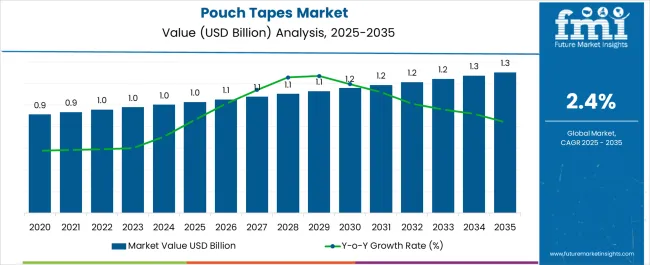

The Pouch Tapes Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.4% over the forecast period.

| Metric | Value |

|---|---|

| Pouch Tapes Market Estimated Value in (2025 E) | USD 1.0 billion |

| Pouch Tapes Market Forecast Value in (2035 F) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 2.4% |

The pouch tapes market is experiencing steady expansion, supported by the rapid growth of e-commerce, increasing demand for secure packaging, and rising emphasis on operational efficiency in supply chains. Industry publications and packaging company press releases have highlighted the growing use of durable sealing solutions to ensure product safety during storage and transit.

Polypropylene-based tapes have become widely adopted due to their strength, cost-effectiveness, and adaptability to automated packaging systems. Additionally, shifts in global trade and consumer behavior have heightened the need for packaging products that balance performance with sustainability, prompting manufacturers to introduce recyclable and eco-friendly tape variants.

Logistics hubs and distribution centers have continued to expand, driving consistent consumption of pouch tapes across sectors. The market outlook is supported by innovations in adhesive formulations, greater adoption of tamper-evident packaging, and integration of tapes with automated sealing systems. Future growth is expected to be driven by rising packaging volumes in shipping and logistics, product diversification across width formats, and material advancements targeting durability and sustainability.

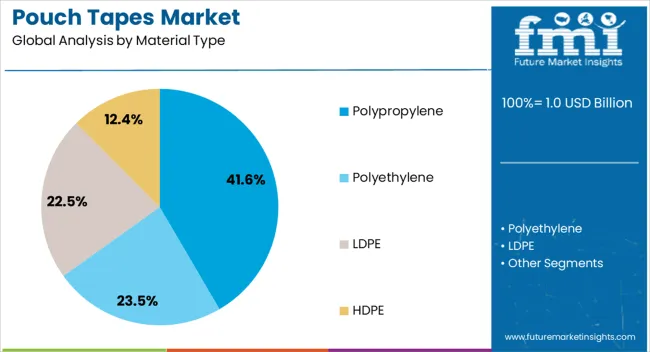

The Polypropylene segment is projected to contribute 41.6% of the pouch tapes market revenue in 2025, sustaining its leadership in material usage. Growth in this segment has been driven by polypropylene’s favorable balance of tensile strength, flexibility, and cost-efficiency, which has made it the preferred material in both manual and automated packaging operations.

Manufacturers have increasingly adopted polypropylene due to its resistance to tearing, superior adhesion performance, and compatibility with high-speed sealing equipment. Additionally, the material’s recyclability has aligned with sustainability initiatives within the packaging industry, further reinforcing its adoption.

With strong demand from e-commerce packaging and industrial shipping applications, polypropylene-based pouch tapes are expected to remain the primary choice among packaging professionals.

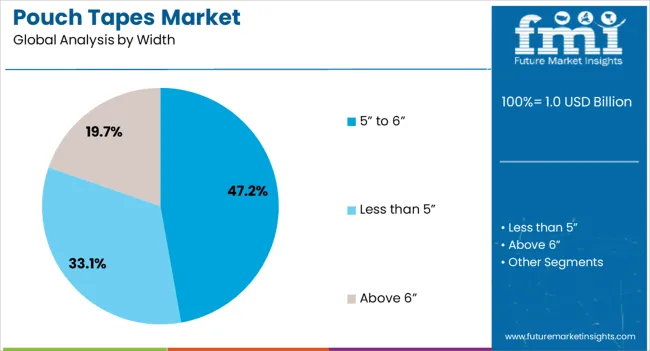

The 5” to 6” width segment is projected to account for 47.2% of the pouch tapes market revenue in 2025, positioning it as the dominant width category. This growth has been supported by the versatility of medium-width tapes in sealing larger pouches and cartons while maintaining cost efficiency.

Packaging professionals have favored this width for its ability to provide reliable sealing coverage without excess material use, balancing durability with productivity. The segment has also benefited from its compatibility with automated dispensers and industrial sealing equipment, making it a standard choice in large-scale logistics and warehousing environments.

With increasing shipping volumes and demand for efficient packaging formats, the 5” to 6” width segment is expected to maintain its strong position in the market.

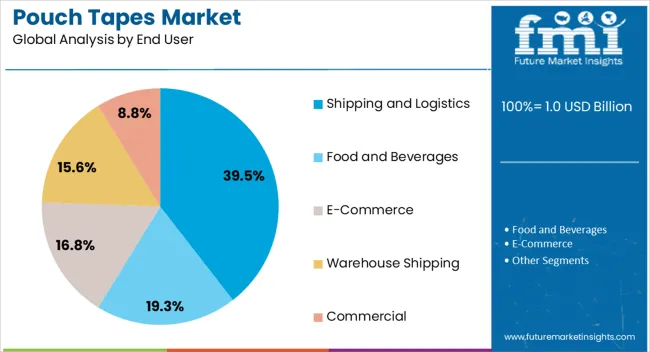

The Shipping and Logistics segment is projected to hold 39.5% of the pouch tapes market revenue in 2025, establishing itself as the leading end-user category. This dominance has been attributed to the surge in global e-commerce, rising cross-border trade, and the growing complexity of supply chains.

Shipping and logistics providers have prioritized pouch tapes for their role in ensuring product integrity, tamper resistance, and secure labeling during long-distance transport. Industry reports have highlighted the increased use of pouch tapes in parcel handling and cargo operations, where durability and quick application are essential.

Additionally, logistics companies have incorporated pouch tapes into standardized packaging practices to streamline operations and reduce loss or damage. As the demand for efficient, secure, and reliable packaging solutions grows in the logistics sector, the Shipping and Logistics segment is expected to remain the primary driver of pouch tape consumption.

Shipping and logistics sectors are expected to grow under the backdrop of e-commerce growth, increasing the sales of pouch tapes as per the market demand analysis. Pouch tapes have tacky borders, resulting in strong adhesion for attaching and protecting packing lists, information & work instructions and others that have raised the sales of pouch tapes in the postal communication department.

The key features leading to the demand for pouch tapes are high resistance to moisture and abrasion, which can be used in adverse climatic conditions. And the growing necessity of keeping the official documents safe is likely to grow the sales of pouch tapes in the coming years.

The demand for pouch tapes is rising as they are reducing waste disposal, thus resulting in reduced carbon emissions. It also improves the overall look of the package that has also contributed remarkably for the boosting of pouch tapes market share in last couple of years.

Pouch tapes offer less material usage which reduces the transportation and storage cost leading to greater demand for pouch tapes in recent years. Also pouch tapes are easy to use, low price, and exhibit good performance in various applications that is likely to increase the sales of pouch tapes in small scale industrial sectors.

Demand for pouch tapes is rising as they are light in weight, as it does not increase the overall weight of the products to be shipped. Pouch Tapes provide a quick, simple, and secure method of attaching documents, fueling the pouch tapes market share growth.

Despite the favorable opportunities, there has been a decline in the sales of pouch tapes in the recent past due to the stringent government regulations towards the use of plastics. Moreover, substitute products such as document pouches can hamper the pouch tapes market share growth to a certain degree.

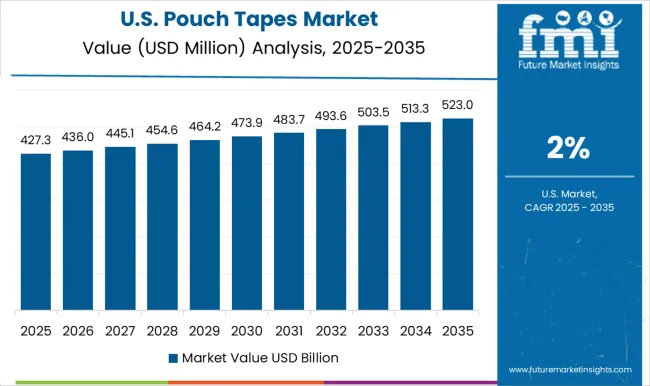

North America is expected to dominate the pouch tapes market during the forecast period.

The North American region acquires about 32% of the share. Due to an increase in shipping and logistics activity in the region, the demand for pouch tapes in the countries of the United States and Canada is poised to remain intact throughout the forecast years.

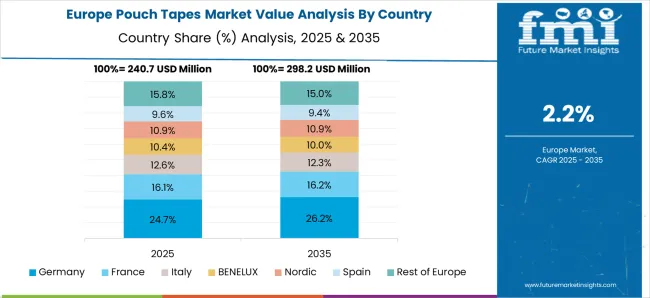

Europe region is anticipated to follow North America in terms of growth rate and placed second in the sales of pouch tapes. It acquires 26% of the total pouch tapes market share all around the globe.

The increase in the e-commerce sector in European countries resulting in the consumer preference towards online purchasing, is likely to boost the sales of pouch tapes in Europe as per market survey.

New trends, innovative technology, and product phase are the tactics adopted by start-ups emerging in the pouch tapes market share at another height in recent years.

The pouch tapes start-up market is innovating on chemical resistance and adhesion pouch tapes which are not harmful and are performing better to re-use at your standards. These pouch tapes prevent the packed accessories with their electroplating solutions and are expected to drive the market in the coming forecast period.

Recently available printed pouch tapes are improved by 40% with Scotch adjustable tape dispenser M797 and scotch pouch tape dispenser M727 which can boost the demand for pouch tapes during the forecast period.

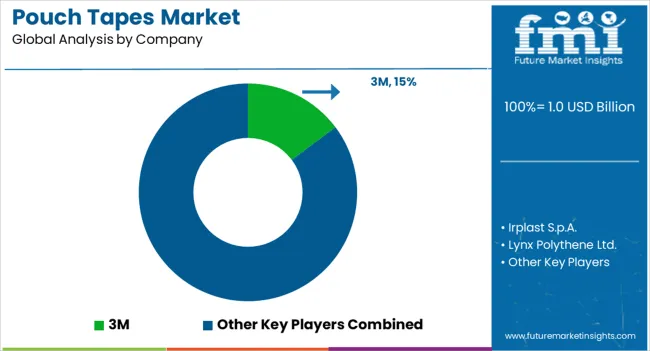

Some of the key players in the pouch tapes market are 3M, Irplast S.p.A., Lynx Polythene Ltd., and Flexopack Ltd., among others.

The industry players are focused on generating large revenue by adopting various methods, business model analysis, and key strategies that can be predicted to raise the pouch tapes market future trends as per market reports in the coming period.

IRPLAST, the pouch tapes company that innovates cost-saving solutions, has introduced print-on tape, UV-resistant, in its recently launched products with solvent-free and reverse printing techniques.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 2.4% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Material Type, Width, End User, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | 3M; Irplast S.p.A.; Lynx Polythene Ltd.; Flexopack Ltd |

| Customization | Available Upon Request |

The global pouch tapes market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the pouch tapes market is projected to reach USD 1.3 billion by 2035.

The pouch tapes market is expected to grow at a 2.4% CAGR between 2025 and 2035.

The key product types in pouch tapes market are polypropylene, polyethylene, ldpe and hdpe.

In terms of width, 5” to 6” segment to command 47.2% share in the pouch tapes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Pouch-Bowl Packaging Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Pouch Film Market Trends & Industry Growth Forecast 2024-2034

Pouch Market Insights – Growth & Trends 2024-2034

Pouch Sealing Machine Market

Pouch Dispensing Fitment Market

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Competitive Breakdown of Box Pouch Providers

OPP Pouches Market Trends - Growth, Demand & Forecast 2024 to 2034

PCR Pouches Market

Doy Pouch Packaging Market

Foil Pouch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Foam Pouch Market Analysis - Demand, Size & Industry Outlook 2025 to 2035

Twin Pouch Packaging Market

Peel Pouches Market

Kraft Pouch Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA