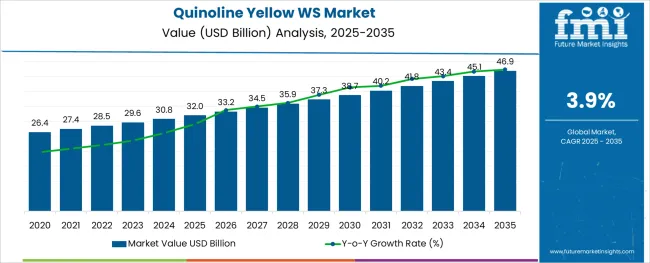

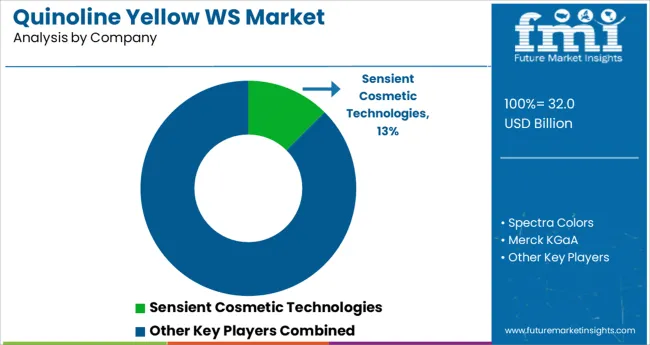

The Quinoline Yellow WS Market is estimated to be valued at USD 32.0 billion in 2025 and is projected to reach USD 46.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The Quinoline Yellow WS market is gaining steady traction due to its wide use in food and beverage coloring, cosmetic formulations, and pharmaceutical coatings. Regulatory approvals across multiple jurisdictions, particularly in Europe and Asia, have facilitated consistent demand in consumer goods applications. Manufacturers are focusing on maintaining high batch-to-batch consistency, enhancing water solubility profiles, and ensuring compliance with stringent food-grade standards.

Process advancements in dye stabilization and formulation science are enabling greater dispersibility and improved lightfastness. Additionally, as clean labeling and formulation transparency continue to influence buyer preferences, producers are differentiating their offerings through certifications and traceable sourcing.

The expansion of functional beverages, rising demand for aesthetic appeal in confectionery, and broadening applications in oral care products are creating sustained market opportunities. Going forward, innovation in microencapsulation, controlled-release colorants, and hybrid dyes is expected to open new frontiers, especially in health-aligned consumer product segments.

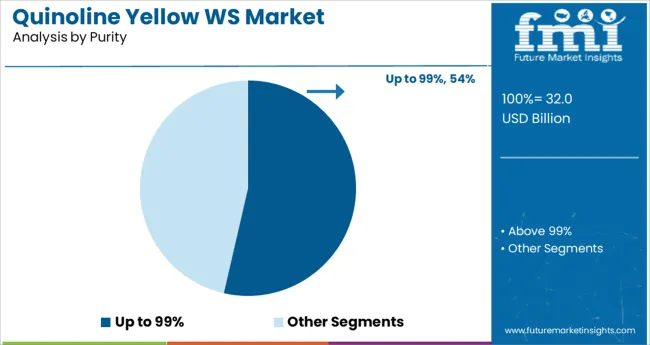

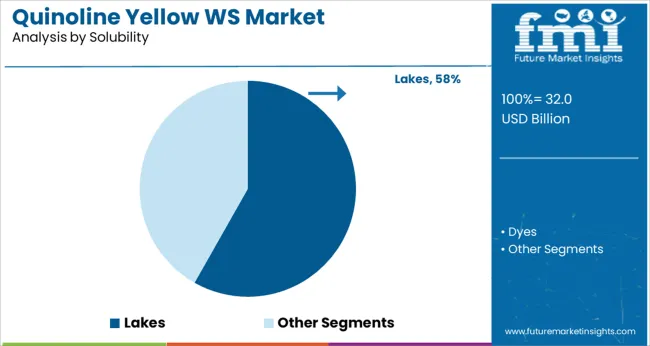

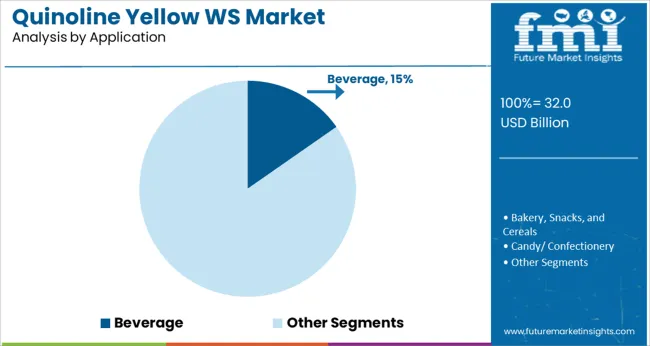

The market is segmented by Purity, Solubility, and Application and region. By Purity, the market is divided into Up to 99% and Above 99%. In terms of Solubility, the market is classified into Lakes and Dyes. Based on Application, the market is segmented into Beverage, Bakery, Snacks, and Cereals, Candy/ Confectionery, Dairy, Fruit Preparations/ Fillings, Meat, Poultry, Fish, and Eggs, Potatoes, Pasta, and Rice, Sauces, Soups, and Dressings, Seasonings, Pet Food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Purity, Solubility, and Application and region. By Purity, the market is divided into Up to 99% and Above 99%. In terms of Solubility, the market is classified into Lakes and Dyes. Based on Application, the market is segmented into Beverage, Bakery, Snacks, and Cereals, Candy/ Confectionery, Dairy, Fruit Preparations/ Fillings, Meat, Poultry, Fish, and Eggs, Potatoes, Pasta, and Rice, Sauces, Soups, and Dressings, Seasonings, Pet Food, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The up to 99% purity category is anticipated to hold a dominant 53.6% revenue share in 2025 within the Quinoline Yellow WS market. This segment’s leadership is driven by the balance it offers between effective coloring performance and cost-efficiency in high-volume applications.

Manufacturers in food, beverage, and personal care sectors prefer this grade for its regulatory compliance and wide formulation compatibility. The up to 99% purity grade is capable of delivering consistent chromatic results while maintaining acceptable limits of heavy metals and contaminants, making it favorable for edible and topical product formulations.

Demand from emerging markets, where regulatory frameworks permit broader use of this purity range, is also contributing to its growth. Its use in applications requiring moderate to high solubility without the added cost of ultra-purified grades has further reinforced its leading position.

Lakes are projected to command a 58.2% revenue share in 2025 under the solubility category, making them the most utilized form of Quinoline Yellow WS. This dominance is attributed to their superior stability in oily or dry applications where water-soluble dyes fall short.

The ability of lakes to bind with substrates, resist leaching, and provide uniform dispersion in non-aqueous systems has driven their preference in cosmetic compacts, coated tablets, and dry beverage powders. Moreover, their enhanced tinting strength and resistance to light and heat exposure make them suitable for long shelf-life consumer goods.

The manufacturing flexibility they offer in terms of particle size control and pigment loading has enabled formulation diversity across industries. With rising demand for multifunctional and hybrid product lines, lakes are expected to remain the solubility form of choice in high-performance applications.

In the application segment, beverages are forecast to contribute 15.3% of total revenue by 2025, making it a leading consumer-facing use case for Quinoline Yellow WS. Growth in this segment is being fueled by increasing demand for visually differentiated drinks in carbonated, energy, and flavored water categories.

Brands are emphasizing vibrant color profiles to enhance product appeal and support thematic branding, particularly in markets with high consumer engagement through packaging aesthetics. Quinoline Yellow WS is being utilized for its brightness, pH tolerance, and compatibility with transparent and acidic beverage matrices.

Regulatory clearances and formulation versatility have enabled its integration into both synthetic and hybrid colorant strategies. As health-conscious formulations continue to rise, beverage producers are relying on stable color systems that can perform across diverse ingredients and packaging formats, reinforcing the market share of this segment.

Quinoline yellow WS is gaining immense popularity worldwide due to its affordability and easy accessibility. The advent of numerous start-up food processing companies with rising penetration of the internet and increasing health concerns is also expected to drive the market.

Synthetic colors like quinoline yellow WS are cost-effective and hold a huge competitive advantage as they are conveniently miscible. Quinoline is thus widely incorporated in the production of various specialty chemicals.

Unlike conventional synthetic food colors, quinoline yellow WS has antibacterial properties. It contains primaquine, amodiaquine, chloroquine, and quinine which are utilized in the treatment of malaria. Hence, quinoline yellow WS finds application in drugs and pesticides. Demand for these end-use products is expected to surge in Asia Pacific, thereby pushing the market.

The ability of quinoline yellow WS to add more vibrancy and stability to food products, as compared to natural yellow colorants is another vital factor that would aid growth. It is also used in frozen foods like meat, ice creams, and cakes.

Apart from that, quinoline yellow WS is used in convenience, ready-to-eat, and processed foods, as well as baked goods, carbonated drinks, alcoholic beverages, juices, sauces, and soup mixes. Spurred by the aforementioned factors the global quinoline yellow WS is set to exhibit growth at a CAGR of 3.9% in the forthcoming years from 2025 to 2035.

Overexposure to quinoline yellow WS may cause nausea. It can also lead to adverse effects on the cornea, retina, and optic nerves. Besides, bans in a few regions and reluctance for synthetic food colorants among consumers are some of the other key restraints in the market. The surging use of natural food colors like spirulina colorants by international food processing companies is another significant factor that may challenge growth.

Use of Quinoline Yellow Colour as a Precursor to Oxine Will Boost Mexico Market

As per FMI, the Brazil quinoline yellow WS market was valued at USD 30.8 Million in 2024 and is set to be followed by China in terms of share. As government agencies have banned the use of quinoline yellow WS in the USA and Canada, the North American market is mainly driven by Mexico. Increasing utilization of quinoline yellow WS as a precursor to 8-hydroxyquinoline (oxine) across Brazil is anticipated to drive growth.

Quinoline Yellow Dye Producers to Set up Manufacturing Facilities in India

India is projected to show considerable growth in the South Asia quinoline yellow WS market during the forecast period. Increasing adoption of numerous innovative food colorants by local companies in the country is projected to drive the market.

Various international food-grade color manufacturers are setting up their technologically advanced manufacturing facilities and establishing robust distribution networks in India owing to the easy availability of raw materials.

In addition, rising agricultural activities in the country are set to push the need for pesticides. Thus, increasing utilization of quinoline yellow WS for the manufacturing of pesticides is anticipated to bolster growth.

Expansion of the food industry, especially meat processing, bakery & confectionery, and processed food segments is another crucial factor that would augment growth in India. The presence of favorable government policies accelerating the development of unique foods and drinks is also set to spur growth.

Quinoline Yellow Colour to Find Application in Dairy Products

Based on application, the dairy, beverage, bakery, snacks, & cereals, fruit preparations/fillings, and candy/confectionery segments are likely to dominate the global quinoline yellow WS market. The dairy segment is anticipated to grow at a CAGR of 4.16% in the assessment period. Besides, the beverage segment is likely to hold nearly 27% of the quinoline yellow WS market share in the forthcoming years.

Some of the leading companies operating in the global quinoline yellow WS market include Merck KGaA, Vijay Chemical Industries, Salvi Chemical Industries, Neelikon Food Dyes & Chemicals, Symrise, Sigma-Aldrich Co. LLC., and Shanghai Dyestuffs Research Institute Co. Ltd., among others.

Emerging countries across the globe have been a target for synthetic food colorant producers in the recent past. Several companies are focusing on expanding their product portfolios to attract more consumers. A few other key players are aiming to engage in mergers & acquisitions, joint ventures, agreements, and product innovations to gain a competitive edge.

| Attributes | Details |

|---|---|

| Estimated Market Size (2025) | USD 32.0 billion |

| Projected Market Valuation (2035) | USD 46.9 billion |

| Value-based CAGR (2025 to 2035) | 3.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | Value (million) and Volume (MT) |

| Key Regions Covered | North America; Latin America; Europe; the Middle East and Africa; East Asia; South Asia; and Oceania |

| Key Countries Covered | United States of America, Canada, Mexico, Brazil, Peru, Argentina, United Kingdom, China, India, Japan, Germany, Italy, France, South Africa, South Korea, Australia, and GCC Countries |

| Key Segments Covered | Purity, Solubility, Application, and Region |

| Key Companies Profiled | Sensient Cosmetic Technologies; Spectra Colors; Merck KGaA; Koel Colours; Shaedong Aoertong Chemical; Steris PLC; Sigma-Aldrich Co. LLC.; Diversey Inc.; Kao Corporation; Clariant; Neelikon Food Dyes and Chemicals; Symrise; Sun Chemical (DIC); Daito Kasei Kogyo; Others |

| Report Coverage | Market forecast, Drivers, Restraints, Opportunities and Threats analysis, company share analysis, competition intelligence, market dynamics and challenges, and strategic growth initiatives |

The global quinoline yellow ws market is estimated to be valued at USD 32.0 billion in 2025.

It is projected to reach USD 46.9 billion by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are up to 99% and above 99%.

lakes segment is expected to dominate with a 58.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Quinoline Market Growth – Trends & Forecast 2025 to 2035

Yellow Petroleum Jelly Market Size and Share Forecast Outlook 2025 to 2035

Yellow Fats Market Size and Share Forecast Outlook 2025 to 2035

Yellow Pea Protein Market Outlook - Growth, Demand & Forecast 2025 to 2035

Yellow Fever Treatment Market

Sunset Yellow FCF Market Size and Share Forecast Outlook 2025 to 2035

Carthamus Yellow Market

Tile Saws Market Size and Share Forecast Outlook 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Neck Pillows Market Analysis - Trends, Growth & Forecast 2025 to 2035

Canada Straws Market Size and Share Forecast Outlook 2025 to 2035

Reusable Straws Market Analysis - Trends, Growth & Forecast 2025 to 2035

Aircraft Windows and Windshields Market Size and Share Forecast Outlook 2025 to 2035

Dog Dental Chews Market Analysis by Product Type, Age, Flavor, Application and Sales Channel Through 2035

Void Fill Pillows Market Size and Share Forecast Outlook 2025 to 2035

Face and Ear Bows Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Void Fill Pillows Industry

Portable Band Saws Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Vegan Marshmallows Market Analysis by Pumpkin, Peppermint, Chocolate and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA