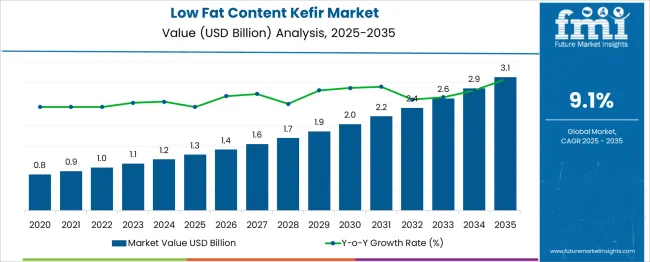

The low fat content kefir market is projected to advance from USD 1.3 billion in 2025 to approximately USD 3.1 billion by 2035. Between 2020 and 2024, values rise from USD 0.8 billion to USD 1.2 billion, adding USD 0.4 billion or around 17% of the total projected growth, supported by niche consumer adoption, early-stage brand entries, and health-oriented positioning. From 2025 to 2029, the category scales from USD 1.3 billion to USD 2.0 billion, contributing USD 0.7 billion in incremental gains as supermarket distribution widens, multi-pack formats enter mainstream retail, and lactose-free or high-protein low-fat kefir variants become regular household staples. The 2030–2034 period witnesses further expansion from USD 2.2 billion to USD 2.9 billion, adding USD 0.7 billion driven by production efficiency gains, stabilized mouthfeel technologies, and broader foodservice inclusion. The final growth stage, from 2035, takes the market to USD 3.1 billion, with USD 0.2 billion added through consolidation, standardization of core SKUs, and co-packing arrangements.

| Metric | Value |

|---|---|

| Low Fat Content Kefir Market Estimated Value in (2025 E) | USD 1.3 billion |

| Low Fat Content Kefir Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

The low fat content kefir market is expanding steadily, driven by increased health consciousness among consumers and the growing demand for functional beverages with probiotic benefits. As modern dietary patterns prioritize low-fat, high-nutrient formulations, kefir products with reduced fat content are gaining traction, particularly in urban and health-focused demographics. The availability of high-quality low-fat kefir has been supported by advancements in fermentation technology, improved shelf stability, and expansion in cold chain logistics, which together have enabled wider distribution across retail formats.

Manufacturers are leveraging the rising interest in gut health and immune-boosting food categories to promote kefir as a daily dietary staple. Regulatory encouragement around low-fat dairy consumption and the emergence of lactose-reduced variants are further encouraging adoption.

Strategic product launches by dairy cooperatives and health food brands, along with increased placements in health-focused food service outlets, are expected to contribute to continued growth. As demand for clean-label and functional nutrition expands globally, low-fat kefir is positioned as a leading option in the evolving dairy beverage landscape.

The low fat content kefir market is segmented by fat content, product type, source, packaging type, distribution channel, and geographic region. By fat content, the market is divided into non-fat (0–0.5% fat), low-fat (1–2% fat), and reduced-fat (2–3% fat), along with other fat content levels. In terms of product type, the market is classified into plain/unflavored, flavored, organic, conventional, Greek-style, frozen, and other product variants. By source, the market is segmented into cow milk, goat milk, sheep milk, plant-based alternatives, and other sources. Based on packaging type, categories include bottles, pouches, tetra packs, cups & tubs, and other packaging formats. By distribution channel, the market is segmented into supermarkets & hypermarkets, convenience stores, specialty stores, online retail, foodservice, direct sales, and other distribution channels. Regionally, the low fat content kefir industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Low fat kefir is gaining market share through health-driven demand, flavor innovation, diversified distribution, and strategic brand positioning. Increasing consumer awareness of probiotics and low-calorie nutrition is fostering long-term growth potential in this category.

Consumer preferences have moved toward dairy products that combine nutrition with lighter calorie intake, and low fat kefir has benefited from this trend. The increasing awareness of probiotic benefits and digestive health support has positioned low fat kefir as a daily consumption choice for many households. The category has gained traction among fitness-oriented and weight-conscious consumers seeking reduced fat without losing the nutritional and sensory attributes of traditional kefir. Growth in functional food consumption has also encouraged product development with added vitamins, minerals, and natural flavors. Retailers have expanded shelf space for low fat kefir, responding to steady volume growth across multiple distribution channels, including supermarkets, specialty health stores, and online platforms.

Manufacturers have introduced a variety of flavored low fat kefir options to appeal to broader taste preferences, moving beyond plain variants to fruit blends, herbal infusions, and dessert-inspired profiles. Texture enhancement techniques have improved creaminess without increasing fat levels, making the product more appealing to traditional dairy consumers. Product differentiation has also extended to packaging innovations, such as single-serve bottles and resealable containers, catering to on-the-go lifestyles. Seasonal flavor launches and limited editions have helped maintain consumer engagement and repeat purchases. Clean-label claims, reduced sugar options, and organic sourcing have been incorporated to strengthen brand positioning. These innovations have contributed to higher price realizations and increased market penetration across diverse demographics.

Expansion across diversified retail channels has significantly contributed to low fat kefir’s market growth. Supermarkets remain a dominant sales point, but specialty health stores and online platforms have recorded faster growth rates due to targeted marketing and consumer convenience. The rise in e-commerce grocery platforms has allowed smaller brands to compete with established players by offering niche flavors and subscription-based deliveries. Foodservice outlets, particularly cafes and health-focused restaurants, have started integrating low fat kefir into smoothie blends and breakfast menus, increasing product visibility. Strategic partnerships with retailers have enabled promotional campaigns and in-store sampling, boosting trial rates. This multi-channel availability is enhancing brand competitiveness and fostering wider consumer adoption.

Health-oriented marketing strategies have been central to positioning low fat kefir as a premium functional dairy beverage. Brands emphasize digestive health benefits, gut microbiome support, and the role of probiotics in immunity enhancement. Social media campaigns featuring dietitians, fitness influencers, and wellness bloggers have been leveraged to create credibility and consumer engagement. Scientific endorsements and transparent labeling of probiotic strains have also elevated consumer trust. Companies are focusing on regional taste adaptations and culturally relevant messaging to strengthen market presence in diverse geographies. This health-centric positioning, backed by clinical research and consumer education initiatives, is enabling differentiation in a competitive functional dairy landscape.

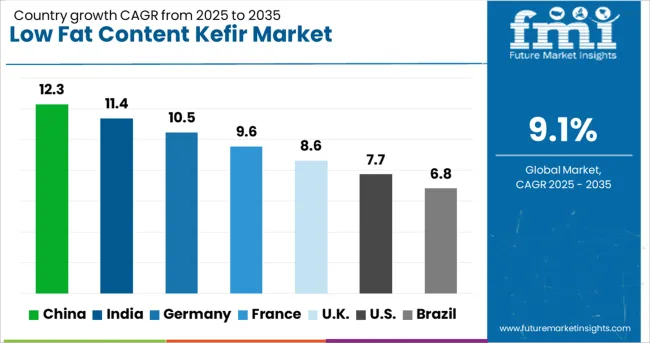

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

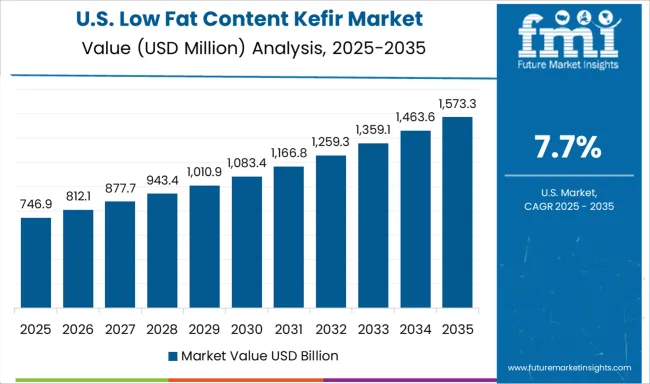

| USA | 7.7% |

| Brazil | 6.8% |

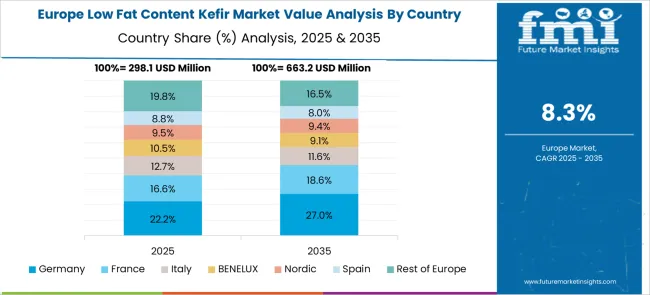

The low fat content kefir sector is projected to grow at a global CAGR of 9.1% from 2025 to 2035, fueled by increasing demand for probiotic-rich dairy alternatives, wider flavor portfolios, and expanding retail availability. China leads with a CAGR of 12.3%, supported by heightened consumer focus on digestive wellness, premium dairy imports, and rapid penetration in urban retail chains. India follows at 11.4%, driven by a rising middle-class preference for functional beverages, strong local production growth, and health-centric marketing campaigns. France posts 9.6% growth as traditional dairy culture merges with functional product innovation, while the United Kingdom records 8.6% through increased consumption in health-conscious urban demographics and specialty cafes. The United States grows at 7.7%, supported by higher awareness of probiotic benefits, rising demand for reduced-fat dairy, and strong brand-led education initiatives. The analysis spans over 40 countries, with these markets acting as key indicators for product innovation, channel strategies, and investment directions in the evolving low fat content kefir landscape.

China is projected to post a 12.3% CAGR during 2025–2035, clearly ahead of the 9.1% global path. Rising interest in gut-friendly beverages, strong placement in modern trade, and wider use of drinkable formats in breakfast occasions are lifting volumes. Pharmacy chains favor clinically positioned SKUs with labeled CFU counts, while supermarkets rotate seasonal fruit and herb blends to keep repeat buyers engaged. Cold-chain expansion aids distribution into lower-tier cities, and online grocery bundles pair kefir with granola and protein snacks to grow basket size. Foodservice operators add kefir smoothies and parfaits, adding weekday demand from commuters. Local dairies are scaling cup sizes, multipacks, and family bottles, which improves shelf efficiency and trade promotions. With private label pushing entry price points and premium brands investing in texture and mouthfeel, China remains the pace-setter for category expansion.

India is expected to record an 11.4% CAGR for 2025–2035. Household penetration is rising in metros and Tier-2 cities as consumers shift from sweetened lassi and flavored milk toward lighter, probiotic drinks. Regional dairies pilot cup-and-spoon formats for snack occasions, while quick commerce drives trial with smaller bottles and multipack discounts. Ayurvedic flavor cues such as tulsi, ginger, and cardamom help first-time buyers accept the tang profile. Gyms and nutrition stores stock high-protein lines, creating pull among young professionals. Hotels and cafés use kefir for smoothies and breakfast bowls, which increases visibility with travelers and office workers. Local sourcing of cultures and fruit purees cuts cost per unit and stabilizes margins for mid-price brands targeting daily consumption.

France is set to grow at a 9.6% CAGR during 2025–2035. A strong dairy tradition supports acceptance of fermented drinks, while pharmacies and para-pharmacies curate dermo-nutrition selections that include kefir with strain disclosure. Retailers push limited-edition fruit blends and sugar-reduced options, and premium glass bottles target design-led kitchens. Travel and hospitality return to large dispensers and 1-liter formats for breakfast service, lifting institutional volumes. Recipes that pair kefir with berries and oats feature in cooking magazines, normalizing weekday consumption. Private labels match leading textures at lower prices, widening the entry base. Export-minded French dairies trial lactose-managed lines for broader EU placement, improving plant utilization and keeping promo calendars active through the year.

The United Kingdom is projected at 8.6% CAGR for 2025–2035. Using proportional scaling to the 9.1% global path and applying an early-cycle damping based on historical adoption curves, the 2020–2024 UK CAGR is estimated at about 7.3%. Earlier growth was softer due to trade-down into basic yogurts, modest shelf space in mainstream grocers, and limited flavor variety outside London and the Southeast. The move up to 8.6% is tied to grocery planogram upgrades, stronger e-commerce subscriptions for family bottles, and café chains adding kefir smoothies to breakfast menus. Sports and wellness retailers promote protein-enriched variants, raising price realization. Independent dairies run regional flavors and glass-return programs that keep local loyalty high, while national brands push multipacks for lunchbox usage.

The United States is anticipated to grow at 7.7% CAGR during 2025–2035. Natural and specialty chains lead discovery with clear strain labeling and low-sugar cues, while club stores anchor value through twin-packs and family-size bottles. Dietitians and creators on social platforms share breakfast prep using kefir, pushing weekday consumption. Colleges and hospitals add sealed single-serves to vending and cafeterias, improving convenience and safety. Co-pack partners help emerging brands trial lactose-managed and dairy-blend lines, keeping R&D risk contained. Convenience stores test grab-and-go 250–300 ml bottles near protein bars, expanding on-the-go use. With strong refrigerated logistics and broad retailer coverage, the category gains steady shelf turns even as price sensitivity persists in mid-income cohorts.

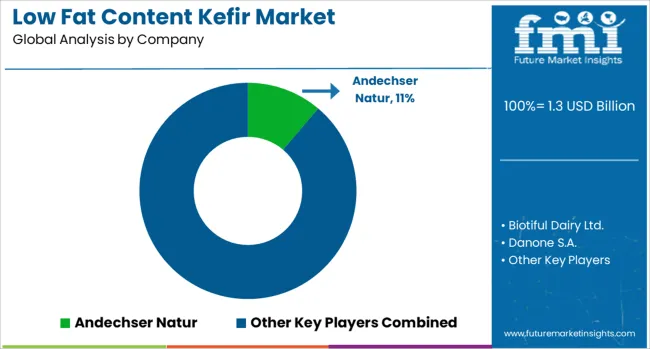

The low fat content kefir industry is defined by a mix of established dairy giants, specialized probiotic drink manufacturers, and niche organic brands that leverage unique flavor profiles and sourcing transparency. Andechser Natur maintains strong traction in Europe through organic certification and a diversified fermented dairy portfolio. Biotiful Dairy Ltd. drives growth in the UK with high-protein kefir drinks and innovative fruit blends, supported by strong retail visibility. Danone S.A. leverages its global scale, brand equity, and distribution depth to penetrate both premium and mainstream kefir segments. Evolve Kefir focuses on handcrafted small-batch production, appealing to artisanal and local-first consumers, while Green Valley Creamery offers lactose-free kefir targeting digestive wellness audiences.

Harmonica stands out with clean-label recipes and sustainable sourcing of fruits and dairy inputs. Lifeway Foods, Inc. leads the US market with flavor variety, child-friendly packs, and active social media engagement. Maple Hill Creamery, LLC emphasizes grass-fed milk sourcing, while Miil brings plant-forward kefir variants to flexitarian consumers. Redwood Hill Farm & Creamery taps into goat milk kefir for niche dietary needs. Valio Ltd. integrates Nordic dairy expertise with probiotic science, and Wallaby Yogurt Company focuses on organic and smooth-texture kefir lines. Strategic priorities across these players include expanding cold-chain distribution, innovating with functional ingredients, and balancing premiumization with affordability to capture both health-focused and mainstream segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Fat Content | Low-fat (1–2% fat), Reduced-fat (2–3% fat), Other fat content levels, and Non-fat (0–0.5% fat) |

| Product Type | Plain/unflavored, Flavored, Organic, Conventional, Greek-style, Frozen, and Other product types |

| Source | Cow milk, Goat milk, Sheep milk, Plant-based alternatives, and Other sources |

| Packaging Type | Bottles, Pouches, Tetra packs, Cups & tubs, and Other packaging types |

| Distribution Channel | Supermarkets & hypermarkets, Convenience stores, Specialty stores, Online retail, Foodservice, Direct sales, and Other distribution channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Andechser Natur, Biotiful Dairy Ltd., Danone S.A., Evolve Kefir, Green Valley Creamery, Harmonica, Lifeway Foods, Inc., Maple Hill Creamery, LLC, Miil, Redwood Hill Farm & Creamery, Valio Ltd., and Wallaby Yogurt Company |

| Additional Attributes | Dollar sales, share, regional consumption trends, competitive positioning, pricing benchmarks, retail penetration, product innovation pipelines, and growth opportunities across emerging distribution channels. |

The global low fat content kefir market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the low fat content kefir market is projected to reach USD 3.1 billion by 2035.

The low fat content kefir market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in low fat content kefir market are low-fat (1–2% fat), reduced-fat (2–3% fat), other fat content levels and non-fat (0–0.5% fat).

In terms of product type, plain/unflavored segment to command 51.2% share in the low fat content kefir market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Low-Fat Kefir Companies

Low Fat Drinks Market Size and Share Forecast Outlook 2025 to 2035

Low-Fat and Low-Cholesterol Diet Market Growth - Health Trends 2025 to 2035

Low Fat Product Market Insights - Size & Growth Forecast 2025 to 2035

Low Fat and Low Carb Foods Market Growth -Trends & Forecast 2025 to 2035

Low-Fat Cheese Nutrition Market Insights - Size & Trends 2025 to 2035

Low-fat and Low Protein Diet Market Analysis - Consumer Trends 2025 to 2035

Low-Fat Low-Calorie Desserts Market Insights - Consumer Shifts 2025 to 2035

Low Fat Butter Market

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Yellow Fats Market Size and Share Forecast Outlook 2025 to 2035

Workflow Content Automation (WCA) Market Growth – Trends & Outlook 2023-2033

Healthy Low-Fat Desserts Market Growth – Innovations & Trends 2025 to 2035

Healthy Fats Low Carb Market Trends - Demand & Consumer Shifts 2025 to 2035

Low Molecular Weight Chondroitin Sulfate Sodium Market Size and Share Forecast Outlook 2025 to 2035

Low Alloy Steels Powder Market Size and Share Forecast Outlook 2025 to 2035

Low Alkali Cement Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low-Level Order Picker Pallet Truck Market Size and Share Forecast Outlook 2025 to 2035

Low Voltage Components Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA