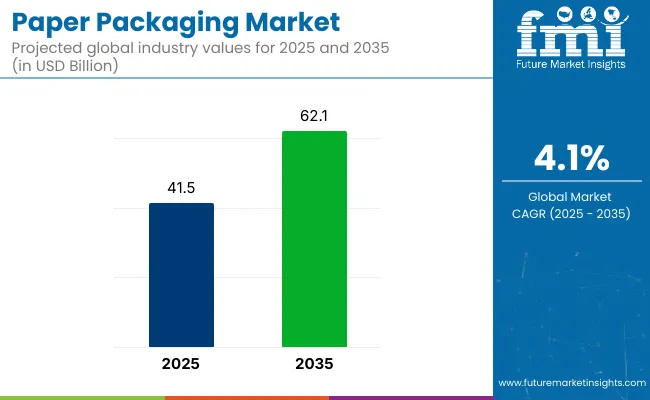

The global paper packaging market is projected to grow from USD 41.5 billion in 2025 to USD 62.1 billion by 2035, registering a CAGR of 4.1% over the forecast period. Sales in 2024 were recorded at USD 39.8 billion.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 41.5 Billion |

| Projected Market Size in 2035 | USD 62.1 Billion |

| CAGR (2025 to 2035) | 4.1% |

This growth is primarily attributed to the increasing demand for sustainable and eco-friendly packaging solutions across various industries, including food and beverage, healthcare, personal care, and e-commerce. Paper packaging offers advantages such as recyclability, biodegradability, and cost-effectiveness, making it a preferred choice for manufacturers aiming for environmentally responsible packaging.

The expansion is being driven by a widespread shift toward sustainable, biodegradable, and recyclable packaging solutions, particularly across the food & beverage, pharmaceutical, personal care, and e-commerce sectors. Paper-based materials are increasingly preferred due to their high tensile strength, lightweight nature, and environmental advantages over single-use plastic packaging.

In markets with stringent regulations on plastic consumption, such as the European Union, Canada, and parts of Asia, paper packaging is being adopted not just as a regulatory necessity but as a competitive brand differentiator.

Governmental initiatives encouraging circular economy practices and extended producer responsibility (EPR) frameworks are reinforcing the demand. According to a 2024 report by the World Packaging Organization (WPO), more than 70 countries had introduced regulatory roadmaps targeting single-use plastics, indirectly supporting the growth of the paper packaging sector.

In a 2024 press statement, Andrew King, CEO of Mondi Group, highlighted the company’s acquisition of the Hinton Pulp Mill in Alberta, Canada, as a pivotal move in expanding the group’s sustainable production footprint.

“This acquisition significantly increases our corrugated converting capacity, extends our reach across Western Europe, and offers strong downstream integration opportunities,” King noted. The deal was viewed as a strategic response to rising European demand for recycled and semi-chemical corrugated packaging materials.

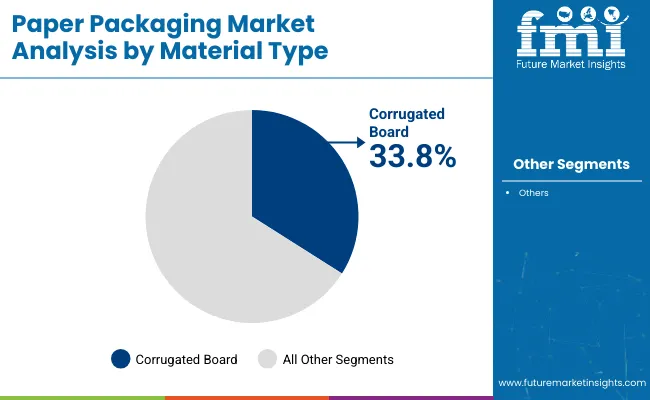

Corrugated board is expected to hold the largest share of 33.8% in the paper packaging market in 2025, as its use has been supported by structural rigidity, cushioning ability, and adaptability across packaging formats. Single-wall and double-wall variants have been applied for shipping cartons, shelf-ready packaging, and protective outer wraps.

Resistance to compression, stacking damage, and vibration has been optimized through flute design and box geometry. Printing compatibility and consistent performance in varied load conditions have reinforced its usage in industrial and retail logistics.

Die-cut corrugated formats have been engineered for high-speed packing lines and standardized transport modules. Custom configurations for partitioning, cushioning, and bulk handling have enabled widespread deployment across manufacturing hubs. Demand has been driven by packaging efficiency and versatility across product categories. Continued preference has been maintained for corrugated board due to its reliability in large-volume applications.

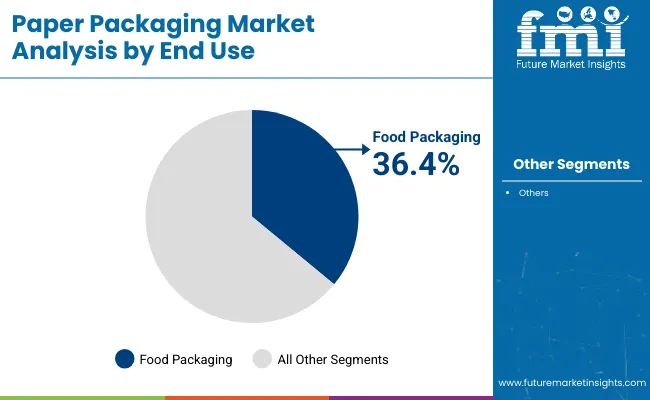

The food packaging segment is projected to account for 36.4% of the paper packaging market share in 2025, as its dominance has been driven by high-frequency production, perishability, and compliance with handling standards. Boxes, wraps, and cartons have been used extensively to package frozen meals, baked goods, dry snacks, and quick-serve products.

Paper-based containers and liners have been selected for direct food contact and transit readiness. High-speed filling and sealing systems have been supported through compatibility with paperboard-based configurations.

Moisture-resistant coatings and grease barriers have been applied where required to maintain packaging integrity. Shelf-ready features and standardized sizing have been implemented to meet modern merchandising requirements. Branding and labeling zones have been incorporated into box designs for improved market visibility. Steady demand from QSR chains, retail grocers, and frozen food manufacturers has preserved the segment’s leadership.

Challenges

Opportunities

In the paper packaging industry, the United States is at the forefront with a likely growing demand for sustainable, cost-efficient, and long-lived packaging solutions by consumers from various industries like food & beverages, healthcare, and e-commerce. The demand for green alternatives, alongside some government strict rules against single-use plastics, create a space for innovation concerning recyclable and biodegradable paper packaging.

Companies are investing heavily in corrugated packaging designed especially to be high-strength, molded fiber trays, and water-resistant paper coatings to better protect and place their products more sustainably. Additional investments are being made into artificial intelligence (AI) packaging automation, intelligent tracking solutions, and digital printing technologies to maximize efficiency and consumer interaction. Lastly, the USA's growing popularity of recyclable and plant-based materials will further drive the market for paper packaging in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

The UK paper packaging industry is witnessing swift growth because of regulatory measures to curb plastic waste and foster circular economy approaches. The introduction of extended producer responsibility (EPR) schemes, plastic taxes, and sustainability pledges by large brands is speeding up the transition towards recyclable, compostable, and reusable paper-based packaging.

Businesses are investing in light-weight yet robust paperboard, food-grade coatings, and fiber-based flexible packaging to address changing industry demands. In addition, advancements in waterproof paper wraps, grease-proof film coatings, and tamper-evident packages are picking up pace. Growing demand for custom and digitally printed packaging for labeling is also driving innovation in the UK paper packaging industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.7% |

Japan's paper packaging industry is recording stable growth through high consumer education, stringent recycling rules, and innovations in paper-based materials through technological improvements. Lightweight, neat, and practical packaging solutions to the food, cosmetic, and electronic industries are stimulating paper package innovation.

Such firms are inventing high-barrier paper packages, water-barrier paperboard, and antimicrobial paper treatments for improved protection of products. Also, developments in AI-driven quality control, robot-based packaging automation, and RFID-enabled smart labels are enhancing efficiency and traceability. The shift towards minimalist, plastic-free, and compostable packaging is also in line with Japan's sustainability agenda and reinforcing its paper packaging sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

South Korea's paper packaging industry, according to government initiatives on green packaging and extended recycling programs combined with business commitment to sustainability, has a good growth prospect. An increasing demand and popularity for biodegradable and lightweight paper packaging among consumers, e-commerce food delivery, and consumer goods sectors are consequently propelling the market's growth.

Add to that, coated barrier paper, plant-based ink, and recyclable adhesives these companies are investing into the packaging industry to improve functionality and minimize negative environmental impacts. Such innovations include digital printing, automated packaging lines, and smart supply chains. The South Korean paper packaging industry is poised to grow due to an increasing preference for bio-based materials in packaging and novel fiber-based forms for packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.8% |

The paper packaging industry is driven by growing demand in food & beverage, e-commerce, and retail sectors. The industry is being led by innovation in the form of developments in new materials, including water-resistant paper, bio-based coatings, and AI-driven printing optimization, to mitigate efficiency, sustainability, and performance concerns.

There are also developments in automated paper packaging manufacturing and AI-assisted quality control driving industry patterns. The increasing demand for compostable and high-barrier paper packaging is also driving market growth. Additionally, growing investments in sustainable paperboard manufacturing and smart packaging integration are enhancing product efficiency and broadening market opportunities.

Hybrid packaging solutions that combine high-strength paper with moisture-resistant barriers are also being developed by companies for greater usability. Further, partnerships among consumer brands and packaging manufacturers are fuelling innovation for tailored paper-based packaging solutions with varied industry demands.

Key Development

The overall market size for the Paper Packaging Market was USD 41.5 Billion in 2025.

The Paper Packaging Market is expected to reach USD 62.1 Billion in 2035.

The market will be driven by increasing demand from food & beverage, e-commerce, and sustainable retail packaging industries. Innovations in water-resistant coatings, AI-driven material optimization, and improvements in high-performance paperboard packaging will further propel market expansion.

Key challenges include fluctuating raw material costs, the need for improved moisture resistance, and regulatory compliance with sustainable packaging initiatives. However, advancements in biodegradable coatings, AI-powered defect detection, and high-strength kraft paper innovations are addressing these concerns and supporting market growth.

North America and Europe are expected to dominate due to stringent environmental regulations, increased consumer preference for eco-friendly packaging, and investments in paper recycling infrastructure. Meanwhile, Asia-Pacific is experiencing rapid growth driven by expanding e-commerce, rising disposable incomes, and increased demand for sustainable consumer goods packaging.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Paper Packaging Industry

Paperboard Packaging Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Waxed Paper Packaging Market

coated-paper-packaging-box-market-market-value-analysis

Aseptic Paper for Packaging Market from 2023 to 2033

Recycled Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Flowpack Paper Packaging Market

Polycoated Paper Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Polycoated Paper Packaging Market Share

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Aseptic Packaging Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Medical Packaging Paper Market

Flexible Packaging Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Flexible Packaging Paper Manufacturers

Tissue and Hygiene Paper Packaging Market

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA