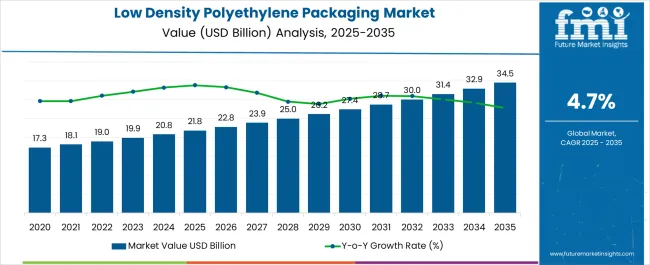

The low density polyethylene packaging market is estimated to be valued at USD 21.8 billion in 2025 and is projected to reach USD 34.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period.

The low density polyethylene (LDPE) packaging market, valued at 21.8 USD billion in 2025, is projected to reach 34.5 USD billion by 2035, reflecting a CAGR of 4.7% over the period. The market maturity curve shows early adoption during 2020–2024, with annual growth from 17.3 to 20.8 USD billion, driven by trials in flexible packaging for food, personal care, and consumer products. By 2025, the curve enters the scaling phase, supported by increased production capacity, standardization of applications, and broader market acceptance. Between 2025–2030, the market grows from 21.8 to 27.4 USD billion, reflecting operational efficiency and wider adoption. From 2030–2035, growth moderates as consolidation occurs, with leading suppliers dominating supply chains and capturing the majority of demand.

The adoption lifecycle mirrors this trajectory. During 2020–2024, early adopters validate packaging performance, durability, and compatibility with production lines, creating reference cases for broader uptake. From 2025–2030, scaling occurs as mainstream manufacturers expand procurement, optimize production, and standardize contracts with suppliers. By 2030–2035, consolidation dominates: late entrants adopt established sourcing models, partnerships and acquisitions shape competition, and procurement focuses on cost efficiency and supply reliability. The market transitions from experimental adoption, through rapid scale-up, to a mature phase characterized by predictable demand, standardized operations, and strong supplier relationships.

| Metric | Value |

|---|---|

| Low Density Polyethylene Packaging Market Estimated Value in (2025 E) | USD 21.8 billion |

| Low Density Polyethylene Packaging Market Forecast Value in (2035 F) | USD 34.5 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

Seasonality in the low density polyethylene (LDPE) packaging market is influenced by production cycles, product launches, and peak consumption periods. Data shows that Q3 and Q4 often account for 35–40% of annual procurement, coinciding with peak demand for food, beverage, and consumer goods packaging ahead of festive seasons. Conversely, Q1 typically records 10–15% lower activity, as manufacturers adjust inventories and plan production for new product lines. Seasonal campaigns, limited-edition packaging, and promotional cycles can create short-term spikes of 10–15% above baseline demand. Suppliers coordinate production, inventory, and logistics to maintain steady supply during high-demand periods while avoiding overstock during slower quarters.

Cyclicality reflects broader industrial investment and capacity replacement trends. Packaging lines and LDPE processing facilities typically undergo upgrades or expansions every 5–7 years, generating periodic surges in demand that can increase annual market size by USD 2–3 billion. Changes in regulatory requirements, raw material availability, or trade policies can also temporarily accelerate procurement, producing short-term spikes of 5–10% above projected growth. These cyclical patterns overlay the underlying CAGR of 4.7%, creating alternating periods of rapid growth and moderate stabilization. Recognizing these cycles allows manufacturers and suppliers to optimize production planning, inventory management, and supply chain coordination.

The market is experiencing steady expansion, supported by its versatility, cost-effectiveness, and suitability for a wide range of applications. The material’s excellent flexibility, moisture resistance, and strength-to-weight ratio have contributed to its strong adoption in various packaging formats.

Increasing demand from the food and beverage, consumer goods, and healthcare industries has been driving market momentum, as LDPE enables manufacturers to meet evolving consumer preferences for durable and lightweight packaging. Advancements in extrusion and film production technologies are further enhancing the performance characteristics of LDPE packaging, allowing for thinner, stronger, and more sustainable solutions.

The growing emphasis on recyclable and eco-friendly materials is opening new avenues for LDPE products, particularly in markets with stringent environmental regulations With rising global consumption patterns and the expansion of modern retail channels, LDPE packaging is expected to maintain its relevance, supported by continuous innovation and strategic investments in material science.

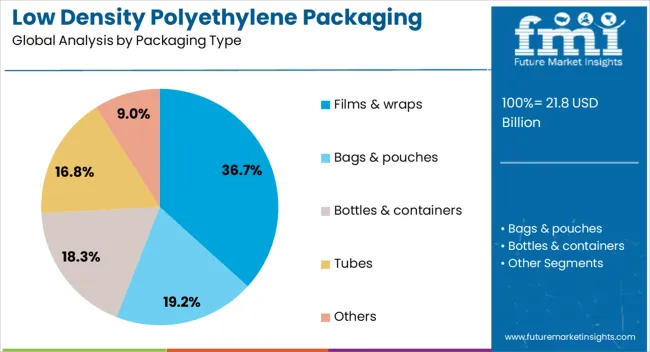

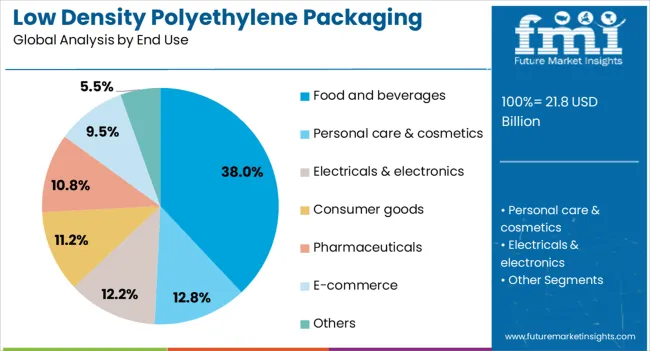

The low density polyethylene packaging market is segmented by packaging type, end use, and geographic regions. By packaging type, low density polyethylene packaging market is divided into films & wraps, bags & pouches, bottles & containers, tubes, and others. In terms of end use, low density polyethylene packaging market is classified into food and beverages, personal care & cosmetics, electricals & electronics, consumer goods, pharmaceuticals, e-commerce, and others. Regionally, the low density polyethylene packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The films and wraps segment is projected to hold 36.70% of the low density polyethylene packaging market revenue share in 2025, positioning it as the leading packaging type. This dominance has been driven by the segment’s ability to deliver high clarity, superior sealing performance, and strong barrier properties against moisture and contaminants. LDPE films and wraps are widely preferred in applications where flexibility, stretchability, and durability are required, making them suitable for both primary and secondary packaging. The lightweight nature of these materials reduces transportation costs while maintaining product integrity during storage and distribution. In addition, advances in co-extrusion technology have improved the mechanical strength and sustainability profile of LDPE films, enabling manufacturers to use less material without compromising performance. The segment’s growth has also been supported by its compatibility with a wide range of printing and labeling techniques, enhancing brand visibility and consumer appeal The ability to meet diverse packaging needs efficiently has reinforced the position of films and wraps as a market leader.

The food and beverages segment is anticipated to account for 38.00% of the market revenue share in 2025, making it the leading end-use category. Growth in this segment has been supported by the rising demand for packaging solutions that ensure product freshness, safety, and extended shelf life. LDPE packaging offers excellent moisture resistance, flexibility, and impact strength, making it suitable for a variety of food and beverage applications, from frozen goods to ready-to-eat meals. The segment’s expansion has been further reinforced by increasing consumption of packaged food products, driven by urbanization, changing lifestyles, and growth in quick-service and online food delivery markets. Food manufacturers have increasingly adopted LDPE packaging for its compatibility with automated filling and sealing processes, ensuring operational efficiency. Additionally, the recyclability of LDPE aligns with sustainability goals and regulatory requirements, further boosting its acceptance As consumer preferences continue to shift toward convenience and safety, the demand for LDPE packaging in the food and beverages sector is expected to remain strong.

The LDPE packaging market is expanding due to demand for lightweight, flexible, and durable packaging in food, beverages, personal care, and industrial sectors. Asia-Pacific leads in production and consumption, while North America and Europe focus on premium and high-barrier packaging. Key players such as ExxonMobil, LyondellBasell, SABIC, Braskem, and Dow Inc. emphasize film clarity, puncture resistance, and sealability. Market growth is driven by increasing processed food consumption, ease of transport, and demand for versatile packaging formats.

LDPE films and bags are widely used for snacks, frozen foods, bakery products, and liquid packaging due to their flexibility, moisture resistance, and transparency. Companies like ExxonMobil and SABIC provide high-clarity films that maintain product freshness while allowing consumers to view contents. Food manufacturers prioritize LDPE for its heat sealability, light weight, and low cost compared to alternative polymers. Asia-Pacific shows strong growth due to rising packaged food demand, while Europe and North America focus on high-barrier applications. LDPE remains a preferred solution for cost-effective and flexible packaging in high-volume production environments.

LDPE is favored for pouches, shrink films, liners, and multilayer laminates, providing durability and ease of handling. Specialty grades with enhanced puncture resistance or anti-static properties cater to industrial and electronics packaging. Companies like Dow Inc. and Braskem offer customizable solutions to meet specific functional requirements. Flexible packaging lines benefit from LDPE’s processability, enabling high-speed extrusion and thermoforming. Until alternatives such as biodegradable polymers match LDPE’s combination of cost, versatility, and performance, LDPE remains a key material for both consumer and industrial packaging applications.

LDPE packaging must meet regional regulations for food contact, migration limits, and chemical safety. Europe and North America enforce strict compliance through FDA, EFSA, and ISO standards. Manufacturers like LyondellBasell ensure their products are certified for direct food contact and maintain consistent resin properties. Regulatory adherence is critical for global distribution and brand credibility. Emerging markets are increasingly aligning with international standards, requiring suppliers to maintain traceable supply chains and reliable documentation. LDPE’s proven safety profile supports its continued adoption across food and beverage packaging applications.

Global players focus on product quality, film clarity, mechanical strength, and consistent supply to maintain competitive advantage. ExxonMobil, Dow Inc., and SABIC leverage R&D and global distribution networks to serve high-volume markets, while regional suppliers compete on cost and niche applications. Companies differentiate by offering multilayer solutions, specialized grades, and compatibility with existing packaging equipment. Partnerships with food and consumer goods manufacturers ensure tailored solutions and long-term contracts. Until alternative polymers achieve similar performance and cost efficiency, LDPE remains a dominant choice in flexible and lightweight packaging solutions.

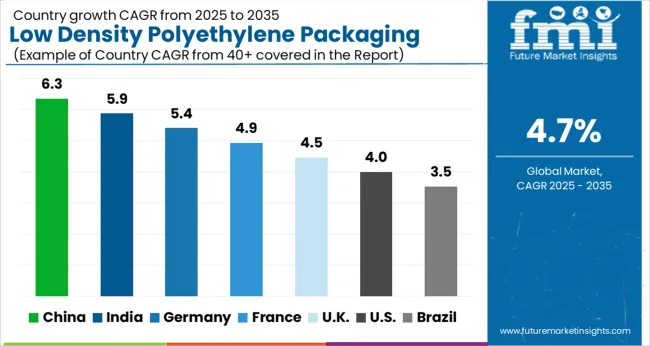

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| U.K. | 4.5% |

| U.S. | 4.0% |

| Brazil | 3.5% |

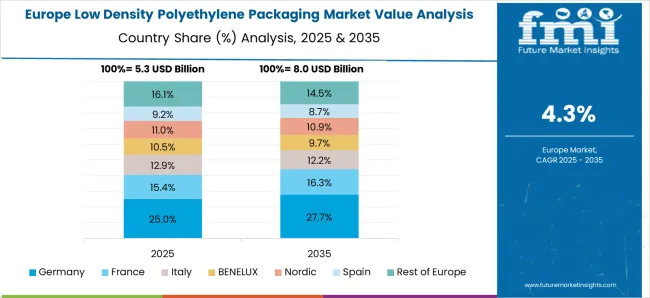

The global low density polyethylene packaging market is projected to grow at a CAGR of 4.7% through 2035, supported by increasing demand across food, beverage, and consumer goods packaging applications. Among BRICS nations, China has been recorded with 6.3% growth, driven by large-scale production and deployment in packaging and retail sectors, while India has been observed at 5.9%, supported by rising utilization in consumer and industrial packaging. In the OECD region, Germany has been measured at 5.4%, where production and adoption for packaging in food, beverage, and consumer goods applications have been steadily maintained. The United Kingdom has been noted at 4.5%, reflecting consistent use in retail and industrial packaging, while the U.S. has been recorded at 4.0%, with production and utilization across food, beverage, and consumer goods packaging sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The low density polyethylene (LDPE) packaging market in China is expanding at a CAGR of 6.3%, driven by rising demand in food, beverage, and consumer goods industries. LDPE is favored for its flexibility, lightweight, and chemical resistance, making it ideal for films, bags, and containers. Growth in e-commerce, urbanization, and disposable income boosts LDPE adoption in packaging solutions. Key producers such as ExxonMobil, Dow, LyondellBasell, SABIC, and Braskem supply high-quality LDPE materials to meet industrial and retail demand. Technological improvements, including enhanced barrier properties and recyclability, further enhance its market appeal. Increasing government support for modern packaging infrastructure and sustainable practices fuels further growth. LDPE’s applications in flexible food packaging, pharmaceutical containers, and retail solutions ensure steady adoption across China, making it a critical material in the packaging industry.

The LDPE packaging market in India is growing at a CAGR of 5.9%, supported by increasing industrial, retail, and consumer goods applications. LDPE films and containers are preferred for their flexibility, moisture resistance, and lightweight properties. Rapid growth in e-commerce, packaged food consumption, and urbanization drives market expansion. Key suppliers, including ExxonMobil, Dow, LyondellBasell, SABIC, and Braskem, provide reliable LDPE products to meet rising domestic demand. Technological innovations, such as improved recyclability and enhanced barrier performance, make LDPE more sustainable and efficient. Government initiatives promoting modern packaging and safe food storage contribute to market adoption. LDPE packaging is widely used in flexible films, bags, and protective containers for food, beverages, and personal care products. Increasing industrial and retail expansion ensures continued growth of the LDPE packaging market in India.

The LDPE packaging market in Germany is advancing at a CAGR of 5.4%, driven by applications in food, industrial, and consumer goods sectors. LDPE’s chemical resistance, flexibility, and lightweight characteristics make it a preferred choice for films, bags, and containers. Market growth is fueled by rising consumer demand for eco-friendly and high-quality packaging. Key producers such as ExxonMobil, Dow, LyondellBasell, SABIC, and Braskem supply advanced LDPE solutions to meet industrial and retail needs. Technological enhancements, including better barrier performance and recyclability, improve environmental compliance and operational efficiency. Adoption is strong in food packaging, pharmaceuticals, and e-commerce sectors. Germany’s regulations promoting sustainability and modern packaging infrastructure further drive market expansion. The combination of industrial demand, technological innovation, and regulatory support positions the LDPE packaging market in Germany for steady growth over the forecast period.

The LDPE packaging market in the United Kingdom is growing at a CAGR of 4.5%, driven by industrial, retail, and consumer goods applications. LDPE is valued for its flexibility, chemical resistance, and lightweight properties, making it ideal for films, bags, and containers. E-commerce growth, food packaging requirements, and hygiene awareness are driving adoption. Major suppliers, including ExxonMobil, Dow, LyondellBasell, SABIC, and Braskem, provide quality LDPE products to meet domestic market needs. Technological innovations, such as improved barrier properties and recyclability, make LDPE packaging more sustainable. Government policies promoting modern and eco-friendly packaging solutions further support growth. Key applications include food and beverage packaging, personal care, and retail packaging. Rising industrial and retail expansion ensures steady demand for LDPE packaging in the United Kingdom.

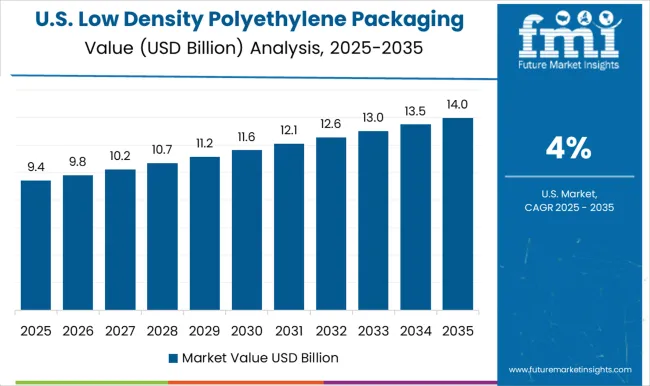

The LDPE packaging market in the United States is expanding at a CAGR of 4.0%, with strong demand from food, beverage, and consumer goods industries. LDPE is widely used due to its flexibility, chemical resistance, and lightweight nature, making it ideal for films, bags, and containers. Leading producers, including ExxonMobil, Dow, LyondellBasell, SABIC, and Braskem, supply high-quality LDPE to domestic manufacturers. Growth is supported by government initiatives promoting sustainable packaging and recycling. Technological advancements in LDPE, such as improved barrier performance and recyclability, enhance operational efficiency and environmental compliance. Applications in flexible packaging for food, personal care, and retail sectors are increasing. Consumer awareness of hygiene, convenience, and safety further drives market adoption. Continuous industrial and retail expansion ensures consistent growth of the LDPE packaging market in the United States.

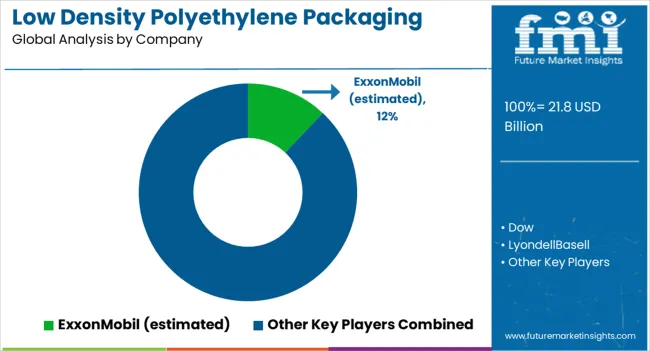

The low density polyethylene (LDPE) packaging market is a crucial segment of the global plastics industry, driven by increasing demand for flexible packaging, food packaging, and consumer goods applications. LDPE is valued for its lightweight, chemical resistance, and excellent moisture barrier properties, making it a preferred material for films, bags, containers, and multilayer packaging solutions. Market growth is fueled by rising e-commerce, expanding retail sectors, and the push for sustainable and recyclable packaging solutions. ExxonMobil is a key player, supplying high-quality LDPE resins used in flexible packaging and industrial applications, emphasizing consistent performance and global availability.

Dow offers a broad portfolio of LDPE products, including films and specialty grades that cater to both food and non-food packaging applications. LyondellBasell is recognized for its innovative solutions in LDPE film and packaging applications, providing high-performance, durable, and recyclable materials. SABIC supplies LDPE resins with tailored properties for enhanced processing and packaging performance, supporting applications from shrink films to food wraps. Braskem focuses on sustainable LDPE solutions, including bio-based polyethylene, aligning with global trends toward circular economy and eco-friendly packaging. In addition to these major global producers, other regional manufacturers are expanding production capacities to meet growing demand in emerging markets. Innovations in LDPE blends, co-extrusions, and lightweight films are enabling manufacturers to improve sustainability while maintaining mechanical and barrier properties, ensuring LDPE remains a dominant material in flexible packaging applications worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.8 billion |

| Packaging Type | Films & wraps, Bags & pouches, Bottles & containers, Tubes, and Others |

| End Use | Food and beverages, Personal care & cosmetics, Electricals & electronics, Consumer goods, Pharmaceuticals, E-commerce, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ExxonMobil (estimated), Dow, LyondellBasell, SABIC, Braskem, and Other major producers |

| Additional Attributes | Dollar sales by type including films, bags, and containers, application across food & beverages, pharmaceuticals, and consumer goods, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for flexible packaging, increasing retail and e-commerce activities, and focus on lightweight, cost-effective packaging solutions. |

The global low density polyethylene packaging market is estimated to be valued at USD 21.8 billion in 2025.

The market size for the low density polyethylene packaging market is projected to reach USD 34.5 billion by 2035.

The low density polyethylene packaging market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in low density polyethylene packaging market are films & wraps, bags & pouches, bottles & containers, tubes and others.

In terms of end use, food and beverages segment to command 38.0% share in the low density polyethylene packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Disconnect Switch Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA