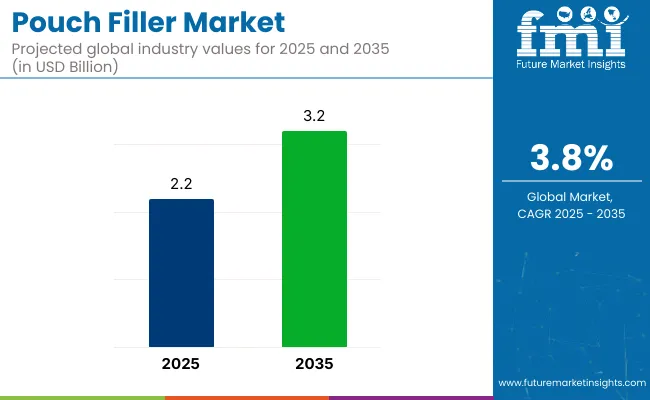

The global pouch filler market is expected to reach USD 3.2 billion by 2035, growing from USD 2.2 billion in 2025, with a CAGR of 3.8%.

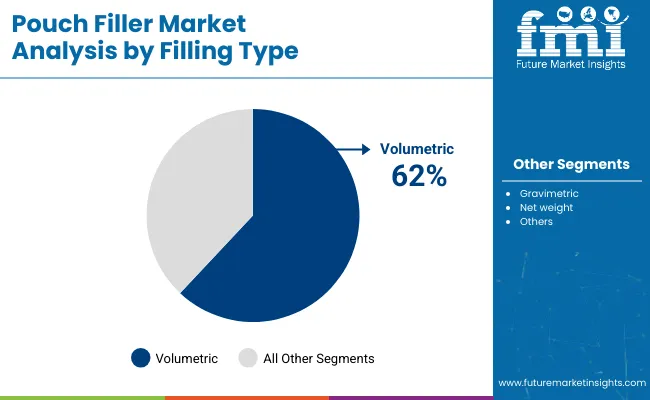

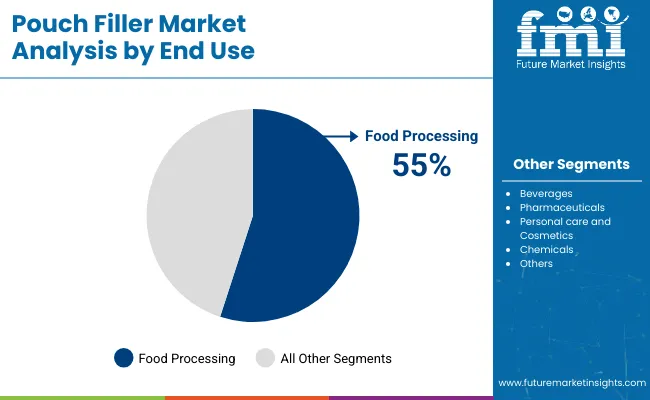

This growth is primarily driven by the increasing adoption of Volumetric filling technology, which is projected to account for 62% of the market share in 2025. Volumetric filling technology is favored for its cost efficiency, ease of maintenance, and versatility in handling various pouch sizes and fill volumes. The food processing sector will continue to dominate, capturing nearly 55% of the market share in 2025, fueled by rising demand for packaged ready-to-eat meals, dairy products, and snack foods.

The pouch filler market holds a specific share within various packaging segments. In the flexible packaging market, it represents about 3-5% due to its role in packaging liquids, powders, and foods. Within the pouch packaging market, this share is higher, around 10-15%, as pouch fillers are integral for efficiently filling and sealing various pouch types.

In the seafood packaging market, it accounts for roughly 5-8%, driven by the need for freshness retention in seafood products like fish fillets. Within the broader food packaging market, the pouch filler market holds about 6-8%, with pouches gaining popularity for ready-to-eat meals and beverages. In the cold chain packaging market, its share is lower, around 3-5%, due to the specialized nature of cold chain systems for perishable goods.

In May 2025, ProMach’s Flexibles & Trays business unit introduced its state-of-the-art MAG-R rotary horizontal form-fill-seal machine during the Pack Expo Southeast event. The MAG-R system is designed to deliver enhanced operational flexibility and performance efficiency for pouch packaging lines.

It features a modular design architecture and employs advanced magnetic linear track technology that enables faster tool changeovers, improved sealing precision, and minimized downtime. This new machine targets food and snack manufacturers seeking reliable, high-speed filling solutions that comply with stringent food safety and packaging quality standards. This development was officially announced by ProMach and listed on its website

Volumetric filling systems, food processing end use, automatic pouch fillers, and Asia Pacific region are expected to dominate the industry in 2025, driven by rising automation and packaged food demand.

Volumetric filling systems are projected to lead the filling type segment with a 62% industry share in 2025, due to their accuracy, cost-effectiveness, and adaptability across dry and liquid products. These systems are mostly preferred in industries like food processing and beverages, where quick product changeover and reduced spillage are essential.

Food processing will dominate the end use category with an estimated 55% industry share in 2025, fueled by rising global demand for packaged snacks, ready-to-eat meals, and dairy products. Pouch fillers ensure product freshness, portability, and attractive packaging in foods like cereals, sauces, and frozen items.

Automatic pouch fillers are projected to capture the largest share of 68% in 2025, driven by the need for speed, efficiency, and consistency in high-volume production lines. These systems reduce labour dependency and operational costs while ensuring precise filling and sealing, especially in food and beverage processing facilities.

Top Pouch Filler Market DynamicsThe pouch filler market is driven by increasing demand for efficient, automated packaging systems, advancements in technology, and growing applications across industries like food and beverages, pharmaceuticals, and chemicals. However, challenges remain in integration costs and regulatory compliance.

Key players are investing in advanced robotics and automation to improve pouch filling speed and precision.The adoption of IoT-enabled systems enhances production efficiency and real-time monitoring.

Top Challenges Limiting Market Potential

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

| United Kingdom | 4.2% |

| Germany | 5.7% |

| China | 4.9% |

| India | 6.1% |

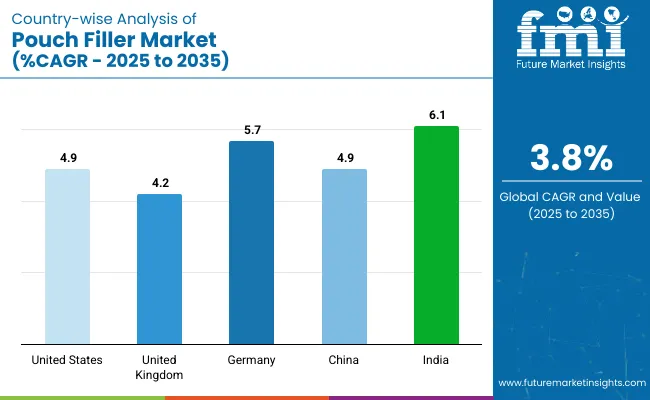

India leads the growth in the Pouch Filler market with a projected CAGR of 6.1%, driven by increasing demand in the food and beverage sector, along with advancements in packaging technology. China follows closely with a CAGR of 4.9%, reflecting strong industrial growth and the increasing use of pouch fillers in various applications such as food, beverages, and consumer goods.In developed economies.

The United States (4.9%) and Germany (5.7%) show steady growth, supported by innovations in packaging solutions and the rising preference for convenient packaging options. The United Kingdom (4.2%) also continues to grow at a moderate pace, bolstered by rising demand for efficient packaging solutions in food processing.

This report covers the in-depth analysis of 40+ Countries; Five top performing OECD countries highlighted below.

The United States industry continues to lead globally, registering a steady CAGR of 4.9% from 2025 to 2035. Growth is driven by the increasing demand for fully automated, high-speed, and flexible filling systems catering to food, beverage, and pharmaceutical industries.

The United Kingdom industry is projected to expand at a CAGR of 4.2%, supported by regulatory emphasis on green packaging and low-carbon manufacturing. Manufacturers are investing in compact, multi-functional filling systems optimized for organic foods, specialty beverages, and health products.

The Industryin Germany is anticipated to grow at a steady CAGR of 5.7% during the forecast period, reflecting its reputation for advanced industrial machinery.Robotics, IoT connectivity, and sensor-driven automation are being integrated into pouch filling lines by German manufacturers. These systems accommodate diverse product types-including viscous liquids, granules, and powders-while maintaining superior hygiene standards vital for food and pharmaceutical applications.

The Industry in China is expected to maintain a CAGR of 4.9%, propelled by rapid industrialization and expansion in the packaged food and personal care sectors. Domestic machinery producers are scaling up production of versatile filling equipment tailored for high-volume output, addressing the needs of both local manufacturers and export-driven industries.

India is set to record the highest CAGR of 6.1% in the industry between 2025 and 2035, fueled by booming demand in packaged food, dairy, and ready-to-drink beverage segments. Rapid urbanization, rising middle-class incomes, and changing dietary patterns drive the need for efficient, flexible pouch filling solutions.

The pouch filling machinery industry is a mix of established leaders and emerging innovators. Companies like ElecsterOyj and R.A. Jones Group have solidified their positions through years of experience and technological advancements.

Elecster, known for its aseptic pouch filling systems, serves the dairy and beverage industries with a focus on green initiative. R.A. Jones Group offers high-speed filling solutions, like the Pouch King machine, which caters to industries such as food and pharmaceuticals. New players are entering the market by focusing on flexible, modular, and eco-friendly filling solutions, addressing the growing demand for ecofriendly packaging.

The industry is expected to grow steadily, driven by the increasing demand for flexible packaging and automation in manufacturing processes. However, entry barriers are high due to the significant capital required, complex integration needs, and regulatory challenges. Despite these obstacles, consolidation is occurring, with larger firms acquiring smaller innovators to expand their technological capabilities and industry reach, leading to a more competitive landscape.

Recent Pouch Filler Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.2 billion |

| Projected Market Size (2035) | USD 3.2 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand units for volume |

| Filling Types Analyzed (Segment 1) | Volumetric Filling Systems, Gravimetric Filling Systems, Net Weight Filling Systems, Others |

| Automation Types Analyzed (Segment 2) | Automatic Pouch Fillers, Semi-Automatic Pouch Fillers, Manual Pouch Fillers |

| End Uses Analyzed (Segment 3) | Food Processing, Beverages, Pharmaceuticals, Personal Care and Cosmetics, Chemicals, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

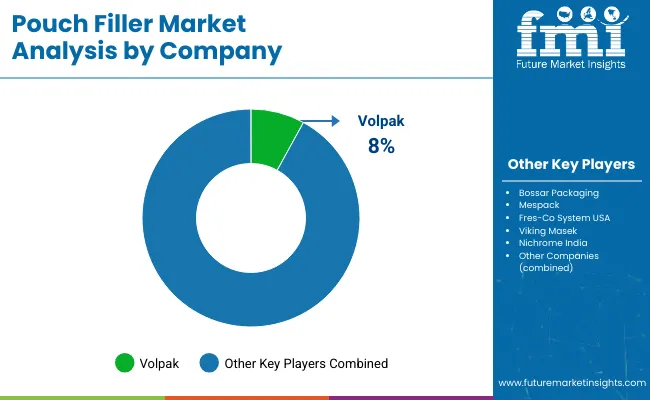

| Key Players influencing the Market | Volpak , Bossar Packaging, Mespack , Fres -Co System USA, Viking Masek , Nichrome India, All-Fill Inc., Paxiom Group, KHS GmbH |

| Additional Attributes | Dollar sales, share by automation type and end use, growing demand in food processing and beverage sectors, technological advancements in automatic filling solutions, regional machinery adoption trends |

The industry is segmented by filling type into volumetric filling systems, gravimetric filling systems, net weight filling systems, and others.

By automation type, the industry is divided into automatic pouch fillers, semi-automatic pouch fillers, and manual pouch fillers.

By end use, the industry is segmented into food processing, beverages, pharmaceuticals, personal care and cosmetics, chemicals, and others.

By region, the industry is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The global industry is projected to reach USD 2.2 billion in 2025.

The industry is expected to grow to USD 3.2 billion by 2035.

Leading players include Volpak, Bossar Packaging, Mespack, Fres-Co System USA, Viking Masek, Nichrome India, All-Fill Inc., Paxiom Group, and KHS GmbH.

The industry is anticipated to expand at a CAGR of 3.8% during the forecast period.

Rising demand for flexible packaging, automation in filling systems, and growing usage in food & beverage and pharmaceutical sectors are key drivers.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Tapes Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Doy Pouch Packaging Market

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Twin Pouch Packaging Market

Peel Pouches Market

Kraft Pouch Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA