The global Pharmaceutical Filtration Market is estimated to be valued at USD 21,643.3 million in 2025 and is projected to reach USD 39,497.5 million by 2035, registering a CAGR of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 21,643.3 Million |

| Industry Value (2035F) | USD 39,497.5 Million |

| CAGR (2025 to 2035) | 6.7% |

The pharmaceutical filtration market has evolved rapidly as manufacturers prioritize robust contamination control and process consistency in the production of biopharmaceuticals, vaccines, and sterile injectable.

Stringent regulatory requirements from agencies such as the USA FDA and the European Medicines Agency have reinforced investment in validated filtration technologies across upstream and downstream workflows. Demand has been amplified by the acceleration of biologics pipelines and the expansion of contract manufacturing capacity to meet global therapeutic needs.

Advances in membrane chemistry, depth filtration media, and single-use systems have enhanced throughput and flexibility while reducing cross-contamination risks. Increasing focus on continuous manufacturing and modular production systems is expected to further drive adoption of next-generation filtration solutions

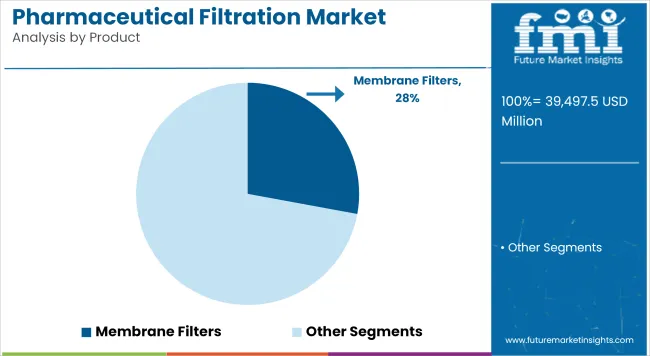

Membrane Filters to account for a revenue share of 27.9% in 2025. This segment is driven by their validated performance in removing bacteria and particulate contaminants during final fill-finish operations. Regulatory agencies have mandated the use of membrane filtration for critical process steps where sterility assurance is paramount.

Advances in polymeric materials and pore structure engineering have enabled improved flow rates, higher protein recovery, and enhanced chemical compatibility. Manufacturers have invested in scaling up production capacity and offering pre-sterilized, ready-to-use assemblies that streamline validation and deployment.

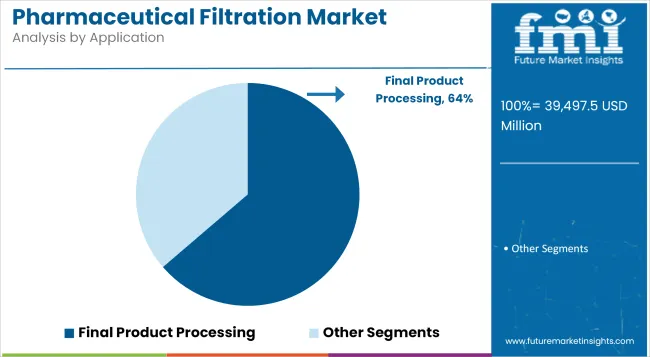

Final Product Processing is estimated to contribute 32.9% revenue share in the pharmaceutical filtration market, reflecting its essential function in ensuring compliance with sterility and particulate standards. Adoption has been driven by the need to protect patient safety and maintain the integrity of high-value drug products during the final fill-finish phase.

Regulatory frameworks require stringent microbial retention validation, reinforcing demand for validated filtration assemblies. Manufacturers have prioritized integration of closed systems and aseptic connectors to mitigate contamination risks. As biopharmaceutical production scales up to meet increasing demand, investments in advanced final filtration systems have become a cornerstone of quality assurance programs.

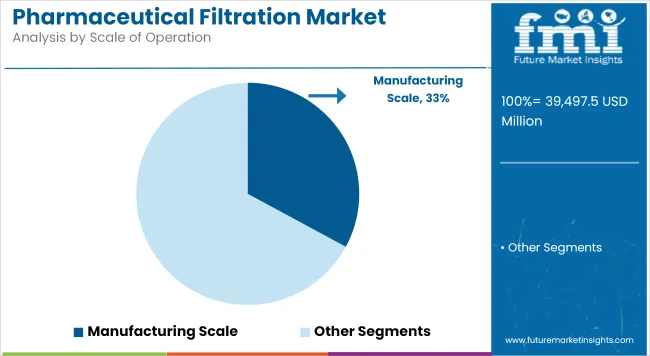

Manufacturing Scale holds a revenue share of 63.7% which is attributed to underscoring their importance in commercial production environments. Utilization has been driven by the need for validated, scalable filtration platforms capable of processing large batch volumes under GMP conditions.

Pharmaceutical companies and contract manufacturers have invested heavily in single-use bioprocessing and modular filtration skids to support accelerated production timelines. Regulatory requirements for sterility assurance, batch record traceability, and process validation have reinforced the adoption of high-capacity filtration systems. Advances in membrane formats and automated integrity testing have further improved operational efficiency and compliance

Complexity in Regulatory Compliance and ValidationHinders the Adoption of Pharmaceutical Filtration

Pharmaceutical filtration face its most serious challenge in respect of meeting many intricate regulatory compliance and validation specifications. While sterility assurance and particulate control requirements from regulatory agencies such as the FDA, EMA, PMDA become stricter, much time and effort are spent by drug and biologic manufacturers on validating filtration equipment specific for drugs and biologics. This entails comprehensive testing for bacterial retention, integrity testing, extractables and leachables, and compatibility with active pharmaceutical ingredients (APIs) and excipients.

Batch-specific documentation and cGMP compliance add to growing stress on small and mid-sized companies. Poor validation or deviation from the procedures can lead to sanctions from regulators, units being shut down, or product recalls. Therefore, consistency, documentation, and traceability of filtration systems remain continued nagging operational and financial issues, especially as product portfolios become more diverse and move towards more sensitive biologics.

Rising Demand for Biologics and Advanced TherapiesPoses New Opportunities

This is a very high opportunity for pharmaceutical filtration growth because of the increasing worldwide demand for biologics and advanced therapies such as monoclonal antibodies, gene therapies, and cell-based therapies. These biologics are complex, very delicate, and require very sophisticated filtration solutions to ensure that the infection organism, purity, and safety are guaranteed without compromising the molecular integrity of the drug. Increasingly longer pipelines in biopharmaceuticals are increasingly tailored to specific patients.

Thus, there is a much higher demand for sterile filtration, virus filtration, and nanofiltration technologies. With that, massive investments are into the biomanufacturing facilities mainly in the Asia Pacific and Latin America filter businesses to tap existing and emerging new markets.

Biopharmaceutical Manufacturing Drive Filtration Demandand anticipates the Growth of the Market

Biopharmaceuticals-in particular, monoclonal antibodies, recombinant proteins, and vaccines-are becoming mainstream therapeutic modalities. Hence, the need for rightsized, high-performance filtration systems for sterility has grown. This fact, that biologics are especially prone to contamination and degradation, means that reliable filtration has become critical to product integrity. Consequently, manufacturers have begun adopting pre- and end-fill filtration solutions that guarantee reliable sterility without compromising either yield or performance.

This trend is most obviously true for CMOs and lead pharma companies increasing their biologics pipeline. Filtration solutions that correspond with the requirements of high-volume, multi-product manufacturing facilities for meeting GMP and global quality would be very high-priority requirements of the global manufacturing platforms.

Single-Use Technologies Gain Ground in Filtrationdemonstrates the Growth of the Market

Single-use filtration technologies lower the risk of cross-contamination, facilitation in cleaning validation, and a reduction in time for batch turnarounds that make them among the most preferable options for modern modular and multi-product facilities. In biologics and vaccination production, sterility is most critical, and downtime should be kept to a minimum.

As production methods trend more flexible and scalable, single-use filtration units-like capsule filters and disposable membrane cartridges-are clearly becoming de rigueur. Regulations and lower capital investment requirements further promote their use by both large pharmaceutical companies and CMOs.

Integration of Automation and Smart Monitoring is an Ongoing Trend in the Market

unit filtration systems now come equipped with sensors and data loggers to monitor differential pressure, flow rate, and membrane integrity, all in real time. These new-age systems can now support proactive maintenance, reduce human error, and ease the burden of regulatory compliance through better documentation. As part of a larger Pharma 4.0 strategy, companies are investing in these digital approaches to achieve continuous manufacturing goals, strengthening the integrity of data in sterile processing operations.

Automation of filtration is especially useful in large-scale biologics' production, where process reliability becomes critical. The filtration systems incorporating these AI and IoT technologies are expected to emerge as the new standard in the generation of facilities that will be upgraded in the future, along with a continuous digital transformation that is likely to occur across pharmaceutical facilities.

Emphasis on Development of Sustainable and Eco-Friendly Filtration Solutions

Environmental sustainability is emerging as one of the strongest driving forces behind the development and implementation of environmentally friendly pharmaceutical filtration solutions. The companies are among those eying recyclable materials, biodegradable membranes, and energy-saving systems, which aim to minimize production wastes and carbon footprints. This goes hand in hand with international environmental targets and, at the same time, business sustainability objectives, especially among major pharmaceutical firms with net-zero targets.

Some single-use filtration systems are also being redeveloped in a more eco-friendly direction with lesser use of plastics and better disposal. Supply chain partners and regulatory agencies are also beginning to consider green manufacturing, thus compelling filtration suppliers to innovate further. As environmental laws stiffen in Europe and North America and as public awareness grows about pharmaceutical waste, so will the adoption of environmentally sustainable filtration systems in commercial and clinical applications.

Market Outlook

Pharmaceutical filtration is led by the USA with heavy investments in biologics, enormous clinical trial volume, and leadership in CDMO service. FDA regulations spur developments and innovations in sterile filtration. Increased growth in gene therapy and monoclonal antibodies thus drive the growth of these sophisticated filters and attribute to the growth of the market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

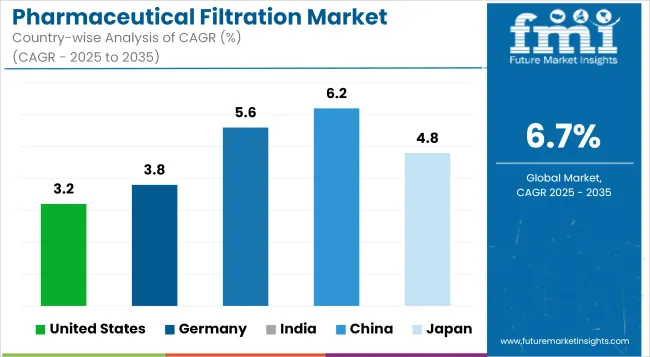

| United States | 3.2% |

Market Outlook

Germany's Pharmaceutical Filtration Industry is driven by stringent EU regulatory environment, advanced biologic drug production, and growth in sterile contract manufacturing. The emphasis on quality assurance, biopharma innovation, and the promotion of environmentally friendly filtration technologies mark the country as a forerunner in high-efficiency and sustainable filtration systems in Europe.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

The thriving generic and biosimilar manufacturing industry in India, coupled with government promotion of pharma manufacturing under "Make in India," drives the demand for pharma filtration. Increased investment in biologics, elevated export requirements, and stiffer quality standards have necessitated manufacturers to equip their production streams with advanced, compliant, and scalable filtration systems.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

The aggressive pharmas growth in China, especially in biologics and vaccine production, is driving growth for the uptake of sophisticated filtration systems. Government initiatives, local innovations, and rising standards of GMP compliance are enhancing market opportunities. The demand for filtration is also boosted through mega investments in pandemic preparedness, export-driven drug manufacturing, and homegrown biopharma champions.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

Aging population and high-value biologics in Japan drive the demand for pharmaceutical filtration. The market is buoyed by government-driven R&D, stringent regulatory requirements, and targeted efforts at sterile drug formulation. Local companies are implementing modular and single-use filtration technologies to support flexibility and compliance, particularly considering personalized medicine and specialty biologics therapies.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The competitive landscape has been shaped by manufacturers investing in next-generation membrane chemistries, modular filtration assemblies, and pre-sterilized, single-use systems. Leading players have prioritized collaborations with contract manufacturing organizations to expand market access and validate new filtration technologies.

Strategic acquisitions of complementary filtration and separation platforms have strengthened product portfolios and technical expertise. Investment in digital monitoring solutions and automated integrity testing has further differentiated offerings. These activities are expected to drive continued innovation and sustain robust competition as pharmaceutical manufacturers scale up biologics and advanced therapies.

Key Development

In 2024, Nephros, Inc. launched the HydraGuard 20” UltraFilter, extending their filtration technology. This innovation offers higher volume and flow rates, removing contaminants like bacteria, viruses, and endotoxins. It enables Nephros to enter new markets like medical device and pharmaceutical manufacturing, ensuring compliance with strict water quality standards such as ANSI/AAMI ST108.

In 2024, Asahi Kasei Medical launched the Planova™ FG1 in October. This next-generation virus removal filter offers higher flux for manufacturing biotherapeutics. It's a key part of their bioprocess business, which includes virus removal filters, biosafety testing, and CDMO operations, driving future growth for the Asahi Kasei Group.

The overall market size for pharmaceutical filtration market was USD 21,643.3 Million in 2025.

The pharmaceutical filtration market is expected to reach USD 39,497.5 Million in 2035.

The demand for pharmaceutical filtration will be driven by a combination of expanding biologics production, increasing regulatory compliance, and the rising need for sterile drug formulations.

The top key players that drives the development of pharmaceutical filtration market are Sunrise Medical LLC, Invacare Corporation, OttoBock Healthcare GmbH, Stryker Corporation and Medline Industries.

Membrane Filters segment by product is expected to dominate the market during the forecast period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Autoclave Machine Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Zinc Powder Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Secondary Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Glass Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Manufacturing Equipment Market Forecast and Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Industry Analysis in Saudi Arabia Forecast and Outlook 2025 to 2035

Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Mini Batch Blender Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Continuous Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA