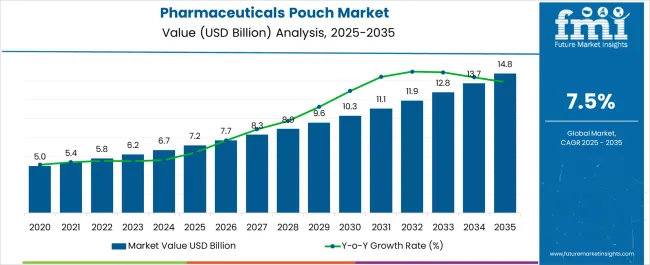

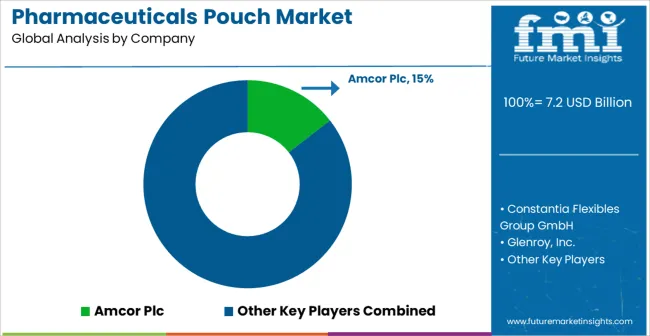

The Pharmaceuticals Pouch Market is estimated to be valued at USD 7.2 billion in 2025 and is projected to reach USD 14.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Pharmaceuticals Pouch Market Estimated Value in (2025 E) | USD 7.2 billion |

| Pharmaceuticals Pouch Market Forecast Value in (2035 F) | USD 14.8 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The Pharmaceuticals Pouch market is witnessing robust growth, driven by increasing demand for secure, durable, and user-friendly packaging solutions in the pharmaceutical industry. Rising production of tablets, capsules, and other oral dosage forms is fueling the need for innovative pouches that provide protection against moisture, contamination, and mechanical damage. Regulatory requirements regarding product safety, labeling, and tamper evidence are further supporting the adoption of high-performance packaging solutions.

Advancements in material science and packaging technology are enabling the production of pouches with enhanced barrier properties, breathability, and durability, while maintaining cost efficiency. The growing focus on patient convenience, easy storage, and compliance with environmental sustainability initiatives is also shaping market dynamics.

As pharmaceutical companies continue to expand their product portfolios and improve distribution efficiency, pouches are increasingly being preferred over traditional packaging formats Ongoing innovations in flexible packaging design, coupled with integration of smart labeling and traceability features, are expected to drive sustained growth in the Pharmaceuticals Pouch market over the coming decade.

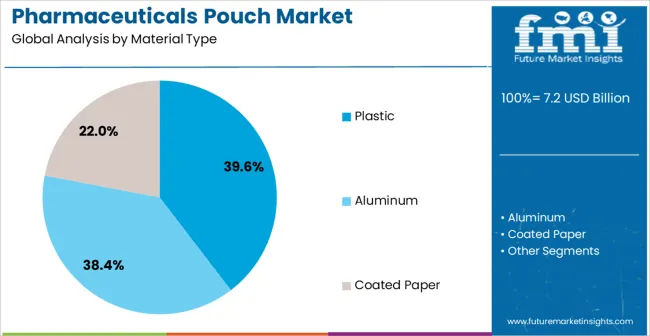

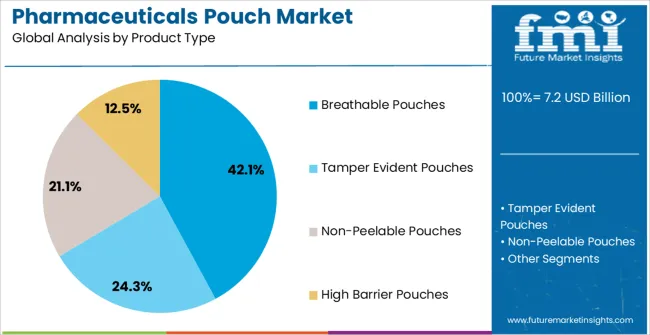

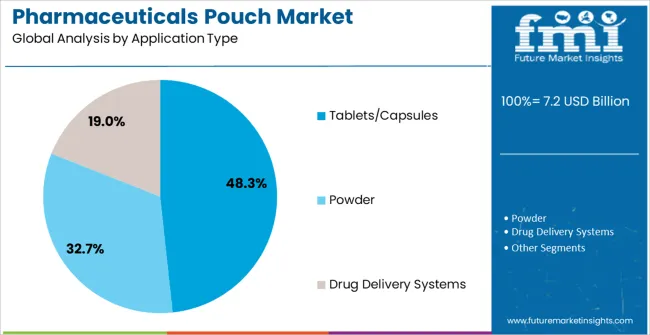

The pharmaceuticals pouch market is segmented by material type, product type, application type, and geographic regions. By material type, pharmaceuticals pouch market is divided into Plastic, Aluminum, and Coated Paper. In terms of product type, pharmaceuticals pouch market is classified into Breathable Pouches, Tamper Evident Pouches, Non-Peelable Pouches, and High Barrier Pouches. Based on application type, pharmaceuticals pouch market is segmented into Tablets/Capsules, Powder, and Drug Delivery Systems. Regionally, the pharmaceuticals pouch industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material segment is projected to hold 39.6% of the market revenue in 2025, establishing it as the leading material type. Growth in this segment is being driven by the superior flexibility, durability, and moisture resistance offered by plastic-based pouches, which are critical for maintaining the stability of pharmaceutical products. Plastic materials allow for lightweight packaging while providing excellent protection against environmental factors, making them highly suitable for transportation and storage.

The ability to incorporate multiple layers and barrier coatings enhances performance, ensuring product safety and extending shelf life. Cost-effectiveness, scalability of production, and compatibility with automated filling and sealing systems further support adoption.

Increasing regulatory compliance requirements and demand for high-quality, tamper-evident packaging are reinforcing the preference for plastic pouches As pharmaceutical manufacturers focus on efficiency, sustainability, and patient convenience, plastic pouches are expected to maintain their leading position, driven by technological improvements in polymer formulations and processing capabilities.

The breathable pouches product type segment is anticipated to account for 42.1% of the market revenue in 2025, making it the leading product type. Its growth is driven by the ability to allow controlled air and moisture transmission, which is essential for maintaining the quality of sensitive pharmaceutical products such as tablets and capsules. Breathable pouches prevent condensation and moisture buildup while ensuring product integrity during storage and transportation.

Advanced manufacturing techniques and material combinations are enabling high-performance breathable pouches that are compatible with automated packaging systems. The flexibility to adapt pouch properties to specific pharmaceutical requirements enhances operational efficiency and reduces waste.

Growing awareness of product safety, patient convenience, and sustainability is further supporting adoption As pharmaceutical companies continue to focus on innovative packaging solutions that balance protection, usability, and compliance, breathable pouches are expected to maintain a leading position in the market, supported by ongoing technological innovation and evolving industry standards.

The tablets and capsules application segment is projected to hold 48.3% of the market revenue in 2025, establishing it as the leading application area. Growth in this segment is being driven by the high global demand for oral dosage forms and the critical need to protect these products from moisture, oxygen, and contamination. Pharmaceuticals pouches designed for tablets and capsules ensure safe handling, extended shelf life, and compliance with regulatory standards.

Flexibility in design, such as resealable or child-resistant options, enhances patient convenience and adherence to medication regimens. Integration with automated packaging systems improves operational efficiency and reduces production costs.

The growing prevalence of chronic diseases and increasing consumption of prescription and over-the-counter medications are further fueling demand for secure and efficient pouch packaging As pharmaceutical manufacturers prioritize product integrity, patient safety, and sustainability, the tablets and capsules segment is expected to continue driving the overall growth of the Pharmaceuticals Pouch market.

Drug development plays a big role in the pharmaceutical sector, from generics to new drugs. The use of pharmaceutical pouches for advanced drug delivery systems is one of the most widely used forms of packaging. Packages are utilized for a variety of purposes, including storage, transportation, display, and consumption of products, as well as presentation, protection, identification information, convenience, and compliance.

Pharmaceutical pouches have a wide range of advantages, which are expected to increase their popularity in the market. Manufacturers offer smart pouches with various uses, from fine powders to large chunks of material used in medical, healthcare, and pharmaceutical packaging. In addition to protecting drugs from harmful rays, these pouches can be imprinted with prescription information.

Furthermore, manufacturers offer pharmaceutical flat pouches, stand-up pouches, and laminated roll stock films for preserving products and ensuring they endure shelf life by protecting them against oxygen, moisture, odour, light, chemical resistance, and contaminants.

As a result of the technological advancements in the pharmaceutical industry, the drug delivery mechanisms and the chemical ingredients contained in the drugs are rapidly changing. For hygienic and sustainable pharmaceutical packaging, manufacturers offer a wide range of dust-free packaging papers, designed to be used with tablets in blister packs or tablets sachets, or powder in powder sachets.

High-quality and modern packaging is required to ensure that the new medication delivery technology works as intended. In addition, pharmaceutical pouches are among the packaging types that are widely used in the modern delivery of medications.

Several forms and mechanisms are provided by manufacturers that are available for pharmaceutical pouches, which include child-proofing, senior citizen-friendly mechanisms, as well as barrier properties that prevent the pouch from being damaged by external factors.

Increasing environmental concerns and tighter government restrictions will likely drive the demand for bio-degradable polyethene during the forecast period. Polyethene market growth has been greatly buoyed by the development of innovative methods for reusing recycled plastic to generate maximum results in the market.

The growing propensity of various end-users, including hospitals and medicine manufacturers, to use pouches is likely to drive the market during the forecast period. Sustainable packaging, durability, and recyclables are other factors that may promote the pouch market.

The pharmaceutical pouches industry is also being driven by global concerns over environmental issues, safety concerns, and new recycling regulations. A variety of packaging and delivery solutions have been developed to meet the needs of the pharmaceutical industry, research, and manufacturing.

Industry developments, research, and manufacturing have been triggered by environmental concerns, patient adherence, and the development of new medicines. Increasing investments in research and development has resulted in the development of large-molecule biopharmaceuticals, which are still in the process of being developed, increasing the demand for injectable pouches to carry these products.

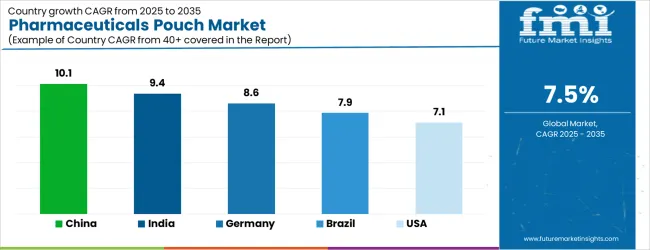

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

The Pharmaceuticals Pouch Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Pharmaceuticals Pouch Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Pharmaceuticals Pouch Market is estimated to be valued at USD 2.7 billion in 2025 and is anticipated to reach a valuation of USD 2.7 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 379.1 million and USD 245.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Material Type | Plastic, Aluminum, and Coated Paper |

| Product Type | Breathable Pouches, Tamper Evident Pouches, Non-Peelable Pouches, and High Barrier Pouches |

| Application Type | Tablets/Capsules, Powder, and Drug Delivery Systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amcor Plc, Constantia Flexibles Group GmbH, Glenroy, Inc., Sonoco Products Company, ProAmpac LLC, Huhtamaki Oyj, Mondi Group, Sealed Air Corporation, Berry Global Inc., Winpak Ltd., Clondalkin Group Holdings B.V., and Uflex Ltd. |

The global pharmaceuticals pouch market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the pharmaceuticals pouch market is projected to reach USD 14.8 billion by 2035.

The pharmaceuticals pouch market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in pharmaceuticals pouch market are plastic, _polypropylene (pp), _polyethylene (pe), _polyethylene terephthalate (pet), _polyvinyl chloride (pvc), _others, aluminum and coated paper.

In terms of product type, breathable pouches segment to command 42.1% share in the pharmaceuticals pouch market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Preservative Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceuticals Machinery Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pharmaceuticals Grade Sodium Bicarbonate Market Insights - Size, Share & Industry Growth 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Biopharmaceuticals Packaging Market Growth – Forecast 2025 to 2035

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Doy Pouch Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA