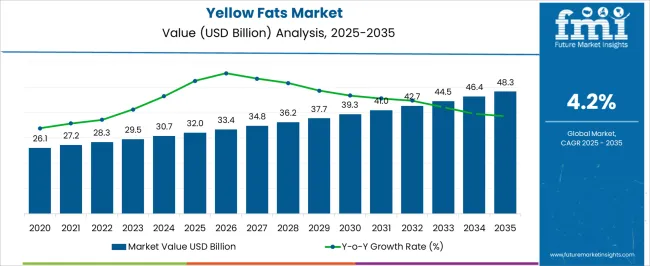

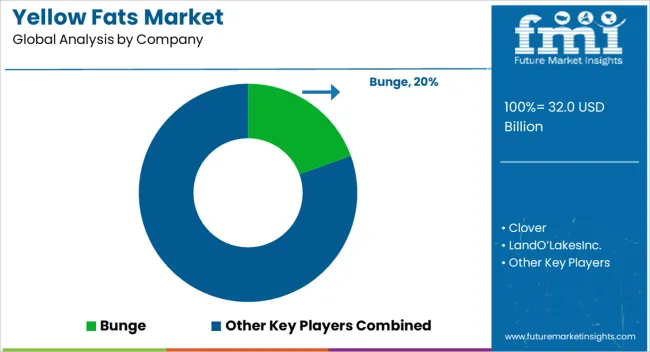

The Yellow Fats Market is estimated to be valued at USD 32.0 billion in 2025 and is projected to reach USD 48.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

| Metric | Value |

|---|---|

| Yellow Fats Market Estimated Value in (2025 E) | USD 32.0 billion |

| Yellow Fats Market Forecast Value in (2035 F) | USD 48.3 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The yellow fats market is witnessing stable growth, supported by shifting dietary preferences, growing consumption of full-fat dairy products, and increasing industrial demand from processed food manufacturers. Consumers are gradually moving toward natural and minimally processed fat sources, encouraging greater demand for products like butter and ghee over synthetic alternatives.

This trend is reinforced by ongoing clean-label and organic food movements, along with a renewed focus on traditional cooking practices across both developed and emerging economies. In parallel, the food and beverage industry is scaling up production of baked goods, sauces, and ready-to-eat meals, where yellow fats serve as core ingredients.

Key manufacturers are investing in fortified and flavored fat varieties to cater to health-conscious and gourmet consumer segments. With evolving regulatory standards around trans fats and a rise in premiumization across dairy-based spreads, the market is expected to see sustained innovation and product differentiation, especially in urban retail and food service distribution channels.

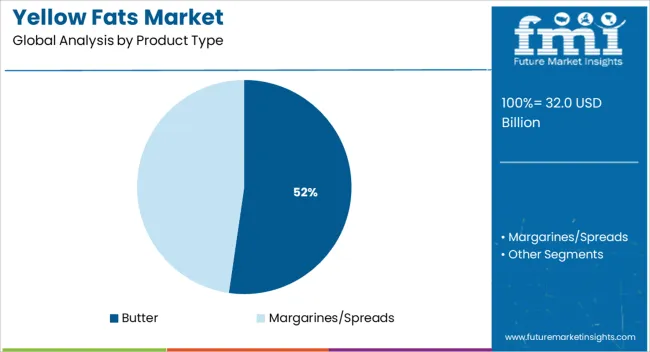

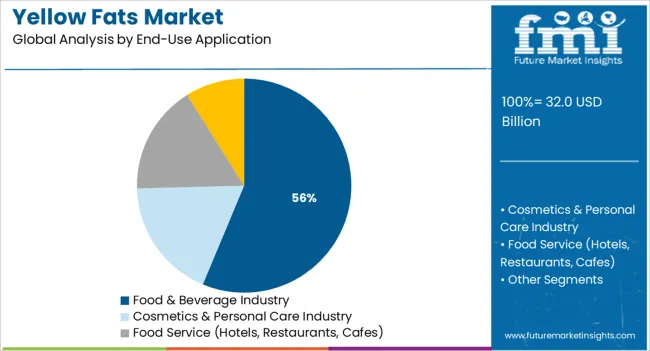

The market is segmented by Product Type and End-Use Application and region. By Product Type, the market is divided into Butter and Margarines/Spreads. In terms of End-Use Application, the market is classified into Food & Beverage Industry, Cosmetics & Personal Care Industry, Food Service (Hotels, Restaurants, Cafes), and Household/Retail. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Butter is projected to account for 52.3% of the total revenue share by 2025 in the product type segment, positioning it as the leading category in the yellow fats market. This dominance is supported by its wide culinary usage, strong cultural integration in traditional cuisines, and rising acceptance as a clean-label fat alternative.

Butter’s perception as a natural product, coupled with growing preference for fewer-ingredient foods, has elevated its demand across both retail and food service channels. The segment has benefited from increased bakery and confectionery production, where butter serves as a core ingredient for texture and flavor enhancement.

In addition, innovation in unsalted, cultured, and grass-fed varieties is meeting demand from health-conscious consumers and gourmet cooking applications. Ongoing product diversification and rising consumption in emerging markets, driven by expanding middle-class households and evolving taste preferences, have further supported butter’s leading market position.

The food and beverage industry is projected to hold 56.3% of the total market share by 2025 under the end-use application segment, making it the most prominent contributor to yellow fats consumption. This leadership is being driven by the extensive application of yellow fats in bakery, confectionery, snacks, ready meals, and culinary sauces.

Food manufacturers rely on yellow fats not only for flavor and texture but also for shelf life enhancement and product consistency. Increased demand for convenience and processed foods in both domestic and international markets has reinforced reliance on fats like butter, margarine, and blends across large-scale production lines.

Furthermore, rising demand from quick service restaurants and commercial food preparation units has accelerated industrial uptake. Food innovation trends focused on premiumization, clean-label ingredients, and global cuisine expansion continue to influence fat usage patterns, ensuring the food and beverage industry remains the leading end-use sector through the forecast period.

Yellow fats have a smooth texture, which makes them simple to prepare and use. It is simple to utilize in machines and has a high level of stability for safe processing. Furthermore, it aids in separating the dough and butter layers during the laminating process.

It also allows for the coloring of pastries and the browning of pastry items. Textured butter further improves the flavor and texture of culinary goods. Bakery product consumption is increasing, which is projected to contribute to the expansion of the yellow fats market.

Yellow fats retain their smooth and firm texture at any melting point throughout the year, enhancing their use in confectionery and bakery products. The number of hotels, restaurants, and cafes is increasing globally. Various restaurant and cafe owners prefer to buy yellow fats in bulk and keep them for extended periods.

People choose to visit restaurants and cafés more frequently due to rapid urbanization, another reason driving the demand for yellow fats. Thus, by 2035, the yellow fats market is anticipated to be worth USD 32 Billion and exhibit growth at a CAGR of 4.2% from 2025 to 2035.

Increasing Demand for Butter and Margarine

Spreads are no longer merely a morning choice served with toast. Though spreads are becoming oversaturated as a breakfast companion product, they are increasingly being employed to enhance convenience in making other foods. Apart from traditional breakfast, spreads are extensively employed during dining occasions, workplace lunches, and leisure snacking.

The term "yellow fat spread" refers to any spreadable fat such as butter, margarine, or blended fat spreads. The versatility of yellow fat spreads is thus expected to drive growth in the global yellow fats market over the forecast period.

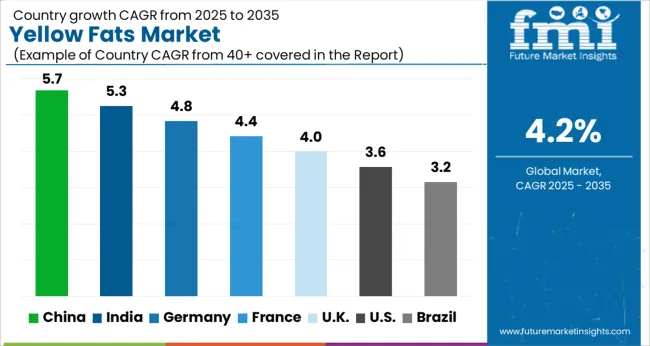

Demand for Vegetable Fat Spreads to Grow in the USA amid Surging Need for Unique Flavors

Consumers in the USA are becoming more interested in various mouthwatering culinary products offered by the food and beverage market. As customers explore more of the globe via the lusciousness of regional cuisines, flavor inspiration is affecting the food and beverage market. Flavor inspiration is one of the primary factors driving the demand for yellow fats among customers in the USA spreads industry.

Yellow fat spreads are produced with various ingredients that provide flavor, texture, and scent. These spreads are also available in grocery store aisles and are gradually becoming the most desired go-to food choice due to their wide variety of tastes. These factors are pushing the USA yellow fats market at a rapid pace.

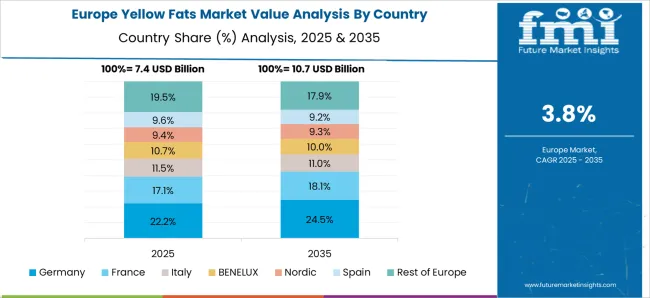

Increasing Number of Cake Shops in Germany to Fuel Sales of Fat Spread Butter

In Germany, increasing need for nutritionally beneficial value-added baking and confectionery items is driving the demand for yellow fats among bakery and confectionery artisans & craftsmen. Yellow fats are mainly utilized in a wide range of products, including cakes, waffles, confectioneries, and doughnuts, to give customers tasty culinary alternatives & cutting-edge taste profiles. Furthermore, expansion of the bakery and confectionery industry, as well as rising number of various cake shops in several parts of Germany, is expected to foster the yellow fats market in the next decade.

Yellow Fat Spreads to Gain Traction in India with Surging Inclination towards Premium Products

The concept of premiumization in India is pushing various food & beverage companies to go beyond cost and provide outstanding quality and a greater experience. Premiumization has also increased customer awareness regarding high-quality, value-added products made by using premium components that offer greater health benefits. Consumers are prepared to pay more for items that provide various health advantages, which is their only requirement. They are looking for one-of-a-kind products that would fulfill their fundamental nutritional and health demand, while also providing a sensory delight.

Butter Brands to Generate High Demand in the Upcoming Decade

According to FMI, the butter segment is set to account for a significant share of the global yellow fats market, but margarine is expected to witness a steady growth rate during the forecast period. Increasing demand for spreads from millennials and Gen-Z consumers is driving growth of the global market.

Food & Beverage Industry to Extensively Use Fat Spreads and Margarines

On the basis of end-use application, the household/retail consumption of yellow fats is anticipated to witness lucrative growth rate over the forecast period. High demand for unique flavors, convenience, and nutritional properties in food is expected to drive the demand for yellow fats in the food & beverage industry. Companies are also making new soft items that may be distributed straight from the fridge

Margarine has evolved through time into a diverse range of products for both home use and for baking, catering, & prepared meal businesses. As a result of this diversification, the general phrase "yellow fats" is now frequently used to refer to margarine, spreads, and similar products. Key players operating in the global yellow fats market are focusing on increasing retail sales of yellow fats, as its popularity as margarine is increasing at a fast pace.

For instance,

Bunge, Land O'Lakes, Inc., and Danone Are Introducing Vegan and Kid-friendly Products to Deepen Their Relationships with Customers

Bunge Limited is an American agricultural and food corporation headquartered in St. Louis, Missouri. It was founded in Bermuda. It engages in grain trade, food processing, fertilizer production, and exporting soybeans internationally. It is considered to be the largest producer and supplier of fertilizers to farmers in South America. Bunge is also the world's top marketer of bottled vegetable oil to consumers and the world's largest processor of oilseeds.

In May 2025, Bunge North America, Inc., a division of Bunge Limited signed a deal with Chevron USA Inc., a division of Chevron Corporation, to establish Bunge Chevron Ag Renewables LLC. By combining Bunge's knowledge of oilseed processing and relationship with farmers with Chevron's expertise in fuel production and marketing, the new firm will produce sustainable fuel feedstock. Similarly, in April 2025, Bunge announced its agreement to sell Zen-Noh Corporation 35 interior grain elevators in the USA Sale completion is anticipated to occur in Q4 2024 or Q1 2024, subject to regulatory approval.

Land O'Lakes, Inc., on the other hand, is a dairy-focused American member-owned agricultural cooperative with headquarters in the Arden Hills neighborhood of Minneapolis-St. Paul, Minnesota. Through its dairy goods division, the co-op is among the biggest makers of butter and cheese in the USA It also provides services to farmers, animal owners, and their families through more than 4,700 local cooperatives. For instance, in June 2025, the company announced that with seven new varieties at some stores, Land O Lakes Cheese may now be available in the dairy case area of the grocery store.

Danone S.A. is another global food-products firm headquartered in Paris. It was established in Spain's Barcelona. Danone India provides a variety of specialist products for all phases of life, including pregnancy, babies, early children, and adults, under well-known Indian and international brands such as Aptamil, Neocate, Farex, Protinex, Dexolac, and Nusobee.

In July 2025, in response to parents' requests for vegetarian and flexible diet alternatives for their babies, Danone announced the release of the first-ever Dairy and Plants Blend infant formula. The consumption of plant-based foods is rising significantly, with almost 70% [69%] of parents increasingly preferring their children eat more plant-based meals, and more than one-third [37%] of EU consumers selecting a vegan, vegetarian, or flexitarian diet.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 32.0 billion |

| Projected Market Valuation (2035) | USD 48.3 billion |

| Value-based CAGR (2025 to 2035) | 4.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (USD Billion) and Volume (MT) |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Nordic, Russia, Poland, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Singapore, Australia, New Zealand, GCC countries, North Africa, South Africa, others. |

| Key Segments Covered | Product Type, End-use Application, and Region |

| Key Companies Profiled | Bunge; Clover; Land O’ Lakes Inc.; Arla Foods; Amul; Crystal Farms; Danone SA; Horizon Organics; Dean Food Company; Nestle SA; Kraft Foods Inc.; Yorkshire Butter; Vitalite; County Milk Products; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global yellow fats market is estimated to be valued at USD 32.0 billion in 2025.

The market size for the yellow fats market is projected to reach USD 48.3 billion by 2035.

The yellow fats market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in yellow fats market are butter and margarines/spreads.

In terms of end-use application, food & beverage industry segment to command 56.3% share in the yellow fats market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Yellow Pea Protein Market Outlook - Growth, Demand & Forecast 2025 to 2035

Yellow Fever Treatment Market

Sunset Yellow FCF Market Size and Share Forecast Outlook 2025 to 2035

Bismuth Yellow Market Size and Share Forecast Outlook 2025 to 2035

Quinoline Yellow WS Market Size and Share Forecast Outlook 2025 to 2035

Carthamus Yellow Market

Fats And Oils Market Size and Share Forecast Outlook 2025 to 2035

Algae Fats Market Trends - Sustainable Fat Innovations 2025 to 2035

Filling Fats Market Size, Growth, and Forecast for 2025 to 2035

Healthy Fats Low Carb Market Trends - Demand & Consumer Shifts 2025 to 2035

Powdered Fats Market – Growth, Demand & Industrial Applications

Spreadable Fats Market Analysis by Product, Source, End Use and Distribution channel Through 2035

Confectionery Fats Market

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Interesterified Fats Market Growth - Food Processing & Health Trends 2025 to 2035

Normal and Specialty Fats Market Analysis by Type, Application, End Use and Region through 2035

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA