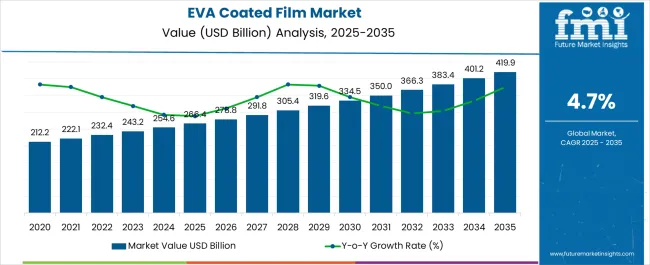

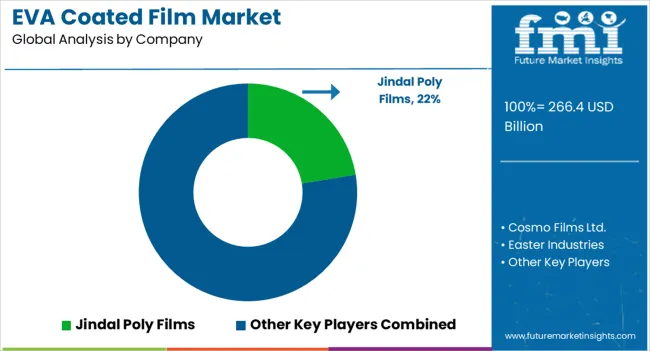

The EVA Coated Film Market is estimated to be valued at USD 266.4 billion in 2025 and is projected to reach USD 419.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

| Metric | Value |

|---|---|

| EVA Coated Film Market Estimated Value in (2025 E) | USD 266.4 billion |

| EVA Coated Film Market Forecast Value in (2035 F) | USD 419.9 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The EVA coated film market is experiencing robust growth driven by the rising demand for flexible packaging, laminates, and barrier films across diverse industries. Increasing consumer preference for packaged food and beverages coupled with expanding retail and e commerce channels has accelerated adoption.

The films provide superior adhesion, sealability, and durability, which are critical for packaging integrity and product safety. Advancements in film extrusion technologies and coating formulations have enhanced performance characteristics, including thermal resistance and moisture protection.

Regulatory pressure for recyclable and sustainable materials is further pushing innovation in EVA coated films, particularly in food grade applications. The outlook remains promising as industries continue to prioritize lightweight, cost effective, and high performance film solutions for packaging, lamination, and industrial uses.

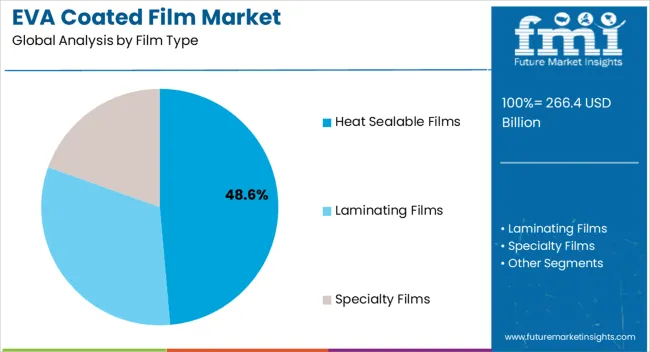

The heat sealable films segment is projected to represent 48.60% of total revenue by 2025 within the film type category, making it the leading segment. Growth is being supported by the demand for secure and reliable sealing in packaging applications that require extended shelf life and product protection.

The ease of processing, compatibility with multiple substrates, and ability to deliver consistent sealing strength have reinforced its adoption.

As industries prioritize product integrity and consumer safety, heat sealable films continue to dominate the film type category.

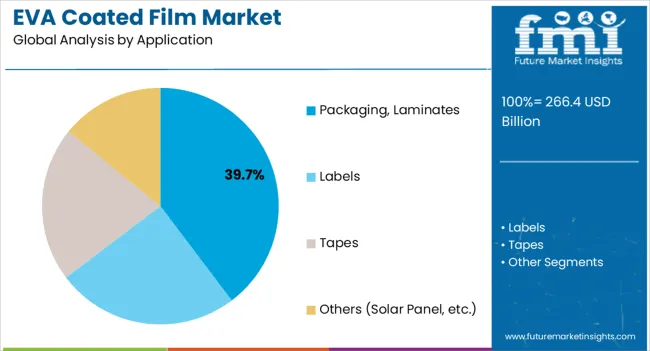

The packaging and laminates segment is expected to account for 39.70% of market revenue by 2025, positioning it as the largest application category. This is driven by the increasing requirement for flexible, lightweight, and protective solutions in consumer goods and industrial packaging.

The films offer high clarity, adhesion, and lamination performance, which enhance product appeal and safety.

As packaging innovations evolve to meet sustainability and convenience goals, EVA coated films in packaging and laminates have emerged as the most preferred application segment.

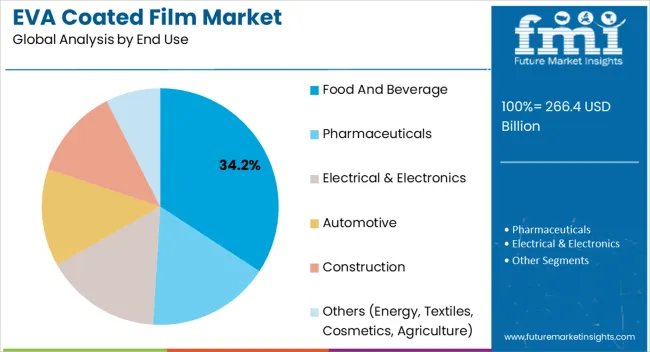

The food and beverage segment is projected to hold 34.20% of total revenue by 2025 within the end use category, making it the leading sector. This dominance is attributed to the growing consumption of packaged foods, ready to eat products, and beverages requiring reliable and safe packaging formats.

The superior sealability and barrier properties of EVA coated films ensure extended freshness, quality preservation, and compliance with food safety standards.

As consumer demand for convenient and sustainable food packaging rises, the food and beverage sector continues to be the most significant end use category in the EVA coated film market..

From 2020 to 2025, the global EVA coated film market experienced a CAGR of 3.8%, reaching a market size of USD 266.4 million in 2025.

From 2020 to 2025, the global EVA coated film industry witnessed steady growth as flexible packaging solutions witnessed significant demand from key industries such as food & beverage, construction, packaging, pharmaceuticals, and others.

A massive range of buyers from different countries was targeting almost every niche segment within the flexible packaging industry including EVA coated film. Over the year, the EVA coated film witnessed consistent growth over the years owing to its versatile properties.

Looking ahead, the global EVA coated film industry is expected to rise at a CAGR of 4.9% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 390.6 million.

The EVA coated film industry is expected to continue its growth trajectory from 2025 to 2035, as the consumers have become more environmentally conscious, the preference for sustainable and non-toxic packaging solutions has increased, thus this will boost the EVA coated film market.

Due to the Covid-19 pandemic, manufacturers have become more aware food safety regulations, environmental standards, and industry-specific certifications. The EVA coated film complies with US FDA, EC and REACH regulations for food contact, thus EVA coated films will be essential for market growth and customer trust.

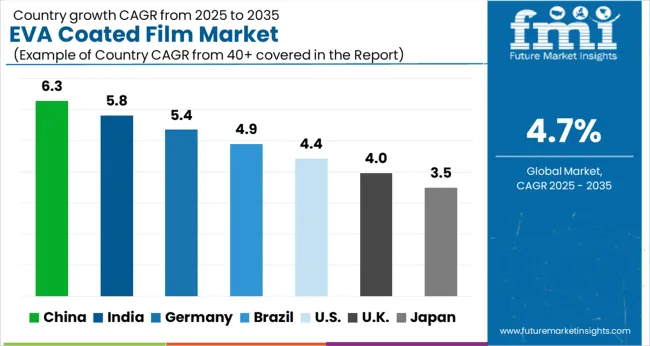

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 419.9 million |

| CAGR % 2025 to End of Forecast (2035) | 5.7% |

The EVA coated film industry in the China is expected to reach a market share of USD 419.9 million by 2035, expanding at a CAGR of 5.7%. The Chinese government has implemented various policies and initiatives to promote sustainable development, including the use of eco-friendly materials and technologies.

Government spending on industrial, infrastructure, and renewable energy initiatives helps to increase demand for EVA coated films.

| Country | India |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 38.5 million |

| CAGR % 2025 to End of Forecast (2035) | 6.3% |

The EVA coated film industry in India is expected to reach a market share of USD 38.5 million, expanding at a CAGR of 6.3% during the forecast period. According to India Brand Equity Foundation (IBEF), India is undergoing expansion in the e-commerce and retail sectors.

The e-commerce market in India is expected to reach USD 419.9 billion by 2035. This will generate significant growth opportunities for EVA coated film market.

The specialty films segment is expected to dominate the EVA coated film industry with a CAGR of 5.9% from 2025 to 2035. This segment captures a significant market share in 2025 due to its various distinct properties such as barrier properties, anti-static properties and others.

The specialty films can be customized according to the customers’ requirements, thus providing flexibility to EVA coating film to meet the requirements of various end use industries.

The food and beverage industry is expected to dominate the EVA coated film industry with a CAGR of 5.5% from 2025 to 2035. This segment captures a significant market share in 2025 as the manufacturers ensure the packaging that maintains product safety, shelf life, and compliances regulations for food contact.

The EVA coated film assures all these factors, thus the demand for EVA coated film in the food and beverage market will grow.

The EVA coated film industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Sustainability

Companies are focuses on sustainable development by implementing eco-friendly manufacturing practices.

Strategic Partnerships and Collaborations

Key players in the industry often form strategic partnerships and collaborations with other companies to leverage their strengths and expand their reach in the market.

Expansion into Emerging Markets

The EVA coated film industry is witnessing significant growth in emerging markets such as China and India.

The global EVA coated film market is estimated to be valued at USD 266.4 billion in 2025.

The market size for the EVA coated film market is projected to reach USD 419.9 billion by 2035.

The EVA coated film market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in EVA coated film market are heat sealable films, laminating films and specialty films.

In terms of application, packaging, laminates segment to command 39.7% share in the EVA coated film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

Evaporated Filled Milk Market Size, Growth, and Forecast for 2025 to 2035

Evaporative Condensing Units Market Trend Analysis Based on Type, Operation, Application, and Region 2025 to 2035

Evaporative Cooling Market Size, Share, Trend & Forecast 2024-2034

Levant Power Cable Market Size and Share Forecast Outlook 2025 to 2035

Elevators and Escalators Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Elevator Control Panelboard Market Growth – Trends & Forecast 2024-2034

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Vacuum Evaporators Market Size, Growth, and Forecast 2025 to 2035

Home Elevator Market Growth – Trends & Forecast 2025 to 2035

Mouse Elevated Cross Maze Market Size and Share Forecast Outlook 2025 to 2035

China Elevator Ropes Market Size and Share Forecast Outlook 2025 to 2035

Smart Elevator Market Size and Share Forecast Outlook 2025 to 2035

Smart Elevator Automation System Market Growth - Trends & Forecast 2024 to 2034

Aircraft Evacuation Market Size and Share Forecast Outlook 2025 to 2035

Marine Elevators Market Growth - Trends & Forecast 2025 to 2035

Aircraft Evacuation Slide Market

Digital Elevation Model Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Short Path Evaporator for Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA