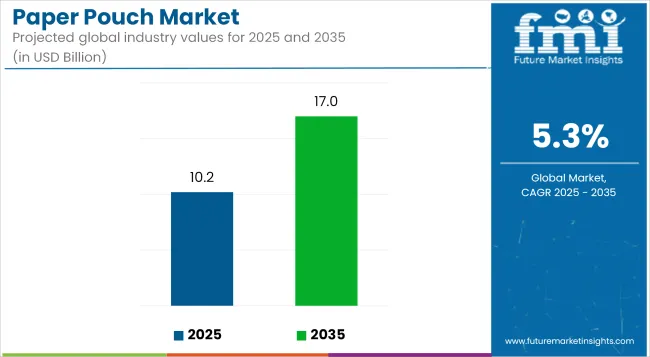

The paper pouch market is projected to grow from USD 10.2 billion in 2025 to USD 17.0 billion by 2035, registering a CAGR of 5.3% during the forecast period. Sales in 2024 reached USD 9.6 billion, indicating a steady demand trajectory.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 10.2 billion |

| Market Value (2035F) | USD 17.0 billion |

| CAGR (2025 to 2035) | 5.3% |

This growth has been attributed to the increasing demand for sustainable and eco-friendly packaging solutions across various sectors, including food and beverage, pharmaceuticals, and personal care. The rise in environmental awareness and the need for biodegradable alternatives have further propelled the adoption of innovative paper pouch solutions. Additionally, advancements in packaging technologies have enhanced the functionality and sustainability of these pouches, aligning with the evolving needs of manufacturers and consumers alike.

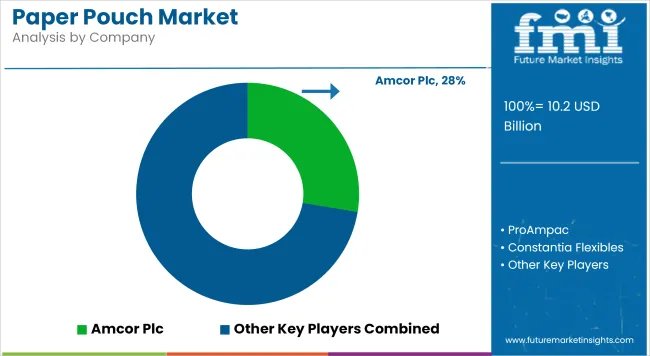

In June 2025, Amcor a global leader in developing and producing responsible packaging solutions, has announced the launch of its new AmFiber™ Performance Paper stand-up pouch, a paper-based refill pack for instant coffee and dry beverage products. Giorgio Dini, Marketing Manager for Coffee at Amcor says:

“This newest addition to the AmFiber™ family offers coffee and dry beverage brands a more attractive packaging solution that has a natural, paper-based appeal and is recycle-ready. Helping to advance more circular refill packaging, we are proud to announce the AmFiber™ Performance Paper stand-up pouch, as we continue to innovate in paper-based solutions.”

The paper pouch sales has been significantly influenced by the increasing demand for sustainable and environmentally friendly packaging solutions. Manufacturers have been transitioning towards recyclable and biodegradable materials to align with environmental sustainability goals and meet consumer preferences for eco-conscious products.

Innovations in material science have led to the development of pouches that not only provide superior protection but also minimize environmental impact. Additionally, advancements in manufacturing technologies have enabled the production of customizable and efficient pouches, catering to a wide range of applications across different industries.

The paper pouch demand is poised for continued growth, driven by the ongoing expansion of various end-use industries and the increasing emphasis on sustainable packaging solutions. The market's trajectory suggests a steady rise in demand for innovative, eco-friendly pouches that cater to both consumer preferences and regulatory requirements.

Companies investing in research and development to create durable, cost-effective, and environmentally friendly pouches are expected to gain a competitive edge. The integration of advanced materials and ergonomic designs will likely play a crucial role in shaping the future of the Paper Pouch Market.

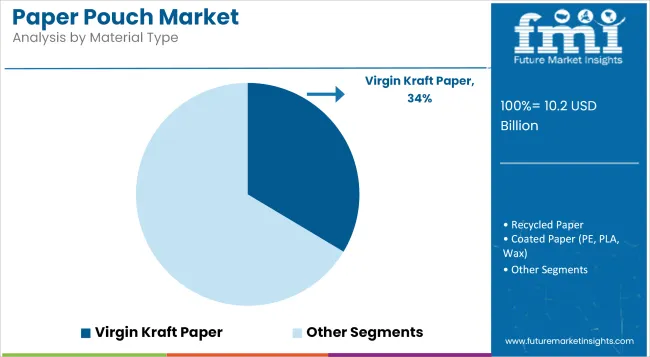

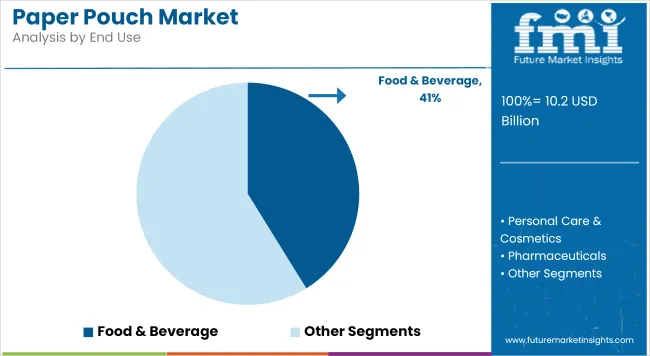

The market is segmented based on pouch type, material type, end-use industry, and region. By pouch type, the market includes flat paper pouches, stand-up paper pouches, gusseted paper pouches, zipper paper pouches, side-seal paper pouches, and window paper pouches. In terms of material type, the market is categorized into virgin kraft paper, recycled paper, coated paper (PE, PLA, wax), laminated paper with foil/film, and bleached & unbleached paper.

By end-use industry, the market comprises food & beverage, personal care & cosmetics, pharmaceuticals, pet food, household products, and retail & apparel. Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa.

Stand-up paper pouches have been estimated to hold a 39.8% share of the paper pouch market in 2025, driven by their visibility, branding space, and consumer convenience. A wide base has allowed these pouches to stand upright on retail shelves without support, enhancing product display.

They have been designed to accommodate resalable zippers, spouts, and degassing valves. Multiple layers, including barrier coatings, have been applied to improve moisture, grease, and oxygen resistance.

These pouches have been widely used across dry snacks, coffee, tea, and powdered beverage mixes. A strong preference has been observed in health and organic food segments due to their biodegradable or recyclable nature. Lightweight construction has contributed to shipping efficiency and reduced carbon emissions.

Print-friendly paper surfaces have enabled brands to implement vibrant, matte, or textured finishes to elevate consumer appeal. Compatibility with digital and flexographic printing has made short production runs cost-effective. Compostable films and water-based adhesives have been increasingly incorporated to meet sustainability regulations.

Tamper-evident seals and transparent windows have also been included without compromising the pouch structure. Global food safety and labeling regulations have been met through certified food-grade coatings and adhesives. Manufacturers have invested in advanced lamination and slitting equipment to meet the growing demand for premium pouches. Retailers and contract packers have preferred stand-up formats for their uniformity and convenience.

The food & beverage industry has been projected to account for 41.2% of the global paper pouch market by 2025, fueled by rising consumer demand for sustainable, convenient packaging. Edible dry goods, granolas, spices, and single-serve beverage mixes have increasingly been packed in barrier-coated paper pouches.

Regulatory compliance, composability claims, and growing online retail have accelerated the shift from plastic to paper alternatives. Shelf-ready, lightweight formats have helped improve logistics and reduce damages during handling. Eco-conscious consumers have driven the switch to fiber-based packaging in organic and functional food segments.

Resalable closures and easy-tear notches have been integrated into pouches for snacks and confectionery to improve portability. Natural aesthetics and recyclable symbols have been aligned with wellness-driven branding strategies. Brands have preferred minimalist and biodegradable formats to align with ESG targets and circular economy efforts.

Multinational food processors and direct-to-consumer startups have deployed paper pouches for new product launches. Heat-sealable options with advanced barrier properties have enabled extended shelf life for dehydrated and semi-moist products. Food-safe water-based inks and adhesives have been employed to ensure compliance with FDA and EU standards.

As digitization expands, QR code-enabled pouches have also been introduced to boost traceability and consumer engagement. With the rise of urban snacking, meal kits, and health-focused products, paper pouches have served as a sustainable yet functional packaging option.

Cost competitiveness with plastic multilayer films has improved through optimized supply chains and growing paper pouch manufacturing capacities. Continued innovation in barrier coatings and print quality will support food brands' transitions to paper. Growth is expected to accelerate further with regulatory pressures favoring single-material, recyclable solutions.

The growing worldwide popularity of paper-based packaging solutions is resulting in a sharp rise in consumption and demand for paper bags, pouches and many other packaging solutions.

These paper pouches are made up of three layers with having outermost layer made of Kraft paper, a middle layer made of aluminium foil and an innermost layer made of LLDPE (Linear Low-Density Polyethylene).

Paper pouches are the most preferred packaging solution for packaging roasted coffee, dried fruits, snacks, chocolates & candy, pet food, spices, cereals and many other products that can be packed using paper pouches.

The durable properties of Kraft paper make it compatible for manufacturing paper pouches from it, also some manufacturers combine Kraft paper and recycled paper to produce these paper pouches. Overall global paper pouch market is anticipated to witness an exponential rise over the next decade.

The most important driver fuelling sales of paper pouches is these pouches are eco-friendly and has no negative impacts on the environment. Moreover, these paper pouches are recyclable and can decompose easily after disposal, which makes them the most preferred packaging solution for modern-day consumers.

The paper pouches made up of Kraft paper are perfectly suitable for packaging edible contents like food & beverages, as these pouches are not toxic and do not release any chemicals into eatable products when it comes in direct contact with it.

Another benefit of using paper pouches is that they are easy to fold and easy to transport, along with the cost-effectiveness of these pouches as compared to other packaging solutions made up of plastic and glass. All the above-mentioned factors are driving sales of paper pouches globally, eventually contributing to the growth of the global paper pouch market.

The primary restraint of using paper pouches is that paper pouches have very poor water resistance and their strength is reduced in wet conditions, which negatively impacts the potential growth of the global paper pouch market.

Large amounts of forests are cut to procure paper for the production of paper pouches and other packaging solutions. Along with that large amounts of waste are generated by these paper pouches, due to improper disposal of the same.

Manufacturers of paper pouches are developing and designing attractive looking paper pouches, by using various moisture barrier layers in the inner side of the pouch to provide complete protection with aesthetic appeal and quality are providing producers to market these pouches as reliable packaging solutions.

Customization offered by key global players which offers a wide range of paper pouches such as pouches having window to provide a look of the ingredients packed, pouches with side gussets and also flat paper pouches for several applications. All these different types of pouches are gaining worldwide popularity especially in developing parts of the world and provides key players with an opportunity to penetrate developing markets.

An increasing number of end-user industries using paper pouches as packaging solutions for their products, such as pharmaceutical, cosmetics & personal care and many other industries are choosing paper pouches as sustainable packaging solutions for their goods. All these factors provide rewarding growth opportunities for paper pouch manufacturers.

The booming food & beverages industry in China and India, along with a growing number of millennials among the population demanding easy to carry packaging for consumables, makes both of these countries fast-paced growth offering markets for paper pouches.

Rapid developments in the manufacturing sector in China and easy availability of raw materials such as paper, with cheaper labour, encourages the packaging industry players to expand their markets domestically & internationally. All these factors make India and China the most favourable countries for the global paper pouches market.

The stringent laws for food packaging formed by the FDA (Food and Drug Administration), usage of non-toxic materials made it compulsory for packing all food & beverages. Approval of Kraft paper as a safe packaging material by the FDA makes the USA a key country for the global paper pouches market.

Increasing trends of ready-to-eat foods in the country, along with that international fast food chains expanding the takeaway culture, makes paper pouch a user-friendly packaging solution for the manufacturer and end-user industries to cater latest consumer requirements. All these aforementioned factors are contributing towards the expansion of the paper pouches market in the USA.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Paper Pouch Manufacturers

Rice Paper Stand Up Pouch Market Growth & Sustainable Packaging 2024-2034

Kraft Paper Pouch Market Growth – Demand & Forecast 2025 to 2035

Stand Up Paper Pouches Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA