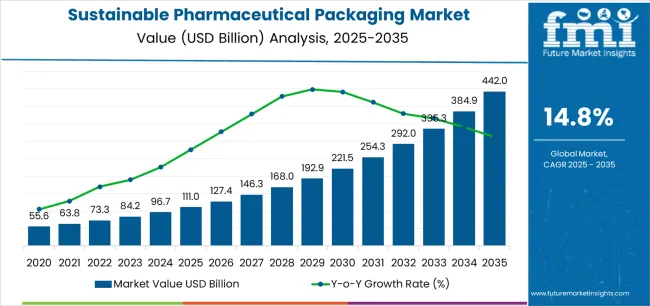

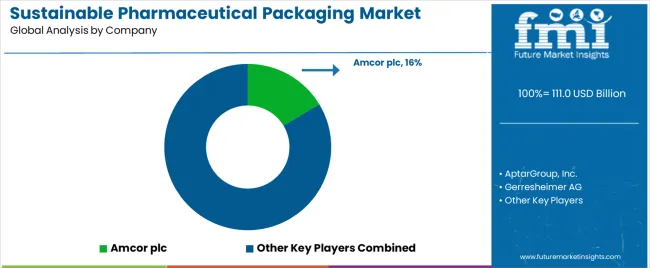

The Sustainable Pharmaceutical Packaging Market is estimated to be valued at USD 111.0 billion in 2025 and is projected to reach USD 442.0 billion by 2035, registering a compound annual growth rate (CAGR) of 14.8% over the forecast period.

The sustainable pharmaceutical packaging market is expanding steadily, driven by global initiatives to reduce plastic waste and carbon emissions within the healthcare supply chain. Regulatory support, combined with increasing corporate commitments to circular economy principles, has accelerated the adoption of recyclable, biodegradable, and reusable packaging solutions.

Manufacturers are prioritizing lightweight designs and renewable materials without compromising product safety or efficacy. The integration of smart and traceable packaging technologies is further enhancing sustainability performance and compliance.

The current market scenario reflects heightened collaboration between material scientists, pharmaceutical companies, and packaging converters. Future growth is anticipated through innovations in bio-based polymers, paper composites, and closed-loop recycling systems, positioning sustainable packaging as a key enabler of environmental stewardship in the pharmaceutical sector..

| Metric | Value |

|---|---|

| Sustainable Pharmaceutical Packaging Market Estimated Value in (2025 E) | USD 111.0 billion |

| Sustainable Pharmaceutical Packaging Market Forecast Value in (2035 F) | USD 442.0 billion |

| Forecast CAGR (2025 to 2035) | 14.8% |

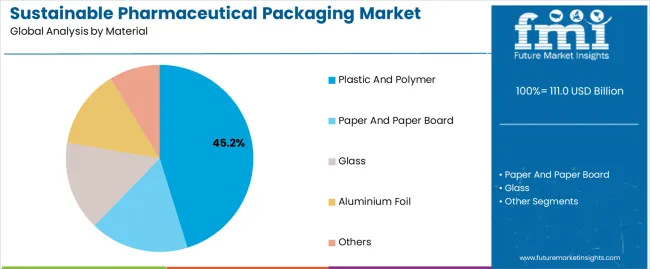

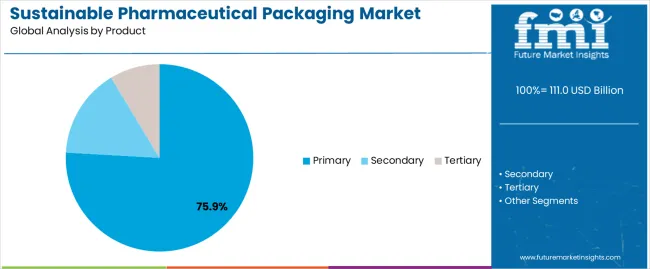

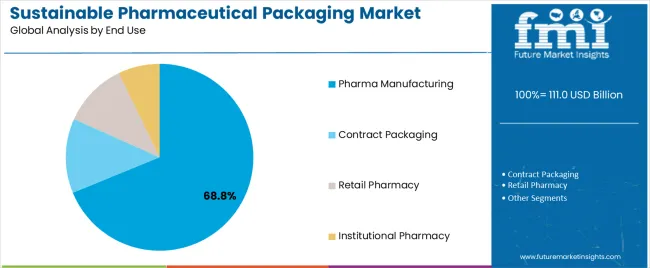

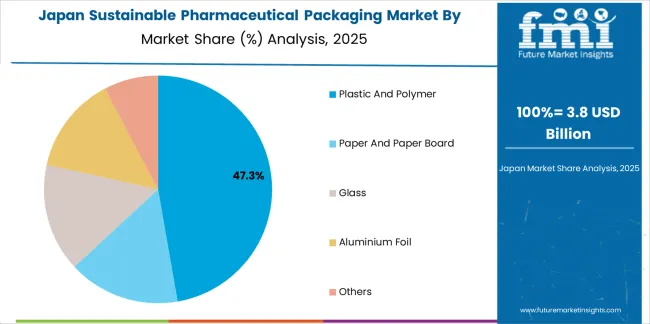

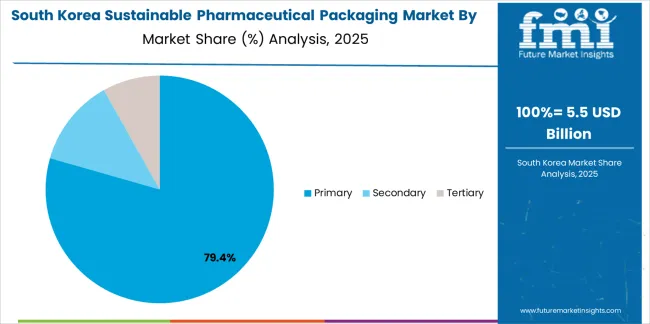

The market is segmented by Material, Product, and End Use and region. By Material, the market is divided into Plastic And Polymer, Paper And Paper Board, Glass, Aluminium Foil, and Others. In terms of Product, the market is classified into Primary, Secondary, and Tertiary. Based on End Use, the market is segmented into Pharma Manufacturing, Contract Packaging, Retail Pharmacy, and Institutional Pharmacy. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic and polymer segment leads the material category with approximately 45.2% share, driven by its adaptability, cost-effectiveness, and ongoing transition toward recyclable and bio-based alternatives. Pharmaceutical manufacturers rely on these materials for their barrier properties, sterilizability, and compatibility with sensitive drug formulations.

The shift toward eco-friendly polymer grades, including biodegradable and recycled variants, has strengthened the segment’s position. Regulatory initiatives promoting sustainable material use have further accelerated development in this category.

With advancements in polymer science enhancing durability and recyclability, the plastic and polymer segment is expected to remain a primary material choice for sustainable pharmaceutical packaging..

The primary packaging segment dominates the product category with approximately 75.9% share, reflecting its essential role in protecting pharmaceutical products from contamination and degradation. Sustainable solutions in this category include recyclable blister packs, eco-design vials, and bio-based containers.

The segment’s growth is supported by the rising demand for compliance-driven packaging that ensures product integrity while reducing environmental impact. Manufacturers are investing in material innovation to balance sustainability with regulatory standards for safety and stability.

As pharmaceutical production volumes increase and sustainability commitments strengthen, the primary segment is expected to sustain its leadership position..

The pharma manufacturing segment accounts for approximately 68.8% share in the end use category, driven by the large-scale implementation of sustainable packaging practices at production facilities. Manufacturers are adopting recyclable materials and optimized packaging formats to align with environmental targets and cost reduction goals.

The segment benefits from regulatory emphasis on responsible production and waste minimization across the supply chain. Strategic partnerships between packaging suppliers and pharmaceutical companies are further promoting innovation in material sourcing and product design.

With ongoing expansion of global manufacturing capacities and stronger ESG compliance frameworks, the pharma manufacturing segment is poised to retain its dominant market position in the foreseeable future..

Compostable Packaging Materials Continue to Gain Prominence in the Market

The pharmaceutical sector addresses environmental issues related to conventional packaging materials by implementing compostable pharmaceutical packaging materials. Renewably sourced compostable materials spontaneously decompose into organic molecules, decreasing waste and having a minimal negative environmental impact.

This trend is in line with customer desires for eco-packaging for pharmaceuticals, legal requirements, and company sustainability aims.

Pharmaceutical firms can demonstrate ecological responsibility, lower their carbon footprint, and improve brand perception by investing in biodegradable pharmaceutical packaging materials.

Moreover, compostable pharmaceutical packaging solutions support the circular economy by encouraging resource conservation and easing the shift to a more sustainable packaging environment.

Robotics and Automation Integration in Packaging Processes Rises in the Market

Robots and automation can make green pharmaceutical packaging operations more productive, accurate, and efficient. Automated packing systems enhance productivity and product quality by streamlining processes, cutting labor costs, and minimizing mistakes.

Pharmaceutical production is experiencing digital transformation and innovation due to this trend, which aligns with the concepts of Industry 4.0. Businesses can boost operational efficiency, scalability, and flexibility while gaining a competitive edge by investing in robots and automation technology.

Additionally, robotic pharmaceutical packaging solutions help achieve sustainability objectives by lowering energy usage, waste production from materials, and environmental damage caused by labor-intensive manual procedures.

Developing Modular and Reconfigurable Packaging Solutions Presents Opportunities in the Market

Creating modular and reconfigurable pharmaceutical packaging solutions provides a special chance to maximize the effectiveness and versatility of packaging. Packaging solutions that are quickly adjusted for varying product sizes, formats, or transportation needs save material waste and improve operational flexibility.

Pharmaceutical companies can improve sustainability measures, reduce costs, and expedite packaging operations by taking advantage of this opportunity that is in accordance with lean manufacturing principles.

Businesses can achieve operational excellence and environmental responsibility by positioning themselves as resource-efficient and adaptable by implementing reconfigurable and modular pharmaceutical packaging solutions.

| Attribute | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Segment | Plastic and Polymer (Material) |

|---|---|

| Value CAGR (2025 to 2035) | 15.3% |

Based on material, the plastic and polymer segment is predicted to expand at a 15.3% CAGR through 2035.

| Segment | Primary (Product) |

|---|---|

| Value CAGR (2025 to 2035) | 15.2% |

Based on product, the primary segment is expected to expand at a 15.2% CAGR through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 15.7% |

| United Kingdom | 16.3% |

| China | 15.9% |

| Japan | 17.0% |

| South Korea | 18.2% |

The demand for sustainable pharmaceutical packaging in the United States is projected to rise at a 15.7% CAGR through 2035.

The sales of sustainable pharmaceutical packaging in the United Kingdom are expected to surge at a 16.3% CAGR through 2035.

The sustainable pharmaceutical packaging market growth in China is estimated at a 15.9% CAGR through 2035.

The demand for sustainable pharmaceutical packaging in Japan is anticipated to rise at a 17.0% CAGR through 2035.

The sales of sustainable pharmaceutical packaging in South Korea are predicted to thrive at an 18.2% CAGR through 2035.

The competitive environment of the sustainable pharmaceutical packaging market is characterized by fierce rivalry and aggressive strategies as players compete for market dominance in a fast-changing sector.

Established businesses, including international firms such as Amcor plc, AptarGroup, and Gerresheimer AG, lead the market due to their global reach and diverse product offerings.

These industry titans use their financial resources and R&D expertise to create novel sustainable packaging solutions, establishing themselves as pioneers in pursuing environmentally responsible packaging practices.

Recent Developments

The global sustainable pharmaceutical packaging market is estimated to be valued at USD 111.0 billion in 2025.

The market size for the sustainable pharmaceutical packaging market is projected to reach USD 442.0 billion by 2035.

The sustainable pharmaceutical packaging market is expected to grow at a 14.8% CAGR between 2025 and 2035.

The key product types in sustainable pharmaceutical packaging market are plastic and polymer, paper and paper board, glass, aluminium foil and others.

In terms of product, primary segment to command 75.9% share in the sustainable pharmaceutical packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Glycerin Alternatives Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Bamboo Charcoal Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Palm Oil Market Size and Share Forecast Outlook 2025 to 2035

Sustainable Finance Market Trends - Growth & Forecast 2025 to 2035

Sustainable Aviation Fuel Market Growth – Trends & Forecast 2025 to 2035

Sustainable Label Market Report - Key Trends & Forecast 2024 to 2034

Sustainable Footwear Market Trends – Demand & Forecast 2024-2034

Sustainable Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Distribution Among Sustainable Packaging Providers

Sustainable Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

UAE Sustainable Tourism Market Analysis - Growth & Forecast 2025 to 2035

Italy Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

India Sustainable Tourism Market Analysis – Trends & Forecast 2024 to 2034

Mexico Sustainable Tourism Market Trends – Growth & Forecast 2025 to 2035

New Zealand Sustainable Tourism Market Size and Share Forecast Outlook 2025 to 2035

USA Sustainable Tourism Market Trends - Growth & Forecast 2025 to 2035

Trends, Growth, and Opportunity Analysis of Sustainable Tourism in Thailand Size and Share Forecast Outlook 2025 to 2035

Indonesia Sustainable Tourism Market Growth – Forecast 2024-2034

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA