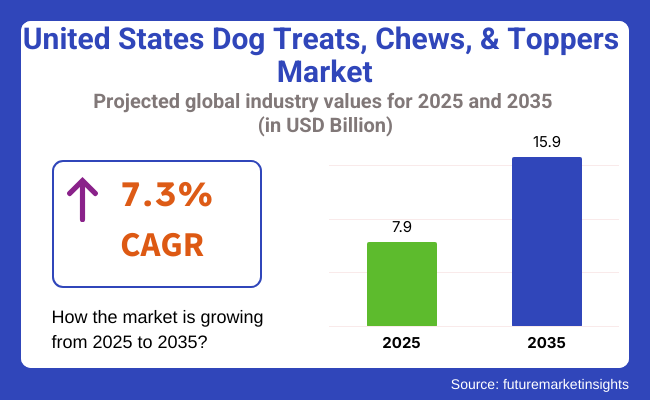

United States dog treats, chews, & toppers market size was worth USD 7.9 billion in 2025 and is forecasted to witness a 7.3% CAGR during 2025 to 2035. The dog treats, chews, and toppers market is also expected to reach USD 15.9 billion by 2035. The growth is fueled by increasing pet humanization, growing realization for pet nutrition, and the transition to functional, gourmet, and natural recipes matching wellness trends in human food.

Toppers, chews, and treats have crossed over from luxurious add-ins to become essential components of a dog's daily diet, with roles in joint support, digestion, dental care, stress management and weight management. Pet owners now seek products that offer health benefits alongside palatability, often using grain-free, single-protein, organic and veterinarian-recommended versions.

Product innovation is driving differentiation as functional ingredients like turmeric, probiotics, glucosamine, and CBD go mainstream in products. Yak milk, collagen, and antler sustained-release chews are mainstream for behavior and dental care maintenance. Meal toppers, once a specialty, have gone mainstream delivering targeted nutritional boosts and palatability improvement in wet, freeze-dried, or powder form.

E-commerce is revolutionizing consumer engagement with subscription models, DTC customization, and algorithmic product recommendations. Pet specialty chains and independent retailers are focusing on curated products, wellness positioning and education-based selling. Grocery and mass merchants are expanding shelf space for clean-label and functional treat brands to meet increasing demand.

With an increasing number of USA households with dogs, the real growth manifests itself in more dollars spent per dog and longer breed-specific, age-specific, activity level-specific, or medical condition-specific feeding. Pet owners are more evolved and demand human-grade quality, transparency, and ethical sourcing values that are changing the competitive landscape.

Consumer interest in dog treats and topper space follows trends in human health and wellness products. Consumers appreciate the authenticity of ingredients, health and palatability. Greater demand for functional formats has also raised further expectations regarding quality control, transparency of sourcing and claims verified by veterinarians.

The strongest growth in demand is in air-dried and freeze-dried treats, natural chews, and functional toppers for digestive, immunity, and coat health care. The premium segments perform well on the back of higher health awareness and increased emotional commitment toward pet welfare. Customized treatment plans with innovation and integration with smart feeders are adding value to tech-savvy homes.

Regulation compliance i.e., labeling honesty, nutritional value, and sourcing claims becomes increasingly judged by the consumer and demands the trustworthiness of the brand. Brands that deliver functional, delicious, sustainably made products can fuel category development.

While being on an upward trend, the dog treats, chews, and toppers market is also prone to a variety of risks that may derail its momentum. The greatest risk is ingredient quality and safety. Contamination or mislabeling recalls can lead to irrevocable damage to brand trust, especially in a health-oriented and emotionally involved consumer group. Stringent testing and open sourcing are essential to avoid such risks.

With the sudden appearance of boutique and private-label offerings, consumers get confused by too many choices, and price warfare drives profit margins to zero. In-market companies will have to reinvent and reposition their value propositions time and time again in order to remain viable and avoid commoditization.

In addition, regulatory focus is increasing, especially on health benefits, therapeutic ingredients, and ingredient source claims. Non-compliant companies face fines, shelf withdrawal, or damage to reputation from being unable to keep pace with evolving federal and state-level pet food regulations. Compliance, sustainability, and third-party certifications will be key to brand longevity in this growing but highly regulated industry.

Between 2020 and 2024, the United States dog treats, chews, & toppers Market experienced significant growth, driven by increased pet ownership and a shift towards premium, health-conscious pet products. Pet owners started to treat pets like family, and that instigated spending more on high-end housing and high-quality nutrition.

Single-ingredient natural treats and functional chews that promote dental care, joint health, and digestive health saw increased demand. Pet influencers and social media further fueled the trend since owners desired products that were aligned with the current pet care industry trends and supported their pets' lifestyles.

During the forecast period 2025 to 2035, the dog treats, chews, and toppers market will continue to shift with emphasis on technology integration, personalization, and sustainability. Pet food will experience innovation and the creation of customized treat forms in sync with individual canine health requirements.

The application of intelligent technology, i.e., treat dispenser and mobile app integration, can also grow, enabling owners to monitor better and control their pet's treat consumption. In addition, the greater emphasis on green packaging and sustainably sourced ingredients will also impact shopping behavior, as consumers will be more responsible in selecting products that are more environmentally friendly.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing pet population, humanization of pets, and premium product demand | Sustainability, personalization, and technology integration |

| The emergence of e-commerce sites and social media impact | Creation of smart treat dispensers and individual nutrition apps |

| Single-ingredient, natural treats, functional chews, and quality toppers | Custom treats, sustainable packaging, and wellness-centered innovations |

| Aesthetically pleasing, high-quality, health-oriented products | Personalized, tech-savvy, and eco-friendly pet care solutions |

| Supply chain shutdowns and heightening competition | Meeting innovation and affordability needs and upholding ethical standards |

The United States dog treats, chews and toppers market is anticipated to experience steady growth during the forecast period from 2025 to 2035. The industry size in 2025 was USD 4.2 billion and will be more than USD 8.1 billion by 2035, fueled by increasing pet ownership and improving pet wellness and nutritional issues.

Increased spending on pet care is driving opportunities in mainstream retail and online stores. The trend towards human-grade ingredients and functional treats designed to aid digestion, dental health, and general health is converting traditional product ranges into more specialist products. Unrelenting demand is most prevalent in premium and organic stores, where owners are looking for clean-label, high-protein and single-ingredient treats.

The increasing number of health-aware consumers is applying that skepticism to pet treats and pet food, causing manufacturers to prioritize nutritional value and sourcing integrity. Functional chews with added vitamins, probiotics, or calming agents are popular, as meal toppers are designed to enhance palatability as well as nutrient uptake. Independent retailers and specialty stores remain healthy by providing tailored, boutique-style experiences and creative products.

Treats and Dental Chews in the USA dog treats, chews, and toppers market would be highly dominating, with Training Treats acquiring a 22% value share and Dental Chews attaining a 23% value share.

Training Treats (22%) will continue to enjoy great demand as they serve the dual function of training rewards for dogs and obedience enhancers. Many training treats are smaller and thus are easily administered in training sessions. Several kinds are available to cater to canine tastes and specific health needs.

Hill's Prescription Diet Treats can be functional and appealing for pets with special health needs, and Greenies' Training Treats promote dental health while being rewarding for training purposes. These treats reinforce good behavior and are now being increasingly used by pet owners in training programs for their dogs.

Dental chews (23%) will contribute to growth because of the favor they enjoy from dog owners, who value oral health in dogs. They help reduce plaque and tartar build-up and give dogs fresh breath. This is, however, complemented by the increasing awareness of oral hygiene being all-important for dogs.

Pedigree and Purina products like Pedigree DentaStix and Purina Pro Plan Veterinary Diets Dental Chews dominate this segment, whereby they help with oral health. Still, they also serve the chewing instinct in dogs for general well-being.

Recently, the likes of Virbac and Petsmile penetrated a growing industry for premium dental chews that mostly come with natural ingredient health benefits. As demand for holistic solutions increases among pet owners for their dogs' health, demand for dental chews will also grow.

By 2025, the USA dog treats, chews, & toppers market is likely to witness a heavy demand for Pouches and Bags as packaging formats, with Pouches holding 35% of the revenue share and Bags holding 30%.

Pouches constitute the leading segment of trade to account for 35 % of its share by virtue of the said convenience, portability, and preservation of freshness for treats and chews. They are light, wallet-sized and resealable containers, making them easy to carry wherever pet owners go. Many premium dog treat brands prefer this type of packaging because it keeps treats fresh by protecting them from moisture and contamination, both of which are important to product quality.

Brands like Milk-Bone and Blue Buffalo also use pouch packaging, offering easy resealability for better storage and freshness over time. In addition, pouches are cost-effective and eco-friendly in today's world because of the rising demand for recyclable or biodegradable materials in pet product packaging.

Bags (30%) maintain a stronghold in the industry primarily due to their usability in bulk buying, especially for multi-pet households and customers who buy larger quantities. Bags are typically used for large-sized treats, chews, and toppers and are a popular option for retailers that want to provide value packs.

Brands such as Pedigree and Purina utilize bags for their product lines, which include Pedigree Marrobones and Purina Busy Bone, respectively. Bags fulfill the needs of pet owners for whom quantity and value are more critical than the portability offered by pouches. Nevertheless, as consumer price consciousness grows, bag packaging will remain a strong performer among larger pack sizes.

The USA Dog Treats, Chews, & Toppers industry has a fierce competition where health-oriented innovations in formulation, natural ingredients, and functional benefits are the driving forces behind the activities of key players.

The former includes some major firms, such as Mars Inc., General Mills Inc., The Honest Kitchen, Merrick Pet Care Inc., and Wellness Pet Company (Zuke's LLC), which have very actively been expanding their portfolio with grain-free, organic, and freeze-dried products aiming at health-conscious pet owners.

Mars Inc. tops the industry because of strong brand equity with Greenies and Pedigree Dentastix, providing dental health benefits with high palatability. The company is continuously engaged in R&D and acquisition strategies to achieve better functional treats. General Mills Inc., through Blue Buffalo, manufactures protein-rich and life-stage-specific treats that have recently been incorporating limited ingredients to satisfy hypoallergenic pets.

The Honest Kitchen is mainly for dehydrated toppers and high-quality human-grade ingredients, catering to the premium niche industry. Merrick Pet Care Inc., owned by Nestlé Purina PetCare, has a focus on slow-cooked, high-meat treats and functional chews for joint, skin, and coat health. Wellness Pet Company, including Zukes LLC, targets active dogs with energy-dense, protein-forward snacking options, riding the trend toward purposeful snacking.

Small premium brands such as Plato Pet Treats, Redbarn, and Primal Pet Group are fast gaining traction by way of e-commerce and specialty pet retailers, often highlighting single-ingredient formats, raw or freeze-dried, with a clean label appeal.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Mars Inc. | 22-27% |

| General Mills Inc. | 15-19% |

| The Honest Kitchen | 10-14% |

| Merrick Pet Care Inc. | 9-12% |

| Wellness Pet Company | 7-10% |

| Other Key Players | 20-25% |

| Company Name | Offerings & Activities |

|---|---|

| Mars Inc. | It offers Greenies and Dentastix and focuses on dental treats and functional chews with wide retail reach. |

| General Mills Inc. | Blue Buffalo offers grain-free, high-protein treats and meal toppers. |

| The Honest Kitchen | It specializes in human-grade, dehydrated toppers and functional treats, and it has a strong DTC presence. |

| Merrick Pet Care Inc. | Offers oven-baked treats with high meat content; focuses on health-centric formulations. |

| Wellness Pet Company | It provides energy-dense and protein-rich treats via Zuke’s and targets active and aging dogs. |

Key Company Insights

Mars Inc. (22-27%)

Key leader with top-performing brands in functional and dental treats; invests heavily in product innovation and brand expansion.

General Mills Inc. (15-19%)

Leverages Blue Buffalo’s success in the holistic nutrition space to drive strong retail and e-commerce performance.

The Honest Kitchen (10-14%)

Gaining loyal premium consumers with clean-label, human-grade treats and meal toppers in dehydrated formats.

Merrick Pet Care Inc. (9-12%)

Strong presence in natural treat categories; emphasizes slow-cooked, meaty recipes with targeted health benefits.

Wellness Pet Company (7-10%)

Innovates in the high-protein and active dog category; growing presence in functional chews and training snacks.

The segmentation is into freeze-dried treats, training treats, dental chews, jerky treats, biscuits & cookies, and others.

The segmentation is into plant-based and animal-based ingredients.

The segmentation is into pouches, bags, cans, and bottles & jars.

The segmentation is into 0 to 10 units, 10 to 20 units, and above 20 units.

The segmentation is into life stages, including puppies and adult dogs.

The segmentation is into pet specialty stores, drug stores, modern trade (hypermarkets/supermarkets), online retailers, convenience stores, and other sales channels.

The industry is slated to reach USD 7.9 billion in 2025.

The industry is predicted to reach a size of USD 15.9 billion by 2035.

Key companies include General Mills Inc., Merrick Pet Care Inc., Zuke's LLC, Wellness Pet Company, Mars Inc., Plato Pet Treats, The Honest Kitchen, Canidae Pet Food, Primal Pet Group, Redbarn Pet Products LLC, and Natural Balance Pet Foods.

The United States, with a projected CAGR of 7.3% during the forecast period, is poised for the fastest growth.

Treats and dental chews are being widely used.

Table 1: Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 2: Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 3: Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2033

Table 4: Market Volume (Units) Analysis By Ingredient Type, 2018 to 2033

Table 5: Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2033

Table 6: Market Volume (Units) Analysis By Packaging Type, 2018 to 2033

Table 7: Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2033

Table 8: Market Volume (Units) Analysis By Packaging Size, 2018 to 2033

Table 9: Market Value (US$ Million) Analysis By Life Stage, 2018 to 2033

Table 10: Market Volume (Units) Analysis By Life Stage, 2018 to 2033

Table 11: Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 12: Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 13: West Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 14: West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 15: West Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2033

Table 16: West Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2033

Table 17: West Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2033

Table 18: West Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2033

Table 19: West Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2033

Table 20: West Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2033

Table 21: West Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2033

Table 22: West Region Market Volume (Units) Analysis By Life Stage, 2018 to 2033

Table 23: West Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 24: West Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 25: South East Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 26: South East Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 27: South East Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2033

Table 28: South East Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2033

Table 29: South East Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2033

Table 30: South East Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2033

Table 31: South East Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2033

Table 32: South East Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2033

Table 33: South East Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2033

Table 34: South East Region Market Volume (Units) Analysis By Life Stage, 2018 to 2033

Table 35: South East Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 36: South East Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 37: South West Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 38: South West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 39: South West Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2033

Table 40: South West Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2033

Table 41: South West Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2033

Table 42: South West Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2033

Table 43: South West Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2033

Table 44: South West Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2033

Table 45: South West Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2033

Table 46: South West Region Market Volume (Units) Analysis By Life Stage, 2018 to 2033

Table 47: South West Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 48: South West Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 49: Mid-West Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 50: Mid-West Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 51: Mid-West Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2033

Table 52: Mid-West Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2033

Table 53: Mid-West Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2033

Table 54: Mid-West Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2033

Table 55: Mid-West Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2033

Table 56: Mid-West Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2033

Table 57: Mid-West Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2033

Table 58: Mid-West Region Market Volume (Units) Analysis By Life Stage, 2018 to 2033

Table 59: Mid-West Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 60: Mid-West Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Table 61: North East Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2033

Table 62: North East Region Market Volume (Units) Analysis By Product Type, 2018 to 2033

Table 63: North East Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2033

Table 64: North East Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2033

Table 65: North East Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2033

Table 66: North East Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2033

Table 67: North East Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2033

Table 68: North East Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2033

Table 69: North East Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2033

Table 70: North East Region Market Volume (Units) Analysis By Life Stage, 2018 to 2033

Table 71: North East Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2033

Table 72: North East Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2033

Figure 1: Market Value (US$ Million) and Volume (Units) Analysis, 2018 to 2022

Figure 2: Market Value (US$ Million) and Volume (Units) Forecast, 2023 to 2033

Figure 3: Market Value (US$ Million) Analysis, 2018 to 2022

Figure 4: Market Value (US$ Million) Forecast, 2023 to 2033

Figure 5: Market Absolute $ Opportunity Value (US$ Million), 2023 to 2033

Figure 6: Market Value (US$ Million) Analysis By Product Type, 2018 to 2022

Figure 7: Market Volume (Units) Analysis By Product Type, 2018 to 2022

Figure 8: Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 9: Market Attractiveness By Product Type, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2022

Figure 11: Market Volume (Units) Analysis By Ingredient Type, 2018 to 2022

Figure 12: Market Y-o-Y Growth (%) Projections, By Ingredient Type, 2023 to 2033

Figure 13: Market Attractiveness By Ingredient Type, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2022

Figure 15: Market Volume (Units) Analysis By Packaging Type, 2018 to 2022

Figure 16: Market Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 17: Market Attractiveness By Packaging Type, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2022

Figure 19: Market Volume (Units) Analysis By Packaging Size, 2018 to 2022

Figure 20: Market Y-o-Y Growth (%) Projections, By Packaging Size, 2023 to 2033

Figure 21: Market Attractiveness By Packaging Size, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis By Life Stage, 2018 to 2022

Figure 23: Market Volume (Units) Analysis By Life Stage, 2018 to 2022

Figure 24: Market Y-o-Y Growth (%) Projections, By Life Stage, 2023 to 2033

Figure 25: Market Attractiveness By Life Stage, 2023 to 2033

Figure 26: Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2022

Figure 27: Market Volume (Units) Analysis By Distribution Channel, 2018 to 2022

Figure 28: Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 29: Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 30: Market Value (US$ Million) Analysis By Region, 2018 to 2022

Figure 31: Market Volume (Units) Analysis By Region, 2018 to 2022

Figure 32: Market Y-o-Y Growth (%) Projections, By Region, 2023 to 2033

Figure 33: Market Attractiveness By Region, 2023 to 2033

Figure 34: West Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2022

Figure 35: West Region Market Volume (Units) Analysis By Product Type, 2018 to 2022

Figure 36: West Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 37: West Region Market Attractiveness By Product Type, 2023 to 2033

Figure 38: West Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2022

Figure 39: West Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2022

Figure 40: West Region Market Y-o-Y Growth (%) Projections, By Ingredient Type, 2023 to 2033

Figure 41: West Region Market Attractiveness By Ingredient Type, 2023 to 2033

Figure 42: West Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2022

Figure 43: West Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2022

Figure 44: West Region Market Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 45: West Region Market Attractiveness By Packaging Type, 2023 to 2033

Figure 46: West Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2022

Figure 47: West Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2022

Figure 48: West Region Market Y-o-Y Growth (%) Projections, By Packaging Size, 2023 to 2033

Figure 49: West Region Market Attractiveness By Packaging Size, 2023 to 2033

Figure 50: West Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2022

Figure 51: West Region Market Volume (Units) Analysis By Life Stage, 2018 to 2022

Figure 52: West Region Market Y-o-Y Growth (%) Projections, By Life Stage, 2023 to 2033

Figure 53: West Region Market Attractiveness By Life Stage, 2023 to 2033

Figure 54: West Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2022

Figure 55: West Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2022

Figure 56: West Region Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 57: West Region Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 58: South East Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2022

Figure 59: South East Region Market Volume (Units) Analysis By Product Type, 2018 to 2022

Figure 60: South East Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 61: South East Region Market Attractiveness By Product Type, 2023 to 2033

Figure 62: South East Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2022

Figure 63: South East Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2022

Figure 64: South East Region Market Y-o-Y Growth (%) Projections, By Ingredient Type, 2023 to 2033

Figure 65: South East Region Market Attractiveness By Ingredient Type, 2023 to 2033

Figure 66: South East Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2022

Figure 67: South East Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2022

Figure 68: South East Region Market Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 69: South East Region Market Attractiveness By Packaging Type, 2023 to 2033

Figure 70: South East Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2022

Figure 71: South East Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2022

Figure 72: South East Region Market Y-o-Y Growth (%) Projections, By Packaging Size, 2023 to 2033

Figure 73: South East Region Market Attractiveness By Packaging Size, 2023 to 2033

Figure 74: South East Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2022

Figure 75: South East Region Market Volume (Units) Analysis By Life Stage, 2018 to 2022

Figure 76: South East Region Market Y-o-Y Growth (%) Projections, By Life Stage, 2023 to 2033

Figure 77: South East Region Market Attractiveness By Life Stage, 2023 to 2033

Figure 78: South East Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2022

Figure 79: South East Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2022

Figure 80: South East Region Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 81: South East Region Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 82: South West Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2022

Figure 83: South West Region Market Volume (Units) Analysis By Product Type, 2018 to 2022

Figure 84: South West Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 85: South West Region Market Attractiveness By Product Type, 2023 to 2033

Figure 86: South West Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2022

Figure 87: South West Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2022

Figure 88: South West Region Market Y-o-Y Growth (%) Projections, By Ingredient Type, 2023 to 2033

Figure 89: South West Region Market Attractiveness By Ingredient Type, 2023 to 2033

Figure 90: South West Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2022

Figure 91: South West Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2022

Figure 92: South West Region Market Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 93: South West Region Market Attractiveness By Packaging Type, 2023 to 2033

Figure 94: South West Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2022

Figure 95: South West Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2022

Figure 96: South West Region Market Y-o-Y Growth (%) Projections, By Packaging Size, 2023 to 2033

Figure 97: South West Region Market Attractiveness By Packaging Size, 2023 to 2033

Figure 98: South West Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2022

Figure 99: South West Region Market Volume (Units) Analysis By Life Stage, 2018 to 2022

Figure 100: South West Region Market Y-o-Y Growth (%) Projections, By Life Stage, 2023 to 2033

Figure 101: South West Region Market Attractiveness By Life Stage, 2023 to 2033

Figure 102: South West Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2022

Figure 103: South West Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2022

Figure 104: South West Region Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 105: South West Region Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 106: Mid-West Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2022

Figure 107: Mid-West Region Market Volume (Units) Analysis By Product Type, 2018 to 2022

Figure 108: Mid-West Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 109: Mid-West Region Market Attractiveness By Product Type, 2023 to 2033

Figure 110: Mid-West Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2022

Figure 111: Mid-West Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2022

Figure 112: Mid-West Region Market Y-o-Y Growth (%) Projections, By Ingredient Type, 2023 to 2033

Figure 113: Mid-West Region Market Attractiveness By Ingredient Type, 2023 to 2033

Figure 114: Mid-West Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2022

Figure 115: Mid-West Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2022

Figure 116: Mid-West Region Market Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 117: Mid-West Region Market Attractiveness By Packaging Type, 2023 to 2033

Figure 118: Mid-West Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2022

Figure 119: Mid-West Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2022

Figure 120: Mid-West Region Market Y-o-Y Growth (%) Projections, By Packaging Size, 2023 to 2033

Figure 121: Mid-West Region Market Attractiveness By Packaging Size, 2023 to 2033

Figure 122: Mid-West Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2022

Figure 123: Mid-West Region Market Volume (Units) Analysis By Life Stage, 2018 to 2022

Figure 124: Mid-West Region Market Y-o-Y Growth (%) Projections, By Life Stage, 2023 to 2033

Figure 125: Mid-West Region Market Attractiveness By Life Stage, 2023 to 2033

Figure 126: Mid-West Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2022

Figure 127: Mid-West Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2022

Figure 128: Mid-West Region Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 129: Mid-West Region Market Attractiveness By Distribution Channel, 2023 to 2033

Figure 130: North East Region Market Value (US$ Million) Analysis By Product Type, 2018 to 2022

Figure 131: North East Region Market Volume (Units) Analysis By Product Type, 2018 to 2022

Figure 132: North East Region Market Y-o-Y Growth (%) Projections, By Product Type, 2023 to 2033

Figure 133: North East Region Market Attractiveness By Product Type, 2023 to 2033

Figure 134: North East Region Market Value (US$ Million) Analysis By Ingredient Type, 2018 to 2022

Figure 135: North East Region Market Volume (Units) Analysis By Ingredient Type, 2018 to 2022

Figure 136: North East Region Market Y-o-Y Growth (%) Projections, By Ingredient Type, 2023 to 2033

Figure 137: North East Region Market Attractiveness By Ingredient Type, 2023 to 2033

Figure 138: North East Region Market Value (US$ Million) Analysis By Packaging Type, 2018 to 2022

Figure 139: North East Region Market Volume (Units) Analysis By Packaging Type, 2018 to 2022

Figure 140: North East Region Market Y-o-Y Growth (%) Projections, By Packaging Type, 2023 to 2033

Figure 141: North East Region Market Attractiveness By Packaging Type, 2023 to 2033

Figure 142: North East Region Market Value (US$ Million) Analysis By Packaging Size, 2018 to 2022

Figure 143: North East Region Market Volume (Units) Analysis By Packaging Size, 2018 to 2022

Figure 144: North East Region Market Y-o-Y Growth (%) Projections, By Packaging Size, 2023 to 2033

Figure 145: North East Region Market Attractiveness By Packaging Size, 2023 to 2033

Figure 146: North East Region Market Value (US$ Million) Analysis By Life Stage, 2018 to 2022

Figure 147: North East Region Market Volume (Units) Analysis By Life Stage, 2018 to 2022

Figure 148: North East Region Market Y-o-Y Growth (%) Projections, By Life Stage, 2023 to 2033

Figure 149: North East Region Market Attractiveness By Life Stage, 2023 to 2033

Figure 150: North East Region Market Value (US$ Million) Analysis By Distribution Channel, 2018 to 2022

Figure 151: North East Region Market Volume (Units) Analysis By Distribution Channel, 2018 to 2022

Figure 152: North East Region Market Y-o-Y Growth (%) Projections, By Distribution Channel, 2023 to 2033

Figure 153: North East Region Market Attractiveness By Distribution Channel, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United States Dog Toys Market Size and Share Forecast Outlook 2025 to 2035

United States Hand Holes Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

United States Biodegradable Cups and Lids Market Size and Share Forecast Outlook 2025 to 2035

United States Green Tea Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Hispanic Novelties Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

United States Label Release Liner Market Size and Share Forecast Outlook 2025 to 2035

United States Beetroot Supplement Market Size and Share Forecast Outlook 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Digital Ovulation Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States of America Digital Pregnancy Test Kits Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Collision Repair Parts Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Pest Control Services Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Collation Shrink Films Market Size and Share Forecast Outlook 2025 to 2035

United States & Canada Aluminum Tubes Market Size and Share Forecast Outlook 2025 to 2035

United States and Canada Child Resistant Bottles Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA