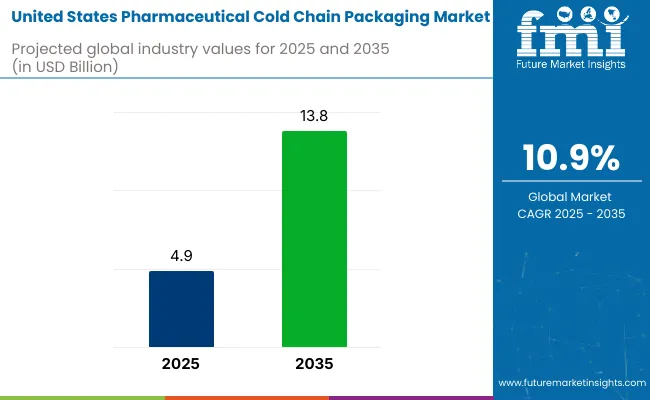

The Pharmaceutical Cold Chain Packaging Industry Analysis in the United States is valued at USD 4.9 billion in 2025 and projected to reach USD 13.8 billion by 2035, growing at a robust CAGR of 10.9%. Cold chain packaging is a vital link in the pharmaceutical logistics network, ensuring temperature-sensitive drugs, biologics, and vaccines are transported within controlled environmental conditions.

In 2025, the USA pharmaceutical cold chain packaging market maintains a modest share across several broader industries. It accounts for 4-6% of the pharmaceutical packaging space by volume and approximately 1.2% of the overall cold chain logistics market. Within the biopharmaceuticals sector, driven by biologics and vaccine distribution, it accounts for around 2-3%.

In the broader healthcare packaging market, its share stands at 2-4%, while in the temperature-sensitive packaging category, it represents a more substantial 15-20%, underscoring the technical complexity and regulatory importance of maintaining drug safety through controlled-temperature packaging.

In December 2024, Knipper Health made a strategic move to strengthen its role in the USA pharmaceutical cold chain packaging market by acquiring Thermo Fisher Scientific’s commercial sample management operations in Memphis, Tennessee. CEO Michael LaFerrera stated, “The Memphis facility will expand our cold chain footprint beyond our existing Lakewood, NJ, and Charlestown, IN, locations and further strengthen the company’s position for future growth.

The proximity of the Memphis facility to the FedEx world hub in Memphis further enables us to accelerate delivery to all points of the country.” This development highlights the growing importance of cold chain infrastructure and strategic logistics hubs in meeting the rising demand for temperature-sensitive pharmaceuticals across the United States.

Active packaging formats, refrigerated temperature control, EPS substrates, boxes, coolants, and biopharmaceutical companies are projected to dominate the USA pharmaceutical cold chain packaging market by 2025, driven by stringent regulatory needs.

Refrigerated temperature control solutions are expected to capture 45% market share in 2025, driven by widespread adoption for transporting biologics, vaccines, and injectables requiring precise thermal stability during storage and distribution.

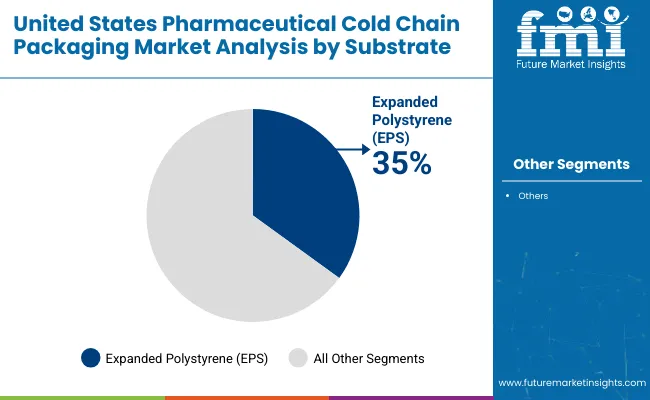

EPS projected to dominate substrate usage with 35% market share in 2025, favored for its superior insulation capabilities, lightweight nature, and cost-effectiveness in ensuring thermal stability during long-haul pharmaceutical shipments.

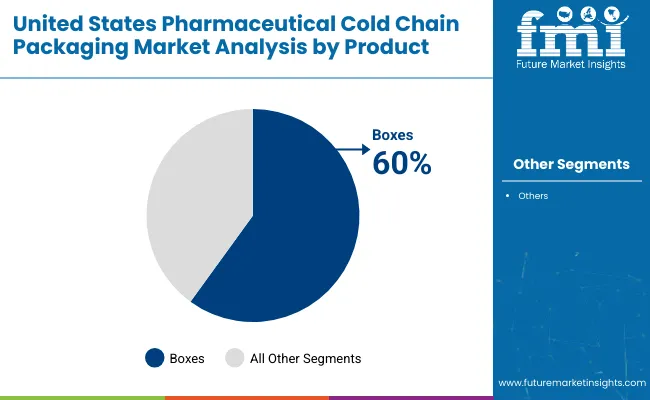

Boxes anticipated to hold a commanding 60% market share in 2025, supported by their versatility, affordability, and suitability for small- to medium-sized shipments of temperature-sensitive pharmaceuticals such as vaccines, injectables, and biologics.

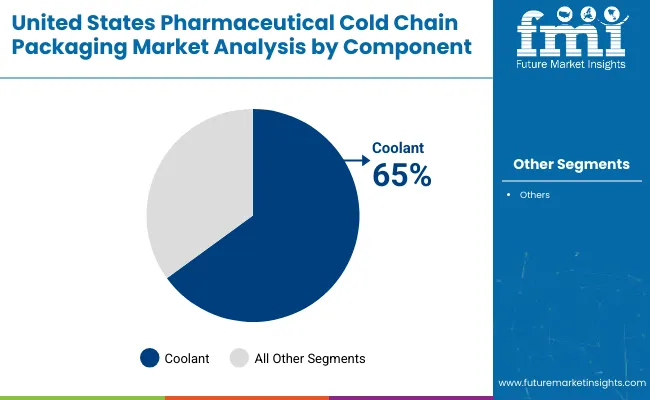

Coolants expected to lead the component segment with 65% market share in 2025, driven by critical need to maintain temperature stability throughout transit phases of biologics, specialty drugs, and vaccines requiring stringent thermal control.

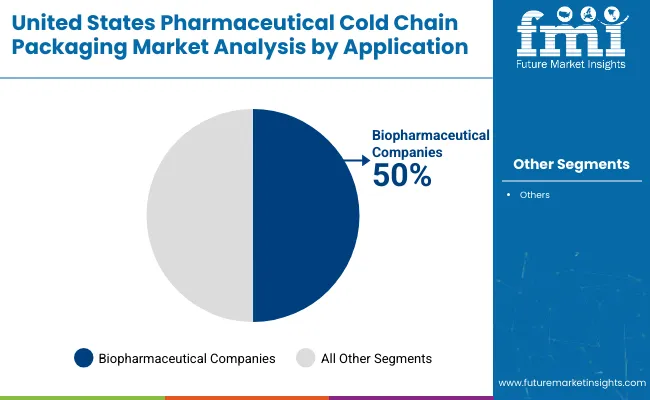

Biopharmaceutical firms projected to control 50% market share in 2025, reflecting their heavy reliance on specialized cold chain packaging for transporting monoclonal antibodies, vaccines, biosimilars, and cell & gene therapies.

The United States pharmaceutical cold chain packaging market is growing rapidly due to rising biologics demand, logistics innovation, and stricter regulatory standards. Active packaging and EPS dominate current usage, while sustainability goals are reshaping substrate innovation. Challenges include cost pressures, environmental concerns, and infrastructure gaps in extreme-temperature shipping.

Advanced Therapies Drive Demand for Temperature-Controlled Logistics

A key driver of market growth is the increasing development and distribution of biologics, including mRNA vaccines, monoclonal antibodies, and cell and gene therapies. These high-value products require strict temperature control throughout the supply chain to maintain efficacy. The expansion of clinical trials, global vaccine programs, and personalized medicine necessitates advanced packaging systems that offer reliable performance and real-time monitoring.

Compliance with Good Distribution Practices (GDP) and FDA mandates has intensified demand for validated cold chain packaging. As pharma companies invest in scalable, compliant logistics systems, cold chain packaging is becoming a critical element of drug safety, efficacy, and regulatory approval.

High Packaging Costs and Regulation Limit Smaller Players

One major restraint is the high cost associated with advanced cold chain packaging solutions. Active packaging systems with integrated sensors, GPS tracking, and rechargeable components involve significant upfront investment and operational complexity.

Additionally, the need for specialized handling, storage, and recharging infrastructure adds to logistics expenses. Smaller pharmaceutical companies and research institutes may face financial constraints when adopting these technologies. Environmental regulations targeting polystyrene and plastic waste also raise compliance costs, particularly in states with strict sustainability mandates. Balancing thermal performance with cost efficiency remains a key concern for stakeholders in a highly regulated and increasingly sustainability-focused environment.

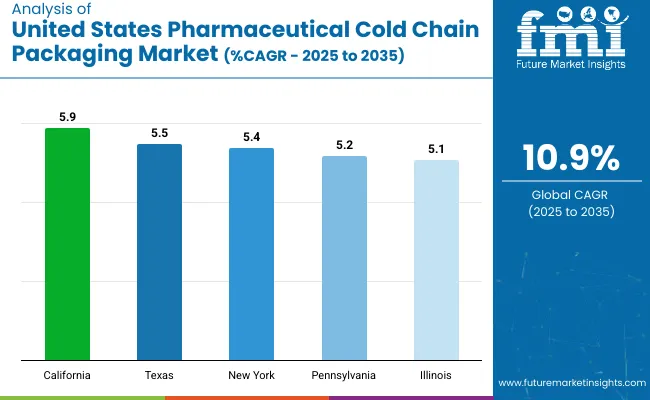

| States | CAGR (2025 to 2035) |

|---|---|

| California | 5.9% |

| Texas | 5.5% |

| New York | 5.4% |

| Pennsylvania | 5.2% |

| Illinois | 5.1% |

The USA pharmaceutical cold chain packaging market is evolving rapidly amid rising biologics production, temperature-sensitive vaccine distribution, and sustainability mandates. California leads growth among key states with a 5.9% CAGR, followed closely by Texas (5.5%) and New York (5.4%), driven by regional biotech hubs and shipping corridor expansion. Pennsylvania (5.2%) and Illinois (5.1%) play vital roles due to their manufacturing, warehousing, and integrated logistics capabilities.

As part of the broader NAFTA/USMCA trade bloc, the USA cold chain packaging market benefits from advanced infrastructure, regulatory rigor from the FDA, and public-private initiatives targeting thermal stability, last-mile tracking, and reusable packaging formats.

The report includes insights from 30+ USA states. The five below represent the most strategic players shaping the future of cold chain packaging for high-value pharmaceuticals.

California leads with a 5.9% CAGR, driven by its biopharma concentration, port-based logistics networks, and stringent environmental regulations. Home to global vaccine developers and biotech manufacturers, California emphasizes sustainable packaging innovation through compostable materials, reusable shipping solutions, and carbon-neutral warehousing. Silicon Valley’s tech integration supports real-time cold chain tracking and thermal analytics.

Texas is growing at a 5.5% CAGR, leveraging its central location, expanding pharmaceutical manufacturing base, and extensive freight corridors. As a rising hub for clinical trial material and vaccine logistics, Texas is investing in ultra-cold storage, temperature-controlled trucking, and packaging compliance infrastructure. Emerging partnerships with Mexico under USMCA enhance cross-border cold chain efficiency.

New York is expanding at 5.4% CAGR, supported by a robust hospital network, research institutions, and state-backed biomanufacturing incentives. Demand for cold chain packaging is rising in biologics, specialty pharmacies, and government stockpiles. The state emphasizes compliance with FDA labeling, traceability standards, and cold chain integrity across urban healthcare systems.

Pennsylvania’s market is growing at a 5.2% CAGR, driven by its historical pharmaceutical manufacturing base and centralized distribution infrastructure. Major companies in the state are modernizing packaging lines to accommodate mRNA, biologic, and cell therapy requirements. Pennsylvania’s proximity to Northeast urban centers makes it a cold chain transit hub for the broader mid-Atlantic.

Illinois is growing at 5.1% CAGR, supported by its strategic logistics positioning in the Midwest and proximity to O’Hare International Airport-one of the busiest pharma freight hubs globally. Chicago’s ecosystem of third-party logistics providers and packaging integrators is investing in validated temperature-controlled systems. Regulatory focus is intensifying on returns management, thermal risk, and eco-friendly components.

The USA pharmaceutical cold chain packaging market is moderately consolidated, with dominant players such as Sealed Air, CSafe, and PeliBioThermal leading in active packaging systems and end-to-end cold chain services. These companies offer validated solutions featuring real-time monitoring, temperature tracking, and extensive global logistics networks.

Key players like Cryoport Systems, Intelsius, and SkyCell specialize in niche segments, including cryogenic transport and biologics handling. Emerging players are introducing innovations in recyclable insulation materials, ultra-lightweight shippers, and AI-driven cold chain optimization.

High entry barriers persist due to strict regulatory compliance, technology validation processes, and economies of scale. Strategic collaborations between packaging providers, logistics firms, and pharmaceutical manufacturers are fostering product co-development, as the industry trends toward scalable and sustainable cold chain solutions.

Recent News in Pharmaceutical Cold Chain Packaging Industry in the United States

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.9 billion |

| Projected Market Size (2035) | USD 13.8 billion |

| CAGR (2025 to 2035) | 10.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Packaging Formats Analyzed (Segment 1) | Active, Passive |

| Temperature Requirements Analyzed (Segment 2) | Controlled Room Temperature (15°C - 25°C), Refrigerated (2°C - 8°C), Frozen (0°C and below), Deep-Frozen ( to 20 °C to -40°C), Cryogenic (-150°C and below) |

| Substrates Analyzed (Segment 3) | Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Expanded Polystyrene (EPS), Polyurethane (PU), Vacuum Insulated Panel (VIP), Temperature Insulated Packaging (TIP), Metal, Others |

| Products Analyzed (Segment 4) | Boxes, Mailers, Pallets, Others |

| Components Analyzed (Segment 5) | Coolant, Insulation |

| Applications Analyzed (Segment 6) | Biopharmaceutical Companies, Clinical Research Organizations, Hospitals, Research Institutes, Logistics and Distribution Companies, Others |

| Regions Covered | United States (national-level market) |

| Key Players Influencing the Market | Sealed Air, Peli BioThermal Limited, CSafe, Intelsius, Sonoco ThermoSafe, Cryoport Systems, LLC, SkyCell AG, Inmark Global Holdings, LLC, Smurfit Kappa, Insulated Products Corporation |

| Additional Attributes | Passive packaging dominates dollar sales; refrigerated and frozen ranges hold the majority share; VIP and PU substrates drive premium demand; biologics push growth among biopharma and logistics users |

The market is segmented into Active and Passive packaging formats.

The market is segmented into Controlled Room Temperature (15°C - 25°C), Refrigerated (2°C - 8°C), Frozen (0°C and below), Deep-Frozen ( to 20°C to -40°C), and Cryogenic (-150°C and below).

The market is segmented into Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Expanded Polystyrene (EPS), Polyurethane (PU), Vacuum Insulated Panel (VIP), Temperature Insulated Packaging (TIP), Metal, and Others.

The market is segmented into Boxes, Mailers, Pallets, and Others.

The market is segmented into Coolant and Insulation.

The market is segmented into Biopharmaceutical Companies, Clinical Research Organizations, Hospitals, Research Institutes, Logistics and Distribution Companies, and Others.

It is expected to reach USD 13.8 billion by 2035, up from USD 4.9 billion in 2025.

Active Packaging dominates the market with a projected 79.8% share by 2035.

Boxes lead the product type segment with approximately 60% share in 2035.

Active packaging formats dominate with 79.8% share due to their reliability and real-time temperature control.

Key players include Sealed Air, Peli BioThermal Limited, CSafe, Intelsius, Sonoco ThermoSafe, Cryoport Systems, LLC, SkyCell AG, Inmark Global Holdings, LLC, Smurfit Kappa and Insulated Products Corporation.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pharmaceutical Excipient SNAC Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Bottle Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Carbonate Market Forecast and Outlook 2025 to 2035

Pharmaceutical Grade Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Plastic Pots Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Liquid Prefilters Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade P-Toluenesulfonic Acid Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Track and Trace Systems Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Vials Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Logistics Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Lactose Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pharmaceutical Tubes Market Analysis Size, Share & Forecast 2025 to 2035

Pharmaceutical Filtration Market Growth - Trends & Forecast 2025 to 2035

Pharmaceutical Lipids Market Report - Growth, Demand & Forecast 2025 to 2035

Pharmaceutical Solvents Market Insights - Size, Share & Industry Growth 2025 to 2035

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Pharmaceutical Caps and Closures Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA