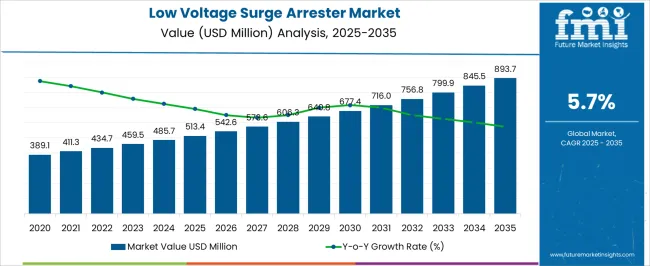

The low voltage surge arrester market is estimated to be valued at USD 513.4 million in 2025 and is projected to reach USD 893.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

Between 2020 and 2024, the market grows from USD 389.1 million to USD 485.7 million, marking the early adoption phase where conventional silicon carbide arresters remain dominant due to their cost-effectiveness and widespread use in grid and facility protection. During this stage, polymeric housing arresters also begin to emerge, offering greater durability, lighter weight, and improved weather resistance, although their adoption is limited when compared to traditional porcelain models. From 2025 to 2030, the market enters a scaling phase, rising from USD 513.4 million to USD 677.4 million, driven by investments in modernizing distribution networks, expansion of power infrastructure in emerging economies, and integration of renewable energy and distributed power systems.

Polymer-housed designs gain significant traction during this period, offering safer and more efficient alternatives to older systems, while smart surge arresters with monitoring capabilities begin to find selective application in utility and industrial settings. Between 2031 and 2035, the market progresses from USD 716.0 million to USD 893.7 million, reflecting a consolidation phase where standardized devices dominate mainstream use while advanced IoT-enabled smart arresters establish a stronghold in critical infrastructure and smart grids. Overall, the low voltage surge arrester market exhibits a clear maturity cycle, transitioning from reliance on conventional models to polymer innovations, and eventually to intelligent networked solutions that reinforce grid reliability and long-term operational resilience.

| Metric | Value |

|---|---|

| Low Voltage Surge Arrester Market Estimated Value in (2025 E) | USD 513.4 million |

| Low Voltage Surge Arrester Market Forecast Value in (2035 F) | USD 893.7 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

The low voltage surge arrester market occupies a critical position within the broader electrical protection and power distribution sector, representing approximately 10–12% of the overall surge protection device category. Within the residential, commercial, and light industrial segments, low voltage surge arresters account for roughly 7–9%, driven by rising demand for safeguarding sensitive electrical and electronic equipment from voltage transients, lightning strikes, and switching surges. In the wider power quality and grid reliability market, low voltage surge arresters capture an estimated 4–6% share, supported by applications in distribution transformers, consumer electronics, photovoltaic systems, and small-scale industrial installations. Growth is reinforced by increasing adoption of smart grids, stricter electrical safety regulations, and infrastructure modernization programs in North America, Europe, and Asia-Pacific.

Challenges such as competition from medium-voltage arresters, cost pressures, and evolving standards influence market penetration, yet innovations in polymeric housing, hybrid materials, and compact designs continue to drive uptake. Regional adoption is particularly strong in Europe and North America due to well-established grid infrastructure and regulatory compliance requirements, while Asia-Pacific shows rising demand driven by expanding residential, commercial, and renewable energy installations. Overall, low voltage surge arresters remain indispensable for ensuring electrical safety, power quality, and system reliability, maintaining steady share within the global surge protection ecosystem.

The low voltage surge arrester market is witnessing steady growth due to the increased deployment of sensitive electronic equipment in residential, commercial, and utility sectors. As smart grid infrastructure expands and electrical networks grow more complex, the need for efficient protection from voltage transients becomes crucial.

Regulatory emphasis on equipment safety, coupled with rising losses from power surges and lightning strikes, has driven adoption across both developed and emerging markets. Manufacturers are focusing on durable, compact materials and real-time monitoring features to align with next-generation grid demands.

Additionally, infrastructure modernization in utility distribution networks and industrial facilities continues to be a major growth catalyst for this segment.

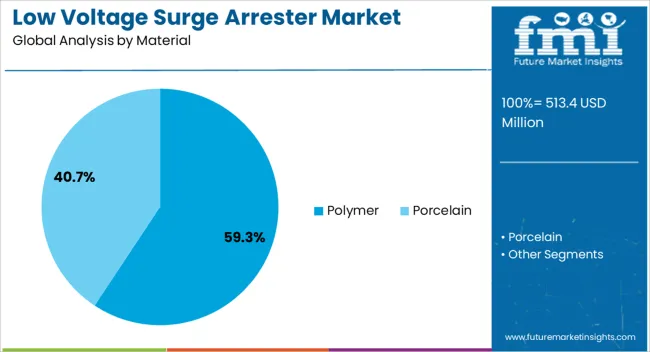

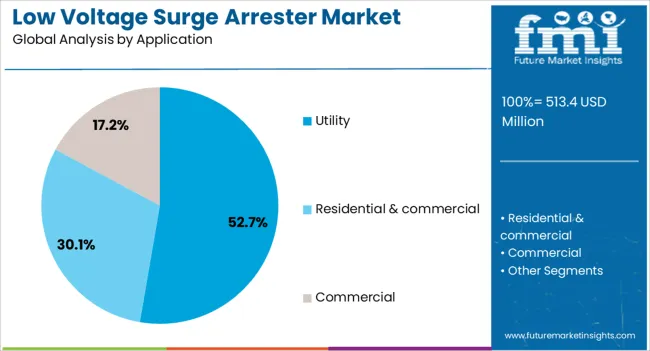

The low voltage surge arrester market is segmented by material, application, and geographic regions. By material, low voltage surge arrester market is divided into polymer and porcelain. In terms of application, low voltage surge arrester market is classified into utility, residential & commercial, and commercial. Regionally, the low voltage surge arrester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polymer surge arresters are expected to dominate the market with 59.30% share in 2025, primarily due to their superior performance in harsh environments and mechanical strength advantages. These materials offer lightweight, corrosion-resistant solutions that reduce maintenance needs and extend equipment life, particularly in outdoor utility and industrial installations. Their hydrophobic nature and resistance to UV degradation make them ideal for long-term applications where environmental exposure is significant. Innovations in polymer compounding and housing technology are further enhancing dielectric properties and thermal endurance, solidifying their position as the preferred material over traditional porcelain counterparts.

The utility sector is projected to lead with a 52.70% share in 2025, driven by rising investments in transmission and distribution networks. With the ongoing shift toward grid digitization and decentralized energy sources, utilities are increasingly relying on surge protection systems to maintain operational reliability and safeguard infrastructure. Surge arresters play a crucial role in preventing equipment failure caused by transient overvoltages, especially in areas with high lightning incidence or switching activity. Government support for rural electrification and the replacement of aging grid assets in urban regions are further expanding the scope of application in utility systems. As energy demand grows, reliable surge protection will remain critical to minimizing unplanned outages and ensuring system longevity.

Low voltage surge arresters are increasingly adopted across residential, commercial, industrial, and utility applications, driven by equipment protection, grid safety, and compliance standards. Innovations in material, design, and performance certifications enhance adoption while ensuring steady dollar sales and market share expansion globally.

Rising deployment of low voltage surge arresters is largely fueled by the need to protect residential, commercial, and small industrial installations from voltage spikes, lightning surges, and switching transients. Adoption is increasing in smart homes, office complexes, and commercial buildings equipped with sensitive electronics such as HVAC systems, communication devices, and computing equipment. Grid modernization efforts and stricter compliance with electrical safety codes are driving adoption. Residential demand is propelled by the proliferation of home electronics, while commercial uptake is supported by energy management systems, automated controls, and data centers. Early-stage replacement of aging surge protection devices also contributes to dollar sales growth. The combination of regulatory compliance, system reliability, and equipment protection is shaping product selection, installation practices, and market expansion in key regions globally.

Industrial and utility installations are increasingly incorporating low voltage surge arresters to protect equipment, transformers, and power distribution networks. Adoption is prominent in small-scale manufacturing plants, renewable energy setups, and secondary distribution networks, where sensitive loads are vulnerable to transient overvoltages. Industrial expansion, coupled with safety regulations, drives demand for arresters with higher performance and longer operational life. Utilities are focusing on minimizing downtime, reducing equipment damage, and maintaining grid reliability through arrester installation in distribution transformers and substations. Dollar sales in this segment are influenced by contract-based projects, bulk procurement by power utilities, and grid reinforcement programs. Regional growth is concentrated in North America, Europe, and Asia-Pacific, where industrialization and electrical infrastructure investment remain key growth drivers.

Product improvements in low voltage surge arresters, such as polymeric housings, hybrid materials, and compact modular designs, are boosting adoption in diverse applications. Enhanced durability, resistance to environmental stressors, and reduced maintenance requirements are increasing confidence among installers and end-users. Innovations in arrester design allow integration into smaller distribution boards and retrofit applications without major system redesign. Demand is also shaped by performance certifications, compliance with IEC standards, and user preferences for long-lasting devices. Improved reliability ensures cost-effective protection, minimizing replacement cycles and downtime costs. This drives incremental dollar sales growth, particularly in premium segments and regions with high safety standards. Adoption trends are reinforced by distributors emphasizing product differentiation through quality, design, and service support.

Government regulations, electrical codes, and grid reliability standards significantly influence low voltage surge arrester adoption. Mandatory installation in residential, commercial, and industrial setups to mitigate power surge risks is shaping procurement decisions. Utilities and distributors prefer certified products, ensuring conformity with voltage rating, discharge capacity, and operational longevity standards. Regional compliance frameworks in Europe, North America, and Asia-Pacific accelerate arrester deployment. Training programs for installers, coupled with government-led grid enhancement initiatives, support broader adoption. Dollar sales are influenced by enforcement of building codes, replacement mandates, and contractual obligations for industrial and utility projects. Regulatory focus ensures consistent arrester quality, reliability, and contribution to system resilience across installed networks.

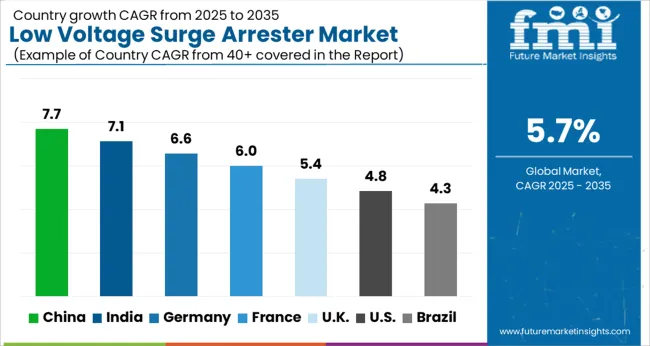

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

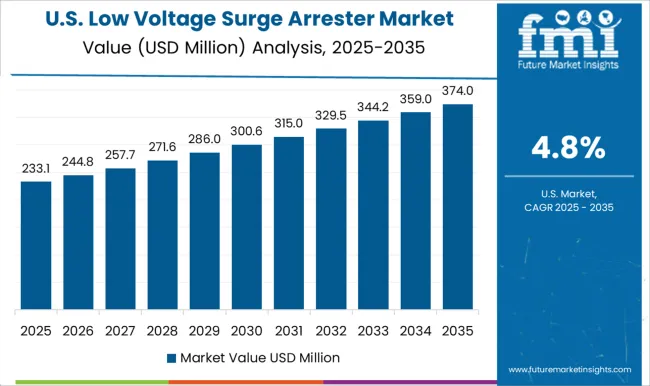

| USA | 4.8% |

| Brazil | 4.3% |

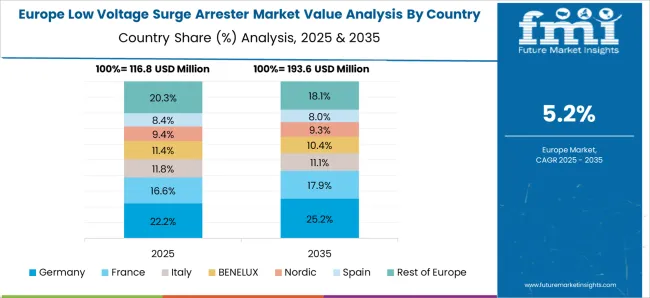

The low voltage surge arrester market is projected to grow globally at a CAGR of 5.7% between 2025 and 2035, supported by increasing adoption across residential, commercial, industrial, and utility applications. China leads with a CAGR of 7.7%, driven by expanding electrical infrastructure, rising industrial and commercial setups, and replacement of aging surge protection devices. India follows at 7.1%, fueled by growing power distribution networks, safety regulations, and deployment in small-scale industrial and residential applications. France records 6.0%, benefiting from grid reliability programs, regulatory mandates, and adoption in commercial and industrial facilities. The United Kingdom grows at 5.4%, shaped by residential installations, code compliance, and replacement demand, while the United States posts 4.8%, reflecting established residential and commercial networks, steady industrial investment, and ongoing infrastructure upgrades. The analysis spans over 40 countries, with these five serving as benchmarks for production planning, regulatory compliance monitoring, and strategic investment in the global low voltage surge arrester ecosystem.

China is forecasted to post a CAGR of 7.7% for 2025–2035, up from 6.8% recorded between 2020–2024, well above the global baseline of 5.7%. Early growth was driven by large-scale power grid expansion, rising industrial electrification, and replacement of aging surge protection units. Over the next decade, demand will be reinforced by increasing residential and commercial installations, adoption in smart building projects, and government-led reliability programs. Investments in local manufacturing capacity, partnerships with international component suppliers, and strategic deployment in industrial facilities are expected to sustain China’s leadership in the low voltage surge arrester sector.

India is projected to achieve a CAGR of 7.1% between 2025–2035, rising from 6.3% during 2020–2024, surpassing the global average. Initial growth was shaped by growing residential electrification, expansion of small- and medium-scale industrial facilities, and increased adoption of safety codes. Over the next decade, higher adoption in renewable integration, commercial infrastructure upgrades, and modernization of power distribution networks will accelerate growth. Strategic alliances with global manufacturers, local capacity expansion, and government incentives for electrical safety standards further strengthen India’s positioning in the low voltage surge arrester market.

France is expected to post a CAGR of 6.0% for 2025–2035, improving from 5.2% during 2020–2024, above the global 5.7% baseline. Early adoption was influenced by stringent safety regulations, utility-led grid modernization, and increasing installation in commercial and industrial facilities. The next decade will see growth driven by smart grid initiatives, replacement of legacy protection devices, and increased emphasis on critical infrastructure protection. Collaborations with local and international manufacturers, alongside technological enhancements for high-voltage stability, will reinforce France’s competitive position in the low voltage surge arrester ecosystem.

The United Kingdom is forecasted to achieve a CAGR of 5.4% for 2025–2035, rising from 4.9% recorded during 2020–2024, slightly below the global baseline of 5.7%. Initial growth was driven by residential and commercial network upgrades, replacement of older surge protection units, and rising awareness of electrical safety compliance. From 2025 onwards, growth will be shaped by enhanced infrastructure reliability programs, integration in commercial construction projects, and increasing adoption in renewable energy installations. Investment in distribution networks, partnerships with surge arrester suppliers, and targeted deployment in industrial facilities are expected to support moderate market expansion.

The United States is expected to record a CAGR of 4.8% for 2025–2035, improving from 4.2% during 2020–2024, reflecting mature market dynamics. Early growth was influenced by steady residential and industrial installation, replacement cycles for outdated surge arresters, and regulatory compliance with electrical safety codes. The next decade will be shaped by utility-led modernization, demand from commercial construction projects, and incremental adoption in critical infrastructure. Collaborations with global suppliers, localized manufacturing, and ongoing maintenance programs ensure continued relevance of low voltage surge arresters across sectors.

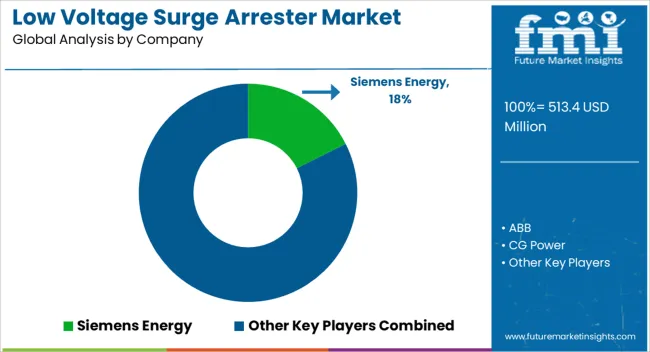

The low voltage surge arrester market is characterized by competition among leading global manufacturers and specialized producers, each emphasizing high-performance protection, reliability, and diversified applications across industrial, commercial, and utility sectors. Siemens Energy maintains a prominent position with a wide portfolio of surge protection devices, leveraging advanced engineering and global service networks. ABB focuses on scalable solutions for industrial and infrastructure projects, integrating monitoring and predictive maintenance capabilities. CG Power, CHINT Group, and DEHN emphasize robust protection systems for commercial and residential installations, supported by regional manufacturing and distribution. Eaton, Elpro, Ensto, General Electric, and Hubbell provide high-reliability arresters for utility and industrial networks, emphasizing durability, compliance, and system integration.

INAEL, Izoelektro, Surgetek, TDK Electronics, and TE Connectivity cater to specialized segments, offering compact, high-performance products for critical applications and niche markets. Competition in this sector is driven by demand for reliability under variable electrical conditions, compliance with regional safety standards, and enhanced durability. Key strategies include expanding production of high-capacity arresters, forming partnerships with utilities and industrial integrators, and developing tailored solutions for critical infrastructure. Market success will depend on maintaining quality and performance standards, offering versatile product lines for diverse applications, and ensuring efficient regional distribution networks to meet growing demand across global power, industrial, and commercial sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 513.4 million |

| Material | Polymer and Porcelain |

| Application | Utility, Residential & commercial, and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Siemens Energy, ABB, CG Power, CHINT Group, DEHN, Eaton, Elpro, Ensto, General Electric, Hubbell, INAEL, Izoelektro, Surgetek, TDK Electronics, and TE Connectivity |

| Additional Attributes | Dollar sales, share, regional demand, end-use sectors, product type adoption, pricing trends, regulatory compliance, utility and industrial uptake, competitive landscape, growth hotspots, technological differentiation, and distribution channels. |

The global low voltage surge arrester market is estimated to be valued at USD 513.4 million in 2025.

The market size for the low voltage surge arrester market is projected to reach USD 893.7 million by 2035.

The low voltage surge arrester market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in low voltage surge arrester market are polymer and porcelain.

In terms of application, utility segment to command 52.7% share in the low voltage surge arrester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Low Profile Compact System Closures Market Size and Share Forecast Outlook 2025 to 2035

Low Flow Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA