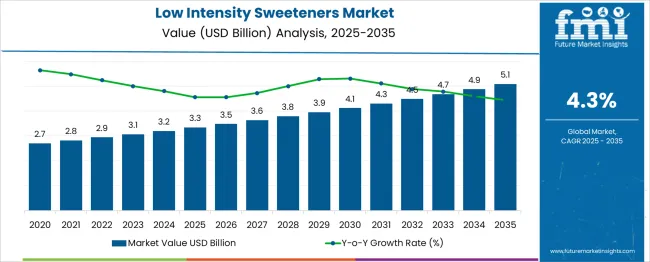

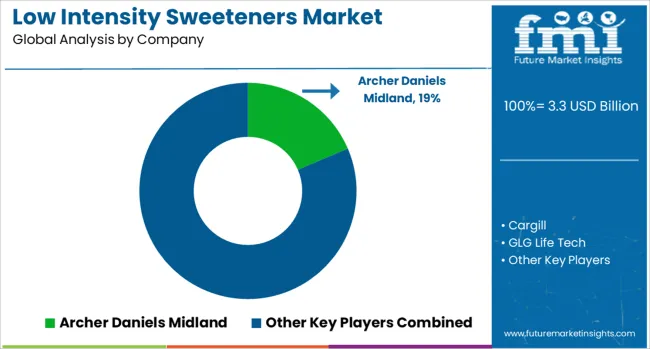

The Low Intensity Sweeteners Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Low Intensity Sweeteners Market Estimated Value in (2025 E) | USD 3.3 billion |

| Low Intensity Sweeteners Market Forecast Value in (2035 F) | USD 5.1 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The low intensity sweeteners market is progressing steadily due to increasing health awareness and consumer shift away from high-calorie, high-glycemic sweetening agents. Growing incidences of obesity, diabetes, and other lifestyle-related disorders have driven demand for sugar substitutes that offer mild sweetness without compromising metabolic health.

These sweeteners are being widely adopted across food, beverage, and nutraceutical sectors owing to their ability to maintain flavor balance while reducing overall calorie content. Natural origin and clean-label positioning further enhance their acceptance among health-conscious consumers and regulatory bodies.

With innovation focused on improved taste profiles, thermal stability, and formulation compatibility, the market is poised for growth in both developed and emerging economies. As demand intensifies for wellness-aligned alternatives in processed foods and beverages, low intensity sweeteners are expected to play a pivotal role in next-generation product development and sugar reduction strategies.

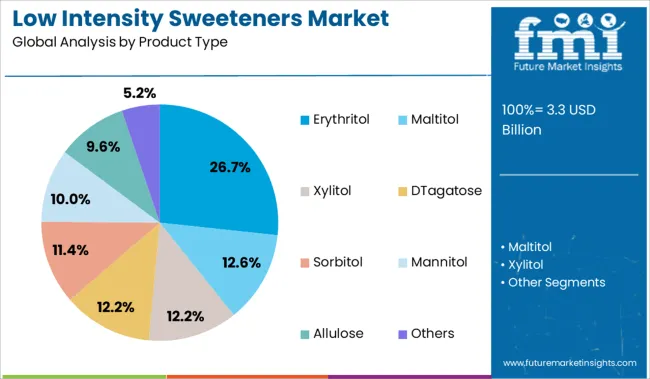

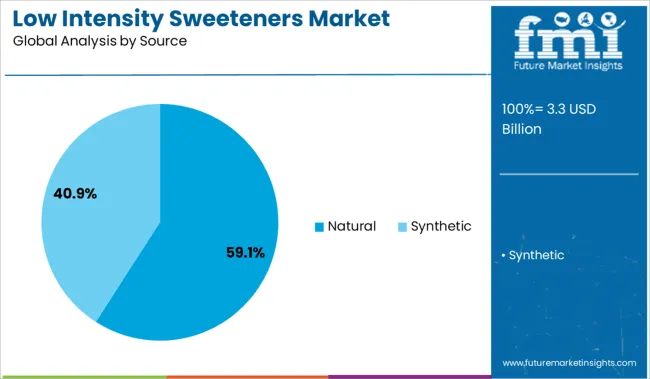

The low intensity sweeteners market is segmented by product type, source, and application and geographic regions. The low intensity sweeteners market is divided by product type into Erythritol, Maltitol, Xylitol, DTagatose, Sorbitol, Mannitol, Allulose, and Others. In terms of the source of the low intensity sweeteners, the market is classified into Natural and Synthetic.

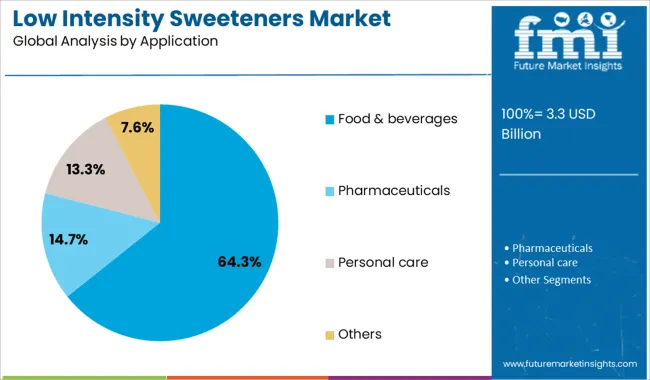

Based on the application of the low intensity sweeteners market, it is segmented into Food & beverages, Pharmaceuticals, Personal care, and Others. Regionally, the low intensity sweeteners industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The erythritol segment leads the product type category with a 26.7% market share, driven by its favorable safety profile, non-cariogenic nature, and zero-calorie appeal. Recognized as a well-tolerated polyol, erythritol has gained traction as a preferred ingredient in sugar-free formulations across confections, beverages, and baked goods.

It closely mimics the sensory attributes of sugar without significantly impacting blood glucose levels, making it suitable for diabetic and health-conscious consumers. Continuous R&D and regulatory support have enabled its widespread adoption in both developed and developing markets.

Moreover, its compatibility with natural flavors and low hygroscopicity enhances product stability and shelf life, increasing its commercial value. The segment is projected to maintain momentum as clean-label and calorie-reduction trends continue influencing purchasing decisions and food reformulation initiatives globally.

Natural sources dominate the low intensity sweeteners market with a commanding 59.1% share, reflecting strong consumer preference for clean-label, plant-derived alternatives over synthetic counterparts. The growing skepticism toward artificial additives has encouraged food manufacturers to prioritize ingredients that align with organic and natural positioning.

Sweeteners derived from fruits, roots, and fermented sources are increasingly used in applications demanding transparency, nutritional benefits, and minimal processing. This segment benefits from robust demand across both premium and mass-market categories, especially in regions with evolving food safety regulations and proactive labeling requirements.

Manufacturers are leveraging naturally sourced low intensity sweeteners to enhance brand trust and capture a wider customer base. As the trend toward holistic wellness and functional nutrition gains pace, the natural segment is expected to remain dominant in product development pipelines and marketing strategies.

The food & beverages segment accounts for the largest 64.3% share of the low intensity sweeteners market, supported by widespread demand for healthier, lower-calorie consumables. These sweeteners are extensively incorporated in snacks, beverages, dairy, and baked products to meet consumer expectations for taste without the metabolic burden of traditional sugar.

Rapid product innovation, reformulation strategies by large F&B companies, and the proliferation of diet-centric products have reinforced segment leadership. Furthermore, rising urbanization and increasing disposable incomes in emerging economies have amplified demand for value-added food options that do not compromise on sweetness or health appeal.

Regulatory encouragement for sugar reduction and front-of-pack nutrition labeling have also driven increased use of low intensity sweeteners in mainstream and specialty food offerings. The segment is poised for continued expansion as food manufacturers seek to balance indulgence and nutrition across their product portfolios.

Low intensity sweeteners are gaining traction due to rising health concerns, regulatory support, and their adoption in low-calorie food and beverage applications. Future opportunities lie in pharmaceuticals, nutraceuticals, and premium segments driven by clean-label trends and evolving consumer preferences.

The growth of low intensity sweeteners has been driven by increasing adoption in processed food and beverage applications where calorie reduction is prioritized. Rising health concerns related to obesity and diabetes have influenced food manufacturers to replace traditional sugars with alternatives offering lower glycemic impact. Regulatory approvals for high-intensity substitutes in multiple regions have further supported incorporation in tabletop sweeteners, dairy formulations, and confectionery products. Growing consumer preference for clean-label products has created favorable conditions for plant-derived sweeteners. Expanding penetration in low-calorie beverages and bakery products has been observed as manufacturers enhance taste-masking capabilities and improve stability across diverse food matrices.

The demand for low intensity sweeteners is expected to gain momentum as pharmaceutical and nutraceutical sectors incorporate these agents into functional formulations aimed at managing calorie intake. An emerging opportunity exists in the premium beverage and sports nutrition segments where natural, low-calorie sweeteners with health-driven consumer preferences. Market players are focusing on creating blends that combine sweeteners with bulking agents to achieve improved sensory profiles, opening avenues for broader application in foodservice and ready-to-eat categories. Regional growth prospects are being influenced by rising adoption in developing economies, driven by increasing awareness of reduced-calorie diets and stricter labeling requirements in packaged goods.

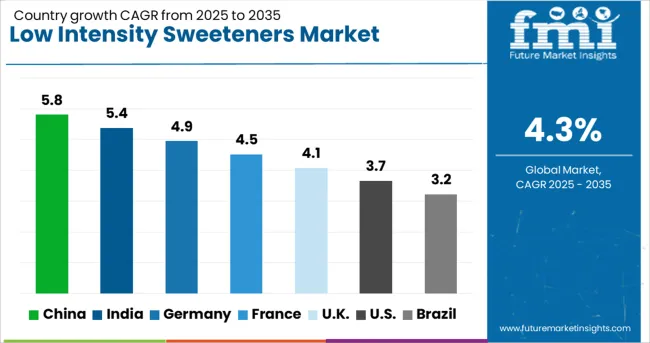

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The low intensity sweeteners market, estimated to grow at a global CAGR of 4.3% from 2025 to 2035, expanding varied growth momentum across key economies. China, a BRICS member, leads with a CAGR of 5.8%, supported by rising demand in beverages and processed foods, along with regulatory emphasis on reducing sugar intake. India follows at 5.4%, driven by rapid adoption in functional foods, expanding bakery production, and increased health-conscious consumer trends. Germany records 4.9%, benefiting from reformulation initiatives by major food brands and EU compliance with sugar-reduction targets.

The UK posts a 4.1% CAGR, influenced by government sugar tax policies and product innovation in low-calorie confectionery. The USA trails at 3.7%, driven by consistent demand in diet beverages and dairy products, though challenged by shifting consumer interest toward natural alternatives. BRICS economies dominate through scalable production and growing health-awareness campaigns, while OECD markets focus on premiumization and ingredient innovation with regulatory norms. The report provides an in-depth analysis of 40+ countries, with the top five markets highlighted as reference.

The CAGR for the China market stood near 4.7% during 2020-2024, driven by limited product penetration beyond premium beverage categories. Growth was initially restricted due to price sensitivity and delayed inclusion in mass-market food formulations. From 2025-2035, the CAGR is forecasted to rise significantly to 5.8%, surpassing the global benchmark of 4.3%.

This sharp improvement is linked to policy-backed sugar reduction initiatives in the beverages, bakery, and dairy sectors. E-commerce platforms amplified accessibility, while multinational firms collaborated with domestic brands to introduce natural sweeteners. Increased adoption in functional beverages and snacks is supported by evolving consumer health priorities, fueling demand across urban and semi-urban clusters.

India reported a CAGR of 4.2% between 2020-2024, a gradual transition from high-sugar products to alternatives amid rising metabolic health concerns. Slow early adoption was linked to fragmented distribution and limited awareness among mid-tier manufacturers. For 2025-2035, the CAGR is projected to improve to 5.4%, driven by regulatory emphasis on front-of-pack labeling and sugar taxes encouraging reformulation. Domestic brands are introducing low-calorie variants in confectionery, traditional sweets, and ready-to-drink beverages. Expansion in quick-service restaurants and digital grocery platforms further strengthens sweetener penetration, especially for stevia and polyols used in diabetic-friendly product lines. Increased private-label participation indicates significant retail-driven momentum.

Germany recorded a CAGR of 3.8% between 2020-2024, with growth centered on diet-focused product lines and premium beverages. Limited use in mass-market bakery and confectionery restricted expansion during early years. For 2025-2035, the CAGR is forecasted to reach 4.9%, rising reformulation commitments under the EU sugar directives. Private-label innovation and demand for natural sweeteners in organic-certified products contributed to a stronger mid-term outlook. Increased consumer focus on caloric moderation is promoting higher integration of stevia and erythritol in plant-based desserts and dairy substitutes. Growth is also supported by retail chains prioritizing reduced-sugar assortments across both packaged and ready-to-eat formats.

The UK low intensity sweeteners market experienced a CAGR of 3.6% during 2020-2024, moderate progress in sugar-reduction adoption. This period was constrained by cost barriers in reformulation across legacy brands. For 2025-2035, CAGR is expected to improve to 4.1%, supported by stricter guidelines from public health authorities and expansion of low-calorie beverage portfolios. Ready-to-drink and sports nutrition products have integrated blends to meet consumer expectations for taste and reduced-calorie profiles. Retail channels also introduced private-label sweetener-based options to compete with branded counterparts. Foodservice players are progressively reformulating menus to with calorie-reduction benchmarks, driving further application diversity.

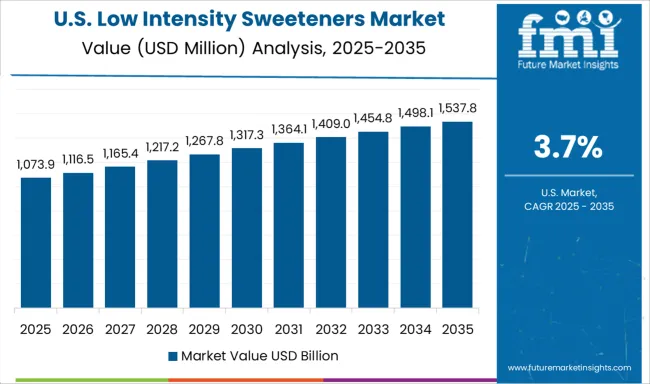

The USA market grew at a CAGR of 3.1% between 2020-2024, with steady integration in beverages but limited penetration in bakery and snacks. Rising concerns over obesity and diabetes are now driving regulatory efforts for sugar reduction, pushing the CAGR forecast for 2025-2035 to 3.7%. This acceleration is supported by aggressive reformulation initiatives by major beverage and dairy manufacturers. Functional beverage segments, including sports drinks and flavored waters, have expanded the adoption of low-intensity sweeteners. Growing partnerships between retail chains and ingredient suppliers further enhance access to natural sweetener alternatives, particularly monk fruit and stevia, for both packaged and private-label products.

In the low intensity sweeteners market, leading players are prioritizing diversification across beverage, bakery, and nutraceutical applications to cater to reduced-calorie and diabetic-friendly product demand. Companies like Archer Daniels Midland, Cargill, and Ingredion are focusing on plant-based sweeteners such as stevia and monk fruit while expanding partnerships with foodservice brands for reformulation programs. GLG Life Tech and PureCircle are emphasizing natural extraction processes and flavor-enhanced blends to improve taste profiles and stability.

Roquette Frères is leveraging expertise in polyols to capture growth in confectionery and dairy segments, while Merisant and Madhava Natural Sweeteners continue to lead in consumer-packaged tabletop sweetener formats. Emerging players such as Monk Fruit Corp and Hill Pharmaceutical are expanding footprints in the Asia-Pacific, targeting both the pharmaceutical and functional beverage sectors. Strategic alliances, sustainable sourcing commitments, and investment in advanced processing facilities define competitive moves, with a strong push for cleaner labeling and regulatory-compliant innovations.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Product Type | Erythritol, Maltitol, Xylitol, DTagatose, Sorbitol, Mannitol, Allulose, and Others |

| Source | Natural and Synthetic |

| Application | Food & beverages, Pharmaceuticals, Personal care, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Archer Daniels Midland, Cargill, GLG Life Tech, Hill Pharmaceutical, Ingredion, Madhava Natural Sweeteners, Merisant, Monk Fruit, PureCircle, and Roquette Frères |

| Additional Attributes | Dollar sales, share by sweetener type, growth outlook across regions, competitive landscape, raw material pricing trends, regulatory frameworks, demand drivers in food, beverage, and pharma, and emerging opportunities in clean-label and diabetic-friendly products. |

The global low intensity sweeteners market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the low intensity sweeteners market is projected to reach USD 5.1 billion by 2035.

The low intensity sweeteners market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in low intensity sweeteners market are erythritol, maltitol, xylitol, dtagatose, sorbitol, mannitol, allulose and others.

In terms of source, natural segment to command 59.1% share in the low intensity sweeteners market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Flexible Tester Market Size and Share Forecast Outlook 2025 to 2035

Low Light Imaging Market Forecast Outlook 2025 to 2035

Low Density Polyethylene Market Forecast and Outlook 2025 to 2035

Low-Temperature Cable Market Size and Share Forecast Outlook 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Radiators Market Size and Share Forecast Outlook 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Low Temperature Commercial Boiler Market Size and Share Forecast Outlook 2025 to 2035

Low Emissivity Film Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Residential Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Substation Market Size and Share Forecast Outlook 2025 to 2035

Low Migration Inks Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Surge Arrester Market Size and Share Forecast Outlook 2025 to 2035

Low Density Polyethylene Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA