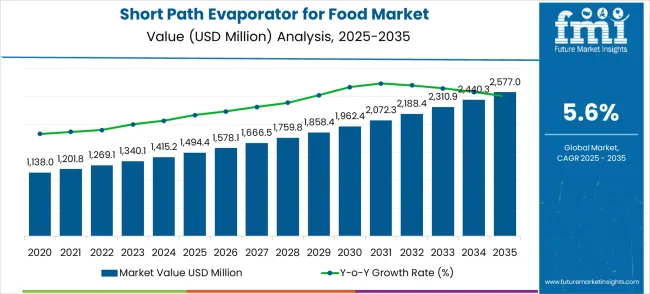

The short path evaporator for food market is expected to grow from USD 1,494.4 million in 2025 to USD 2,577.0 million by 2035, reflecting a CAGR of 5.6%. Inflection point mapping identifies periods where market growth shifts in pace, indicating moments of accelerated adoption or relative stabilization. From 2025 to 2028, the market experiences moderate growth as food processing companies adopt short path evaporators to improve efficiency, product quality, and shelf life.

During this phase, technological improvements such as better temperature control, energy efficiency, and compact designs support steady market uptake, forming the initial upward slope in the growth curve.

Between 2028 and 2032, the market reaches a clear inflection point as adoption expands into emerging markets and diversified food applications, including dairy, oils, and flavor concentrates. Demand accelerates due to increased awareness of process optimization, regulatory requirements for food safety, and investment in modern processing facilities. From 2032 to 2035, growth continues at a steady pace as the market matures, driven by replacement cycles, technological upgrades, and broader penetration in niche segments. Mapping these inflection points provides stakeholders with critical insights to plan production, R&D, and deployment strategies, allowing alignment with periods of rapid adoption and peak market opportunities throughout the decade.

The short path evaporator for the food market is segmented across dairy and dairy-based products (38%), beverages including juices and extracts (26%), flavor and fragrance ingredients (16%), confectionery and chocolate processing (12%), and specialty applications such as nutraceuticals and plant extracts (8%). Dairy producers rely on short-path evaporators for concentrating, retaining flavor, and gently treating milk, cheese, and cream. Beverage manufacturers use them to preserve aroma and nutritional quality in juices, extracts, and alcoholic beverages. Flavor and fragrance industries adopt short-path evaporators for essential oil and aroma concentration.

Confectionery and chocolate processors utilize them for flavor extraction and solvent removal. Specialty applications focus on nutraceuticals and plant-based extracts requiring precise thermal management. Emerging trends include high-efficiency evaporators, energy-saving designs, and modular configurations. Manufacturers are innovating with vacuum optimization, corrosion-resistant materials, and improved condensers. Growth is driven by demand for premium flavors, clean-label ingredients, and reduced thermal degradation. Collaborations between equipment producers and food processors enable customized solutions for efficiency, product quality, and scalability, supporting steady global market expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1,494.4 million |

| Market Forecast Value (2035) | USD 2,577.0 million |

| Forecast CAGR (2025-2035) | 5.6% |

The short path evaporator for the food market grows by enabling food processors to concentrate heat-sensitive compounds while preserving nutritional value and flavor profiles through gentle, low-temperature processing methods. Food manufacturing companies face mounting pressure to meet clean label demands and natural ingredient preferences, with consumer spending on natural food extracts increasing by 15-20% annually, making short-path evaporation essential for producing high-quality concentrated products without chemical additives.

The food industry's need for efficient solvent recovery and waste reduction creates demand for advanced evaporation systems that can handle multiple processing stages while maintaining product integrity and reducing environmental impact. Regulatory requirements for food safety and quality standards drive adoption in extract production, concentration applications, and specialty food manufacturing, where precise temperature control and contamination prevention directly impact product quality and shelf life. The high capital investment requirements for specialized equipment and the complexity of optimizing process parameters for different food matrices may limit adoption rates among smaller food processors and emerging market manufacturers with limited technical expertise.

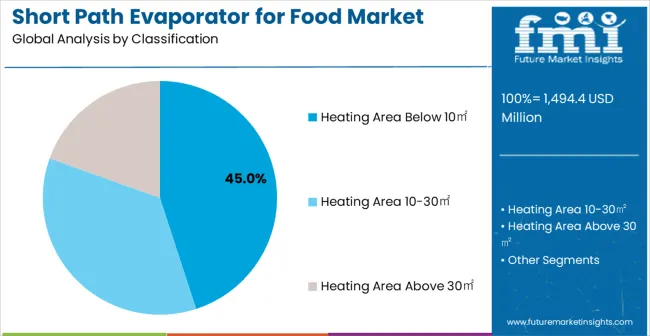

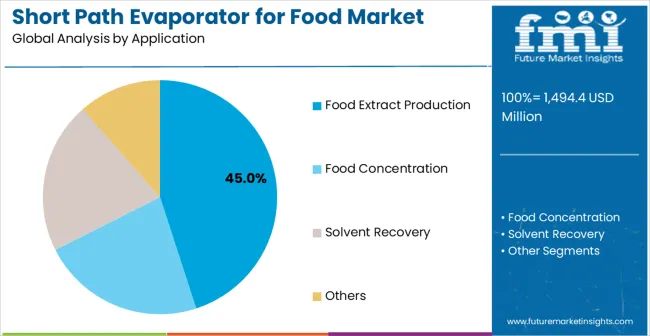

The short path evaporator market for the food industry is growing due to the increasing demand for high-purity extracts and efficient thermal processing. Units with a heating area of 10–30㎡ dominate the segment with approximately 55% of the market share, providing rapid vaporization, high thermal efficiency, and reduced residence time to preserve sensitive food compounds. Food extract production leads the application segment with about 45% of the market, reflecting widespread use in essential oils, flavors, and nutraceutical extractions. Growth is driven by rising consumer demand for natural and concentrated food products, and the need for energy-efficient and precise evaporation systems.

Short path evaporators with heating areas of 10-30㎡ hold roughly 45% of the segment, making them the most widely adopted configuration. These units typically achieve evaporation rates of 50–150 kg/h with vacuum pressures of 0.01–0.05 mbar, preserving heat-sensitive compounds during processing. Leading manufacturers include GEA, Labtech, Buchi, and Heidolph. Units in this range are preferred for small-to-medium scale food extract production, offering precise temperature control, high thermal efficiency, and reduced solvent usage, ensuring product quality and consistency.

Food extract production accounts for approximately 45% of the application segment, making it the largest use case for short path evaporators in the food sector. These units are used for essential oils, plant extracts, flavors, and nutraceutical compounds, requiring precise control over temperature and vacuum conditions. Suppliers such as GEA, Labtech, Buchi, and Heidolph provide systems with heating surfaces of 10–30㎡ and adjustable feed rates for consistent product quality. Segment growth is fueled by increasing consumer demand for natural extracts, concentrated flavors, and high-purity nutraceutical ingredients.

The market is driven by three concrete demand factors tied to food processing optimization outcomes. First, consumer preference for natural and clean label products creates increasing demand for natural food extracts and concentrates, with the global natural food ingredients market growing by 8-10% annually, requiring advanced evaporation technologies for efficient production while maintaining product quality. Second, regulatory compliance requirements for food safety and environmental standards drive mandatory adoption of precise processing equipment that minimizes contamination risks and reduces waste generation through efficient solvent recovery systems. Third, technological advancement in process control and energy efficiency enables more cost-effective and sustainable food processing operations that reduce operational costs while improving product yield and quality consistency.

Market restraints include high capital equipment costs that can deter smaller food processors from implementing advanced evaporation systems, particularly in developing regions where access to specialized food processing equipment financing remains limited. Technical complexity poses another significant challenge, as implementing and optimizing short path evaporation processes requires specialized expertise and extensive process development, potentially causing delays in production scaling and increased operational training costs. Raw material price volatility and supply chain disruptions create additional uncertainty for food manufacturers, demanding flexible processing capabilities that can adapt to varying feedstock qualities and availability.

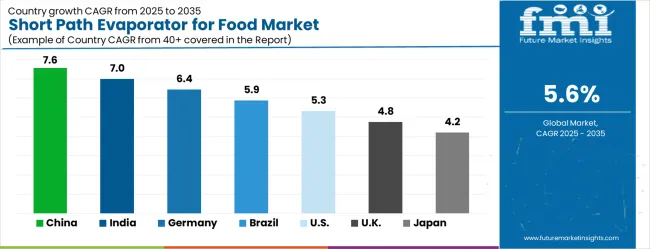

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where expanding food processing industries and increasing consumer awareness of natural products drive comprehensive ingredient production capabilities. Design shifts toward automated process control systems with integrated monitoring and data analytics capabilities enable predictive maintenance and process optimization that reduce downtime and improve operational efficiency. The market thesis could face disruption if alternative concentration technologies or significant changes in food processing regulations minimize reliance on traditional short-path evaporation methods.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

| USA | 5.3% |

| UK | 4.8% |

| Japan | 4.2% |

The short path evaporator for the food market is gathering pace worldwide, with China taking the lead thanks to rapid food processing industry expansion and increasing demand for natural food ingredients. Close behind, India benefits from growing processed food consumption and expanding food manufacturing capabilities, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows steady advancement, where integration of advanced food processing technologies strengthens its role in the European food equipment supply chain. Brazil is sharpening its focus on natural ingredient production and food processing modernization, signaling an ambition to capture growing opportunities in South American food markets. The USA stands out for its established food processing industry and advanced technology adoption, and the UK and Japan continue to record consistent progress in food manufacturing innovation. The China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The market for short path evaporators in China is growing at a CAGR of 7.6%, above the global average. Expansion is driven by the need for high-quality food processing and extraction technologies in oils, flavors, and dairy products. Industrial clusters in eastern provinces are adopting advanced evaporators to improve yield, reduce thermal degradation, and maintain nutritional quality. Suppliers focus on scalable and energy-efficient systems suitable for large-scale operations. Pilot programs demonstrate enhanced productivity and lower material loss. Collaborations between food manufacturers and equipment providers facilitate innovation in continuous evaporation processes. Government initiatives to modernize the food processing sector support the adoption of automated and precise short path evaporator systems.

India is projected to grow at a CAGR of 7.0%, above the global average. Growth is driven by expanding edible oil, dairy, and flavor extraction sectors. Short path evaporators are used to improve product quality, reduce processing time, and enhance shelf life. Industrial clusters and small-scale manufacturing units deploy these systems to optimize production efficiency. Pilot programs demonstrate higher yield and improved aroma retention. Suppliers provide cost-effective and compact units suitable for medium-scale food processing. Collaboration with research centers enables process optimization and innovative solvent recovery techniques. Rising domestic and export demand for processed foods accelerates market adoption.

Germany grows at a CAGR of 6.4%, above the global average. Growth is driven by specialty food, flavor, and beverage processing sectors requiring high-quality extraction and concentration technologies. Short path evaporators are integrated into production lines for precise temperature control and minimal thermal impact. Suppliers provide energy-efficient, automated units with advanced monitoring capabilities. Pilot installations demonstrate improved product consistency and reduced material loss. Industrial clusters implement continuous evaporation systems for efficiency and scalability. Consumer preference for high-quality, minimally processed food drives adoption, alongside R&D initiatives to optimize equipment design for complex ingredients.

The Brazilian market grows at a CAGR of 5.9%, slightly above the global average. Growth is supported by the food and beverage sector, including dairy, juice, and flavor extraction industries. Short path evaporators are used to improve product purity, reduce energy consumption, and optimize processing efficiency. Industrial clusters integrate machines into medium and large-scale plants for consistent results. Suppliers offer durable and climate-adapted equipment for high-volume operations. Pilot programs demonstrate enhanced extraction efficiency and reduced operational costs. Local distributors provide training and maintenance support to ensure smooth deployment in diverse production environments.

The United States grows at a CAGR of 5.3%, slightly below the global average. Slower growth is influenced by a mature food processing sector with existing high-efficiency systems. Short path evaporators are used in specialty oils, flavors, and nutraceutical extraction to maintain quality and aroma. Suppliers provide high-precision, automated units with real-time monitoring. Pilot programs demonstrate reduced thermal degradation and improved consistency across production batches. Industrial hubs integrate evaporators into both research and commercial production lines. R&D initiatives focus on optimizing energy consumption and solvent recovery for cost-effective operations.

The UK market grows at a CAGR of 4.8%, below the global average. Slower growth results from limited expansion of large-scale food processing facilities and reliance on imported equipment. Short path evaporators are used in flavor extraction, dairy processing, and specialty beverages. Suppliers provide compact, precise, and energy-efficient units. Pilot installations demonstrate improved product quality and reduced material waste. Adoption is increasing in medium-sized plants and research facilities. Local distributors provide operator training to ensure effective utilization. Consumer demand for high-quality, minimally processed foods drives gradual adoption in niche markets.

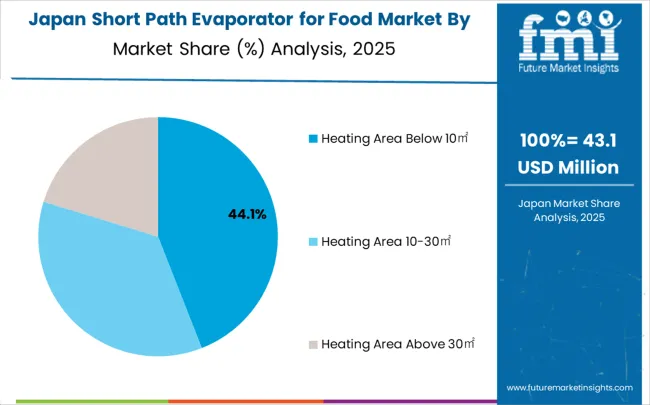

Japan grows at a CAGR of 4.2%, below the global average. Slower growth is influenced by a mature food processing sector and high adoption of existing thermal and extraction equipment. Short path evaporators are deployed in dairy, specialty oils, and research-based food production. Suppliers provide compact, precise, and reliable systems suitable for small-scale operations. Pilot programs demonstrate improved yield and product quality. Industrial clusters integrate evaporators into automated lines for efficiency. R&D initiatives focus on enhancing temperature control, solvent recovery, and energy efficiency to maintain high-quality standards in processed food production.

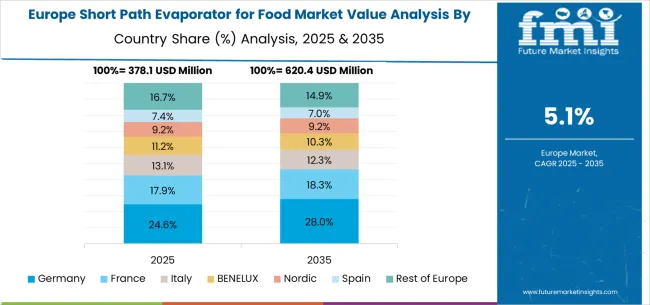

The short path evaporator for the food market in Europe is projected to grow from USD 387.2 million in 2025 to USD 652.3 million by 2035, registering a CAGR of 5.9% over the forecast period. Germany is expected to maintain its leadership position with a 32.8% market share in 2025, declining slightly to 32.4% by 2035, supported by its advanced food processing infrastructure and comprehensive ingredient manufacturing capabilities across major industrial centers in North Rhine-Westphalia, Bavaria, and Baden-Württemberg.

France follows with a 19.6% share in 2025, projected to reach 20.1% by 2035, driven by comprehensive food processing modernization programs and specialty ingredient production initiatives across major food manufacturing regions. The United Kingdom holds a 16.4% share in 2025, expected to maintain 16.2% by 2035 through ongoing green initiatives and food processing efficiency improvement programs. Italy commands a 14.8% share, while Spain accounts for 11.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 5.2% to 5.6% by 2035, attributed to increasing short-path evaporation adoption in Nordic countries and emerging Eastern European food processing facilities implementing modernization programs.

The Japanese short path evaporator for food market demonstrates a mature and precision-focused landscape, characterized by sophisticated integration of compact evaporation systems with existing food quality management infrastructure across specialty food manufacturers, functional ingredient producers, and comprehensive processing facilities. Japan's emphasis on quality assurance and operational excellence drives demand for high-precision evaporation solutions that support kaizen continuous improvement initiatives and statistical process control requirements in food manufacturing operations.

The market benefits from strong partnerships between international technology providers like Sulzer Ltd, De Dietrich, and domestic food processing equipment leaders, creating comprehensive service ecosystems that prioritize product quality, consistency and operator training programs. Processing centers in Tokyo, Osaka, Nagoya, and other industrial regions showcase advanced quality management implementations where evaporation systems achieve 97% product consistency through integrated monitoring programs, while the country's focus on functional food development and premium ingredient production supports steady adoption of specialized processing and concentration technologies across diverse food applications.

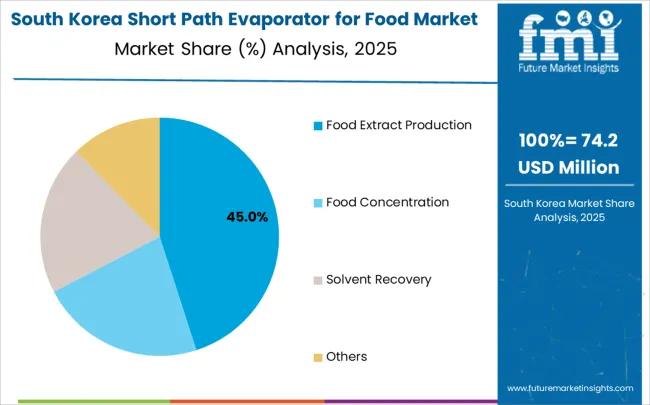

The South Korean short path evaporator for food market is characterized by strong international technology provider presence, with companies like VTA, Sulzer Ltd, and Technoforce maintaining dominant positions through comprehensive system integration and technical services capabilities for food processing facilities and specialty ingredient manufacturers. The market is demonstrating a growing emphasis on localized technical support and rapid response capabilities, as Korean food manufacturers increasingly demand customized solutions that integrate with domestic food safety management systems and comprehensive quality control platforms deployed across major processing regions.

Local food processing equipment companies and regional technology distributors are gaining market share through strategic partnerships with global providers, offering specialized services including process optimization programs and technical training services for processing personnel. The competitive landscape shows increasing collaboration between multinational evaporation equipment manufacturers and Korean food technology specialists, creating hybrid service models that combine international processing expertise with local market knowledge and customer relationship management, particularly in the country's concentrated food processing regions around Seoul, Busan, and other metropolitan areas where comprehensive food manufacturing networks drive continuous demand for advanced evaporation processing solutions.

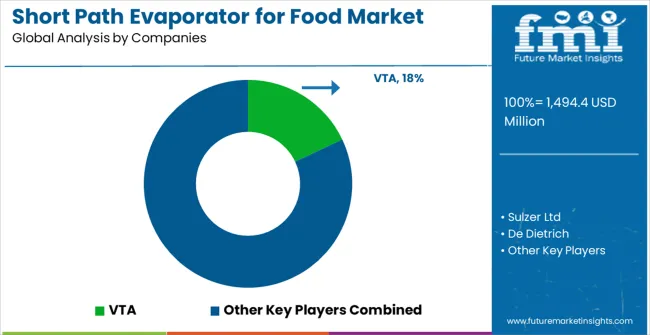

The Short Path Evaporator for Food Market features approximately 15-18 meaningful players with moderate concentration, where the top three companies control roughly 45-50% of global market share through established technology platforms and extensive food processing industry relationships. Competition centers on technological innovation, process efficiency, and service capabilities rather than price competition alone.

Market leaders include VTA, Sulzer Ltd, and De Dietrich, which maintain competitive advantages through comprehensive food processing solution portfolios, global service networks, and deep food industry expertise, creating high switching costs for customers. These companies leverage installed base relationships and ongoing maintenance contracts to defend market positions while expanding into adjacent food processing applications.

Challengers encompass Technoforce and Buss-SMS-Canzler GmbH, which compete through specialized evaporation solutions and strong regional presence in key food processing markets. Technology specialists, including 3V Tech, GIG Karasek GmbH, and UIC GmbH, focus on specific evaporation technologies or vertical applications, offering differentiated capabilities in heating systems, process control, and automation platforms.

Regional players and emerging technology providers create competitive pressure through cost-effective solutions and rapid deployment capabilities, particularly in high-growth markets including China and India, where local presence provides advantages in customer support and regulatory compliance. Market dynamics favor companies that combine advanced processing technologies with comprehensive service offerings that address the complete evaporation system lifecycle from design through ongoing optimization and maintenance support.

Short path evaporators for food represent a specialized but rapidly expanding segment within the food processing equipment ecosystem, with market growth from USD 1,494.4 million in 2025 to USD 2,577.0 million by 2035 reflecting the convergence of clean label demands, natural ingredient preferences, and advanced concentration technology adoption. The technology enables food processors to concentrate heat-sensitive compounds while preserving nutritional value and flavor profiles through gentle, low-temperature processing methods, addressing consumer spending increases of 15-20% annually on natural food extracts. Heating Area Below 10㎡ systems dominate market demand due to their cost-effectiveness for small to medium-scale operations, while Food Extract Production represents the largest application segment driven by functional food market expansion and bioactive compound preservation requirements. The market development faces challenges from high capital investment requirements, complex operational parameters, and the need for specialized technical expertise, requiring coordinated stakeholder action to address financing barriers, skill development needs, and technology accessibility while capitalizing on natural ingredient trends and regulatory compliance drivers.

How Food Safety Authorities and Regulatory Bodies Could Accelerate Market Development?

Advanced Processing Technology Guidelines: Establish clear regulatory pathways and certification standards for short path evaporation systems used in food extract production, concentration applications, and solvent recovery operations. Create guidelines that recognize the food safety benefits of controlled, low-temperature processing while streamlining approval processes for innovative extraction technologies that preserve nutritional integrity and minimize contamination risks.

Clean Label and Natural Ingredient Standards: Develop comprehensive standards for natural food extract production that emphasize processing method transparency and ingredient authenticity, supporting short path evaporation adoption where gentle processing maintains bioactive compound efficacy. Create certification frameworks that validate natural processing claims and enable manufacturers to differentiate products based on processing methodology and ingredient preservation capabilities.

Quality Assurance and Process Validation: Implement standardized testing protocols and validation requirements for short path evaporation systems that ensure consistent product quality, safety compliance, and process reproducibility across different food matrices. Establish critical control point frameworks specifically designed for evaporation-based concentration processes that address temperature control, contamination prevention, and product integrity maintenance.

International Harmonization Initiatives: Lead efforts to harmonize food processing equipment standards across regions, reducing regulatory complexity for manufacturers operating in multiple markets. Create mutual recognition agreements for short path evaporator certifications that facilitate technology transfer and equipment deployment across international food processing operations.

How Equipment Manufacturers Could Strengthen Technology Infrastructure and Market Access?

Modular System Design and Scalability: Develop modular short path evaporator platforms that enable food processors to start with smaller heating areas (below 10㎡) and expand capacity as production requirements grow. Create standardized interfaces and components that reduce complexity while maintaining process flexibility for diverse food applications including extract production, concentration, and solvent recovery operations.

Automated Process Control and Optimization: Integrate advanced automation systems with real-time monitoring capabilities that optimize temperature, pressure, and residence time parameters automatically based on feedstock characteristics and target product specifications. Develop AI-powered control systems that learn from process data to improve yield, quality consistency, and energy efficiency while reducing operator skill requirements.

Energy Efficiency and Sustainability Solutions: Engineer next-generation evaporation systems that incorporate heat recovery technologies, renewable energy integration capabilities, and waste heat utilization systems to reduce operational costs and environmental impact. Develop hybrid processing approaches that combine short path evaporation with complementary concentration technologies to maximize efficiency and product quality.

Technical Support and Process Development Services: Establish comprehensive technical service networks that provide process optimization consulting, operator training programs, and troubleshooting support for food manufacturers implementing short path evaporation technologies. Create application laboratories that enable customer process development, scale-up testing, and validation studies before full-scale equipment investment.

How Food Processing Industry Associations Could Drive Adoption and Knowledge Transfer?

Technology Education and Best Practices: Develop comprehensive educational programs covering short path evaporation principles, application selection criteria, and optimization techniques for different food processing scenarios. Create industry workshops, webinars, and technical conferences that facilitate knowledge transfer between equipment manufacturers, food processors, and research institutions focused on natural ingredient production and clean label manufacturing.

Economic Analysis and Business Case Development: Provide detailed cost-benefit analysis frameworks that help food processors evaluate short path evaporation investments based on product quality improvements, yield optimization, and operational efficiency gains. Create benchmarking studies that demonstrate return on investment timelines, operational cost reductions, and market premium opportunities for natural extract products.

Supply Chain Integration and Standards: Facilitate collaboration between ingredient suppliers, food processors, and end-product manufacturers to establish quality standards and specifications for short path evaporation-produced ingredients. Develop traceability systems that document processing methods, quality parameters, and green metrics throughout the supply chain.

Market Intelligence and Trend Analysis: Provide regular market research covering natural ingredient demand trends, consumer preferences, and regulatory developments that influence short path evaporation adoption decisions. Create industry reports that identify emerging applications, technology developments, and competitive landscapes in the food concentration and extraction markets.

How Research Institutions and Technology Developers Could Advance Innovation?

Process Optimization and Scale-Up Research: Conduct fundamental research on short path evaporation mechanisms, heat transfer optimization, and process intensification techniques that improve efficiency and reduce capital costs. Develop predictive models and simulation tools that enable food processors to optimize system design and operating conditions for specific applications without extensive pilot testing.

Novel Application Development: Explore innovative applications of short path evaporation technology in emerging food categories including plant-based proteins, functional ingredients, and specialty extracts from agricultural waste streams. Research integration opportunities with biotechnology processes, fermentation systems, and other advanced food production technologies.

Sustainability and Environmental Impact Studies: Quantify environmental benefits of short path evaporation compared to alternative concentration and extraction methods, including energy consumption, waste generation, and carbon footprint analysis. Develop lifecycle assessment frameworks that enable food manufacturers to validate sustainability claims and meet corporate environmental objectives.

Technology Transfer and Commercialization Support: Create technology transfer programs that facilitate collaboration between research institutions, equipment manufacturers, and food processing companies. Establish pilot-scale facilities that enable proof-of-concept testing and technology validation before commercial implementation.

How Financial Institutions and Investment Partners Could Unlock Market Potential?

Specialized Equipment Financing Programs: Develop financing solutions tailored to food processing equipment investments, including short path evaporators, that recognize the technology's long-term value creation potential and return on investment characteristics. Create flexible payment structures that align with seasonal food processing cycles and cash flow patterns typical in natural ingredient production.

Technology Innovation Investment: Finance research and development programs focused on next-generation evaporation technologies, process automation systems, and energy efficiency improvements that expand market accessibility and operational performance. Support startups developing complementary technologies including advanced sensors, control systems, and process optimization software.

Market Expansion and Regional Development: Provide growth capital for equipment manufacturers expanding into high-growth markets including China (7.6% CAGR) and India (7.0% CAGR) where food processing modernization creates significant opportunities. Finance regional manufacturing facilities, service networks, and technical support capabilities that enable competitive pricing and responsive customer service.

Value Chain Integration Investment: Support vertical integration strategies and strategic partnerships that combine equipment manufacturing with process development services, technical consulting, and ongoing optimization support. Finance collaborative initiatives between equipment manufacturers, food ingredient suppliers, and end-product manufacturers that create integrated value propositions.

Risk Mitigation and Performance Guarantees: Develop insurance products and performance guarantee programs that reduce technology adoption risks for food processors implementing short path evaporation systems. Create financing structures that include performance milestones, operational efficiency guarantees, and technology upgrade pathways that protect customer investments while encouraging adoption.

| Item | Value |

|---|---|

| Quantitative Units | USD 1,494.4 million |

| Heating Area | Heating Area Below 10㎡, Heating Area 10-30㎡, Heating Area Above 30㎡, Others |

| Application | Food Extract Production, Food Concentration, Solvent Recovery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the USA, the UK, Japan, and 40+ countries |

| Key Companies Profiled | VTA, Sulzer Ltd, De Dietrich, Technoforce, Buss-SMS-Canzler GmbH, 3V Tech, GIG Karasek GmbH, UIC GmbH |

| Additional Attributes | Dollar sales by heating area and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with technology providers and food processing equipment manufacturers, food facility requirements and specifications, integration with sustainable processing initiatives and quality management systems, innovations in evaporation technology and process control systems, and development of specialized applications with efficiency and environmental compliance capabilities. |

How big is the short path evaporator for food market in 2025?

The global short path evaporator for food market is valued at USD 1,494.4 million in 2025.

What will be the size of the short path evaporator for food market in 2035?

The size of the short path evaporator for food market is projected to reach USD 2,577.0 million by 2035.

What will be the short path evaporator for food market growth between 2025 and 2035?

The short path evaporator for food market is expected to grow at a 5.6% CAGR between 2025 and 2035.

What are the key heating area segments in the short path evaporator for food market?

The key heating area segments in the short path evaporator for food market are Heating Area Below 10㎡, Heating Area 10-30㎡, Heating Area Above 30㎡, and Others.

Which application segment is expected to contribute a significant share in the short path evaporator for Food market in 2025?

In terms of application, the food extract production segment is set to command the dominant share in the short path evaporator for food market in 2025.

The global short path evaporator for food market is estimated to be valued at USD 1,494.4 million in 2025.

The market size for the short path evaporator for food market is projected to reach USD 2,577.0 million by 2035.

The short path evaporator for food market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in short path evaporator for food market are heating area below 10㎡, heating area 10-30㎡ and heating area above 30㎡.

In terms of application, food extract production segment to command 45.0% share in the short path evaporator for food market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Short Circuit Isolator Market Size and Share Forecast Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Short Wave IR LED Market Size and Share Forecast Outlook 2025 to 2035

Shortenings Market Size, Growth, and Forecast for 2025 to 2035

Short sleep syndrome Treatment Market Growth & Demand 2025 to 2035

Short-Term Vacation Rental Market Trends – Growth & Forecast 2025 to 2035

Short-Acting Beta-Agonists Market – Trends, Demand & Forecast 2025 to 2035

Short-read Sequencing Market by Product, Workflow, and Region from 2025 to 2035

Short-chain Fructooligosaccharides Market Analysis – Growth, Applications & Outlook 2025-2035

Shortening Powder Market

Short-Term Rental Platform Market Size and Share Forecast Outlook 2025 to 2035

Ultra Short Base Line (USBL) Positioning Systems Market Size and Share Forecast Outlook 2025 to 2035

Icing Shortening Market Size, Growth, and Forecast for 2025–2035

Frying Shortening Market Size and Share Forecast Outlook 2025 to 2035

Flaked Shortening Market

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Emulsified Shortenings Market Size and Share Forecast Outlook 2025 to 2035

High Ratio Shortening Market Trends – Growth & Applications 2025 to 2035

Dairy Free Shortening Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA