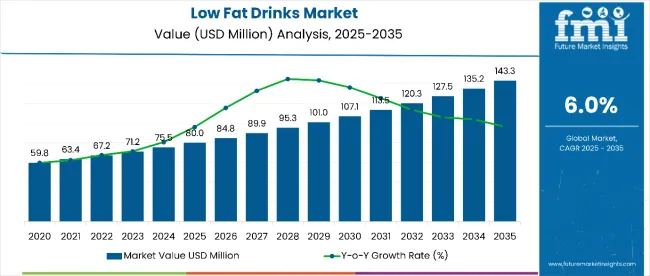

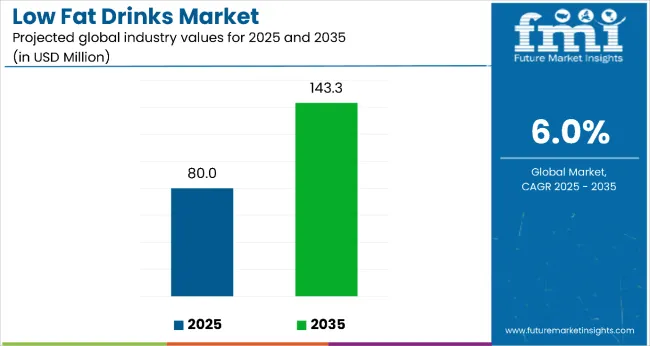

The global low-fat drinks market is estimated at USD 80 million in 2025 and is forecasted to reach USD 143.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 6%. This expansion is being driven by growing consumer preference for healthier beverage options that support weight control and overall wellness. The market is projected to add an absolute dollar opportunity of USD 50 million during the forecast period.

By 2030, the market is likely to reach approximately USD 94.5 million, accounting for an incremental value of USD 19.5 million during the first half of the decade. The remaining USD 30.5 million is expected in the latter half, indicating a moderately back-loaded growth pattern.

Leading manufacturers such as PepsiCo and The Coca-Cola Company are leveraging this trend by broadening their product portfolios and introducing innovative low-fat beverage solutions. Simultaneously, an increased focus on clean-label formulations and natural ingredients is influencing strategic priorities as brands respond to heightened consumer demand for transparency and health-oriented products.

The market holds a notable position across several larger parent industries. It represents approximately 1.2% of the global food and beverage market, driven by its integration into healthier beverage alternatives. Within the health and wellness sector, the share is estimated at 3.5%, supported by increasing consumer demand for functional drinks that assist in weight control and overall metabolic health. Its contribution to the functional beverages category is around 4.8%, reflecting a steady shift toward products offering added nutritional benefits. Additionally, it accounts for nearly 2.0% of the broader consumer goods segment, indicating its expanding relevance in daily nutrition habits.

The low-fat drinks market is undergoing strong growth as consumers increasingly opt for beverages that aid in weight management and reduce the risk of chronic illnesses. Industry leaders such as PepsiCo and The Coca-Cola Company are broadening their portfolios with low-fat, sugar-free, and naturally formulated offerings to cater to a health-conscious consumer base. Innovation within plant-based drinks, particularly vegan options, is accelerating this trend, reinforcing the category’s alignment with clean-label and lifestyle-focused consumption patterns.

Low-fat drinks are witnessing strong adoption as health-conscious consumers seek alternatives that provide reduced fat without compromising on taste, hydration, or functional benefits. These products have become increasingly attractive due to their alignment with weight management goals and lifestyle-oriented nutrition trends. Rising global awareness regarding obesity, hypertension, and cardiovascular diseases has intensified the shift from traditional full-fat and sugary beverages toward healthier options, supporting steady market growth.

Demand is further supported by the surge in low-calorie, sugar-free, and plant-based beverage consumption, driven by the rise of vegan and lactose-free diets. Functional beverages fortified with electrolytes, vitamins, and proteins are gaining traction for post-workout recovery and digestive health benefits. These formulations cater to both fitness enthusiasts and mainstream consumers prioritizing preventive health.

Technological advancements in fat-reduction processes, natural sweetener integration, and flavor-enhancement systems are enabling the development of products that maintain taste and texture integrity while reducing fat content. Innovations such as oat-based, almond-based, and other plant-derived alternatives have expanded product diversity, creating new growth avenues. Ready-to-drink formats, clean-label claims, and transparent ingredient sourcing further reinforce consumer trust, positioning low-fat drinks as a key component of the global wellness beverage category.

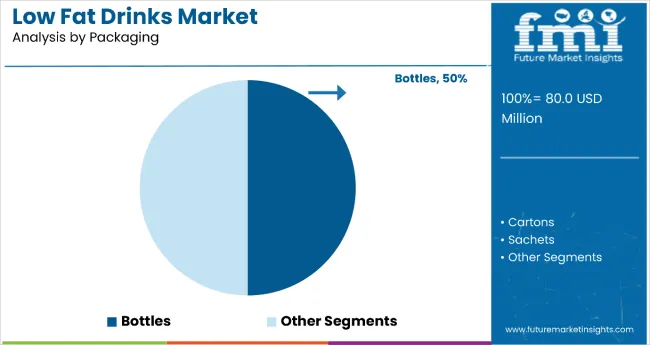

The market is segmented by product type, source, packaging, distribution channel, and region. By product type, the market is bifurcated into alcoholic and non-alcoholic. Based on source, the market is characterized into animal-based and plant-based (oat, pea, almond, soy, coconut, and others). In terms of packaging, the market is divided into cans, bottles, cartons, sachets, and others.

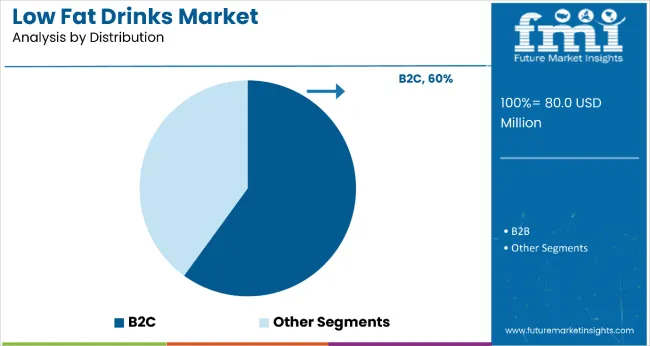

By distribution channel, the market is segmented into B2B, B2C (modern trade, convenience stores, online retailers, hypermarkets/supermarkets, specialty stores, and small groceries). Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa.

The product type segment is divided into alcoholic and non-alcoholic beverages, with non-alcoholic drinks leading the category at 80% market share in 2025. This dominance is driven by a strong consumer shift toward wellness-focused beverage options and reduced alcohol consumption. Non-alcoholic low-fat drinks, particularly in functional and plant-based categories, cater to urban and health-conscious consumers.

Key Factors

The packaging segment includes bottles, cans, cartons, sachets, and others. Bottles-both glass and PET-dominate with a 50% share, attributed to their portability, reseal ability, and suitability for premium and mass-market products. While cans remain popular for convenience and on-the-go consumption, cartons and sachets are gaining traction among sustainability-conscious consumers.

Key Factors

The distribution channel category comprises B2B and B2C, with B2C commanding 60% share in 2025. Within B2C, hypermarkets, supermarkets, and modern trade dominate due to their extensive reach and availability of diverse product offerings. Online retail is growing rapidly, driven by convenience and the popularity of subscription models for functional drinks.

Key Factors

In 2024, global consumption of low-fat drinks rose by 14% year-on-year, with North America and Asia Pacific accounting for nearly 60% of total demand. The market is shaped by key forces-growing consumer interest in health-centric beverages, technological advancements in fat reduction, and the expansion of plant-based alternatives.

However, product reformulation challenges, pricing constraints, and taste perception issues continue to impact adoption. Clean-label positioning, functional health benefits, and sugar-reduction initiatives remain central to market development, driving brand differentiation and consumer loyalty.

Key Drivers Fueling Low-Fat Drinks Market Expansion

The primary growth stimulus is rising global awareness of lifestyle-related health conditions such as obesity, diabetes, and cardiovascular disorders. Consumers are actively seeking beverages that deliver essential nutrition without excess fat or sugar. Low-fat drinks serve as healthier substitutes for traditional options, aligning with preventive health goals and fitness-oriented lifestyles.

Demand is further strengthened by the increasing adoption of functional beverages that aid energy, digestion, and post-workout recovery. Low-fat formulations enriched with proteins, vitamins, and electrolytes are gaining strong traction in sports nutrition and general wellness categories. The growth of plant-based and dairy-alternative beverages-driven by veganism and lactose intolerance-has expanded market opportunities significantly.

Technological progress in fat removal, flavor masking, and natural ingredient integration has improved the sensory profile of low-fat beverages. These advancements allow manufacturers to deliver clean-label, nutrient-rich drinks without compromising on taste or shelf stability.

Major Restraints Challenging Low-Fat Drinks Market Development

Despite positive momentum, the market faces structural hurdles. Reformulation complexity often results in higher production costs, as fat reduction impacts beverage mouthfeel and texture. Manufacturers resort to stabilizers and natural flavoring agents to maintain taste, which can further escalate costs.

Price sensitivity in emerging markets poses another challenge, where premium low-fat beverages compete against cost-effective traditional options. Additionally, regulatory discrepancies in nutrient labeling and health claims across regions create barriers for global standardization. Limited supply of high-quality plant-based ingredients and natural additives adds to procurement difficulties, creating scalability concerns for brands operating in multiple geographies.

Emerging Key Trends Influencing Low-Fat Drinks Market Direction

Clean-label and plant-based innovations dominate emerging trends. Consumers increasingly favor beverages with transparent ingredient lists and ethical sourcing credentials, prompting manufacturers to expand vegan product lines using oat, almond, coconut, and pea proteins. This transition supports broader acceptance among lactose-intolerant and environmentally conscious buyers.

Sugar reduction is another critical trend, with brands adopting natural sweeteners like stevia, monk fruit, and erythritol to maintain taste without raising caloric content. Functional fortification through probiotics, antioxidants, and adaptogens is reshaping product positioning, targeting immunity and energy-boosting benefits. Convenience formats-such as single-serve bottles and ready-to-drink packs-are widely adopted, reflecting the demand for on-the-go health solutions.

Regionally, North America continues to lead in innovation and premiumization, while Asia Pacific emerges as a key growth frontier due to expanding urban middle-class populations and heightened health awareness. These shifts underline the long-term potential of the low-fat drinks category within the global beverage industry.

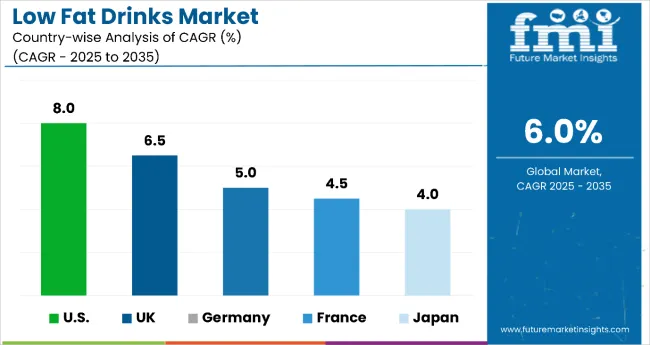

| Country | CAGR |

|---|---|

| United States | 8% |

| United Kingdom | 6.5% |

| Germany | 5% |

| France | 4.5% |

| Japan | 4% |

The growth rates for the low-fat drinks market in the USA, the UK, Germany, France, and Japan vary significantly due to differences in consumer preferences, health trends, and regulatory environments. The USA is expected to lead with the highest growth rate at 8% CAGR, driven by a growing health-conscious population and demand for low-fat alternatives.

The UK follows closely with 6.5% CAGR with strong consumer shifts towards healthier, plant-based options. Germany and France show steady growth at CAGRs of 5% and 4.5% due to established markets for functional beverages. Japan presents a slower growth rate at 4% but a consistent demand for functional and health-focused products.

The USA low-fat drinks market is projected to record the fastest growth globally, with an estimated CAGR of 8% between 2025 and 2035. Rising health awareness, combined with growing concerns over obesity and cardiovascular diseases, continues to drive demand. Non-alcoholic beverages dominate, supported by plant-based innovations like oat and almond-based drinks. Functional beverages targeting fitness and post-workout recovery are gaining popularity among urban and health-conscious consumers.

Key Highlights

The UK low-fat drinks market is expected to expand at a CAGR of 6.5% during the forecast period. Growing consumer demand for health-driven and vegan-friendly beverages drives strong adoption of plant-based low-fat alternatives. Functional drinks supporting immunity, weight management, and digestive health are becoming mainstream across retail channels.

Key Highlights

The sales of low-fat drinks in Germany are growing steadily with a CAGR of 5% from 2025 to 2035, as health-conscious consumers demand better options for weight management and heart health. There is a growing trend toward clean-label and organic beverages, which appeal to the increasing number of people looking for natural and minimally processed products. Additionally, functional beverages designed to improve overall wellness, such as those targeting diabetes and digestive health, are expanding in popularity.

The low fat drinks market in France is projected to grow at a CAGR of 4.5% from 2025 to 2035, supported by an increasing demand for healthier beverage alternatives. French consumers are prioritizing weight management and digestive health, leading to a rise in demand for functional drinks, including low-fat options that support these needs. Plant-based low-fat drinks are seeing strong growth, with oat and almond-based beverages becoming particularly popular among the health-conscious demographic.

The demand for low-fat drinks in Japan is growing steadily, with an estimated CAGR of 4% from 2025to 2035. The country’s aging population, which is increasingly focused on maintaining health, is driving demand for functional beverages, particularly those that support cardiovascular health, weight management, and digestion. Additionally, Japan is witnessing a shift toward plant-based low-fat drinks as part of a broader health and wellness trend. The market for low-fat drinks is expected to continue growing, albeit at a slower pace compared to other regions.

The global low-fat drinks market is highly fragmented, with both established brands and emerging players competing through pricing, innovation, partnerships, and expansion. Major companies like PepsiCo, Coca-Cola, and Nestlé are leveraging both traditional retail and e-commerce platforms to reach health-conscious consumers. These companies are focusing on product diversification, clean-label formulations, and strategic partnerships to strengthen their market presence.

Leading players have introduced innovative products to meet the rising demand for healthier beverages. For example, PepsiCo and Coca-Cola have expanded their portfolios to include low-fat, sugar-free, and plant-based options, responding to the increasing shift toward functional and health-driven drinks. Additionally, companies like Nestlé are incorporating functional ingredients, such as vitamins and minerals, in their low-fat beverage offerings.

Emerging startups and regional players are making significant strides by offering niche products and targeting specific consumer segments, capitalizing on the growing trend of personalized nutrition and the demand for functional beverages.

However, players in this market face challenges such as intense competition, the need for continuous innovation, and regulatory hurdles. Consumer skepticism about the authenticity of health claims, as well as concerns over preservatives and artificial ingredients in low-fat drinks, remain significant obstacles. To overcome these challenges, companies must prioritize transparency, quality assurance, and consumer education.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 80 Million |

| Product Type | Alcoholic, Non-Alcoholic |

| Source | Animal-based, Plant-based, Oat, Pea, Almond, Soy, Coconut, Others. |

| Packaging | Cans, Bottles, Cartons, Sachets, Others |

| Distribution Channel | B2B, B2C, Modern Trade, Convenience Stores, Online Retailers, Hypermarkets/Supermarkets, Specialty Stores, Small Groceries |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Country Covered | United States, United Kingdom, Germany, France, Japan, Canada, India, Brazil, Australia , and 40+ countries |

| Key Companies Profiled | Organic India Pvt. Ltd., Healthvit , Medisyskart , Amazon, Flipkart, PepsiCo, The Coca-Cola Company, Diageo, Bacardi Limited, Herbal Water, SGC Global LLC |

| Additional Attributes | Dollar sales by product type and end-use sector, growing usage in flooring and structural panels for residential construction, stable demand in furniture and interior applications, innovations in cross-laminated bamboo and low-emission adhesives improve strength, durability, and environmental compliance |

The global low fat drinks market is estimated to be valued at USD 80.0 million in 2025.

The market size for the low fat drinks market is projected to reach USD 143.3 million by 2035.

The low fat drinks market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in low fat drinks market are alcoholic and non-alcoholic.

In terms of animal based, plant based segment to command 0.0% share in the low fat drinks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA