The paper pallet market stands at the threshold of a transformative decade that promises to revolutionize logistics infrastructure and material handling solutions. The market's journey from USD 1.2 billion in 2025 to USD 2.1 billion by 2035 represents remarkable expansion, demonstrating the accelerating adoption of lightweight packaging technology and eco-friendly logistics optimization across manufacturing industries, retail distribution centers, and international shipping operations.

The first half of the decade (2025 to 2030) will witness the market climbing from USD 1.2 billion to approximately USD 1.6 billion, adding USD 0.4 billion in value, which constitutes 44% of the total forecast growth period. This phase will be characterized by the rapid adoption of corrugated paper pallet systems, driven by increasing export requirements and the growing need for cost-effective shipping solutions worldwide. Enhanced moisture resistance capabilities and load-bearing control systems will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness accelerated growth from USD 1.6 billion to USD 2.1 billion, representing an addition of USD 0.5 billion or 56% of the decade's expansion. This period will be defined by mass market penetration of specialized lightweight technologies, integration with automated warehouse systems, and seamless compatibility with existing material handling infrastructure. The market trajectory signals fundamental shifts in how logistics operations approach weight reduction and shipping cost management, with participants positioned to benefit from growing demand across multiple pallet types and application segments.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Corrugated paper pallets (standard) | 48% | Export shipping, light-weight goods |

| Honeycomb paper pallets | 24% | Electronics, automotive parts | |

| Molded pulp pallets | 16% | Food products, pharmaceutical goods | |

| Composite paper pallets | 12% | Chemical containers, industrial materials | |

| Future (3-5 yrs) | Moisture-resistant corrugated pallets | 35-40% | International shipping, humid conditions |

| Custom-designed honeycomb pallets | 22-28% | Electronics manufacturing, precision goods | |

| Heavy-duty composite pallets | 15 to 20% | Industrial applications, chemical transport | |

| Biodegradable molded pallets | 12-16% | Food industry, pharmaceutical compliance | |

| Reinforced multi-layer pallets | 8-12% | High-value goods, long-distance transport |

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.2 billion |

| Market Forecast (2035) | USD 2.1 billion |

| Growth Rate | 5.7% CAGR |

| Leading Technology | Corrugated Paper Pallets |

| Primary Application | Export & International Shipping Segment |

The market demonstrates strong fundamentals with corrugated paper pallet systems capturing a dominant share through advanced structural capabilities and logistics optimization. Export and international shipping applications drive primary demand, supported by increasing trade volumes and lightweight packaging equipment adoption requirements. Geographic expansion remains concentrated in manufacturing hubs with established export cultures, while emerging economies show accelerating adoption rates driven by industrial growth and rising cost-efficiency standards.

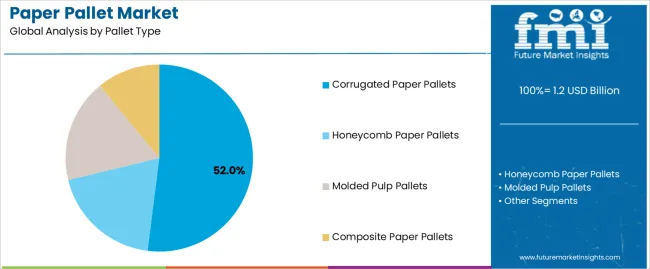

Primary Classification: The market segments by pallet type into corrugated paper pallets, honeycomb paper pallets, molded pulp pallets, and composite paper pallets, representing the evolution from basic shipping materials to sophisticated logistics solutions for comprehensive load protection optimization.

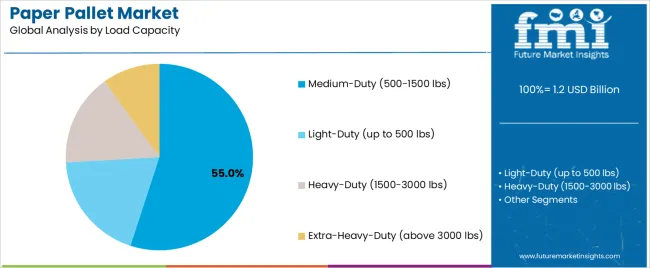

Secondary Classification: Load capacity segmentation divides the market into light-duty pallets (up to 500 lbs), medium-duty pallets (500-1500 lbs), heavy-duty pallets (1500-3000 lbs), and extra-heavy-duty pallets (above 3000 lbs), reflecting distinct requirements for product weight, shipping distances, and load-bearing capacity standards.

Tertiary Classification: Application segmentation covers export & international shipping, domestic logistics, warehouse storage, retail distribution, and manufacturing operations, while material composition spans virgin kraft paper, recycled paper fibers, and specialty treated paper categories.

Regional Classification: Geographic distribution covers Asia Pacific, North America, Europe, Latin America, and Middle East & Africa, with manufacturing regions leading adoption while developing economies show accelerating growth patterns driven by industrial expansion programs.

The segmentation structure reveals technology progression from standard shipping materials toward sophisticated logistics systems with enhanced durability and moisture resistance capabilities, while application diversity spans from export operations to domestic warehouse establishments requiring precise pallet solutions.

Market Position: Corrugated Paper Pallet systems command the leading position in the paper pallet market with 52% market share through advanced structural features, including superior load distribution, weight reduction capacity, and shipping optimization that enable logistics operations to achieve optimal cost efficiency across diverse export and domestic transportation environments.

Value Drivers: The segment benefits from shipping company preference for lightweight pallet systems that provide consistent structural performance, enhanced load protection, and cost optimization without compromising pallet integrity or affecting product safety characteristics. Advanced paper engineering enables weight reduction, shipping cost savings, and integration with existing material handling equipment, where structural performance and cost efficiency represent critical operational requirements.

Competitive Advantages: Corrugated Paper Pallet systems differentiate through proven weight reduction reliability, consistent load-bearing characteristics, and integration with automated warehouse systems that enhance operational efficiency while maintaining optimal shipping cost standards suitable for diverse export and commercial applications.

Key market characteristics:

Honeycomb Paper Pallet systems maintain a 26% market position in the paper pallet market due to their superior strength-to-weight ratio and specialized applications. These systems appeal to manufacturers requiring high-performance pallets with competitive pricing for electronics and automotive shipping applications. Market growth is driven by industrial preference, emphasizing structural performance and specialized packaging through optimized honeycomb design.

Molded Pulp Pallet systems capture 14% market share through food industry requirements in pharmaceutical companies, food processors, and hygiene-sensitive operations. These establishments demand clean manufacturing systems capable of handling diverse product types while providing exceptional food safety and contamination prevention.

Market Context: Medium-duty capacity pallets (500-1500 lbs) demonstrate 55% market share due to widespread adoption of mid-range industrial products and increasing focus on versatile load handling, warehouse optimization, and shipping efficiency that maximizes carrying capacity while maintaining structural standards.

Appeal Factors: Medium-duty pallet operators prioritize load-bearing capacity, structural integrity, and integration with diverse product types that enables optimized shipping operations across multiple weight ranges. The segment benefits from substantial manufacturing investment and export programs that emphasize the acquisition of medium-duty pallets for shipping optimization and cost efficiency applications.

Growth Drivers: Export expansion programs incorporate medium-duty pallets as standard platforms for industrial goods, while manufacturing growth increases demand for versatile capacity capabilities that comply with safety standards and minimize shipping complexity.

Market Challenges: Varying product weights and load composition may limit pallet standardization across different industries or shipping scenarios.

Application dynamics include:

Light-duty capacity pallet applications capture market share through precision product requirements in electronics manufacturing, pharmaceutical goods, and delicate item shipping. These applications demand lightweight pallet systems capable of operating with sensitive handling equipment while providing effective product protection and operational simplicity capabilities.

Heavy-duty capacity pallet applications account for market share, including chemical operations, machinery shipping, and high-weight packaging requiring substantial load-bearing capabilities for operational optimization and transport efficiency.

Market Position: Export & International Shipping applications command significant market position with 7.1% CAGR through growing global trade trends and cross-border logistics adoption for efficient goods transportation.

Value Drivers: This application segment provides the ideal combination of cost reduction and efficiency, meeting requirements for weight optimization, regulatory compliance, and operational effectiveness without reliance on heavy wooden pallets.

Growth Characteristics: The segment benefits from broad applicability across manufacturing industries, automated logistics adoption, and established shipping programs that support widespread pallet usage and operational convenience.

Market Context: Manufacturing Operations dominate the market with 7.6% CAGR, reflecting the primary demand source for paper pallets in production facilities and industrial logistics platforms.

Business Model Advantages: Manufacturing operations provide direct market demand for lightweight pallet materials, driving quality standards and logistics innovation while maintaining product protection and operational efficiency requirements.

Operational Benefits: Manufacturing applications include product handling, quality assurance, and production enhancement that drive consistent demand for paper pallets while providing access to latest logistics technologies.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Rising export volumes & international trade growth (global manufacturing, e-commerce expansion) | ★★★★★ | Exponential growth in international shipping creates massive demand for lightweight pallets; cost-conscious logistics behavior drives market expansion. |

| Driver | Manufacturing industry growth & industrial expansion | ★★★★★ | Rapid proliferation of manufacturing facilities globally; standardized pallet requirements across multiple production locations drive bulk procurement and consistent demand. |

| Driver | Wooden pallet alternatives & weight reduction regulations (shipping cost optimization) | ★★★★★ | Cost pressure eliminating heavy wooden alternatives; paper pallets become preferred option for shipping expense reduction and logistics optimization. |

| Restraint | Competition from plastic pallets & metal alternatives | ★★★☆☆ | Growing adoption of durable pallet programs in select markets; reusable pallet models create substitution pressure for disposable paper options. |

| Restraint | Moisture sensitivity & weather limitations | ★★★★☆ | Paper material vulnerabilities impact usage scenarios; moisture exposure constraints limit applications in certain shipping conditions. |

| Trend | Custom sizing & engineered pallets for specific products (load optimization, product-specific design) | ★★★★★ | Manufacturers leveraging pallets for logistics efficiency; precision-designed solutions drive premium pallet adoption for operational differentiation. |

| Trend | Moisture-resistant & barrier coating innovations (advanced treatment technology) | ★★★★☆ | Technical improvements enhancing weather protection; synthetic barriers replacing traditional treatments for better performance. |

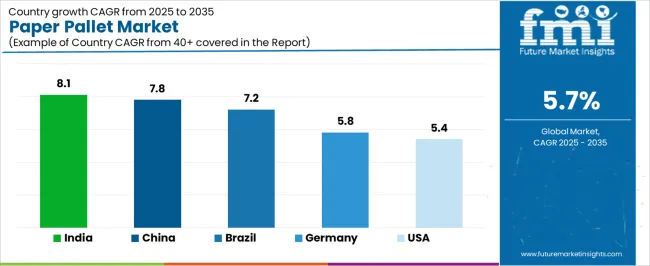

The paper pallet market demonstrates varied regional dynamics with Growth Leaders including China (7.8% growth rate) and India (8.1% growth rate) driving expansion through manufacturing proliferation and export growth initiatives. Steady Performers encompass United States (5.4% growth rate), Germany (5.8% growth rate), and developed regions, benefiting from established manufacturing cultures and logistics platform adoption. Emerging Markets feature Brazil (7.2% growth rate) and developing regions, where industrial expansion and shipping modernization support consistent growth patterns.

Regional synthesis reveals North American markets leading value generation through premium product adoption and specialized pallet culture, while Asian markets demonstrate highest volume growth supported by manufacturing proliferation and rising export trends. European markets show moderate growth driven by regulatory shipping requirements and cost reduction integration.

| Region/Country | 2025 to 2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 7.8% | Manufacturing scale; export-focused solutions | Quality consistency; local competition |

| India | 8.1% | Industrial expansion; cost-effective premium pallets | Infrastructure gaps; distribution challenges |

| United States | 5.4% | Custom engineering; moisture-resistant innovation | Regulatory complexity; margin pressure |

| Germany | 5.8% | Precision solutions; premium positioning | Economic impacts; cost sensitivities |

| Brazil | 7.2% | Industrial growth; regional partnerships | Economic volatility; logistics constraints |

China establishes fastest market growth through massive manufacturing infrastructure and comprehensive export development, integrating advanced paper pallets as standard components in shipping operations and industrial installations. The country's 7.8% growth rate reflects explosive manufacturing adoption and domestic industrial expansion that mandates the use of lightweight pallet systems in commercial and export facilities. Growth concentrates in major manufacturing centers, including Shanghai, Guangzhou, and Shenzhen, where export operations showcase integrated pallet systems that appeal to manufacturers seeking advanced cost reduction capabilities and shipping optimization applications.

Chinese manufacturers are developing domestically-produced pallet solutions that combine local production advantages with functional operational features, including enhanced moisture resistance and load-bearing capabilities. Distribution channels through industrial supply chains and export platform partnerships expand market access, while manufacturing culture supports adoption across diverse commercial and industrial segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, manufacturers and export services are implementing paper pallets as standard platforms for cost reduction and shipping optimization applications, driven by increasing industrial investment and export platform programs that emphasize the importance of logistics efficiency. The market holds an 8.1% growth rate, supported by manufacturing expansion and industrialization programs that promote lightweight pallet systems for commercial and export applications. Indian operators are adopting pallet solutions that provide consistent structural performance and cost reduction features, particularly appealing in urban regions where export shipping and logistics efficiency represent critical operational expectations.

Market expansion benefits from growing industrial consumption patterns and manufacturing proliferation that enable widespread adoption of cost-effective pallet systems for industrial and export applications. Technology adoption follows patterns established in logistics optimization, where functionality and value drive procurement decisions and operational deployment.

Market Intelligence Brief:

United States establishes market leadership through comprehensive manufacturing programs and advanced logistics culture development, integrating paper pallets across industrial and shipping applications. The country's 5.4% growth rate reflects established export consumption patterns and mature logistics technology adoption that supports widespread use of lightweight pallet systems in manufacturing and shipping facilities. Growth concentrates in major industrial areas, including Texas, California, and the Midwest, where manufacturing culture showcases mature pallet deployment that appeals to industrial operators seeking proven cost reduction capabilities and shipping optimization applications.

American manufacturing establishments leverage established distribution networks and comprehensive product availability, including custom-engineered pallets and moisture-resistant options that create operational differentiation and cost advantages. The market benefits from mature export infrastructure and industrial willingness to invest in lightweight pallet materials that enhance shipping efficiency and cost optimization.

Market Intelligence Brief:

Germany's advanced manufacturing regulation market demonstrates sophisticated paper pallet deployment with documented performance effectiveness in industrial applications and export facilities through integration with existing logistics systems and manufacturing infrastructure. The country leverages precision engineering standards and quality requirements to maintain a 5.8% growth rate. Industrial centers, including Munich, Frankfurt, and Hamburg, showcase premium installations where paper pallets integrate with comprehensive export platforms and quality systems to optimize shipping operations and manufacturing effectiveness.

German operators prioritize logistics precision and engineering credentials in pallet procurement, creating demand for certified products with advanced features, including custom engineering and enhanced load-bearing. The market benefits from established industrial consciousness and a willingness to invest in premium pallet materials that provide superior performance benefits and adherence to quality standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse industrial demand, including manufacturing expansion in São Paulo and Rio de Janeiro, industrial establishment growth, and rising export consumption that increasingly incorporate paper pallet solutions for shipping applications. The country maintains a 7.2% growth rate, driven by industrialization and increasing recognition of paper pallet benefits, including improved cost efficiency and enhanced shipping optimization.

Market dynamics focus on affordable quality pallet solutions that balance logistics performance with cost considerations important to Brazilian industrial operators. Growing manufacturing proliferation creates continued demand for modern pallet systems in new facility infrastructure and industrial modernization projects.

Strategic Market Considerations:

The European paper pallet market is projected to grow from USD 0.4 billion in 2025 to USD 0.7 billion by 2035, registering a CAGR of 5.8% over the forecast period. Germany is expected to maintain its leadership position with a 32.1% market share in 2025, supported by its strong manufacturing base and export-oriented economy.

United Kingdom follows with a 24.7% share in 2025, driven by logistics optimization and shipping cost reduction initiatives. France holds a 18.9% share through industrial applications and export operations. Italy commands a 13.2% share, while Netherlands accounts for 11.1% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.8% to 6.4% by 2035, attributed to increasing manufacturing adoption in Nordic countries and emerging industrial establishments implementing lightweight pallet programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global manufacturers | Production capacity, supply chain, engineering networks | Scale efficiency, consistent quality, broad reach | Innovation speed; local customization |

| Specialty converters | Custom engineering; moisture-resistant technology; precision designs | Quality leadership; manufacturing partnerships; differentiation | Mass market penetration; price competition |

| Regional producers | Local manufacturing, distribution channels, competitive pricing | Market proximity; cultural understanding; cost advantage | Technology gaps; international expansion |

| Private label suppliers | Industrial partnerships, value positioning, volume production | Price competitiveness; industrial access; volume scale | Brand loyalty; premium segment access |

| Engineering innovators | Load technology, barrier solutions, material science | Technical expertise; patent portfolio; performance | Market scalability; distribution challenges |

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 billion |

| Pallet Type | Corrugated Paper Pallets, Honeycomb Paper Pallets, Molded Pulp Pallets, Composite Paper Pallets |

| Load Capacity | Light-Duty (up to 500 lbs), Medium-Duty (500-1500 lbs), Heavy-Duty (1500-3000 lbs), Extra-Heavy-Duty (above 3000 lbs) |

| Material Composition | Virgin Kraft Paper, Recycled Paper Fibers, Specialty Treated Paper |

| Application | Export & International Shipping, Domestic Logistics, Warehouse Storage, Retail Distribution, Manufacturing Operations |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, United States, Germany, India, United Kingdom, Brazil, Canada, Japan, France, Mexico, and 25+ additional countries |

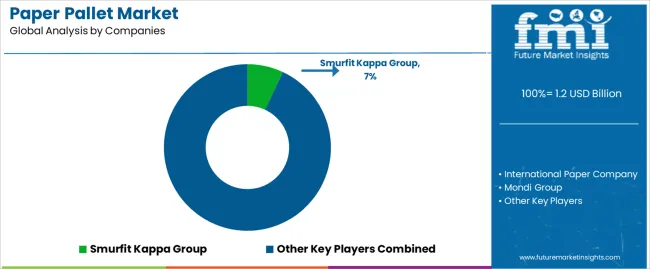

| Key Companies Profiled | Smurfit Kappa Group, International Paper Company, Mondi Group, DS Smith Plc, Cascades Inc., Sonoco Products Company, Corrugated Pallets LLC |

| Additional Attributes | Dollar sales by pallet type and capacity categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with logistics manufacturers and industrial suppliers, customer preferences for cost reduction and load optimization, integration with warehouse platforms and manufacturing systems, innovations in moisture resistance technology and structural enhancement, and development of recyclable pallet solutions with enhanced performance and load protection capabilities. |

The global paper pallet market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the paper pallet market is projected to reach USD 2.1 billion by 2035.

The paper pallet market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in paper pallet market are corrugated paper pallets, honeycomb paper pallets, molded pulp pallets and composite paper pallets.

In terms of load capacity, medium-duty (500-1500 lbs) segment to command 55.0% share in the paper pallet market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Paper Pallet Providers

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Paper Recycling Market Size and Share Forecast Outlook 2025 to 2035

Paper Release Liners Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Materials Market Size and Share Forecast Outlook 2025 to 2035

Paper Pigments Market Size and Share Forecast Outlook 2025 to 2035

Paper Honeycomb Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA