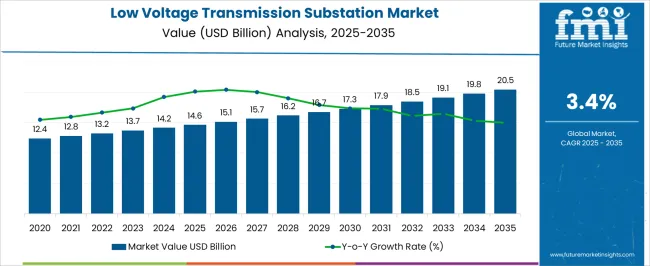

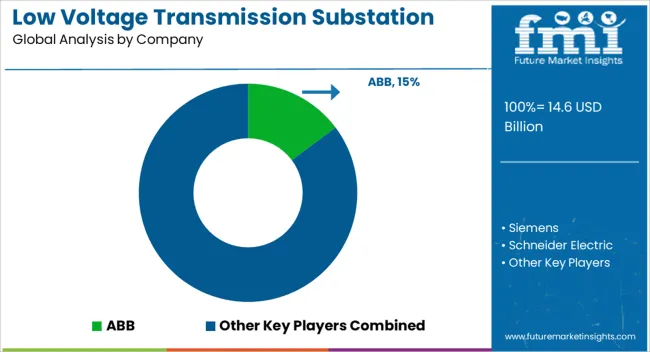

The Low Voltage Transmission Substation Market is estimated to be valued at USD 14.6 billion in 2025 and is projected to reach USD 20.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

The absolute dollar opportunity in the low voltage transmission substation market is expected to experience steady growth, with market value projected to rise from USD 14.6 billion in 2025 to USD 20.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 3.4%. This growth is likely to be fueled by rising global demand for reliable and efficient power distribution systems, as industries and households continue to require robust energy infrastructure. As electricity consumption increases and the focus shifts towards enhancing power grid reliability, investments in low voltage transmission substations are expected to grow, ensuring stable energy distribution across regions.

The projected market expansion indicates that low voltage transmission substations will continue to be critical for the effective delivery of power in both developed and emerging economies. By 2035, the value of this market is set to exceed USD 20 billion, as ongoing infrastructural developments and the modernization of existing grids drive demand. The steady growth underscores the increasing importance of ensuring efficient energy distribution, suggesting that companies involved in the design, development, and maintenance of substations will benefit from the continued market expansion. This presents a compelling opportunity for investment, particularly in regions focused on strengthening energy infrastructure.

| Metric | Value |

|---|---|

| Low Voltage Transmission Substation Market Estimated Value in (2025 E) | USD 14.6 billion |

| Low Voltage Transmission Substation Market Forecast Value in (2035 F) | USD 20.5 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The low voltage transmission substation market is witnessing steady growth, driven by increasing electricity demand, expansion of distribution networks, and modernization of grid infrastructure. The need for reliable and efficient power delivery systems is prompting utilities and industrial facilities to invest in advanced substation technologies. Urbanization, industrialization, and the integration of renewable energy sources are further driving the deployment of low voltage transmission substations, which play a crucial role in reducing transmission losses and ensuring power quality.

Advancements in automation, control systems, and digital monitoring are enhancing the operational efficiency and reliability of substations. Governments and utilities are emphasizing grid resilience and energy efficiency, which is boosting investments in both conventional and modernized substation infrastructure.

The growing trend toward smart grids and distributed generation is expected to open new opportunities for market expansion As the global focus on sustainable energy and electrification intensifies, the market is poised for consistent growth, with manufacturers and service providers concentrating on technological upgrades and long-term operational cost reduction strategies.

The low voltage transmission substation market is segmented by technology, component, category, end use, and geographic regions. By technology, low voltage transmission substation market is divided into Conventional and Digital. In terms of component, low voltage transmission substation market is classified into Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others. Based on category, low voltage transmission substation market is segmented into New and Refurbished. By end use, low voltage transmission substation market is segmented into Utility and Industrial. Regionally, the low voltage transmission substation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

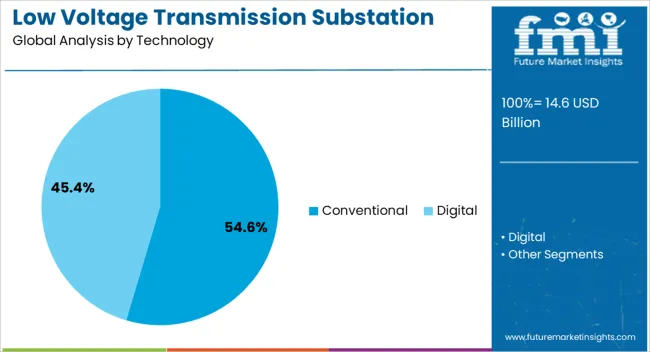

The conventional technology segment is projected to account for 54.6% of the low voltage transmission substation market revenue share in 2025, establishing itself as the leading technology type. Its dominance is supported by widespread adoption in existing power infrastructure, where proven reliability and established maintenance protocols are critical. Conventional substations are favored in many regions due to their cost-effectiveness, long operational lifespan, and compatibility with traditional grid systems.

The ability to handle high loads with minimal complexity in operation makes them suitable for areas where advanced automation is not yet a priority. This segment is benefiting from ongoing refurbishment and expansion projects in emerging economies, where conventional designs remain the preferred choice for rapid deployment.

Availability of skilled workforce for installation and maintenance, along with reduced initial capital expenditure compared to advanced systems, further reinforces adoption As demand for dependable power distribution grows in both urban and rural settings, conventional substations are expected to maintain their leadership while gradually integrating selective modern upgrades for improved efficiency.

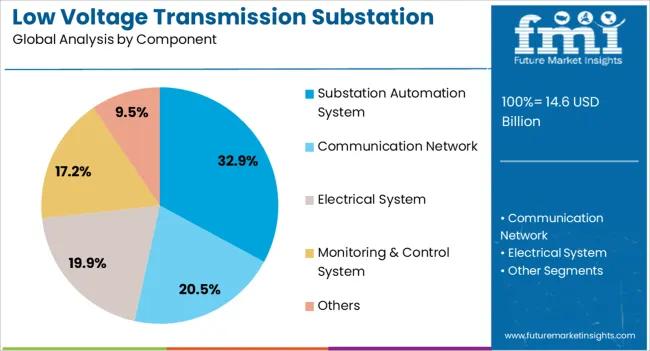

The substation automation system component segment is expected to represent 32.9% of the low voltage transmission substation market revenue share in 2025, positioning it as the leading component category. Its growth is driven by the increasing need for real-time monitoring, fault detection, and automated control of electrical systems to improve operational reliability. Automation systems enhance the efficiency and safety of substations by enabling predictive maintenance, reducing downtime, and minimizing human intervention in critical operations.

Utilities are increasingly investing in these systems to meet regulatory compliance for energy efficiency and system resilience. The integration of digital communication protocols, intelligent electronic devices, and advanced analytics is enabling substations to operate more flexibly and adapt to changing load patterns.

Growing adoption of renewable energy sources and distributed generation is creating further demand for automation solutions that can manage variable power inputs This segment’s growth is expected to accelerate as more utilities shift toward smart grid architectures, making automation systems a core component of modern substation design.

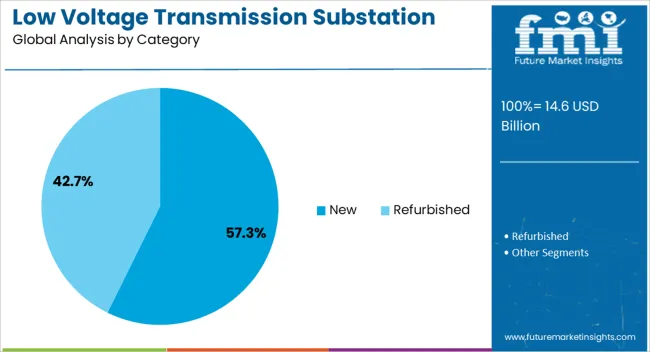

The new category segment is anticipated to capture 57.3% of the low voltage transmission substation market revenue share in 2025, making it the dominant category. This leadership is driven by extensive global investment in new substation construction to support grid expansion, rural electrification, and industrial development. The growing demand for electricity in urban centers, combined with the need to replace outdated infrastructure, is prompting utilities to prioritize new builds over extensive refurbishments.

New substations are being designed with higher efficiency, better safety features, and future-ready configurations that allow integration of renewable energy and smart grid technologies. This segment benefits from government-funded electrification projects, private sector investments in infrastructure, and rapid industrialization in emerging markets.

Advances in engineering design, modular construction methods, and prefabricated substation units are reducing project timelines and costs, further boosting adoption As the global energy transition accelerates, the demand for new low voltage transmission substations is expected to remain strong, particularly in regions undergoing significant grid expansion and modernization initiatives.

The low voltage transmission substation market is growing, driven by increasing demand for efficient power distribution in urban areas and the integration of smart grid technologies. Opportunities in renewable energy integration and microgrids are shaping the market, as substations evolve to support decentralized and sustainable energy systems. However, challenges related to regulatory compliance and high investment costs persist. The market outlook remains positive, with ongoing developments in smart and renewable-friendly substation solutions expected to drive further growth.

The low voltage transmission substation market is seeing strong growth due to the increasing demand for power distribution, particularly in urban and suburban areas. As cities expand and the need for reliable electricity grows, low voltage substations are being implemented to efficiently distribute power to residential, commercial, and industrial sectors. The move toward smart grids and more decentralized power networks is driving the market as low voltage substations play a crucial role in supporting stable and efficient electricity distribution.

A key opportunity in the low voltage transmission substation market lies in the integration of smart grid technologies. By incorporating sensors, real-time data analytics, and automation into substations, utilities can optimize energy distribution, reduce losses, and enhance operational efficiency. The shift towards smart grids is being driven by the need for more resilient and flexible power networks, and low voltage substations are essential in this transformation. As grid modernization efforts intensify globally, the demand for smart low voltage substations is expected to rise.

The trend toward renewable energy integration is influencing the design and implementation of low voltage transmission substations. As solar, wind, and other renewable energy sources are increasingly incorporated into power grids, substations are evolving to accommodate the variable nature of renewable energy production. Additionally, the rise of microgrids is driving innovation in low voltage substations, which must be capable of managing distributed generation sources and maintaining stability in local energy networks. This trend is expected to fuel demand for more advanced substation solutions.

A significant challenge in the low voltage transmission substation market is the stringent regulatory standards governing their design, installation, and operation. Compliance with these standards, particularly in regions with complex regulatory environments, can lead to delays and increased project costs. Additionally, the initial capital investment required for substation infrastructure, coupled with maintenance and operational costs, remains a barrier for utilities, especially in emerging markets. Addressing these challenges through standardized technologies and government incentives can help mitigate costs and accelerate adoption.

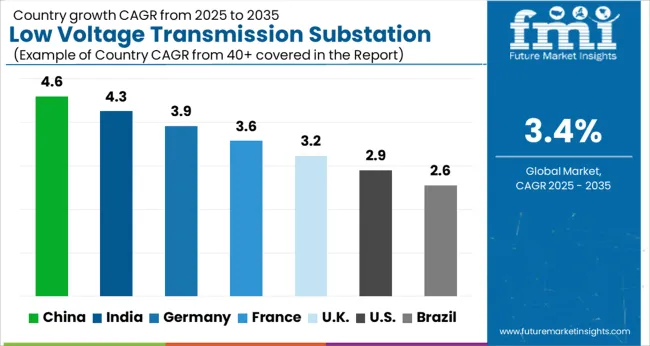

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| France | 3.6% |

| UK | 3.2% |

| USA | 2.9% |

| Brazil | 2.6% |

The global low voltage transmission substation market is projected to grow at a 3.4% CAGR from 2025 to 2035. China leads with a growth rate of 4.6%, followed by India at 4.3% and Germany at 3.9%. The United Kingdom records a growth rate of 3.2%, while the United States shows the slowest growth at 2.9%. The varying growth rates reflect the diverse energy infrastructure needs and government policies driving the adoption of low voltage substations. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, expanding energy access, and growing renewable energy adoption. In more developed markets such as the USA and the UK, steady growth is driven by grid modernization, renewable energy integration, and regulatory support for energy efficiency. This report includes insights on 40+ countries; the top markets are shown here for reference.

The low voltage transmission substation market in China is projected to grow at a CAGR of 4.6%. As one of the largest energy consumers globally, China’s continuous industrialization and urbanization are driving the demand for reliable and efficient power distribution systems. The Chinese government’s commitment to improving energy infrastructure and expanding renewable energy sources is contributing to the adoption of low voltage substations. With a rising focus on reducing power losses and improving the efficiency of transmission networks, China’s demand for low voltage substations is set to continue growing. Additionally, increasing urbanization and the expansion of industrial zones in China are expected to further accelerate the market’s development.

The low voltage transmission substation market in India is projected to grow at a CAGR of 4.3%. India’s rapidly growing population, along with increased industrial activities, is driving the need for robust and efficient power transmission systems. The country’s focus on modernizing its energy infrastructure and expanding access to electricity in rural and urban areas is pushing demand for low voltage substations. Moreover, the increasing adoption of renewable energy sources, particularly solar and wind, is driving the need for efficient power distribution networks. The Indian government's efforts to improve grid reliability and expand energy access to remote regions are expected to fuel the market for low voltage substations in the coming years.

The low voltage transmission substation market in Germany is projected to grow at a CAGR of 3.9%. Germany’s strong commitment to transitioning towards renewable energy, coupled with the country’s emphasis on energy efficiency and grid modernization, is driving the demand for low voltage substations. As part of its "Energiewende" (energy transition), Germany is making significant investments in renewable energy integration, which requires efficient and reliable transmission systems. The growth in the demand for decentralized energy sources, such as solar and wind, is further increasing the need for low voltage substations to balance power supply across the grid. Germany's strong industrial base and focus on reducing power distribution losses also continue to support market growth.

The low voltage transmission substation market in the United Kingdom is projected to grow at a CAGR of 3.2%. The UK is actively investing in the modernization of its energy infrastructure, focusing on integrating renewable energy sources into the national grid. The shift towards cleaner energy generation and decentralized energy production is creating increased demand for low voltage substations to efficiently manage and distribute power. As the country expands its renewable energy capacity, particularly in offshore wind and solar, low voltage substations will be vital to maintaining grid stability. The UK's strong regulatory support and focus on achieving net-zero emissions goals continue to drive growth in this market.

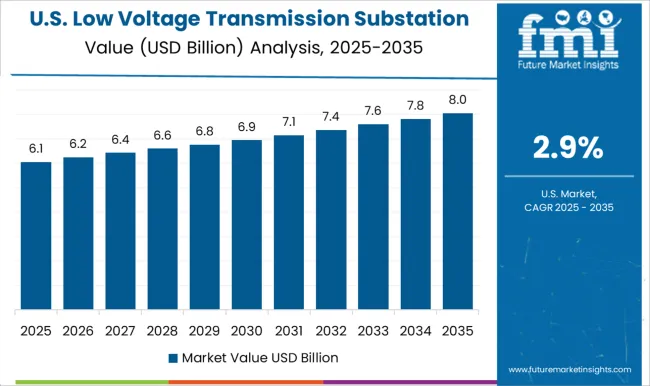

The low voltage transmission substation market in the United States is projected to grow at a CAGR of 2.9%. The USA continues to make steady investments in its energy infrastructure, with a particular focus on enhancing the reliability and efficiency of power distribution systems. The demand for low voltage substations is driven by the need to integrate renewable energy sources, particularly solar and wind, into the existing grid. The increasing focus on smart grid technology, which requires efficient management of energy distribution, is also fueling demand for low voltage substations. Although the growth rate is slower compared to emerging markets, the continued modernization of energy infrastructure and the need for reliable power supply will sustain steady growth in the USA market.

Leading players in the low voltage transmission substation market, such as ABB, Siemens, and Schneider Electric, are driving the industry's growth by offering advanced solutions for efficient power distribution and management. These companies are focused on providing innovative low voltage substations that enhance operational safety, reliability, and energy efficiency. By integrating cutting-edge automation systems and digital technologies, ABB and Siemens are ensuring that their solutions are not only cost-effective but also adaptable to a wide range of applications, from industrial plants to smart grids. Their strong presence in global markets and commitment to innovation positions them as key players in the transition towards more reliable and sustainable energy systems.

Other major players, including General Electric, Hitachi Energy Ltd., and Eaton, are capitalizing on their technological expertise to offer scalable low voltage substations that meet the growing demands of modern energy networks. These companies emphasize smart grid integration, providing substations equipped with advanced monitoring, control, and protection features to optimize energy distribution. Regional suppliers like CG Power & Industrial Solutions Ltd. are expanding their reach by offering tailored solutions that cater to local energy infrastructure needs. As the market becomes more competitive, companies are focusing on improving system flexibility, reducing maintenance costs, and enhancing grid resilience. The future of the low voltage transmission substation market will depend on continuous advancements in digital technologies, energy efficiency, and the ability to meet the evolving demands of global energy networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 Billion |

| Technology | Conventional and Digital |

| Component | Substation Automation System, Communication Network, Electrical System, Monitoring & Control System, and Others |

| Category | New and Refurbished |

| End Use | Utility and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, Siemens, Schneider Electric, General Electric, Hitachi Energy Ltd., Eaton, CG Power & Industrial Solutions Ltd., Texas Instruments Incorporated, Efacec, Tesco Automation Inc., Locamation, and Open System International, Inc. |

| Additional Attributes | Dollar sales by substation type (compact, modular, outdoor) and application (industrial, commercial, residential) are key metrics. Trends include growing demand for energy-efficient, space-saving solutions and integration with renewable energy sources. Regional adoption, advancements in automation, and government regulations on grid stability are influencing market growth. |

The global low voltage transmission substation market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the low voltage transmission substation market is projected to reach USD 20.5 billion by 2035.

The low voltage transmission substation market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in low voltage transmission substation market are conventional and digital.

In terms of component, substation automation system segment to command 32.9% share in the low voltage transmission substation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Low Clearance Loaders Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Desserts Market Size and Share Forecast Outlook 2025 to 2035

Low-Grade Glioma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Low Power Wide Area Network (LPWAN) Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low Fat Content Kefir Market Size and Share Forecast Outlook 2025 to 2035

Low Profile Compact System Closures Market Size and Share Forecast Outlook 2025 to 2035

Low Flow Plumbing Fixtures Market Size and Share Forecast Outlook 2025 to 2035

Low Code Development Platform Market Size and Share Forecast Outlook 2025 to 2035

Low Intensity Sweeteners Market Size and Share Forecast Outlook 2025 to 2035

Low-calorie Sweeteners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Low-calorie Chocolate Business

Low dosage Hydrate Inhibitors Market - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA