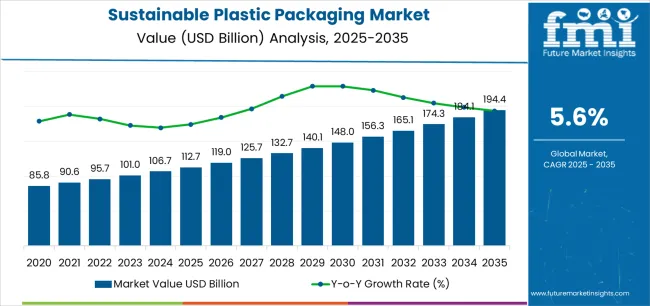

The Sustainable Plastic Packaging Market is estimated to be valued at USD 112.7 billion in 2025 and is projected to reach USD 194.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The sustainable plastic packaging market is expanding rapidly, driven by global sustainability commitments, regulatory mandates, and consumer preference for eco-friendly products. Companies are increasingly adopting recyclable, compostable, and bio-based materials to minimize environmental impact while maintaining functionality.

The market benefits from innovations in lightweighting technologies, improved recycling infrastructure, and circular economy initiatives. Growing awareness among consumers regarding plastic pollution has encouraged brands to redesign packaging with minimal material use and enhanced recovery potential.

Major packaging producers are investing in material science to achieve higher recyclability rates without compromising product protection. With multinational corporations pledging to achieve sustainability goals, the market is projected to grow consistently, positioning sustainable plastic packaging as a key enabler of responsible production and consumption patterns.

| Metric | Value |

|---|---|

| Sustainable Plastic Packaging Market Estimated Value in (2025 E) | USD 112.7 billion |

| Sustainable Plastic Packaging Market Forecast Value in (2035 F) | USD 194.4 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

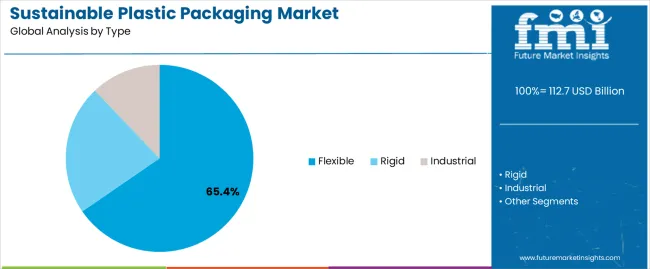

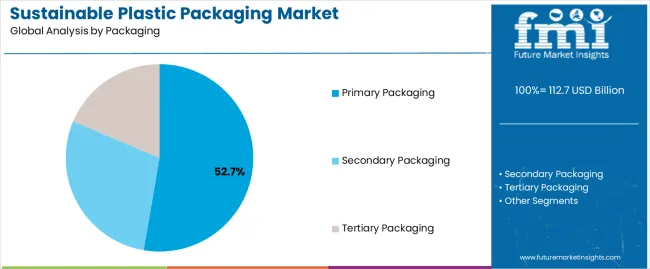

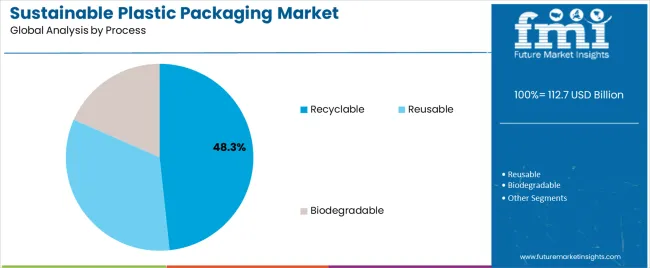

The market is segmented by Type, Packaging, Process, and End Use and region. By Type, the market is divided into Flexible, Rigid, and Industrial. In terms of Packaging, the market is classified into Primary Packaging, Secondary Packaging, and Tertiary Packaging. Based on Process, the market is segmented into Recyclable, Reusable, and Biodegradable. By End Use, the market is divided into Food & Beverage, Personal Care, Healthcare, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flexible segment holds approximately 65.4% share of the type category in the sustainable plastic packaging market. Its dominance stems from lower material usage, lightweight design, and adaptability across diverse products such as pouches, films, and wraps.

Flexible packaging offers reduced transportation costs and improved product-to-package ratio, making it a preferred choice for sustainable solutions. Advancements in mono-material films and recyclable laminates have enhanced environmental performance while maintaining durability.

The segment’s continued growth is reinforced by expanding use in food, beverage, and personal care industries, where sustainability and convenience are key drivers. With ongoing innovation in barrier coatings and bio-based polymers, flexible packaging is expected to sustain its market leadership over the forecast horizon.

The primary packaging segment dominates the packaging category with approximately 52.7% share. This segment’s prominence is driven by the rising emphasis on eco-friendly materials for direct product containment, particularly in food, cosmetics, and pharmaceuticals.

Manufacturers are increasingly replacing conventional plastics with recyclable or compostable alternatives to comply with regulatory standards. The segment benefits from growing demand for branded sustainability, where primary packaging directly influences consumer perception.

Technological improvements in recyclable PET and bioplastic materials have strengthened its adoption. With expanding consumer awareness and corporate sustainability commitments, primary packaging is expected to remain the most dynamic category in sustainable plastic packaging.

The recyclable segment leads the process category, holding approximately 48.3% share in the sustainable plastic packaging market. Its growth is fueled by widespread acceptance of recycling systems and government initiatives promoting circular material flows.

Companies are prioritizing recyclable packaging to meet extended producer responsibility targets and reduce landfill waste. Enhanced collection infrastructure and improved material recovery processes have increased the economic viability of recycled plastics.

Technological advancements in sorting and reprocessing are ensuring higher purity and performance levels of recycled materials. As environmental regulations tighten globally, recyclable packaging is projected to remain the preferred sustainability pathway for the plastic packaging industry.

There is still a lack of awareness about the use of eco-friendly plastic. End-users struggle to find the right sources for obtaining the material, and doubts have been raised about the true sustainability of green plastic.

Additionally, a significant number of consumers are unaware of how to recycle recyclable plastic, which is hindering the growth of the market.

Furthermore, amid doubts about the effectiveness of green plastic, a considerable number of vendors are abandoning plastic altogether in favor of other sustainable options such as paper and metal.

Rigid packaging is the preferred choice of industrialists for traditional plastic packaging, and sustainable plastic packaging is following suit. Consumer awareness about sustainability is positioning sustainable plastic as the primary packaging material for products.

| Attributes | Details |

|---|---|

| Top Type | Rigid |

| Forecasted CAGR (2025 to 2035) | 5.6% |

Rigid sustainable plastic packaging is expected to advance at a CAGR of 5.6% over the forecast period. Some of the factors influencing the progress of rigid sustainable packaging are:

| Attributes | Details |

|---|---|

| Top Packaging | Primary Packaging |

| Forecasted CAGR (2025 to 2035) | 5.5% |

Primary packaging is expected to progress at a CAGR of 5.5% through the forecast period. Some of the reasons for the advancement of primary sustainable plastic packaging are:

The booming industrial sector in the Asia Pacific is helping sustainable plastic packaging make its mark in the region. Increased government measures regarding environmental harm are also supporting the product's cause in the region.

Increased consumer awareness is leading to the market's expansion in North America and Europe. Investment in research for developing and implementing sustainable plastic in packaging further is also benefiting the market's cause in these regions.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 6.1% |

| United Kingdom | 6.2% |

| China | 6.6% |

| Japan | 6.9% |

| South Korea | 7.4% |

The CAGR of the sustainable plastic packaging market in South Korea for the forecast period is anticipated to be 7.4%. Some of the factors influencing the healthy growth are:

The sustainable plastic packaging market is expected to register a CAGR of 6.9% in Japan over the forecast period. Some of the factors leading to the growth of the market in Japan are:

The sustainable plastic packaging market is expected to record a CAGR of 6.6% in China. Some of the factors responsible for the growth of the market are:

The sustainable plastic packaging market is expected to progress at a CAGR of 6.2% in the United Kingdom. Some factors influencing this progress are:

The sustainable plastic packaging market is expected to register a CAGR of 6.1% in the United States. Some factors influencing the growth of the market in the country are:

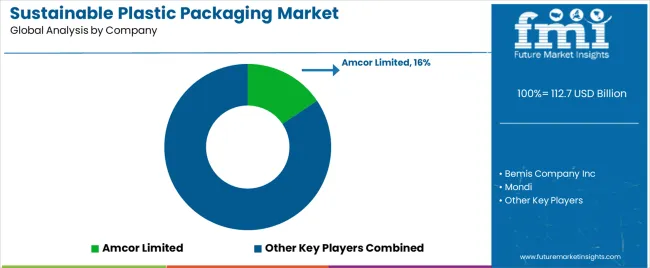

The market is highly fragmented, with opportunities available for all sorts of competitors. Startups and small-scale players are utilizing differentiation strategies to stand out from the competition.

Innovation is a prime area of focus for industry players. To accelerate the research and production of new types of sustainable plastic, investment is being sought from companies adjacent to the packaging industry, such as food & beverage and consumer products.

Recent Developments in the Sustainable Plastic Packaging Market

The global sustainable plastic packaging market is estimated to be valued at USD 112.7 billion in 2025.

The market size for the sustainable plastic packaging market is projected to reach USD 194.4 billion by 2035.

The sustainable plastic packaging market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in sustainable plastic packaging market are flexible, rigid and industrial.

In terms of packaging, primary packaging segment to command 52.7% share in the sustainable plastic packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Packaging For Food and Beverage Market Size and Share Forecast Outlook 2025 to 2035

Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

Competitive Overview of Plastic Jar Packaging Companies

Plastic-free Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic Packaging Bag Market Growth – Demand & Forecast 2025 to 2035

PCR Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Aerosol Packaging Market

Plastic Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Plastic Healthcare Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Bioplastics For Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Plastic Healthcare Packaging Providers

Flexible Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Recycled Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA