulations, and corporate sustainability initiatives. Businesses across industries such as food & beverages, personal care, pharmaceuticals, and e-commerce are transitioning to biodegradable, recyclable, and reusable packaging solutions.

The demand is driven by government policies banning single-use plastics, rising adoption of circular economy practices, and advancements in eco-friendly materials like bioplastics and compostable films.

Companies are innovating with minimalist designs, lightweight materials, and plant-based alternatives to reduce carbon footprints. However, challenges such as higher production costs, limited raw material availability, and recyclability concerns remain key hurdles for widespread adoption.

| Report Attributes | Details |

|---|---|

| Market Size (2024) | USD 285.3 billion |

| Current Total Market Size (2025) | USD 301.8 billion |

| Projected Market Size (2035) | USD 530.4 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million tons for volume |

| Material Types Analyzed (Segment 1) | Paper and Paperboard (Coated Unbleached, Bleached Paperboard, Molded Fiber Pulp, Kraft Paper, Corrugated Board/Boxboard), Plastic (PLA, PBS, PHAs, Starch-based, PVA, PVOH, PBAT), Metal (Steel, Aluminum), Glass, Fabric, Wood, Others |

| Packaging Types Analyzed (Segment 2) | Bags and Sacks, Trays and Clamshells, Cartons and Boxes, Cans, Bottles and Jars, Films and Wraps, Pouches and Sachets, Drums, Intermediate Bulk Containers (IBC), Vials and Ampoules, Tapes and Labels, Others (Jerry Cans, Bowls, Cutlery) |

| Distribution Channels Analyzed (Segment 3) | Direct Sales, Distributors, Retailers |

| End Uses Analyzed (Segment 4) | Food (Bakery & Confectionery, Dairy, Fresh Produce, Snack Food, Processed Food), Beverages (Non-Alcoholic, Alcoholic), Cosmetics & Personal Care, Chemicals, Healthcare, Agriculture, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Sustainable Packaging Market | Amcor Plc, Stora Enso Oyj., Berry Global Inc., Huhtamaki Oyj., WestRock LLC, DS Smith Plc, The Mondi Group plc, International Paper Company, Detmold Group, Sealed Air Corporation |

| Additional Attributes | Innovation in recyclable and biodegradable packaging materials, Adoption trends in food and beverage segments, Market shift toward lightweight and durable packaging, Regional regulatory impact on sustainable material use, Growth in e-commerce packaging solutions |

| Customization and Pricing | Customization and Pricing Available on Request |

The sustainable packaging market is categorized by material type, including paper and paperboard, plastic, metal, glass, fabric, wood, and other materials. The paper and paperboard segment consists of coated unbleached, bleached paperboard, molded fiber pulp, kraft paper, and corrugated board/boxboard.

The plastic segment includes poly lactic acid (PLA), polybutylene succinate (PBS), polyhydroxyalkanoates (PHAs), starch-based plastics, and other plastics such as polyvinyl alcohol (PVA), polyvinyl alcohol (PVOH), and polybutylene adipate terephthalate (PBAT). The metal segment is further divided into steel and aluminum.

Sustainable packaging solutions come in various types, including bags and sacks, trays and clamshells, cartons and boxes, cans, bottles and jars, films and wraps, pouches and sachets, drums, intermediate bulk containers (IBC), vials and ampoules, tapes and labels, and other formats such as jerry cans, bowls, and cutlery.

The distribution of sustainable packaging products occurs through different channels, including direct sales from manufacturers, distributors, and retailers.

Sustainable packaging is widely used across multiple industries, including food, beverages, cosmetics and personal care, chemicals, healthcare, agriculture, and other industrial applications. The food segment includes bakery and confectionery, dairy, fresh produce, snack food, and other processed food. The beverages category is further divided into non-alcoholic and alcoholic beverages.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

The sustainable packaging market is projected to witness CAGR of 5.8% between 2025 and 2035.

The sustainable packaging market stood at 285.3 billion in 2024.

Sustainable packaging market is anticipated to reach USD 530.4 billion by 2035 end.

East Asiais set to record a CAGR of 6.9% in assessment period.

The key players operating in the sustainable packaging market include Amcor Plc, Stora Enso Oyj, Berry Global Inc., Huhtamaki Oyj, WestRock LLC, DS Smith Plc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Sustainable Packaging Providers

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Label Market Forecast Outlook 2025 to 2035

Sustainable Footwear Market Forecast and Outlook 2025 to 2035

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Analysis – Trends & Forecast 2024 to 2034

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA