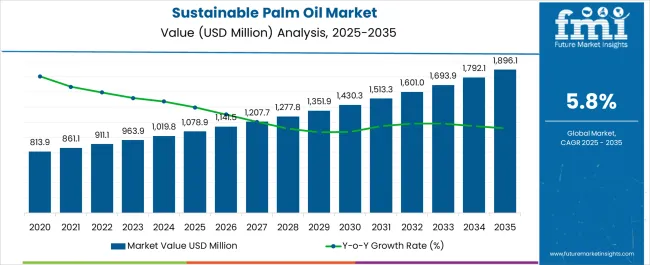

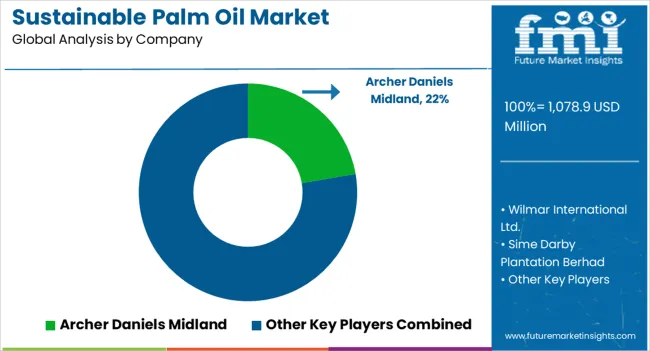

The Sustainable Palm Oil Market is estimated to be valued at USD 1078.9 million in 2025 and is projected to reach USD 1896.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Sustainable Palm Oil Market Estimated Value in (2025 E) | USD 1078.9 million |

| Sustainable Palm Oil Market Forecast Value in (2035 F) | USD 1896.1 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The sustainable palm oil market is witnessing steady expansion as global emphasis on responsible sourcing and environmental stewardship continues to intensify. The growing awareness of deforestation, biodiversity loss, and carbon emissions linked to conventional palm oil production has encouraged adoption of certified sustainable options across multiple industries. Increasing commitments from consumer goods manufacturers, food service providers, and retailers to procure responsibly produced palm oil are supporting long-term demand growth.

Regulatory frameworks in both developed and emerging economies are reinforcing the market by setting stricter guidelines on sourcing and traceability. The Roundtable on Sustainable Palm Oil and other certification bodies are ensuring that production practices align with international sustainability standards, further enhancing consumer trust and industry participation.

Rising demand from food, cosmetics, and biofuel sectors is also influencing market expansion as businesses align procurement strategies with environmental, social, and governance priorities As corporate sustainability goals evolve and consumer preferences increasingly favor ethical sourcing, the sustainable palm oil market is positioned for continued growth across global supply chains.

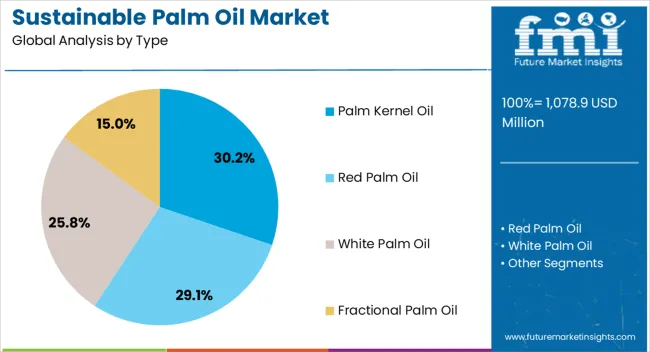

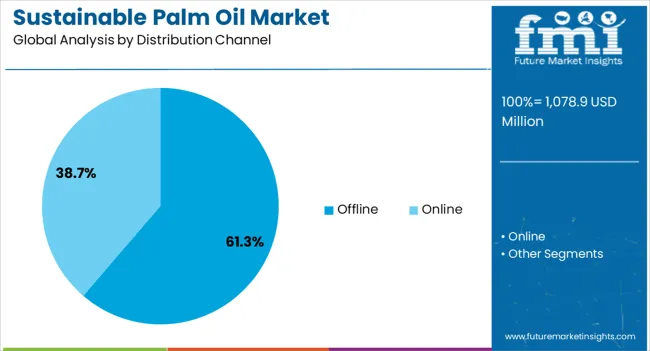

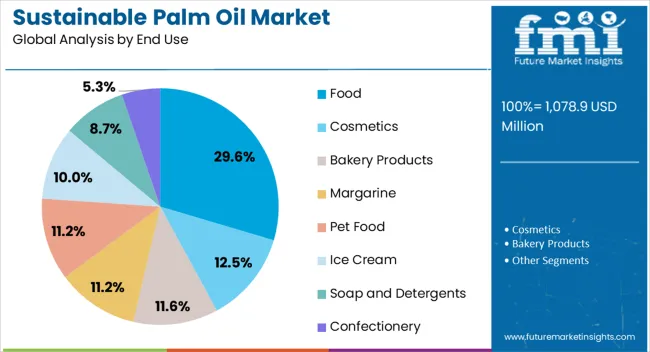

The sustainable palm oil market is segmented by type, distribution channel, end use, and geographic regions. By type, sustainable palm oil market is divided into Palm Kernel Oil, Red Palm Oil, White Palm Oil, and Fractional Palm Oil. In terms of distribution channel, sustainable palm oil market is classified into Offline and Online. Based on end use, sustainable palm oil market is segmented into Food, Cosmetics, Bakery Products, Margarine, Pet Food, Ice Cream, Soap and Detergents, and Confectionery. Regionally, the sustainable palm oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The palm kernel oil segment is projected to account for 30.2% of the sustainable palm oil market revenue share in 2025, making it the leading type. This segment’s dominance is being driven by its wide application in food processing, personal care formulations, and oleochemical industries due to its high lauric acid content and functional versatility. Sustainable production practices are enhancing the acceptance of palm kernel oil as industries seek to minimize environmental impact while maintaining product quality.

Certification initiatives are reinforcing market confidence by ensuring traceability and responsible cultivation practices. Manufacturers are adopting sustainable palm kernel oil for its suitability in bakery fats, confectionery coatings, soaps, and detergents, providing a stable demand base.

The ability of palm kernel oil to deliver both performance benefits and alignment with corporate sustainability commitments has strengthened its market leadership As more companies integrate sustainability criteria into procurement, palm kernel oil is expected to retain its leading position, supported by its adaptability across diverse industrial and consumer applications.

The offline distribution channel segment is anticipated to hold 61.3% of the sustainable palm oil market revenue share in 2025, establishing itself as the dominant distribution method. This leadership is being reinforced by the continued importance of direct procurement channels, bulk supply agreements, and established trade networks in the palm oil industry. Many large-scale food and consumer goods companies prefer offline sourcing for greater control over supply consistency, pricing stability, and quality assurance.

The offline model also enables closer collaboration with certified producers, supporting traceability and adherence to sustainability standards. Traditional distribution through wholesalers and direct trade relationships has remained critical for meeting high-volume demand in industrial applications.

Retailers and manufacturers are also leveraging offline procurement to strengthen long-term supplier partnerships, aligning with their sustainability commitments While digital platforms are gaining traction, the entrenched role of offline channels in managing large-scale transactions and certification compliance ensures that this segment maintains a dominant position in the foreseeable future.

The food segment is expected to capture 29.6% of the sustainable palm oil market revenue share in 2025, making it the leading end use category. Growth in this segment is being fueled by increasing consumer awareness of health, nutrition, and ethical sourcing practices, which has prompted food manufacturers to integrate certified sustainable palm oil into their product formulations. Palm oil’s versatility as a cooking ingredient and functional fat makes it indispensable in bakery, confectionery, snack foods, and packaged goods.

Demand is also being reinforced by regulatory pressures and voluntary commitments from global food brands to transition entirely to sustainable palm oil in their supply chains. The segment is further supported by consumer-driven demand for transparency, with labeling practices and certification logos influencing purchase decisions.

Sustainable palm oil’s ability to deliver functional performance in food processing while aligning with environmental and social governance expectations has ensured its prominence As awareness grows and adoption spreads across mainstream food categories, the segment is set to remain a primary driver of the overall market.

Traceability Drives Transparency in Sustainable Palm Oil

The demand for transparency is a defining trend in the sustainable palm oil market. Consumers and businesses are no longer satisfied with simply knowing a product contains palm oil. They want to be confident that the palm oil was sourced responsibly, minimizing environmental damage. This has led to a growing focus on traceability, which refers to the ability to track the origin of palm oil throughout the supply chain.

Technological progressions are playing a crucial role in this shift. Satellite monitoring systems and digital platforms allow for more comprehensive tracking of palm oil production practices, from plantations to processing facilities. This increased visibility empowers consumers to make informed choices and incentivizes businesses to adopt sustainable practices throughout their supply chains.

Innovation Guides the Sustainable Palm Oil Market

The target market is experiencing a wave of innovation and diversification. A key focus lies in developing sustainable production processes that minimize environmental impact and optimize resource utilization. This might involve advancements in fertilization techniques to reduce reliance on chemical inputs or exploring more efficient methods for palm oil extraction.

The research into alternative palm oil sources is also gaining traction. This includes exploring the potential of byproducts like palm kernel oil, which can be a more sustainable option for certain applications. By investing in these innovations, the industry aims to decouple palm oil production from its historical environmental burdens and create a more responsible and resilient future for the industry.

Market Restraints Hijacking Market Growth

Despite its promise, the sustainable palm oil market faces hurdles. Higher costs associated with certification and sustainable practices can discourage smaller producers. The complex, global supply chain makes consistent sustainability challenging. Limited consumer awareness of the issue can hinder demand for sustainable options.

Price fluctuations in the palm oil market further add uncertainty, and responsible land use to balance production with conservation remains a challenge. Overcoming these obstacles through cost reduction, supply chain transparency, consumer education, and responsible land-use strategies is crucial for the industry's long-term success.

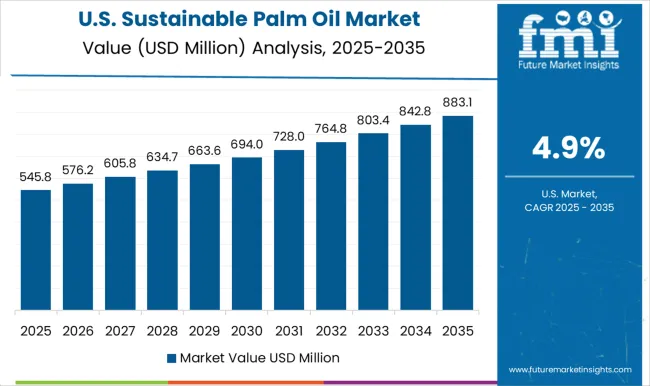

Demand for sustainable palm oil in the United States is on the rise due to several factors that resonate with American consumers and businesses. Growing environmental consciousness among American consumers is fueling a demand for products that are produced responsibly and minimize environmental impact. Sustainable palm oil, with its commitment to reducing deforestation and protecting biodiversity, aligns with this concern.

Leading corporations and retailers in the United States are adopting sustainability goals and practices throughout their supply chains. This includes sourcing sustainable palm oil to reduce their environmental impact and align with their corporate social responsibility initiatives.

Demand for sustainable palm oil in the United Kingdom is rising due to a combination of factors that resonate with British consumers and businesses. British consumers are interested in healthy food choices and understanding the ingredients in their products. Sustainable palm oil offers a natural and potentially healthier alternative to some fats and oils, appealing to this health-conscious trend.

Media coverage highlighting the environmental impact of conventional palm oil production has raised awareness among the United Kingdom consumers. This puts pressure on companies and creates a market opportunity for sustainable palm oil alternatives.

Sales of sustainable palm oil in China are rising due to a confluence of global trends and factors specific to the Chinese market. Government's increased emphasis on food safety and quality control indirectly benefits sustainable palm oil.

Sustainable palm oil production often adheres to stricter quality standards, aligning with the government's food safety goals. In some cases, sustainable palm oil can be associated with a premium or luxury image in China. This can be particularly relevant for certain food products where sustainable palm oil signifies higher quality and responsible practices.

The bakery industry is finding a sweet spot with sustainable palm oil. This versatile ingredient offers functionality and performance benefits that are hard to beat. Palm oil acts as a natural emulsifier, keeping baked goods moist and preventing separation of ingredients. Additionally, it contributes to a desirable crumb structure and mouthfeel.

From a cost perspective, palm oil can be a more budget-friendly option compared to some other fats and oils used in baking. However, the clean label movement has shifted consumer preferences towards natural ingredients. While palm oil can fit this category, the source and sustainability practices behind it are becoming increasingly important. This is where sustainable palm oil comes in.

By using palm oil produced with responsible practices, bakeries can cater to environmentally conscious consumers and potentially enhance their brand image. Furthermore, some regulations might restrict the use of certain non-sustainable fats and oils, making sustainable palm oil a viable alternative for bakeries to stay compliant.

Fractional palm oil is gaining traction due to its versatility. Unlike regular palm oil, it separates into liquid and solid fractions, each with specific functionalities. This allows for targeted applications, like high-heat frying with liquid olein or structure-providing stearin in baked goods. Additionally, fractionation can create lower saturated fat options, appealing to health-conscious consumers.

Efficiency, cost-effectiveness, and potential regulatory compliance with lower-fat content add to its appeal. However, sustainability concerns and the complexity of processing remain challenges. Overall, fractional palm oil's functional benefits, potential health advantages, and cost-effectiveness drive its growing demand.

The fractional palm oil market is witnessing fierce competition for market share. Key players are innovating with specialized fractions and prioritizing sustainable practices through RSPO certification. Geographic expansion, particularly into developing regions, and targeted customer segmentation are crucial growth strategies. Building brand image through transparency and sustainability partnerships further strengthens their position.

Mergers and acquisitions, cost optimization, and industry advocacy are additional tools companies might leverage to gain an edge. This multi-pronged approach ensures key players can not only capture a larger market share but also adapt to evolving customer demands in this growing market.

Industry Updates

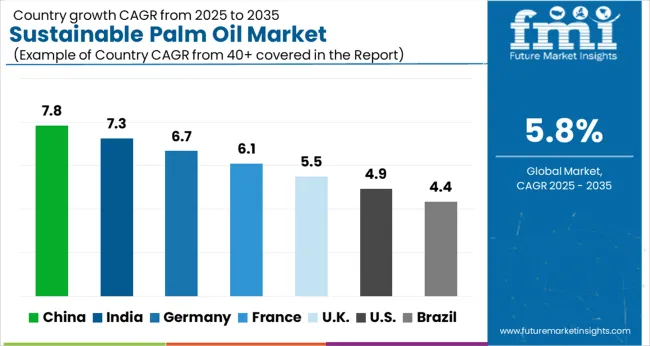

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Sustainable Palm Oil Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Sustainable Palm Oil Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Sustainable Palm Oil Market is estimated to be valued at USD 397.7 million in 2025 and is anticipated to reach a valuation of USD 643.5 million by 2035. Sales are projected to rise at a CAGR of 4.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 52.5 million and USD 32.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1078.9 Million |

| Type | Palm Kernel Oil, Red Palm Oil, White Palm Oil, and Fractional Palm Oil |

| Distribution Channel | Offline and Online |

| End Use | Food, Cosmetics, Bakery Products, Margarine, Pet Food, Ice Cream, Soap and Detergents, and Confectionery |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland, Wilmar International Ltd., Sime Darby Plantation Berhad, IOI Corporation Berhad, Kuala Lumpur Kepong Berhad, United Plantations Berhad, Kulim (Malaysia) Berhad, IJM Corporation Berhad, PT Sampoerna Agro, Tbk, Univanich Palm Oil Public Company Ltd., PT. Bakrie Sumatera Plantations tbk, Asian Agri, and Agropalma S.A. |

The global sustainable palm oil market is estimated to be valued at USD 1,078.9 million in 2025.

The market size for the sustainable palm oil market is projected to reach USD 1,896.1 million by 2035.

The sustainable palm oil market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in sustainable palm oil market are palm kernel oil, red palm oil, white palm oil and fractional palm oil.

In terms of distribution channel, offline segment to command 61.3% share in the sustainable palm oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sustainable Label Market Forecast Outlook 2025 to 2035

Sustainable Footwear Market Forecast and Outlook 2025 to 2035

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

India Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Palmitic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA