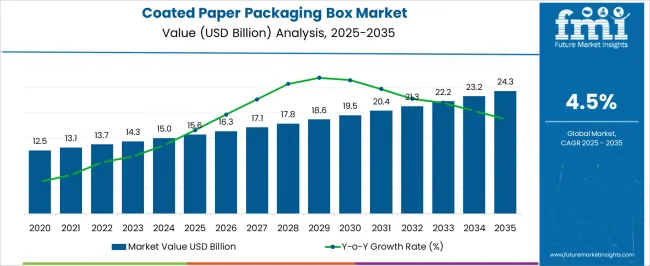

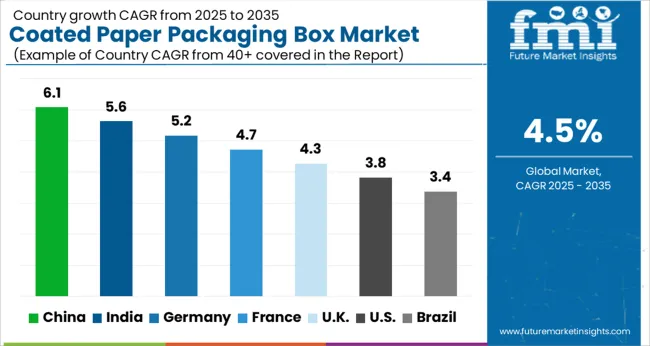

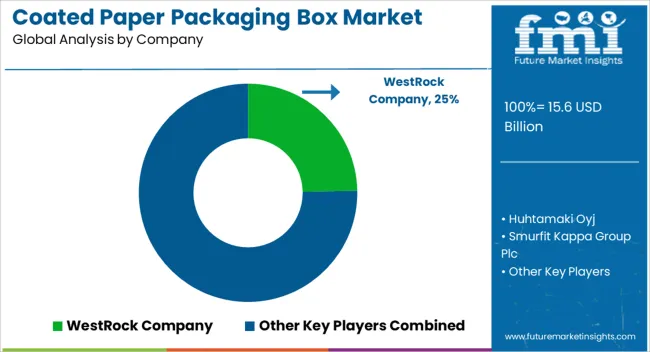

The Coated Paper Packaging Box Market is estimated to be valued at USD 15.6 billion in 2025 and is projected to reach USD 24.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Coated Paper Packaging Box Market Estimated Value in (2025 E) | USD 15.6 billion |

| Coated Paper Packaging Box Market Forecast Value in (2035 F) | USD 24.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The coated paper packaging box market is experiencing notable growth due to increased demand for premium, visually appealing, and sustainable packaging solutions across consumer goods sectors. Brands are focusing on packaging that enhances shelf presence while aligning with eco friendly mandates, and coated paper has emerged as a preferred material due to its printability, durability, and recyclable properties.

The market is further supported by rising disposable incomes, which have fueled consumer preference for premium unboxing experiences, especially in fashion, electronics, and lifestyle products. Technological advances in coating materials and printing techniques have enabled manufacturers to develop packaging that not only protects but also adds value to branding and presentation.

This upward trend is expected to continue as businesses increasingly prioritize packaging aesthetics, product safety, and environmental compliance in their consumer engagement strategies.

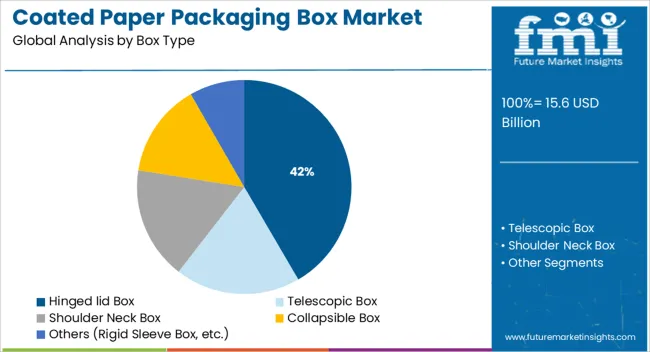

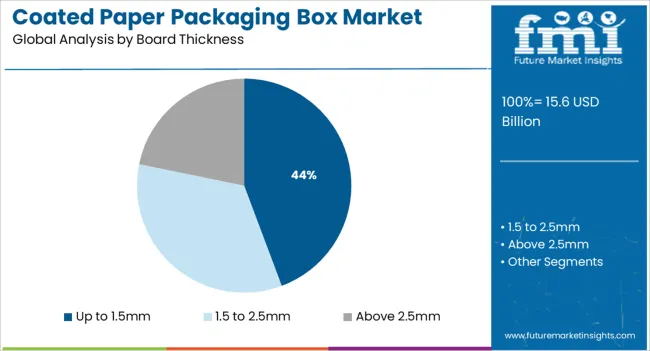

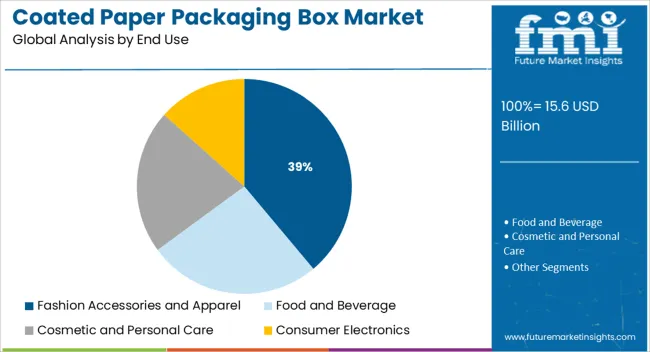

The market is segmented by Box Type, Board Thickness, and End Use and region. By Box Type, the market is divided into Hinged lid Box, Telescopic Box, Shoulder Neck Box, Collapsible Box, and Others (Rigid Sleeve Box, etc.). In terms of Board Thickness, the market is classified into Up to 1.5mm, 1.5 to 2.5mm, and Above 2.5mm. Based on End Use, the market is segmented into Fashion Accessories and Apparel, Food and Beverage, Cosmetic and Personal Care, and Consumer Electronics. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hinged lid box segment is projected to contribute 41.60% of total market revenue by 2025, establishing it as the leading box type. Its popularity is driven by strong structural integrity, a premium presentation format, and ease of access for consumers.

This box type is widely adopted in luxury and high end product categories due to its capacity to enhance perceived product value and reinforce brand identity. The hinged design also enables secure closure and reuse, aligning with circular packaging goals.

With increased focus on sophisticated packaging experiences, particularly in retail and gift items, the hinged lid box format continues to dominate in applications where visual and functional quality are equally important.

The up to 1.5mm board thickness segment is expected to account for 44.30% of the market share in 2025, making it the most utilized thickness category. This preference is attributed to its ideal balance between structural rigidity and cost effectiveness.

Boxes made with this board thickness offer sufficient strength for product protection while remaining lightweight and adaptable to various coating and printing methods. It is favored in sectors requiring both functionality and design flexibility, without incurring the costs of thicker materials.

The increasing focus on optimizing material usage without compromising quality has led to greater adoption of this board thickness across mainstream packaging applications.

The fashion accessories and apparel segment is forecasted to contribute 38.90% of total market revenue by 2025, positioning it as the top end use segment. This growth is being driven by rising demand for aesthetically pleasing, brand centric packaging in the fashion industry, where first impressions significantly influence customer perception.

Coated paper packaging is widely used for its premium surface finish, customization potential, and alignment with sustainable branding. Luxury apparel brands and accessory makers are increasingly adopting coated paper boxes to reinforce product quality and consumer experience.

Additionally, with the rise of e commerce in the fashion sector, the need for durable yet elegant packaging has further propelled demand. As the industry continues to evolve with a focus on sustainability and presentation, this end use category is set to maintain its leading position.

The global coated paper packaging box market witnessed a CAGR of 4.2% during the historic period with a market value of USD 15 Billion in 2024.

Eco-design and sustainable packaging solutions are important while designing products with special consideration for environmental impact. Protection of goods and commodities while transporting is a high priority for manufacturers and industries. Coated paper packaging box gaining the limelight for packaging various products that need to be protected from atmospheric conditions. The coated paper packaging box is used by multiple shipping and logistics companies to transport the products. The coated paper packaging box is basically made from paper having a high barrier coating or lamination to it. Coated paper packaging boxes can easily replace the other box in the various market. The high-end application of coated paper packaging boxes in food & beverage, clothing, accessories, consumer electronics, and beauty products. The updating purchasing patterns of consumers and the upgradation of technology have pushed the coated paper packaging box market. Increased online shopping of food, groceries, clothes, accessories, and many things day to things is expected to increase the coated paper packaging box market.

Coated paper packaging box provides a smooth finish and aesthetics to the packaging which is beneficial for attracting consumers by differentiating the packaging and brand making. Coated paper packaging box enables printing for attracting consumers and builds brand image. Also, the protection ad security provided by the coated paper packaging box makes it the preferred packaging solution for both manufacturers and consumers. With the changing preferences for sustainable and eco-friendly packaging, the coated paper packaging box is gaining popularity in the packaging world. In food packaging, the coated paper packaging box provides high barrier protection from moisture, oxygen, and heat resistance. Growing environmental concerns over packaging solutions boost the coated paper packaging box market because of its recyclability. Coated paper packaging boxes in expected to grow at a moderate pace during the forecasted period.

Nowadays, recyclability has become the most important issue in using plastic as a packaging solution. Paper being the environment-friendly option provides the alternative solution for packaging but with limitations associated with paper packaging. Paper packaging is gaining popularity in the packaging world due to its recyclability and biodegradable nature. Paper packaging proves to be a more versatile and responsible packaging solution for manufacturers and retailers. Coated paper packaging box overcomes the limitations associated with paper packaging.

Paper reinforced with high barrier coating technology improves the properties of paper and provided more clarity and visibility to the packaging. Water-based coatings on the coated paper packaging box improve the performance and barrier properties without hindering the recyclability of the paper. Coated paper packaging boxes offer an improved water barrier for packaging seafood, fruits, and deep freeze applications such as ice creams, tubs, and frozen food. Coated paper packaging box offers excellent print receptivity to enhance the aesthetics of the products and finds more consumer interest.

Coated paper packaging box helps to improve oil and Greece resistance that can be used for the packaging applications such as disposable takeaway boxes used for restaurants, sweets, and seafood delivery, especially by e-commerce brands. The technological development for coated paper packaging boxes opens a new market tapping that will be raising the growth rates of the coated paper packaging box market.

The collapsible box by the box type segment is estimated to remain a leading segment for the global coated paper packaging market from 2025 to 2035. The major advantages of collapsible box type in saving space and reusability factor create a smart packaging solution for the manufacturers as well as consumers.

The food and beverage segment by end use is expected to expand 1.5 times its current value from 2025 to 2035. The increasing working population, changing lifestyle, and changing eating habits of the consumer lead towards increased consumption of food items. The time shortage for the working people propelled the demand for food items. This increasing demand for food items augments the sales of coated paper packaging box market.

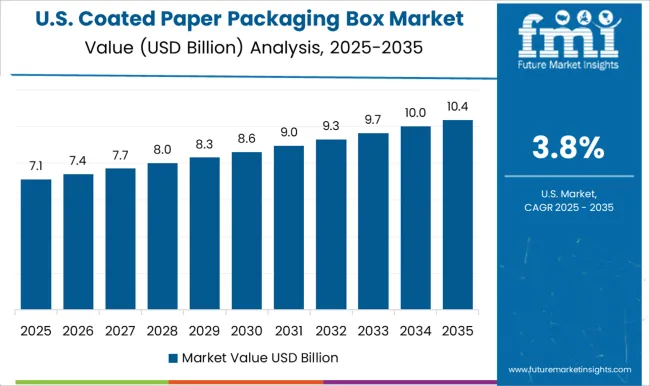

The USA is expected to hold around 81% of the North American Coated Paper Packaging Box market by the end of the forecast period. The food service industry consumes various types of paper packaging which also includes paperboard boxes, coated paper packaging boxes, and others. The coated paper packaging box is preferred by the food service industry due to the increasing concern about eco-friendly packaging among the consumer along with the plastic ban by the government/authority. According to the USA Department of Agriculture (USDA), around USD 1.8 trillion worth of food was supplied by the food service and food retailing industry in the USA, out of which USD 978 billion worth of food was supplied by the food service facilities in the USA The food supplied by the food service facilities may have consumed a large volume of packaging as food is packed in different packaging solutions.

According to the Mexican Online Sales Association, in 2024 the domestic e-commerce in Mexico was valued at USD 12.5 billion, an increase of over 80 percent from 2020. The e-commerce users in Mexico increased by 9% in 2024 from 2020. The expanding e-commerce sector in Mexico bolsters the demand for paper box including coated paper packaging box market.

The major players in the coated paper packaging box market faced a reduction in sales and market share during the pandemic. Currently, the major players in the market are gaining market value by developing new products in the coated paper packaging box market. Recent activities and mergers implemented by the leading player in coated paper packaging box market are:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Box Type, Board Thickness, End-use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Middle East and Africa; Oceania |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia |

| Key Companies Profiled | WestRock Company; Huhtamaki Oyj; Smurfit Kappa Group Plc; ProPack; GWP Packaging; DS Smith plc; Robinson plc; Stora Enso Oyj; Pakfactory; Madover Packaging LLC; Burt Rigid Box; Bigso Box of Sweden; Johnsbyrne; Sunrise Packaging; Autajon C.S.; Taylor Box Company; International Paper Company; Mayr-Melnhof Karton AG |

| Customization & Pricing | Available upon Request |

The global coated paper packaging box market is estimated to be valued at USD 15.6 billion in 2025.

The market size for the coated paper packaging box market is projected to reach USD 24.3 billion by 2035.

The coated paper packaging box market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in coated paper packaging box market are hinged lid box, telescopic box, shoulder neck box, collapsible box and others (rigid sleeve box, etc.).

In terms of board thickness, up to 1.5mm segment to command 44.3% share in the coated paper packaging box market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coated Label Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics Market Size and Share Forecast Outlook 2025 to 2035

Coated Casing Market Size and Share Forecast Outlook 2025 to 2035

Coated Fabrics for Defense Market 2025 to 2035

Coated Duplex Board Market

Coated Recycled Boxboard Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Coated Recycled Boxboard Manufacturers

Coated Recycled Paperboard Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Coated Recycled Paperboard Providers

Coated Sack Kraft Paper Market

Coated White Board Paper Market

Uncoated White Top Testliner Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Paper Market Trends- Growth & Industry Outlook 2025 to 2035

Uncoated Fine Papers Market Size and Share Forecast Outlook 2025 to 2035

Uncoated Fine Paper Market Size and Share Forecast Outlook 2025 to 2035

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

PE Coated Paper Market Trends & Industry Growth Forecast 2024-2034

PE Coated Sack Kraft Paper Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of PE Coated Sack Kraft Paper Providers

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA