The Frying Shortening Market is estimated to be valued at USD 5488.0 million in 2025 and is projected to reach USD 8202.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

| Metric | Value |

|---|---|

| Frying Shortening Market Estimated Value in (2025 E) | USD 5488.0 million |

| Frying Shortening Market Forecast Value in (2035 F) | USD 8202.0 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The frying shortening market is witnessing dynamic evolution as manufacturers and food processors adapt to shifting dietary trends, evolving regulatory frameworks, and growing demand for sustainable and stable frying mediums. The increasing global consumption of fried foods, particularly in quick service restaurants and packaged snacks, has intensified the focus on high-performance shortenings that enhance texture, extend shelf life, and ensure consistent frying quality.

The transition from traditional fats to frying shortenings enriched with tailored fatty acid profiles is being accelerated by the need for reduced trans fats and improved thermal stability. Technological advancements in oil processing, coupled with innovations in emulsification and blending, have allowed formulators to create shortenings suitable for diverse industrial requirements.

Furthermore, rising awareness of clean label ingredients and eco-conscious sourcing is prompting the reformulation of conventional shortenings into more functional and traceable alternatives With expanding fast food chains, bakery outlets, and food delivery networks across emerging economies, the market is positioned for sustained growth through product differentiation and regulatory compliance.

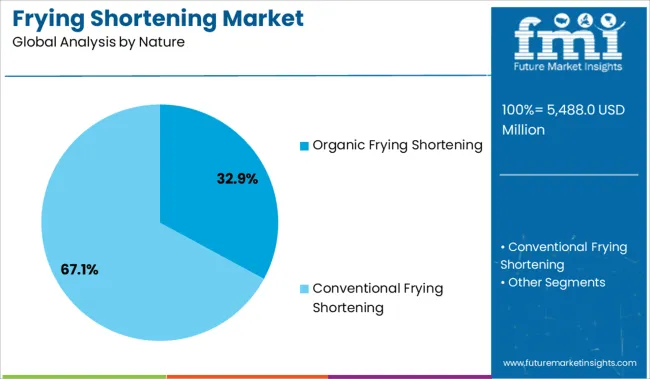

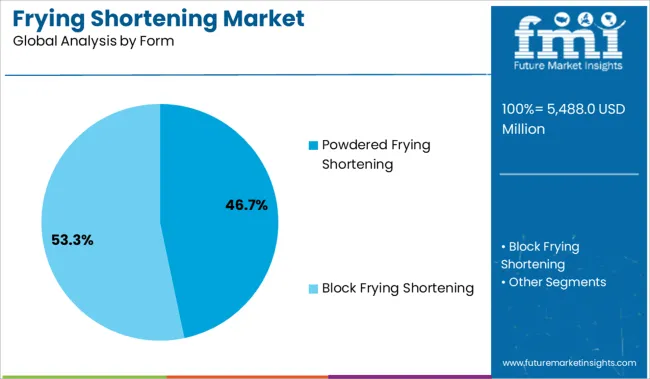

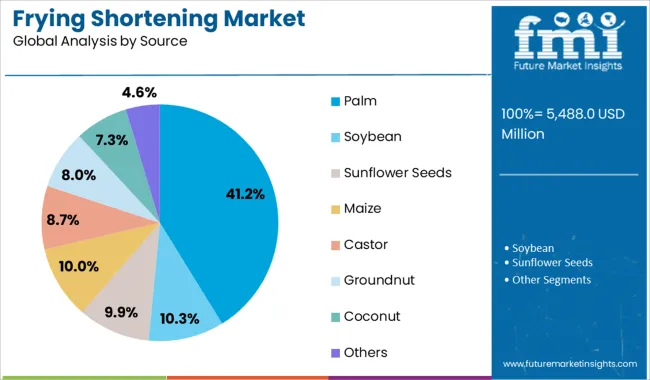

The market is segmented by Nature, Form, Source, and End Use and region. By Nature, the market is divided into Organic Frying Shortening and Conventional Frying Shortening. In terms of Form, the market is classified into Powdered Frying Shortening and Block Frying Shortening. Based on Source, the market is segmented into Palm, Soybean, Sunflower Seeds, Maize, Castor, Groundnut, Coconut, and Others. By End Use, the market is divided into Bakery Products, Confectionary Industry, Dairy Products, Processed Food, Dietary Supplements, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic frying shortening segment is projected to account for 32.9% of the revenue share in the frying shortening market in 2025. The segment's strong performance is attributed to heightened consumer awareness around food purity, non-GMO sourcing, and the avoidance of synthetic additives in processed foods.

Increased demand for organic-certified food ingredients, particularly in North America and Europe, has influenced food manufacturers to incorporate organic frying mediums in their clean label formulations. Organic frying shortening has gained widespread traction among health-focused food service providers and premium snack brands due to its perceived health benefits and alignment with transparent sourcing practices.

Its market strength is also supported by evolving retail standards that favor organic labeling and by rising household use of natural fats in gourmet cooking As the demand for organically certified, traceable, and sustainable ingredients continues to intensify, organic frying shortening is expected to maintain a competitive edge within the overall nature-based segmentation of the market.

Powdered frying shortening is expected to represent 46.7% of the total revenue in the frying shortening market in 2025, making it the most dominant form. The segment's growth is being driven by its operational flexibility, ease of storage, and extended shelf life which appeals to large-scale commercial kitchens and institutional foodservice providers.

Powdered form offers logistical advantages during transportation and is particularly valued in applications requiring dry mix integration, such as instant meals, baking premixes, and seasoning blends. The ability to deliver consistent flavor and textural benefits without the handling challenges of liquid or block shortenings has made powdered formats highly desirable in high-throughput production environments.

Additionally, powdered frying shortenings are increasingly formulated with tailored melting points and anti-caking agents, enhancing their stability in fluctuating temperatures These performance benefits, combined with growing demand for convenience-oriented food ingredients, are reinforcing the strong position of powdered frying shortening in the global market.

Palm-based frying shortening is projected to hold 41.2% of the total revenue share in the frying shortening market in 2025. Its dominance stems from the consistent performance, cost efficiency, and high oxidative stability it offers across multiple frying applications. Palm oil derivatives have become a staple in large-scale commercial frying due to their neutral flavor profile, long fry life, and balanced fatty acid composition.

The adaptability of palm-based shortening to both high-heat deep frying and low-moisture baking has contributed to its widespread use in processed foods, including frozen snacks and confectionery items. In addition, palm shortening's availability in both refined and fractionated formats allows for customized application across varying temperature requirements.

The segment’s resilience is further supported by ongoing efforts in sustainable palm sourcing, traceability initiatives, and RSPO-certified supply chains As demand intensifies for economically viable and high-performing frying solutions in emerging and mature food markets, palm remains a strategic raw material in the frying shortening sector.

Frying shortening was earlier composed of Tran’s fats which are responsible for various heart diseases but nowadays, manufacturers are avoiding Tran’s fats usage in making frying shortening, leading to more demand for frying shortening.

The same is increasing their usage in many food products such as in baking as well as in fried products, and the sales of frying shortening are spiking as consumers are more prone to health consciousness. Furthermore, as more are inclined towards Westernized food culture with low-fat and cholesterol-free products, the demand for frying shortening is expected to soar in coming years.

Due to increased cardiovascular risk consumers are more aware of the amount and quality of the fats consumed in their day-to-day life, and the same increased the demand for cholesterol-free and Tran’s fat-free products, in turn, propelling the demand for frying shortening.

The frying shortening is also used in the manufacturing process of many dietary supplement products such as oatmeal biscuits, which results in huge sales of frying shortening from diet-conscious consumers.

Frying shortening is also used to prevent the interaction of gluten molecules in food, which increases its usage and popularity among consumers and in many food processing industries, ultimately driving up the sales of frying shortening over the forecast period.

On the other side, macroeconomic factors such as an increase in the disposable income of the middle- class consumers have driven the market of cakes, pastries, and other baked products leading to an increase in the demand for frying shortening.

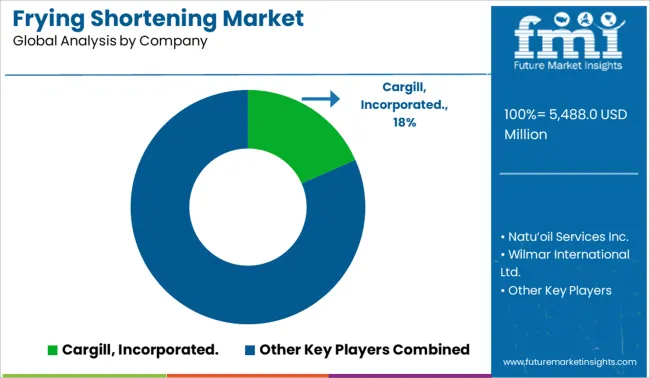

Some of the manufacturer's operations in the frying shortening market are Natu'oil Services Inc., Cargill, Incorporated., Wilmar International Ltd., Archer-Daniels-Midland Company, Ventura Foods, LLC, Hangzhou Dingyi International Foodstuff Co., Ltd., Carotino Sdn Bhd, The J. M. Smucker Company, Bunge Limited., Roberts Manufacturing Co., AAK AB (publ.), and others.

The manufacturers operating in this field have a good advantage due to the products’ cholesterol-free properties and they can be used in processing many food products, leading to higher sales of frying shortening among consumers.

Frying shortening manufacturers could focus on research and development to obtain frying shortenings from different sources other than the plant, for example, enzymes or bacteria.

Manufacturers could serve the product at their best-discounted price to attract additional business manufacturers to use their frying shortening product as an ingredient in their end product.

Frying shortening is less inflammable. Hence, it can be used as a substitute for margarine, leading to an uptick in demand for frying shortening.

The sales of frying shortening could witness a spike as manufacturers shift their focus on introducing various flavors of frying shortening for use in many cakes to enhance the flavor and maintain low fat.

The manufacturers could try to expand their firms in the Asia Pacific region due to its increasing expenditure on processed food, in turn, enlarging their frying-shortening market share.

The report consists of key players contributing to the frying shortening market share.

It also consists of organic and inorganic growth strategies adopted by market players to improve their market positions.

This exclusive report analyzes the competitive landscape and frying shortening market share acquired by players to strengthen their market position.

| Report Attribute | Details |

|---|---|

| Base Year for Estimation | 2024 |

| Historical Data | 2014 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Nature, Form, Source, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Natu'oil Services Inc.; Cargill, Incorporated.; Wilmar International Ltd.; Archer-Daniels-Midland Company; Ventura Foods, LLC; Hangzhou Dingyi International Foodstuff Co. Ltd.; Carotino Sdn Bhd; The J. M. Smucker Company; Bunge Limited.; Roberts Manufacturing Co.; AAK AB (publ.) |

| Customization | Available Upon Request |

The global frying shortening market is estimated to be valued at USD 5,488.0 million in 2025.

The market size for the frying shortening market is projected to reach USD 8,202.0 million by 2035.

The frying shortening market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in frying shortening market are organic frying shortening and conventional frying shortening.

In terms of form, powdered frying shortening segment to command 46.7% share in the frying shortening market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skillets and Frying Pans Market

Shortenings Market Size, Growth, and Forecast for 2025 to 2035

Shortening Powder Market

Icing Shortening Market Size, Growth, and Forecast for 2025–2035

Flaked Shortening Market

Specialty Shortenings Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Emulsified Shortenings Market Size and Share Forecast Outlook 2025 to 2035

High Ratio Shortening Market Trends – Growth & Applications 2025 to 2035

Dairy Free Shortening Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA