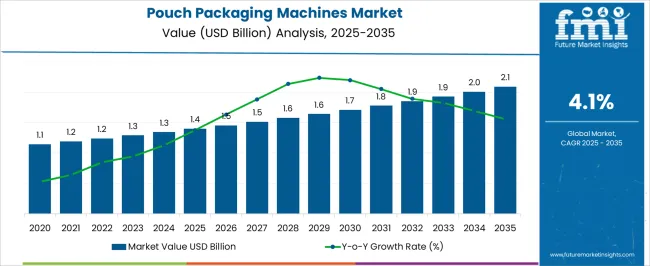

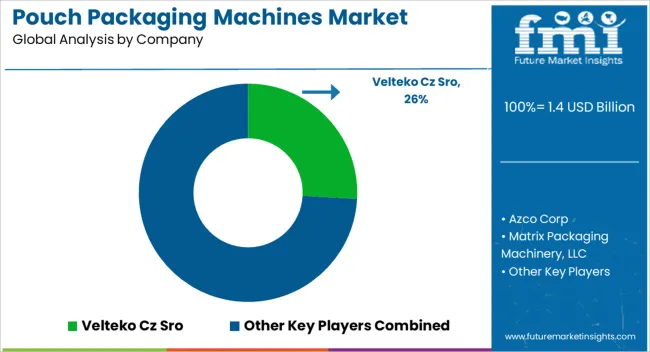

The Pouch Packaging Machines Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Pouch Packaging Machines Market Estimated Value in (2025 E) | USD 1.4 billion |

| Pouch Packaging Machines Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The pouch packaging machines market is expanding steadily owing to increasing demand for efficient, flexible, and compact packaging solutions across fast moving consumer goods sectors. A strong shift toward sustainability and material efficiency has driven the adoption of pouches over traditional rigid formats.

Technological advancements in sealing, filling, and material handling systems have improved the productivity and precision of pouch packaging equipment. Rising urbanization, growth in single serve and convenience packaging, and the need for shelf ready formats have further accelerated demand.

Moreover, manufacturers are investing in modular machines capable of handling multiple pouch formats and materials, aligning with dynamic consumer preferences and regulatory packaging requirements. The market is expected to continue its growth trajectory as end users seek automation, speed, and material flexibility within packaging operations.

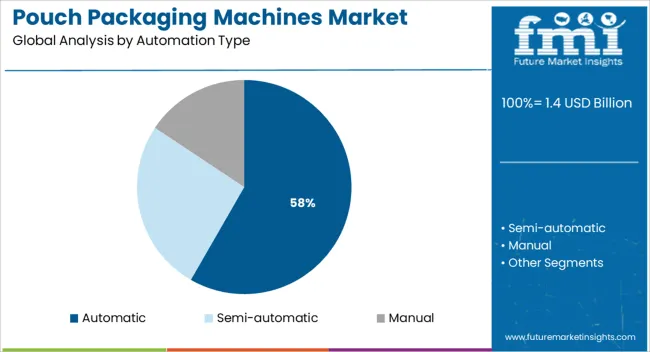

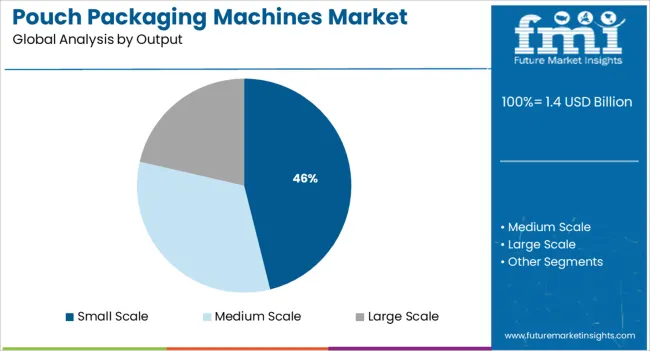

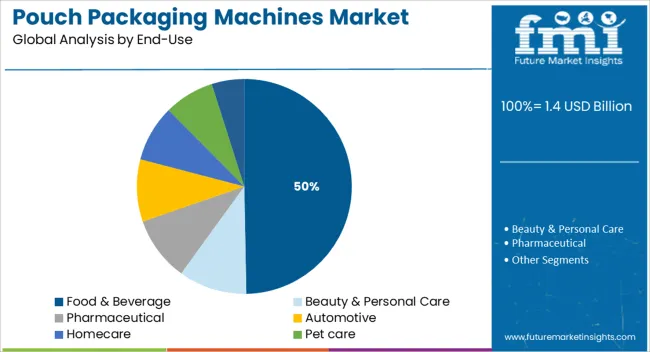

The market is segmented by Automation Type, Output, and End-Use and region. By Automation Type, the market is divided into Automatic, Semi-automatic, and Manual. In terms of Output, the market is classified into Small Scale, Medium Scale, and Large Scale. Based on End-Use, the market is segmented into Food & Beverage, Beauty & Personal Care, Pharmaceutical, Automotive, Homecare, Pet care, and Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The automatic segment is anticipated to contribute 58.30% of the total revenue in the automation type category by 2025, securing its position as the leading segment. This dominance is driven by increasing demand for high speed operations, consistent output, and reduced manual intervention in packaging lines.

Automatic pouch packaging machines enable continuous processing, minimize downtime, and improve sealing accuracy, making them suitable for both high volume and precision based applications. Their ability to integrate with digital controls, sensors, and real time monitoring systems has further boosted their industrial adoption.

As companies focus on improving operational efficiency and reducing labor costs, the preference for fully automatic solutions continues to rise, reinforcing their leadership within the automation landscape.

The small scale output segment is projected to account for 46.10% of market revenue within the output category by 2025, reflecting its dominant role in niche production and startup ecosystems. This segment benefits from the growing need for flexible production batches, seasonal products, and customized packaging.

Small scale machines offer lower capital investment, ease of operation, and adaptability for producers with limited space or varying product lines. Their ability to handle frequent format changes and support short production runs makes them ideal for artisanal brands and local manufacturing units.

As demand for agile and responsive packaging systems grows, this segment continues to lead by offering cost effective and scalable solutions.

The food and beverage segment is expected to command 49.70% of the total market share in the end use category by 2025, making it the most dominant application sector. This growth is supported by the increasing demand for ready to eat meals, snacks, dairy products, and beverages that require reliable and hygienic packaging.

Pouch formats provide superior convenience, extended shelf life, and effective product display, which align with evolving consumer lifestyles. Pouch packaging machines in this sector are tailored to meet strict hygiene standards, high speed requirements, and material compatibility for diverse food textures and volumes.

The sector’s push for automation and sustainable material integration has further intensified the adoption of pouch packaging machines, cementing food and beverage as the primary driver of market expansion.

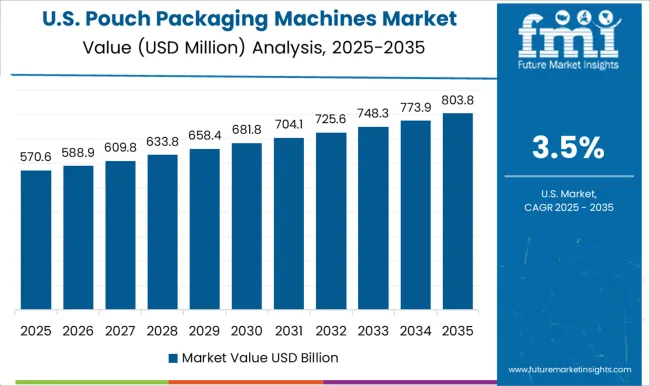

The global pouch packaging machine market witnessed a growth rate at a CAGR of 3.7% from 2020 to 2024 and reached USD 1,156.8 Million in 2024.

Pouch packaging machines are used for fabricating pouches made from flexible material and for packaging the food and non-food items inside them. Despite being the global market for the rigid packaging as the largest segment, the flexible packaging segment is rising at a faster rate. Because of that pouch packaging is the most preferred packaging solution for the various end user. Consumers prefer pouch packaging as it is small, lightweight, easy to carry, and space efficient. The benefits offered by pouch packaging gain the consumer's attention towards flexible packaging.

With the introduction of new technology and trends, which have an impact on the market, consumer purchasing patterns are changing. The biodegradability of product packaging must be taken into consideration when choosing raw materials for the production of packaging products.

Aseptic packaging, moisture resistance, ease and convenience of disposal, good product quality, and cost-effectiveness for both makers and customers are just a couple of the qualities that materials used for packaging must possess. Consumers seek healthier packing pouches as they become more and more health aware. There are numerous different types of foods and beverages available on the global market for pouch packaging machines.

The pouch packaging machines market is largely driven by the food and beverage industry segment. With the constantly growing population, the requirement for packaged food is going upwards and consumers are changing their shopping preferences. People are shopping from retail marts and supermarkets and the demand for ready-to-eat packaged food is increasing.

People are now more worried about the food they are consuming and hence buying properly packaged food. Also, pouch packaging is preferred by many brands as it is having many advantages such as low cost, easy handling, and space-saving and hence reduces the overall production and transportation cost. The surge in demand and the consumption of packaged food is majorly driving the pouch packaging machines market.

According to the report published by The USA Department of Agriculture (USDA), the number of grocery stores increased by 4%, from 63,619 to 65,975 between 2009 and 2014 and convenience stores increased from 120,581 to 124,879 which by 4% in the USA.

The maximum increment was seen in supermarts and warehouse club stores which is by 18%. The largest share of stores out of the four was convenience stores which accounts for 57% and next was grocery stores accounting for 30%. This will positive growth opportunities for the pouch packaging machine market.

According to The World Bank Group, a survey shows that 64% of Chinese agreed that food safety is a major priority as it affects their daily lives.

Chinese government promulgated a new Food Safety Law in the year of 2009 and created a food control system. Food safety is directly related to public health and has more impact on poor people. Thus, the reforms in food safety in china created growth opportunities for the pouch packaging machine market.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Automation Type, Output, End-use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa (MEA); Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | Velteko Cz Sro; Azco Corp; Matrix Packaging Machinery, LLC; Prodo Pak Corporation; Delta ModTech; About Packaging Robotics, Inc; American-Newlong, Inc; Tecno Pack Spa; James Dawson Entreprises Ltd; Hassia-Redatron Gmbh; SN Maschinenbau GmbH; Pacraft Co., Ltd.; Mentpack Gmbh; Nichrome Packaging Solutions; Mespack; Viking Masek Packaging Technologies; Spack Machine; Supertech Packaging Machinery; Echo Machinery Co. Ltd.; Volpak S.A.U; Pacraft Co., Ltd |

| Customization & Pricing | Available upon Request |

The global pouch packaging machines market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the pouch packaging machines market is projected to reach USD 2.1 billion by 2035.

The pouch packaging machines market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in pouch packaging machines market are automatic, semi-automatic and manual.

In terms of output, small scale segment to command 46.1% share in the pouch packaging machines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Doy Pouch Packaging Market

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Peel Pouches Market

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Twin Pouch Packaging Market

Kraft Pouch Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA